piranka

Corporate Office Properties Trust (NYSE:OFC) is a real estate investment trust (“REIT”) that owns a portfolio of specialized properties that support the U.S. Government (“USG”) and its contractors, most of whom are engaged in mission-critical national security, defense, and information technology (“IT”) related activities.

Though their assets are primarily office-centric, they are less exposed to teleworking risks than other owners of commercial office space due to their proximity to sensitive defense installations and unique spacing needs that largely renders off-site work incompatible with the core mission of their tenants. As a result, renewal rates are expected to be higher than is typical in the broader sector.

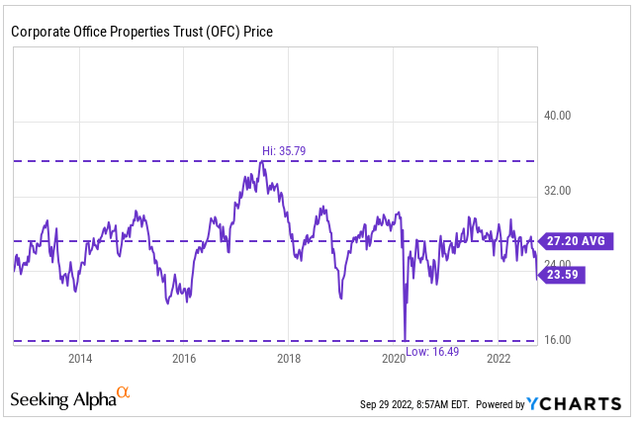

Over the years, the stock price has gone through its cycles but has remained fairly stable compared to many other companies and sectors, with just about $20 separating their 10-year highs and lows.

YCharts – Share Price History Of OFC

After being rangebound through 2021, shares have since fallen about 20% YTD. While this fares better than the broader S&P 500 index, it still represents bear territory. For prospective investors, this presents an attractive entry point for a lightly traded REIT with a positive outlook. Though the current dividend yield of 4.8% may not be enough for income investors, OFC is likely to fully recover their YTD losses. This would provide new investors with attractive risk-adjusted returns, in addition to the reoccurring dividend payment.

Highly Specialized Properties That Are Protected From The Threat Of Off-Site Work

OFC’s total core portfolio of consolidated and unconsolidated assets includes 186 total buildings, comprised principally of 180 buildings in defense/IT locations, which represents 90% of total core annualized revenues (“ABR”).

These properties are primarily occupied by the USG and contractor tenants operating in mission critical defense and IT missions, such as cyber security, research and development (“R&D”), and other highly technical defense and security areas.

While most of these properties are offices, a growing number are data center shells, which are simply core buildings equipped with basic power that are leased to tenants under long-term triple-net structures, whereby the occupants fund the costs for the critical power, fiber connectivity, and data center infrastructure. Tenant funding of these costs not only increases the value of these properties, but it also creates a high barrier to exit for such tenants.

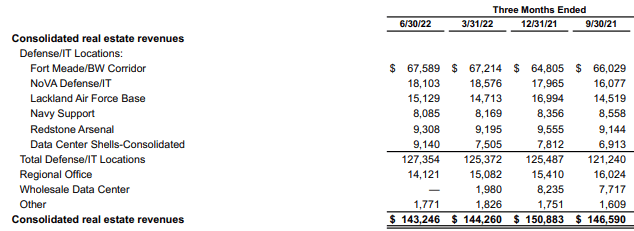

Within their core consolidated portfolio, nearly 50% of total revenues and net operating income (“NOI”) are attributable to the Fort George G. Meade and the Baltimore/Washington Corridor (“Fort Meade/BW Corridor”). Some missions performed at this site include cyber and signals intelligence, among others.

Q2FY22 Investor Supplement – Summary Of Consolidated Revenues By Segment

In addition to their core property holdings, OFC has significant land holdings in their operating regions that can be used to support future development growth, while also serving as a barrier against competitive supply in the interim.

The highly specialized nature of OFC’s properties serves as a competitive advantage against other peers with more standardized commercial office space leased to the USG, such as Office Properties Income Trust (OPI) and Easterly Government Properties, Inc (DEA). This nicheness provides downside protection against rising non-renewal risks associated with more hybrid working arrangements. Though DEA also serves mission critical agencies, as does OPI in some respects, their properties are considered more at risk of being downsized compared to OFC’s holdings.

Significant Upcoming Expirations But High Degree Of Certainty In Renewing

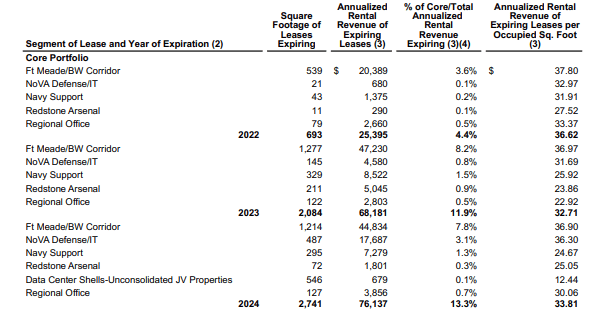

Similar to OPI, OFC has a significant number of leases expiring over the next two years. The total represents approximately 30% of total ABR. Though the expirations present an attractive opportunity to mark-up rents, it also increases the company’s non-renewal risk.

Q2FY22 Investor Supplement – Lease Expiration Schedule

Failure to renew these leases at acceptable spreads or, worse, losing the occupant entirely would materially affect OFC’s results of operations. This is one particular concern for OPI due to the lack of progress on their leasing efforts for expirations in the latter half of 2023 and 2024.

OFC, on the other hand, noted that 50% of the expirations are in 25 leases for space greater than 50K square feet (“SF”). And of this total, they expect over 95% to renew. For the remainder of the leases, there is a high degree of confidence that deals will get done due to the USG’s past tendency to renew and the cost/security risks to the USG associated with seeking alternative spacing needs.

Expected renewals are backed by strong retention rates that have held between the mid to upper-70% range from 2012-2021. And on their most recent earnings release, management increased the midpoint of their retention guidance by 2.5% to an updated range of 72.5%-77.5%. While this is a step down from levels reached between 2017-2020, it is greater than 2021 levels.

Solid Overall Portfolio Metrics In The Present Period

In the current environment, leasing trends continued to exhibit strength, with total leasing of 558K SF during the quarter, 230K of which was related to renewals. Retention did take a hit to 58% due to two non-renewals, but the company expects to have the entire vacancy leased and occupied in the third quarter.

Leasing also remained strong on vacancies, at 120K SF, which is consistent with their 5-YR average for the second quarter. Through the first half of the year, on the other hand, vacancy leasing exceeded their 5-YR average by 23%.

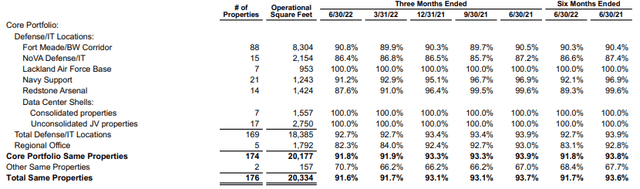

The strong levels of leasing are contributing to occupancy levels of above 90% on a leased basis. And this activity is supplemented by a large development pipeline, which is expected to be a primary source of growth in future periods.

Q2FY22 Investor Supplement – Same-Property Occupancy Summary

At present, there is a 200-basis point lag in physical occupancy. As this space is filled, NOI should track higher in response. Combined with the expected delivery of several projects in the second half of 2022 and into 2024, the incremental impact on NOI could be upwards of +$50M.

Sufficient Liquidity To Carry On Development Activities And Satisfy Reoccurring Obligations

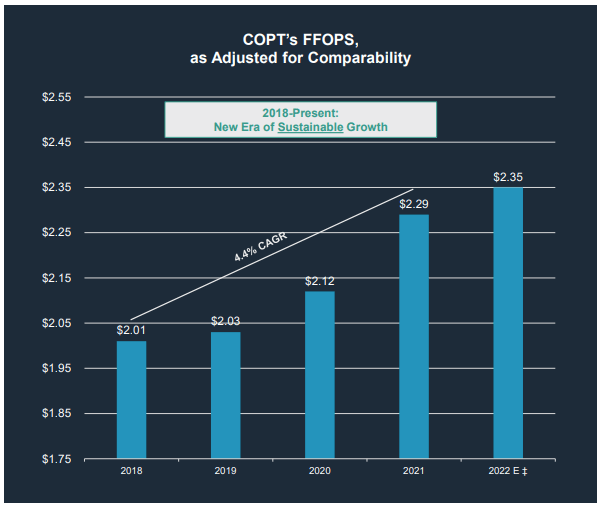

Though higher costs are expected to negatively impact development yields, the company is still expecting sustained compound growth in FFO of 4% or more beginning in 2023 through 2026.

Bank Of America Global Real Estate Conference – OFC FFO/Share Growth Projections

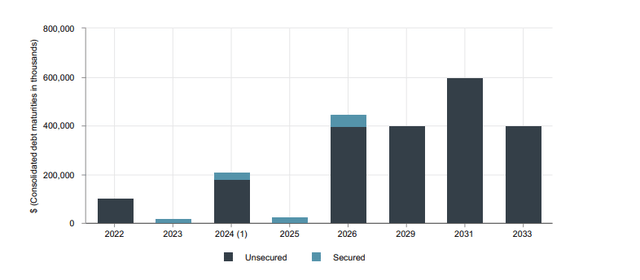

The ability to sustain their development priorities is supported by an investment-grade balance sheet with solid liquidity and a moderate leverage level of 5.8x adjusted EBITDA, assuming fully leased development. In addition, the company benefits from a well-laddered maturity schedule, with limited maturities until 2026, and debt composition that is mostly fixed rate.

Q2FY22 Investor Supplement – Debt Maturity Schedule

Strong coverage levels in excess of 5.0x on their interest obligations ensures that the company has ample flexibility in not only satisfying their interest requirements, but also in maintaining their current dividend payout levels, which amounts to $0.275/share on a quarterly basis. This represents a yield of 4.8% at current pricing levels and a payout ratio of about 62% on an adjusted FFO basis, indicating adequate dividend safety.

For income investors, however, the current dividend is unappealing when compared against higher yielding alternatives, such as risk-free, interest-bearing cash, which is currently benefitting from rapidly increasing interest rates.

A Niche Addition To Any Portfolio With 20% Upside Potential

OFC is a niche REIT that serves the United States Government in their high priority defense/IT missions through the leasing of very specialized office and data center properties. Though the office component of the portfolio may cause some concern among investors, these properties differ from more standardized commercial office space due to their inherent shield against hybrid working arrangements, owing in part to the sensitive nature of their tenants’ missions.

The company does have a significant number of expirations over the next two years. But high retention levels, a past propensity to renew, and the impracticability of seeking alternative spacing needs provides a high degree of certainty that deals will get done. Rising geopolitical threats also has increased the pressure on shoring up the nation’s defenses, which should feed into continuous increases in the defense budget, a critical relevancy for OFC in their leasing efforts.

OFC’s portfolio is otherwise stable, with strong occupancy levels and a significant development pipeline that should serve as the primary catalyst for growth in future periods. Adequate liquidity and a well-laddered debt maturity schedule ensures the company will have the necessary funds to carry-out their priorities, even through challenging market conditions.

For income investors, the current 4.8% dividend yield may not be enticing enough, especially when considering the rising attractiveness of simply holding interest-earning cash. But with shares down about 20% YTD, OFC does offer new investors prospective returns equivalent to at least their current losses. This would provide mean reversion in the share price, which is currently trading at 10x forward FFO.

While there are certainly alternatives in the market with more attractive potential, a 20% return on OFC is still a sizeable reward over its risk premium, and the investment itself would make for an interesting addition to any diversified portfolio.

Be the first to comment