Solidago/E+ via Getty Images

Investment Thesis

Archrock (NYSE:AROC) is currently trading near 52 week lows, at ~25% discount from estimated fair market value, and generates an attractive 8.8% yield.

AROC successfully weathered the 2020 industry downturn and is implementing reasonable strategies to improve operations and eventually profitability.

Investors looking for more diversified exposure to the natural gas industry might find this combination of income and a margin of safety an attractive opportunity.

Archrock Overview

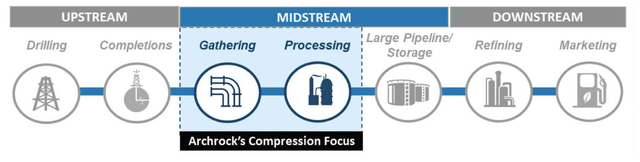

AROC is an oilfield service company which provides compression services to the natural gas business, specifically to the midstream part of the business.

Archrock Business Focus (Archrock Sustainability Report)

“Compression” is this context essentially means pumping natural gas; take in gas at low pressure, output gas at higher pressure, with the purpose being to move the gas. However “pumping” has other connotation in the oilfield, so we’ll stick with compression.

AROC operates in two segment – contract compression and aftermarket services.

In the contract compression segment, they own and operate compression equipment. In the aftermarket segment, they provide parts and services for customer owned compression equipment.

The standard unit of measure for compression equipment is horsepower “HP”, for both individual units and fleets. Unless specifically stated otherwise, most references to portfolio, fleet, market standing, utilization, deployment, capital spending, etc. imply HP.

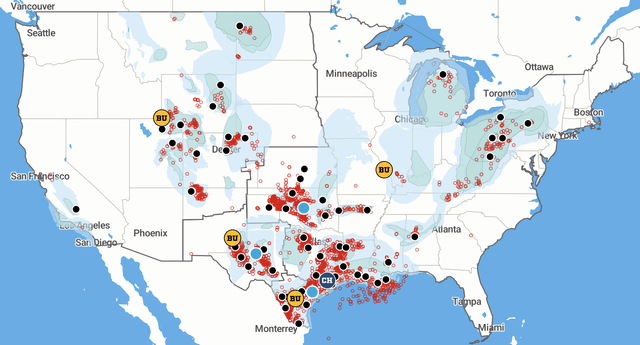

AROC reached its current form, and took its current name, in November 2015 after a series of mergers and spin-offs. AROC is headquartered in Houston and operates in 21 states in the continental US. The map below show their many active compressor locations (red), three regional make-ready shops where equipment is prepared for deployment (blue), and ~ 51 support and service locations (black).

Archrock Area of Operations (Archrock website)

They are the market share leader in contract compression services, and a leading provider in the aftermarket services market.

The AROC compressor fleet is deployed at the field gathering and processing level (77%) to move gas from the well to and through the gathering and and processing system, or near wellheads to provide gas lift (23%). Gas lift pumps gas downhole to lift liquids in the well to the surface.

Compression is a 24/365 “must run” service. AROC guarantees 98% availability for contract compression, and delivered 99.3% in 2021.

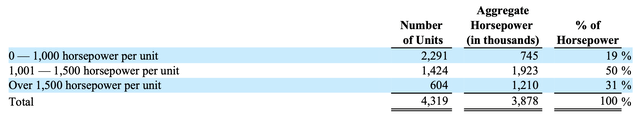

AROC owns about 3.9 million HP of compression equipment, with an average age of 11 years. The fleet profile is shown below.

AROC Fleet Profile – 31 December 2021 (AROC 2021 Annual Report)

Large (1000+ HP) units are primarily reciprocating compressors driven by natural gas-powered engines, with fuel provided by the customer.

At year end 2021, AROC had about 1100 full time employees, including 500 field service technicians and 300 shop employees, plus about 230 contract employees. This is a reduction of 30% from the 2019 headcount.

AROC had 400 customers in 2021. The top 5 customers accounted for about 30% of revenue, but no single customer exceeded 10%. The average duration for contract compression equipment deployment on a customer location is ~ 3 years.

The quarterly dividend of $0.145 per share has been unchanged since August 2019. There are about 153 million shares outstanding.

Unless otherwise noted, the information for this article comes from the 2021 Annual Report, the 2021 Sustainability Report, the company website, earnings calls for Q1 and Q2 2022, and their August 2022 investor presentation.

The Industry Environment

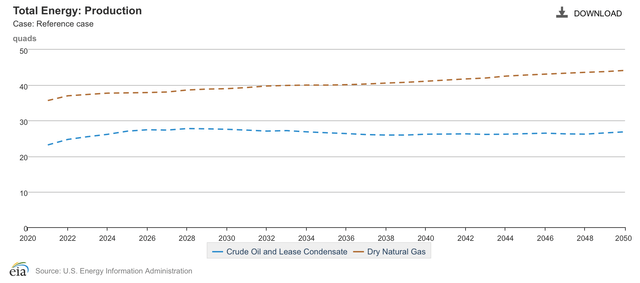

Over the next 25 years, the Energy Information Agency “EIA” projects that US oil production will be roughly steady and gas production will gradually increase.

Oil and Gas Production Forecast [EIA]

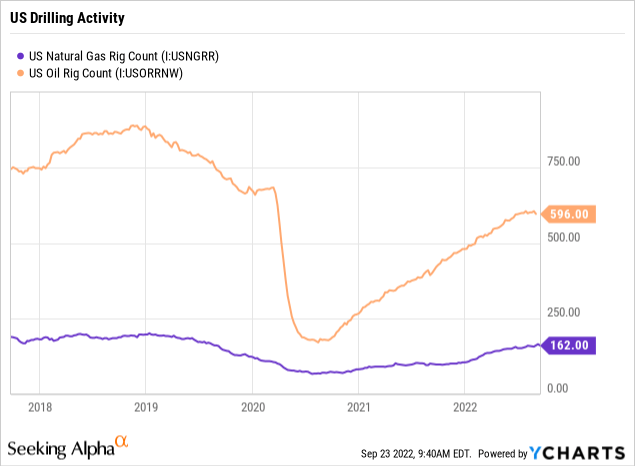

Drilling activity is more immediately responsive to commodity prices than production volumes, illustrated here by the US rig count over the last five years. The COVID impact in Q2 2020 is evident. See here for more detailed data on the rig count.

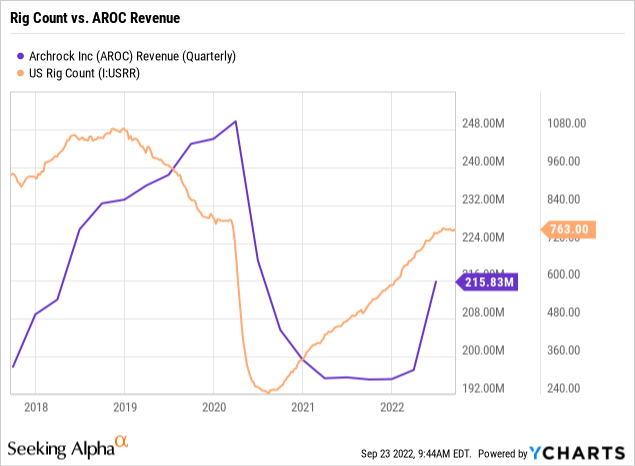

A comparison of total US rig count vs. AROC quarterly revenue illustrates the differences in the response functions for drilling activity and AROC revenue. Note the difference in magnitude; an ~ 80% drop in rig count vs. a ~ 20% drop in revenue (most of AROC revenue comes from wells already in production), and the rapid rig count drill or stack response.

Compression Market Size

A sense of the size of the total compression market in units is provided by this 2018 Department of Energy analysis; 1700 midstream compressor stations with 5000-7000 compressors, 13,000-15,000 smaller compressors in upstream, and 2,000-3,000 in downstream applications.

Penn State provides a non-technical overview of compressor stations here.

AROC Strategic Directions

Brad Childers, CEO, summarized the three elements of AROC’s strategy in the Q1 2022 conference call:

we continue to prioritize and advance our long-term strategies, high grading our fleets, harnessing technology across the organization and increasing our focus on sustainability.

We will discuss each of these elements below.

Fleet Upgrade

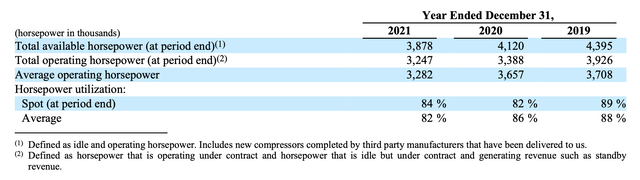

AROC has adopted a strategy to rationalize and upgrade their fleet to newer and higher HP units. The table below illustrates their progress in this area in 2020 and 2021.

Fleet Rationalization (Archrock Annual Report)

To achieve this, in 2020-2021 they retired 960 idle compressors (346,000 HP). They also divested 875 units (140,000 HP) in 2021. In aggregate these units averaged ~ 265 HP. The fraction of operating horsepower contributed by large units (1000+ HP) increased from 74% to 80% over that period.

In H1 2022, they additionally retired 75 idle compressors (57,000 HP), and divested 380 compressors (70,000 HP); In aggregate, these units averaged ~ 279 HP.

Brad Childers, CEO, addressed this effort in the Q1 earnings call:

We’re selling horsepower at attractive multiples and redeploying the proceeds to help advance our strategic priorities and to fund our investment in new, standardized large horsepower. This new horsepower will be deployed in the more stable midstream segment of the market for decades to come. These strategic divestitures have improved our returns and position us well to continue to reduce greenhouse gas emissions from our fleet.

Digital Transformation

Beginning in Q4 2018, AROC has made major changes to improve their internal IT technology and processes, including replacing existing ERP, supply chain and inventory management systems, and upgrading field technology, spending $50 million over three years.

The term they use for increased connectivity and automation is telematics. (I’ve been involved in broadly similar efforts; the improvements can be significant – eventually.)

Brd Childers again speaks to the point in the Q1 call:

we … are in the early stages of leveraging an upgraded technology platform in our field operations recently installing expanded telematics across our fleet and launching a new suite of mobile tools for our field service technicians.

We’re just four months in and have more work to do to operationalize and integrate these enhancements into our business. Over time, I’m confident we will achieve increased asset uptime, improve the efficiency of our field service technicians, improve our supply chain and inventory management, reduce the miles driven by our field service technicians and lower our emissions and carbon footprint.

Eric Thode, senior vice president of operations at Archrock, discusses their remote telematics program, training, and maintenance in this article at American Oil and Gas Reporter.

Sustainability

Sustainability provides a convenient axis to organize improvement efforts in several areas. In July 2021, the AROC board adopted an amended strategy that included helping customers decarbonize their compression operations. AROC has a team working on this.

In April 2022, AROC agreed to acquire for cash an equity interest in ECOTEC, a small company specializing in methane emissions monitoring and management (see here). With the initial April 2022 investment, and a subsequent investment in July 2022, AROC now has a 19% equity interest in ECOTEC.

But the team has a broader charter. From the Q2 call:

Beyond ECOTEC, … exploring potential improvements in compressor operations and design as well as evaluating potential partnerships with additional third parties with the goal of assisting our customers to achieve improvements and emission performance

Beyond new revenue streams, this has the potential to motivate cost reduction efforts, for example reducing the use of lubrication oil, their largest consumable expense, and to navigate increasingly stringent regulatory and ESG hurdles established by regulators, investors (particularly institutional investors), and customers.

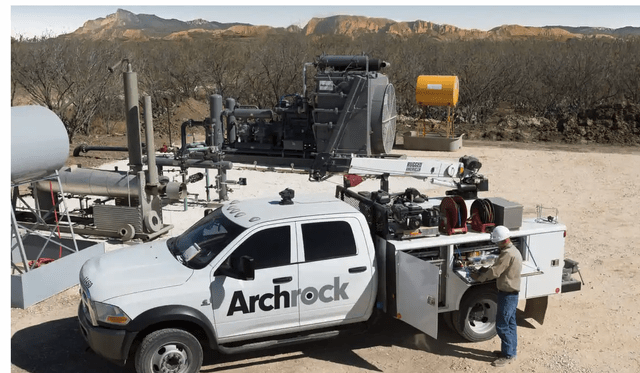

As part of this agenda, AROC plans to invest $15 million in electric drive compression horsepower in 2022 . However, as the picture below shows, some work sites are very off the grid.

Archrock Equipment – Off the Grid (Archrock Sustainability Report)

The map at this link provides an interactive view of compressor station locations and fuel source (gas/electric). By inspection, electric powered for compressors is not rare, but has a pretty small market share in this data set.

Archrock Business Performance in H1 2022

Outlook

Business is improving, the management outlook is positive, and customer demand is described as “robust”.

Utilization increased to 87% in Q2, from 84% in Q1, and bookings for upcoming deployments indicate a further increase. A more favorable supply-demand balance – for both AROC and the general market, particularly for the high demand high HP units – improved pricing power and drove spot prices to record levels. AROC projects it will take about 24 months for this improved pricing to be fully reflected in revenue numbers.

Increased demand is evident in increased deployments, 155,000 HP in Q2, the highest level since 2019, and reduction in equipment being released by customers, with contract terminations falling to “historically low levels”.

Significant growth in aftermarket revenue is attributed in part to customers catching up on deferred maintenance, and in part to customer labor shortages.

Margins have been compressed by reactivation costs for equipment to be deployed, and by record inflation. However, they expect to be able to continue to raise prices enough to reclaim this margin.

Numbers

For Q2, key numbers:

- $216 million total revenue

- $166 million contract compression revenue, up 2% from Q1

- 59% contract compression gross margins

- $50 million aftermarket revenue, up 47% from Q1

- 16% aftermarket gross margins

- $17 million net income

- $99 million adjusted EBITDA

- $61 million total CAPEX

- $1.5 billion total debt at quarter’s end

- 2.3x dividend coverage

- 4.4x leverage ratio

- 3.5x-4.0x leverage ratio long term target confirmed

- $330-350 million total year EBITDA estimate confirmed

- $150 million growth CAPEX budget confirmed unchanged

- expect to pay down a small amount of debt this year

From a slightly longer perspective, revenue was $216 million in Q2 2022, after being essentially flat ($195-$200 million range) for the previous six quarters.

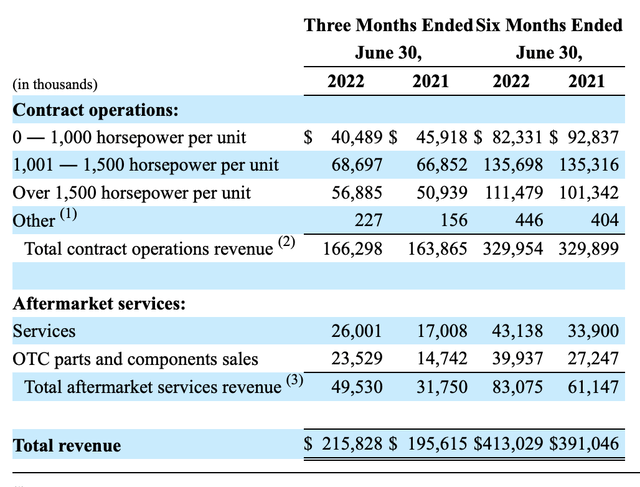

Total revenue for H1 2022 was up 5% over H1 2021. Contract operations revenue was flat. Aftermarket revenue was up 36%, reaching 2019 levels.

The contract operations revenue for H1 2022 by HP class showed about 4% of revenue shifted from the low to high (> 1000HP) vs. H1 2021.

Revenue Components – H2 2022 (Archrock)

The H1 2022 the revenue split between contract and aftermarket was 77%/23%.

Gross margins for H1 2022 were 59.7% and 15.3% respectively. Contract compression generated 80-84% of revenue in 2019-2021, so a return to those levels should improve overall margins.

AROC has a significant amount of debt, $1.5 billion. Of this, $0.2 billion is due in 2024, $0.5 billion in 2027, and $0.8 billion 2028.

The Competition

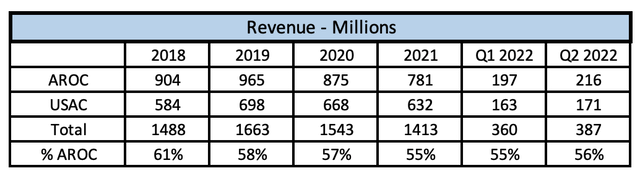

There is one peer competitor of roughly similar size and scope, USA Compression Partners (NYSE:USAC), one perhaps near peer Kodiac Gas Services, LLC (private), and several significantly smaller competitors.

It should be noted that while AROC is a C-corp, USAC is a partnership, and issues a K-1; USAC currently yields ~12%.

It’s a rough back-of-the-envelope assessment, but if you assume AROC and USAC are competing of the same market, how they split that market is an indicator of competitive strength. The table below suggests AROC’s share has stabilized.

AROC vs. USAC Market Share (Table by author, data from Seeking Alpha)

Analysis

There are a couple of points I want to make here.

Durable Industry, Durable Business

The oil and gas industry will be around for decades. There will be a long term requirement for compression services.

Addressable Market

There are perhaps 20-25 thousand compressors operating in the upstream, midstream, and downstream business. Many of these will never be serious candidates for contract compression services. Archrock owns ~ 4,000, the contract compression businesses in total might own 10,000. Archrock is intentionally migrating away from the less profitable lower HP units.

Absent major consolidation, it appears Archrock in unlikely to grow contract compression dramatically; the total addressable market is limited, particularly that fraction with attractive margins.

That probably explains in part the interest in adding compression adjacent services like methane monitoring, which has the added attraction of low capital intensity.

Service Business

This is a medium complexity, geographically dispersed, 24/365 service business, often performed under less than ideal conditions. I’d suggest two implications.

Personnel quality is a critical competitive issue; hiring, retaining, and motivating people a notch or two above the competition is a core competency. Based on their public material, they are at least saying the right things.

Diligent management – paying consistent, systematic attention to operating the business on a day-to-day basis – is required. That’s not easy to maintain.

AROC Stock Valuation

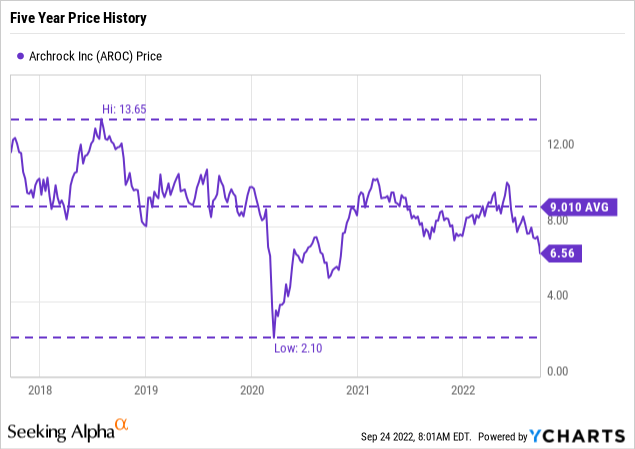

To assess valuation we can look at several indicators. The market’s view as reflects in price history:

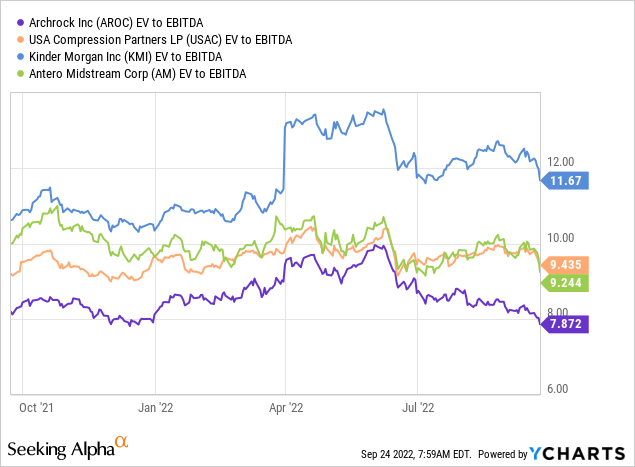

We might also look at EV / EBITDA for AROC, its peer competitor USAC, a very large midstream Kinder Morgan (NYSE:KMI), and a gathering and processing focused regional midstream Antero Midstream (NYSE:AM).

In H1 2022, AROC management sold 447,020 shares of common stock for net proceeds of $4.2 million via ATM arrangements; average price $9.40.

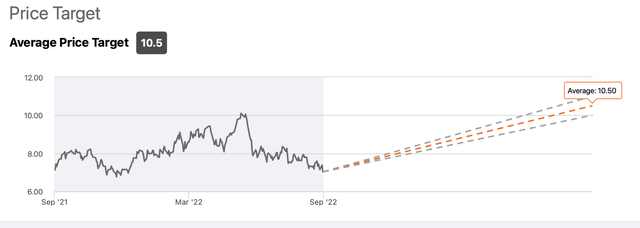

Seeking Alpha provides one Wall Street price target: $10.50. That’s notably close to the 52 week high of $10.44. A 20% safety margin applied to the Wall Street target yields a fair value of $8.40.

AROC Price Target (Seeking Alpha)

I have found as a rule of thumb that applying a 35% discount to the 52 week high often yields a value quite close the Morningstar 5-star “significantly undervalued” price; in this case that rule of thumb yields $6.79 as “significantly undervalued”.

Overall, one might say that ~ $9.00 would be a fair value; the current $6.54 price is ~ 25% under that.

One should note, however, that many analysts call for a further general market decline.

Risks

Owning this business should be relatively boring. Perhaps not utility boring, but relatively drama free.

The biggest general risk I see here is policy and regulatory restrictions on the oil and gas business as a whole. Europe demonstrates the nature and magnitude of the risk. The likelihood of similar restrictions in the US is hard to assess, but there are certainly advocates, see e.g. California’s vote last week to ban the sale of natural gas space an water heaters by 2030.

Sustainalytics provides an ESG risk rating for AROC here.

I view debt as creating current opportunity and future risk. I’d like to see much less debt than their 3.5-4.0 leverage target, but that’s a minority view. I will note the opportunity cost of debt levels that left them unable to aggressively buy back stock in 2020, and again currently.

Investor Takeaway

For an investor seeking additional exposure to the oil and gas industry, this smaller cap service company offers a very generous dividend and potential share price appreciation.

Personally, I am overweight in energy, and already have a full position in AROC, purchased in four tranches between Jan 2018 and March 2020, with an average prices of $7.58 and a yield-on-cost of 7.1%. Held in a Roth IRA, I’ll score that one a win, and I plan to continue to hold it.

I started the research for this article with the expectation that I might take a larger than full position. My conclusion is that although the yield is very attractive, I’m not yet compelled to go beyond a full position, but will put AROC on my active watch list. There were some truly spectacular deals available in March 2020, and there may well be again within the year.

Under the Seeking Alpha rating system, I will rate AROC a Buy.

Be the first to comment