PeopleImages/iStock via Getty Images

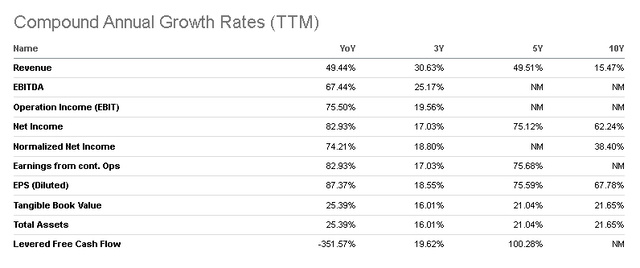

You should consider adding CoreCard Corporation (NYSE:CCRD) to your long-term portfolios. I am impressed by the 26.2% CAGR of this $113.4 billion fintech market. CoreCard is a small but fast-growing company engaged in the fintech industry. The TTM revenue CAGR of CoreCard is 49.44%. The 5-year average sales CAGR is 49.51%. CoreCard is growing notably faster than the 26.2% growth rate of the fintech business.

I rate CCRD as a buy. The chart below told me that CoreCard’s growth story is not fading at all.

Why Go Long?

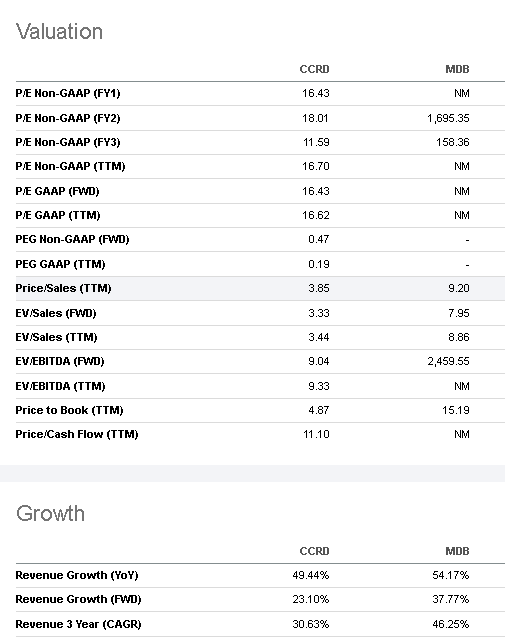

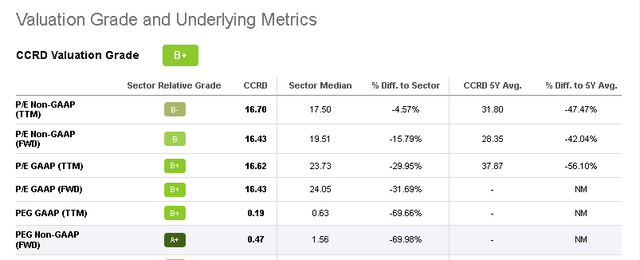

My buy thesis is very compelling. The 1-month +35.79% did not erase CCRD’s qualification as a growth-at-a-reasonable-price (“GARP”) stock. Seeking Alpha Quant gives CCRD a valuation grade of B+. Kindly refer to the chart below. CCRD’s forward P/E GAAP valuation is only 16.43x. This is 31.69% lower than the information Technology sector’s average of 24.05x.

The valuation ratios chart denotes that CCRD is still relatively undervalued even after that massive 35.79% 1-month bull run. CoreCard’s forward TTM GAAP PEG of 0.19x is almost 70% lower than the sector median of 0.63. This relative overvaluation is unjust.

CoreCard is a software company and its topline is growing at almost 50% per year. It deserves a forward P/E of 20x in my book. Any high-growth software company that trades below 20x forward GAAP P/E is a golden bargain.

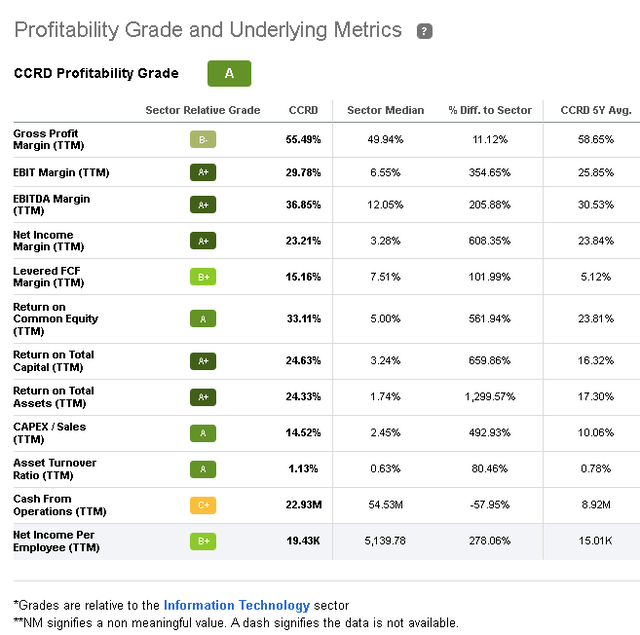

Unlike the consistent unprofitability of MongoDB, Inc. (MDB), CCRD touts high profitability. MongoDB has never made a profit since its inception as a company. CCRD’s TTM net income margin is 23.21%. This is 608.35% higher than the sector median of 3.28.

CCRD is a buy because its 49% revenue CAGR did not lead to consistent annual net losses. This feat is the core premise for CoreCard. CoreCard has been profitable since Q1 2018. A smart pair trade would be to go short MDB and going long on CCRD. Pair trade experts know that the inflated valuation and consistent losses of MDB make it a great short candidate.

Seeking Alpha Premium

Technical Indicators Are Bullish

My bullish endorsement for CoreCard is also fortified by the optimistic technical indicators. Based on Seeking Alpha Quant’s AI, the Relative Strength Index emotional indicator is still bullish for CCRD. The RSI score of CCRD is already 74.19, but the bull run stays strong for CCRD.

The optimism for CCRD is persists if you consider that Exponential Moving Averages [EMA] are still very bullish. The last closing price of CCRD is $29.9. This is higher than its 5-day EMA of $29.83, 13-day EMA of $28.72, and 20-day EMA of $27.76.

The last momentum emotional barometer that I usually use is Stochastic. CCRD’s touts a short-term bullish trade signal called Stochastic Oversold Buried. It means the fast stochastic of CCRD is above 80 and has stayed above 80 for the past five trading days.

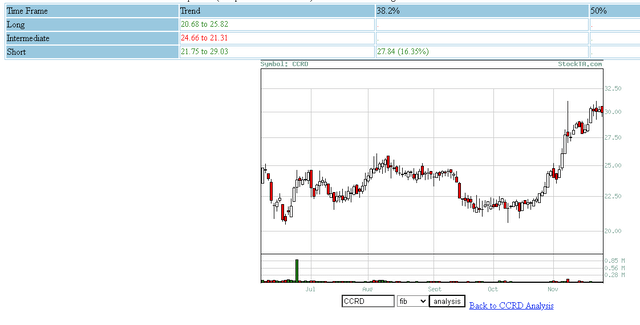

If you like the emotional Fibonacci barometer, it is also bullish for CoreCard’s stock. The Fibonacci screenshot below explains there’s a strong enthusiasm for CCRD. On the 30-day or short-term basis, CCRD’s Fibonacci retracement stayed below the 38.2% magic number. Fibonacci is saying the upward trend of CCRD will continue.

Downside Risk?

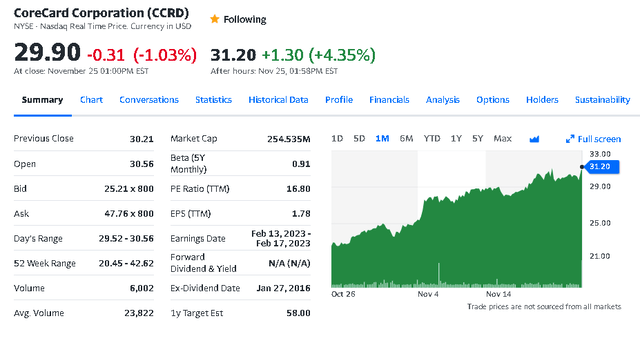

CoreCard is relatively undervalued, so it is not vulnerable to any short attack by the top short-selling experts. It cannot be denied that the massive +35.79% one month gain is partly due to the rumor that Goldman Sachs (GS) was plotting to buy CoreCard. Goldman Sachs has denied this rumor many days ago. To date, this denial has not compelled traders to aggressively take profit on CCRD. The 1-month chart below told me that almost all shareholders and traders dismissed the Goldman Sachs denial.

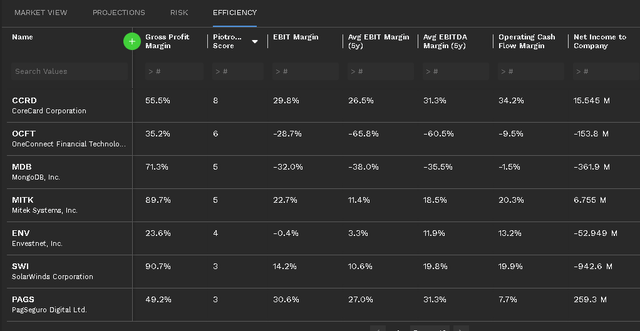

Being profitable, CoreCard has an Altman Z-score of 17.52. A stock only needs to get a Z score of 4 to be recognized as safe from going bankrupt anytime soon. The balance sheet of CoreCard is very sturdy. The total cash is $28.05 million. This is more than 6x higher than CCRD’s total debt of $3.83 million. Unlike MongoDB, CoreCard boasts a positive $22.93 million net operating cash flow.

Seeking Alpha Premium

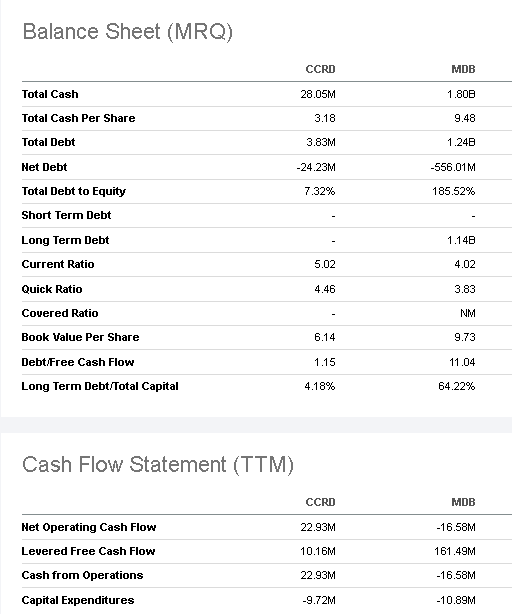

The Piotroski F score is my no. 1 metric when evaluating stocks. CoreCard touts an F score of 8, almost the perfect score of 9. An F score of 8 means CCRD is an excellent value stock, and it has an excellent management team.

Finbox.io Premium account of Motek Moyen

My Verdict

Go long or average up on CoreCard. It is still relatively undervalued. The best investment quality of CCRD is its ability to do 49% revenue CAGR while also achieving 21% net income margin. The high 26.2% growth rate of the $113.4 billion fintech industry is a long-term tailwind for CoreCard.

The screenshot below says it all. CoreCard supplies the software ecosystem that helps top credit/debit card companies make more money. CoreCard is important to their long-term prosperity. The low valuation ratios might attract a suitor other than Golden Sachs.

The EPS estimate for fiscal 2022 is $1.82. My hypothesis is that CoreCard Corporation deserves a forward P/E of 20x. My 12-month price target therefore for this fintech stock is $36.4. This is much lower than the $58 price target of BTIG Research.

Be the first to comment