Edwin Tan/E+ via Getty Images

At the end of 2021, I wrote an article on CoreCard (NYSE:CCRD) in which I stated that the company is undervalued and that the company is poised for long-term growth. Since then the stock price (as well as the major indices) has fallen significantly. Recently, I did another deep dive into the company and what I read made me even more confident in the company’s growth prospects. In this article, I will explain why I think that the company has positioned itself well for the coming years.

The company

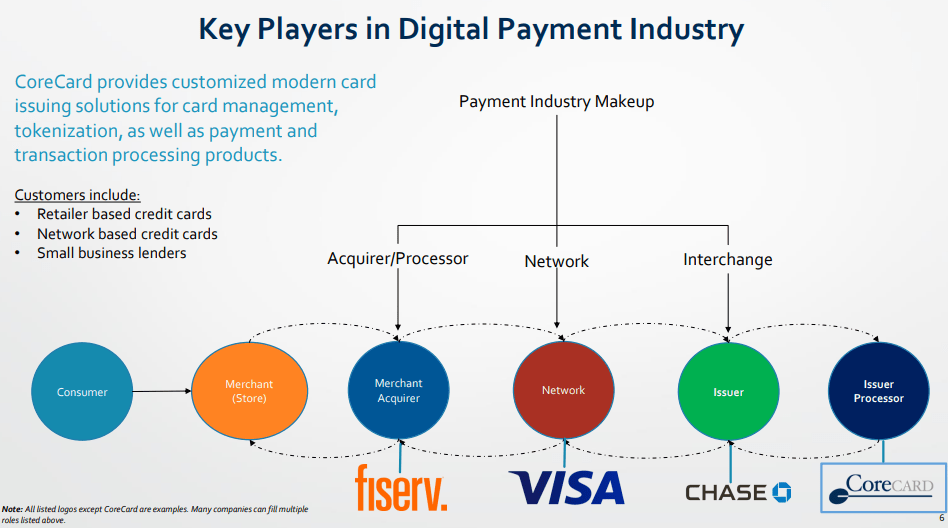

For people that are unfamiliar with the company, CoreCard is an issuer-processor in the payment network space. An issuer-processor manages card issuance, systems of record, authorize transactions among other things. There are many legacy companies that focus on these tasks but CoreCard’s software allows for more customization and is able to process more complicated accounts, for example, it is able to combine multiple loans on one statement, while it is also able to process transactions in various currencies.

Key players fintech industry (CoreCard investor presentation)

The company sells its solutions in two ways. The first is to get a license and pay for managed services, implementation fees, license tiers (based on the number of accounts), professional services (including customization and operational support), maintenance, and license support. The second option is to become a processing customer. If a customer becomes a processing customer, CoreCard will do the processing for transactions and customers pay for implementation, processing, other services (such as monthly statements), and professional services. Currently, the majority of the company’s revenue comes from license customers as the largest program, the Goldman Sachs (GS) Apple (AAPL) credit card, is a license customer.

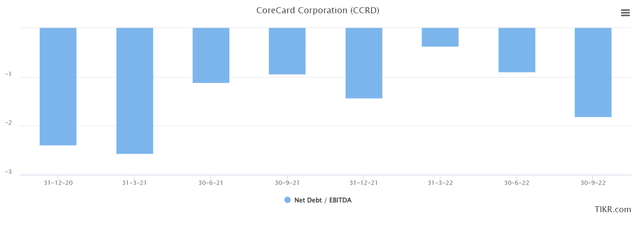

What is refreshing about CoreCard in comparison to other growth stocks is that the company is actually cash flow and EPS positive. The company uses the free cash flow to invest in its business and as I will elaborate on later, hire a substantial amount of new employees. The company needs the majority of these new employees to attract new large programs such as the aforementioned Apple Credit Card. As a result of prudent management and the ability to use its free cash flow for investments the company’s debt levels are low with a net debt-to-EBITDA ratio of -1.8 at the end of Q3 and a debt-to-equity ratio of 7.3%.

CCRD Net debt-to-EBITDA (Tikr.com)

Another thing that I like about the company is its management team. Leland Strange the CEO of the company has been with the company since 1985, although truth be told the company was focusing on different markets at the time and only made CoreCard the primary business in 2015. Nevertheless, Mr. Strange runs the company responsibly, as the company focuses on delivering a quality service to its shareholders and sometimes has to deny new clients in order to not jeopardize its operation. Additionally, his interests are aligned with shareholders as he owns a significant amount of the outstanding shares (approximately 18%).

What has the company been doing over the past year(s)?

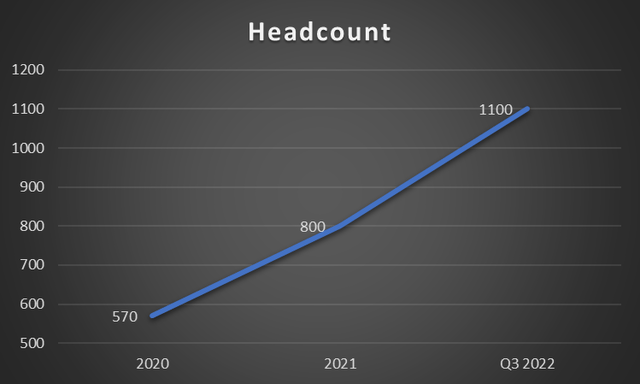

If you listen to the CoreCard earning calls you hear CEO Leland Strange mention that the company needs to invest significant amounts of capital in order to attract a new large client. He also mentions that they will not take on large clients if they feel that they are not ready, or in other words, they will not add a new large client if they cannot deliver the quality that they are aiming for. For this reason, the company hasn’t taken in new large clients but invested a significant amount of money for a company that is the size of CoreCard. They used most of the money to buy new equipment and hire additional employees in their offices abroad located in India, Romania, Colombia, and Dubai. Unfortunately, most of these employees are currently not generating revenue but are merely learning the process from more experienced employees. The company expects that they will be able to add one or two new large programs by fall next year as mentioned in their Q3 earnings call:

What about larger opportunities? We fully expect by this time next fall to have either announced or be working on 1 or 2 large programs. They’ll either be direct CoreCard, or through current partners such as Goldman, or through new ones currently in discussion stages, brought to us by other current program managers.

Headcount CCRD (10Q 2022 Q3, 10K 2021, 10K 2020)

Another thing that the company worked on was the American Express (AXP) certification process, which it completed in October of 2022. Later that month the company launched the Simon (SPG) Amex credit card. This gives the company a direct link with the AMEX network and gives it the possibility to also work together on future projects with American Express. While we’re on the topic of AMEX, the company was also able to finalize a contract with AMEX to process AMEX Kabbage loans. AMEX Kabbage focuses on providing working capital to (small) businesses. At the Goldman Sachs U.S. Financial Services Conference AMEX mentioned that small business formations were up 23%, which increases the TAM of Kabbage. If AMEX is successful with Kabbage, this will increase the revenues of CoreCard going forward.

Valuation

Before investing in a stock, it is important to have a general idea about its valuation. Although a company’s valuation shouldn’t be the only reason that investors invest in a company, valuation can serve as a guideline for when to invest in or divest shares of the company. I prefer to use multiple methods which include a DCF model based on a perpetual growth rate and an exit multiple, as well as a multiples analysis.

Discounted cash flows

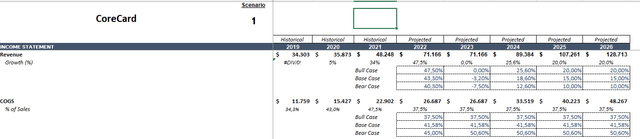

When I make a DCF I like to use multiple scenarios. I use scenarios because making a DCF requires a lot of assumptions. By using scenarios, you can see how the inputs would affect the share price. I use revenue growth as estimated by analysts (data from TIKR) and COGS based on the COGS over the past three years, slightly adjusted based on my expectations. For CoreCard this leads to the following assumptions:

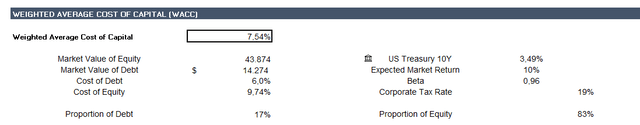

To get the present value, we need to discount the future cash flows to today. To do this, I like to use the weighted average cost of capital (WACC) method, which is based on the company’s beta, my minimum required rate of return, a risk-free rate (in this case the treasury rates), the company’s cost of equity (based on the CAPM), and cost of debt (based on interest payments and value of debt). This leads to the following WACC estimation for CoreCard:

For the perpetuity growth method, I use a perpetual growth rate of 3%. The reason for this is that a company cannot grow faster than GDP in the long run, and over the past decade, the GDP growth rate has averaged 3%. This assumption is important as the majority of the valuation is calculated past the 5-year estimation window. This leads to a target price of $37.17.

For the exit multiple, I like to use the average EV/EBITDA of the company. For CoreCard, I used an exit multiple of 10, which is significantly lower than its average of 31 over the past 5 years. I think 10 is a reasonable estimate as the market has significantly changed, the cost of capital has increased and wages (an important input cost for CoreCard), have also increased substantially. This leads to a price target of $42.46.

Multiples

For the multiples, I like to use the price-to-earnings multiple, as well as the EV/Revenue multiple. In terms of the price-to-earnings multiple, the company’s multiple has been very volatile over the past 5 years. The average since going public is 18.22, but I think that this is slightly too low based on the growth prospects of the company. Based on that, I adjusted it upwards to 30, leading to a price target of $30.90 based on 2021’s earnings.

If we take a look at the company’s EV/Revenue, we see that the average over the past 5 years was 7.7x. I think this is slightly on the higher side given that over the past year, the average was closer to 3-4. Based on that I adjust it slightly downward to 5, leading to a price target of $34.03.

If we combine all the price targets mentioned above, we get a price target of $36.14, which gives an upside of approximately 10%, above the latest closing price.

Risk

Goldman Sachs accounts for more than 60% of revenue

Ever since the company went live with the Apple Credit Card, Goldman Sachs has accounted for a majority of the company’s revenue. In theory, this isn’t a problem as long as Goldman Sachs is happy with the company’s performance, there is limited competition (in terms of customization), and they aren’t able to do it themselves. Over the past year, there have been multiple rumors that Goldman Sachs wants to acquire a payment technology company. If GS would acquire such a firm this could potentially mean bad news for CoreCard. Nevertheless, as the company grows and creates capacity for larger programs, the dependency on Goldman Sachs should decrease (unless new GS programs are added such as the General Motors (GM) one at the beginning of the year). Thus, although the impact of the risk is high, the probability is currently moderate.

Volatile revenue

Although this isn’t much of a risk but more of a thing to keep into account. The company licenses its platform to large companies such as Goldman Sachs, who pay based on the number of accounts and customizations they want. This means that in certain years in which the company’s customers add a significant amount of new customers to their license, the company receives a significant amount in license fees. This makes the earnings of the company significantly more volatile than if these customers were processing customers. Besides the volatility in revenue, this also impacts the company’s margin as license revenue is basically cost-free. Thus, investors should take note of this if they are interested in starting a position in CoreCard.

Conclusion

CoreCard is an issuer-processor best known for its work on the GS Apple Credit Card. The company offers highly customizable software, which gives it an advantage over legacy competitors. The company has a strong balance sheet and its CEO owns a significant stake in the company.

Over the past year, the company has invested a significant amount of money to hire new employees in order to build capacity for new large customers. More recently, the company also got certified for American Express and has launched its first card on the network. This should give the company’s customers more options in the future.

From a valuation perspective, the company is currently undervalued by approximately 10% based on a DCF. There are some risks as Goldman Sachs accounts for over 60% of the company’s revenue and license revenue makes the company’s revenue stream more volatile. Nevertheless, given the arguments set forth in this article, I would argue that the benefits outweigh the risks.

Be the first to comment