nonnie192/iStock via Getty Images

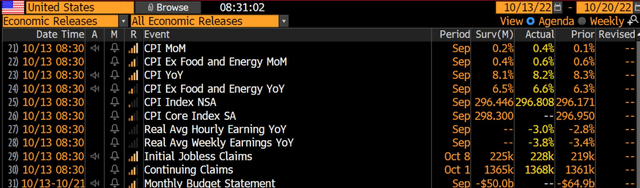

Headline CPI came in at +0.4%, double the market expectations, bringing the year-on-year rate to +8.2% vs. the consensus estimate of +8.1%. Core CPI was hot at +0.6% vs. economist expectations of just +0.4%. Yield surged and stock futures plummeted immediately after the hotter-than-expected inflation data.

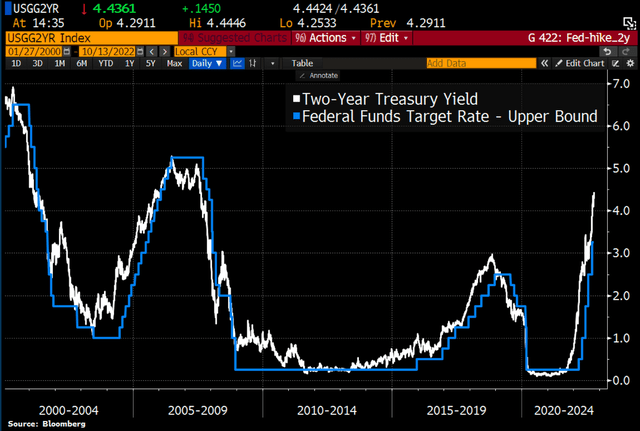

The U.S. 2-year yield hit its highest mark since 2007 as the terminal Fed Funds rate skyrocketed to 4.83%, up about 0.2 percentage point. Interest rate swaps now fully price in a 75-basis-point November rate hike. The chance of a massive full percentage point increase is now near 20% at the meeting in less than three weeks.

CPI Data: Hot Across The Board

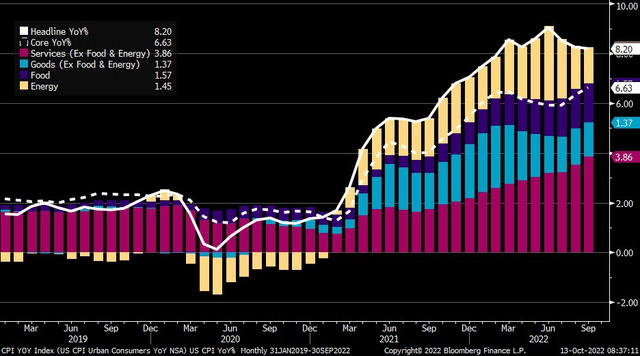

Headline CPI Components

U.S. 2-Year Yield Spikes To 4.5%

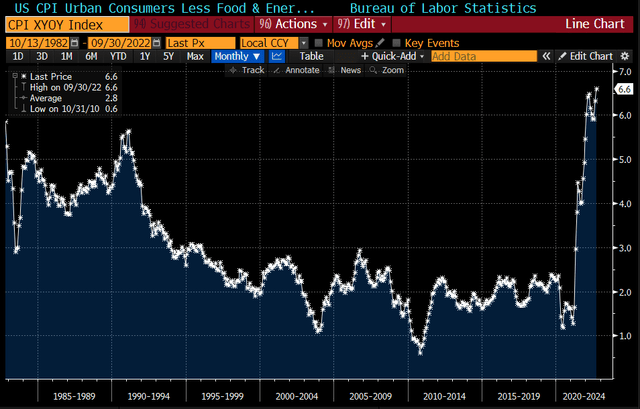

The year-on-year core CPI rate of +6.6% is particularly disturbing as it shows underlying inflation continues to be extremely high, making the Fed’s job all the trickier. At the same time, the Fed is now more emboldened to hike its policy rate quickly. The annual core CPI rate is now at the highest level since 1982, according to Bloomberg.

U.S. Core CPI: Highest Since 1982

Futures were higher in advance of the report on news that tax cuts in the U.K. would be reversed, but that optimism quickly evaporated as the reality of hot inflation once again stoked investors’ fears. The U.S. dollar spiked to a 24-year high, and crypto and oil prices dropped, too. Nasdaq futures fell to the lowest level since July 2020 while the U.S. 30-year rate touched 4%, the highest in more than 11 years.

Corporate bonds with high duration have endured hard selling, but that means forward expected returns are much more attractive today.

According to Vanguard, the Vanguard Total Corporate Bond ETF (NASDAQ:VTC) seeks to track the performance of the Bloomberg U.S. Corporate Bond Index. The fund gives investors broad, diversified exposure to the investment-grade U.S. corporate bond market through an intermediate-duration portfolio, with exposure to short-, intermediate, and long-term maturities.

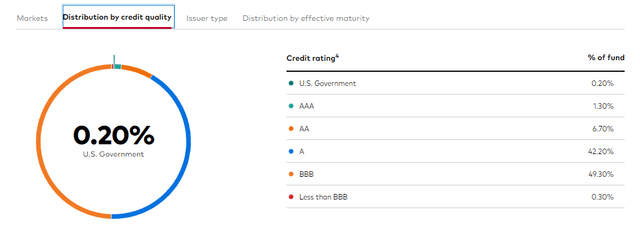

While down a whopping 20% year-to-date, the ETF features a low 0.04% annual expense ratio vs. a category average of 0.60%. Its median intraday bid/ask spread is just 0.09% and has a 30-day SEC yield of 3.0%, but its yield to maturity (a better gauge of expected returns) is 4.8% with an average effective duration of 11.4 years. Credit quality is on the low end of investment grade, though.

VTC: Investment-Grade, But On The Low End

As market interest rates have increased substantially over the past 26 months, both Treasurys and corporates have fallen hard in price. VTC, like so many fixed-income funds, is enduring its worst drawdown on record. Vanguard’s corporate bond fund is down 25% from its August 2020 peak. After inflation and including dividends, that’s a total real return of about minus 30%.

VTC: Below COVID Lows

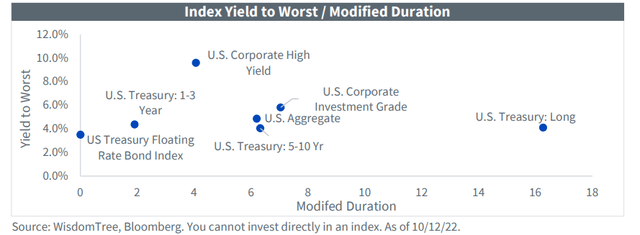

The upside is that bond investors now finally have a bevy of strong choices across maturities and credit quality. The WisdomTree Daily Dashboard shows what investment options are available in the fixed-income space. VTC’s 34% weight in the Vanguard Long-Term Corporate Bond ETF (VCLT) extends VTC’s duration greatly, so if rates continue to rise, expect to see more losses. Still, after today’s drop, the fund now features a very positive real YTM near 5%.

I would avoid VTC, though. According to iShares, you can get a higher yield with lower duration by owning the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). That fund has YTM near 6.0% after today’s drop with an effective duration of just 8.25 years.

Bond Yields And Duration

The Bottom Line

Today’s CPI report stunned traders once again. Dow Futures went from up 300 to down 500 in a matter of minutes. Bond market turmoil only gets worse after today’s 40-year high in Core CPI. While it’s tough to think about buying bonds seeing rates rise month after month, today’s fixed-income investing environment is much better than two years ago. I’d go with LQD over VTC for investment-grade corporate bond exposure.

Be the first to comment