luza studios

This morning Core Scientific (NASDAQ:CORZ) filed an 8-K with the SEC that contained highly troubling language. After detailing some of the liquidity problems in the Bitcoin (BTC-USD) mining industry generally speaking, CORZ disclosed that it will not be servicing its equipment-related debt obligations that are due over the next couple weeks:

the Board has decided that the Company will not make payments coming due in late October and early November 2022 with respect to several of its equipment and other financings, including its two bridge promissory notes. As a result, the creditors under these debt facilities may exercise remedies following any applicable grace periods, including electing to accelerate the principal amount of such debt, suing the Company for nonpayment or taking action with respect to collateral, where applicable

This is a very bad sign yet not totally surprising given the abysmal macro setup that the broad Bitcoin mining industry has been experiencing over the last year or so.

Mining Industry Woes

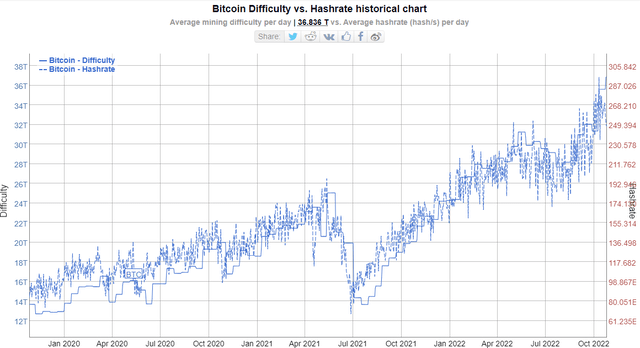

By design, it gets more difficult to mine Bitcoin over time. This difficulty mechanism is even more problematic when there is a surge in mining capacity all competing for an ever smaller number of BTC supply from mining. While already near all time highs, we’ve seen a large surge in the hashrate power devoted to mining Bitcoin over the last several weeks. As you can see, there is a tight correlation between when hashrate is up and when the network difficulty is high:

BTC Hash & Difficulty (BitInfoCharts)

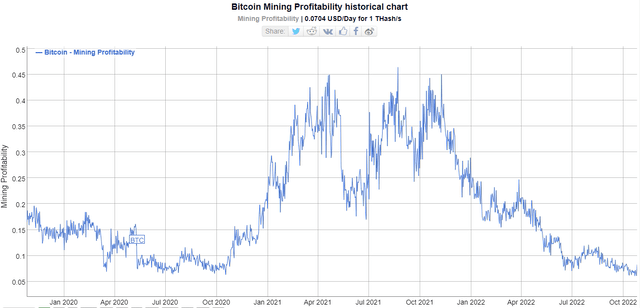

Network difficulty means the miners have a harder time generating the block reward from BTC transactions. This generally means miners are spending more energy to mine. When difficulty is high, miners need BTC price to be high as well or their margins shrink. Over the last year or so, we’ve seen the double whammy of higher network difficulty coupled with lower BTC prices. As a result, miners have been getting margin squeezed for essentially all of 2022:

Mining profitability (BitInfoCharts)

Given the collapse in Bitcoin mining profitability since last year, it’s no wonder many companies in this space are dealing with problems. Energy costs for a lot of the companies are higher and we’ve already seen a chapter 11 filing from Compute North.

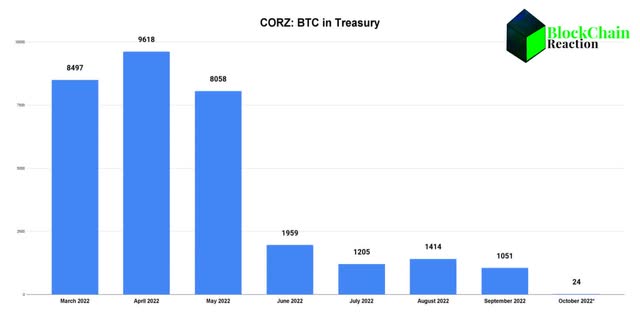

Core Has Been Hemorrhaging Coins For Months

As of yesterday, the company has just 24 BTC remaining on the balance sheet. This follows what has been a months long capitulation in Core Scientific’s BTC HODL treasury:

BTC Treasury (Core Scientific/BCR)

With just 24 BTC remaining on the balance sheet as of yesterday, the company has about $500k remaining in Bitcoin that can be used to raise more cash. Core Scientific also disclosed $26.6 million in cash remaining. Given the severity of the cash drawdown from $128.5 million as of the Q2 filing, Core appears to have a serious cash burn problem on its hands and very little options.

The Road Ahead

In the filing this morning, Core Scientific detailed some of the plan for immediate action. That plan involves hiring outside help to determine the best course moving forward. Of which, CORZ may explore debt restructuring or capital raises:

In light of the foregoing, the Company is in the process of exploring a number of potential strategic alternatives with respect to the Company’s capital structure, including hiring strategic advisers, raising additional capital or restructuring its existing capital structure. Specifically, the Company has engaged Weil, Gotshal & Manges LLP, as legal advisers, and PJT Partners LP, as financial advisers, to assist the Company in analyzing and evaluating potential strategic alternatives and initiatives to improve liquidity. The Company and its advisers have begun to engage in discussions with certain of its creditors regarding these initiatives

Earlier this year, Core Scientific entered an equity purchase agreement with B. Riley Principal Capital II for up to $100 million in stock. Of that agreement, $79.3 million can still be tapped into. The problem for CORZ shareholders is any additional cash to the balance sheet from that purchase agreement is going to be dramatically dilutive given where the share price is this morning. The company also mentioned in the filing that it could potentially be a subject of future litigation and specifically mentioned the 2025 convertible notes:

Any such creditor actions may result in events of default under the Company’s other indebtedness agreements, including its two series of convertible notes due 2025, and the potential exercise of remedies by creditors under such agreements.

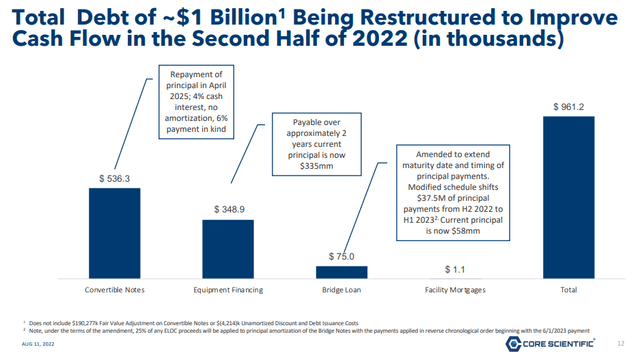

According to Core Scientific’s last quarterly filing, those notes make up more than half of the debt that the company already had planned to restructure:

Previous debt restructuring plan (Core Scientific)

Given the high debt load, very low levels of cash, and having now fired all of the BTC bullets that it could, I think Core Scientific is out of options that could be considered good for current shareholders.

Summary

The risks should be self-evident at this point. As of submission, the company’s shares are down 75% this morning as investors are clearly finding out just how dire the capital situation is for CORZ. I think shareholders should expect quite a bit of dilution in the future and possibly be prepared to see asset liquidations that could result in lower future BTC production numbers. While Core Scientific may be the first publicly listed miner to capitulate, it may not be the last.

The tragic irony is Bitcoin’s price seems to be stabilizing over the last several weeks and any rally higher won’t be as beneficial to Core Scientific because it has already sold down the Bitcoin that it had on the balance sheet. That said, Core Scientific is still the largest monthly producer of BTC and will be able to benefit from any rise in BTC’s price from ongoing monthly production. Even after the brutal sell-off this morning, I can’t recommend going long this stock when there are other publicly listed miners that are in a much better financial position.

Be the first to comment