samxmeg/E+ via Getty Images

Copper has always been the leader of the base metals that trade on the London Metals Exchange and the CME’s COMEX division. While aluminum trades more significant volumes, copper earned its nickname of “Doctor Copper” because of its ability to diagnose the overall health and wellbeing of the global economy. Copper’s price has declined during economic contraction periods and appreciated when the economy is growing, giving it a Ph.D. in economics. During past decades, China has been the world’s leading copper consumer, while Chile remains the top producer.

In 2021, Goldman Sachs’ analysts changed copper’s title from “Doctor” to “the new oil,” saying that decarbonization does not occur without the red base metal. Copper requirements in EVs, wind turbines, and other energy alternatives increase global demand. Last year, Goldman forecasted the price would rise to $15,000 per ton by 2025. The price nearly reached $11,000 per ton at the most recent high at $5.01 per pound in early March 2022 before correcting.

Goldman analysts recently changed their tune, saying battery metals have seen the highs for the near future. However, copper prices moved higher since they issued that forecast. Meanwhile, Goldman’s analysts may have made an error as the world’s leading consumer is coming out of its recent lockdowns.

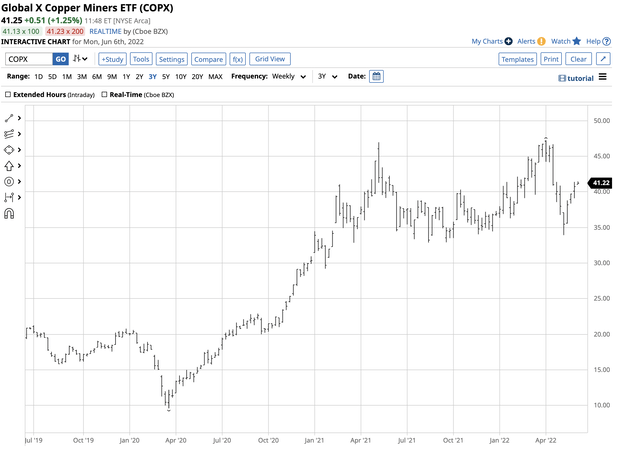

The Global X Copper Miners ETF product (NYSEARCA:COPX) holds shares of leading copper-producing companies.

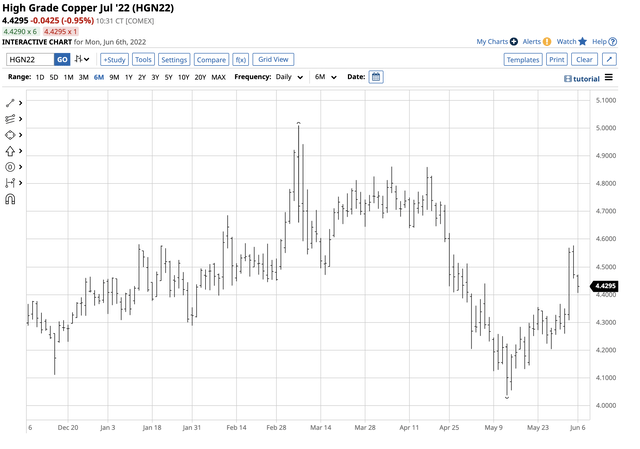

Copper corrects from the highs, but the metal made another higher low

Copper corrected lower after reaching a new record high on March 7 when the active month July COMEX futures contract traded at $5.01 per pound. Rising US interest rates, increasing the cost of carrying inventories, a higher dollar, and COVID-19 lockdowns in China were a bearish trio for the red metal.

Short-Term COMEX Copper Futures Chart (Barchart)

As the chart highlights, the price made lower highs and lower lows from March 7 through May 12, when it reached $4.0370 per pound, a 19.4% correction.

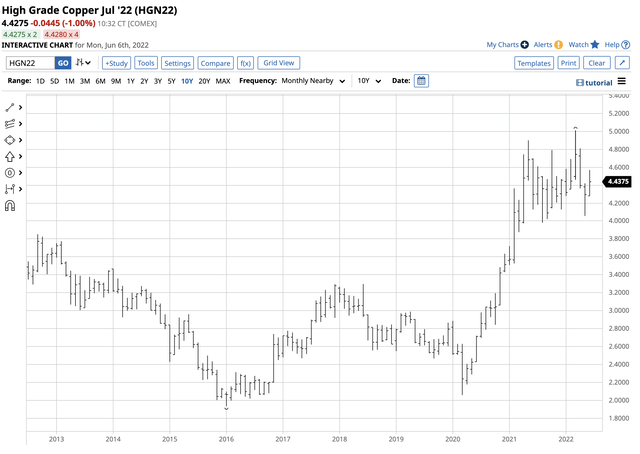

Long-Term COMEX Copper Futures Chart (Barchart)

Source: Barchart

The continuous COMEX futures contract chart shows the decline to $4.0560. Both the low in the July contract at $4.0370 and the continuous contract low of $4.0560 were higher lows than the critical technical support level at the August 2021 $3.98 bottom, which was the low after a correction from the previous record high in May 2021.

The bottom line is that copper has held its technical support levels since the March 2020 low. Even during the height of selling as the global pandemic gripped markets across all asset classes, copper fell to $2.0595, above the long-term support level at the 2016 $1.9365 low. Copper has respected its technical support levels since the 2016 bottom, a sign of a long-term bull market for the leading base metal.

Goldman Sachs analysts say sell battery metals – Are the traders vacuuming up the selling?

Goldman Sachs was copper’s leading cheerleader in 2021, calling the red metal the “new oil” and forecasting the price was on a path of the $15,000 per ton level. At the recent $5.01 high, nearby LME three-month forwards reached a high of below the $10,800 level. According to Goldman’s 2021 forecast, copper still has over 39.5% upside room from the most recent high. A $15,000 price puts copper futures at over the $6.80 per pound level, 35.7% above the early March $5.01 peak.

In late May, Goldman spoke again, telling markets they have soured on the prospects for battery metals. In a research piece titled The End of the Beginning, Goldman Sachs made a case for lower battery metal prices. The investment bank’s research department turned bearish on high-flying nickel, lithium, and cobalt prices. Whole Goldman expects lower prices in 2022 and 2023, the analysts project a rebound in 2024 and 2025. While the research piece did not include a deviation from its copper forecasts, metals tend to move higher or lower as a sector. The Goldman research piece came out on Sunday, May 29, 2022. On Friday, May 27, nearby COMEX copper futures settled at $4.3065 per pound.

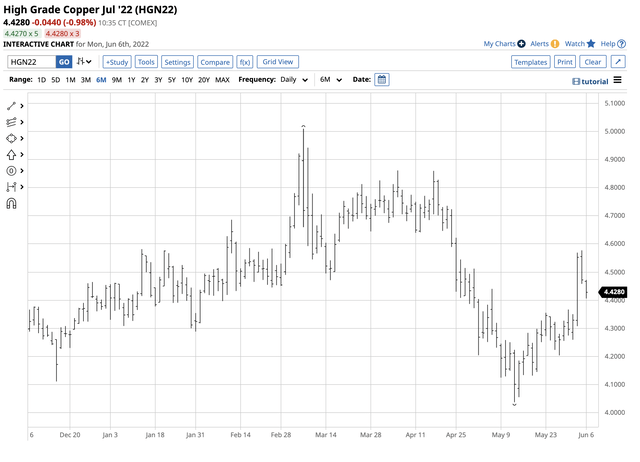

Short-Term COMEX Copper Futures Chart (Barchart)

The chart shows that one week later, on Friday, June 3, copper settled 3.8% higher at the $4.4720 level after trading to a high of $4.5770 on June 3. A bearish report from Goldman’s research department does not mean that investment bank’s traders are not bullish and are not buying copper and even the other three metals. The price was over the $4.42 level on June 6.

Copper – A deficit, rising demand, and new mines take the better part of a decade to bring into operation and an end to Chinese lockdowns

Copper’s bullish path comes on the back of the increasing demand for EVs, wind turbines, and other green energy initiatives. Moreover, the rising demand comes as supplies dwindle because of increasing production costs caused by inflationary pressures. Producing, smelting, and refining copper ores and concentrates into metals is highly energy-intensive. The production costs are moving higher with all goods and services, and a rising dollar and higher financing costs add to the expenses at mines, smelters, and refineries. Moreover, copper supplies cannot keep up with the robust demand.

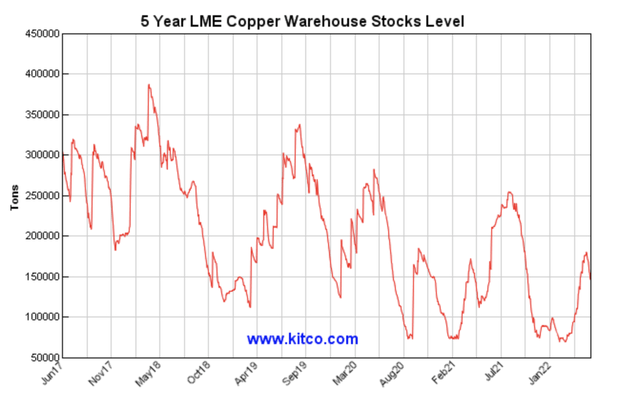

Five-Year Chart of LME Warehouse Stocks (Kitco/LME)

The long-term chart of LME copper inventories highlights the pattern of lower highs and lower lows in copper stocks. After the recent move from the 70,000-ton level to over 170,000 tons, LME stocks were at the 145,950-metric ton level on June 3 – after making another lower high, stocks turned lower.

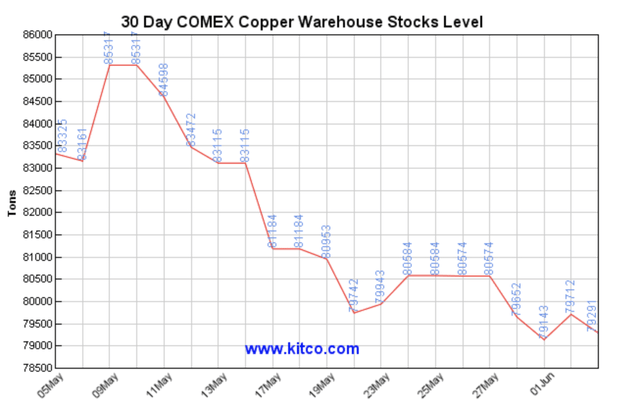

COMEX Warehouse Stocks (Kitco/COMEX)

COMEX copper stocks have declined from 85,317 tons on May 9 to the 79,291-metric ton level on June 3. Falling stockpiles are a sign of rising demand.

Last week’s rally came as stocks turned lower, and bonds and the dollar rallied. However, news that China is emerging from its lockdowns could be the most bullish factor for the copper market. As the world’s leading consumer goes back to work, the flow of copper to China will likely increase, perhaps dramatically.

Mining shares tend to underperform on the downside and outperform on the upside

The most direct route for copper investment is via the futures on COMEX or the forwards on the London Metals Exchange. Copper is a bulky metal, and $100,000 worth of copper involves holding and storing 22,361 pounds of the metal at the June 3 closing price.

Copper producers offer leveraged exposure to the copper market as they can extract lower ore grades from the earth’s crust when prices rise, turbocharging profits. Moreover, as bullish sentiment grips the copper market, the leading copper miners attract buyers in the stock market.

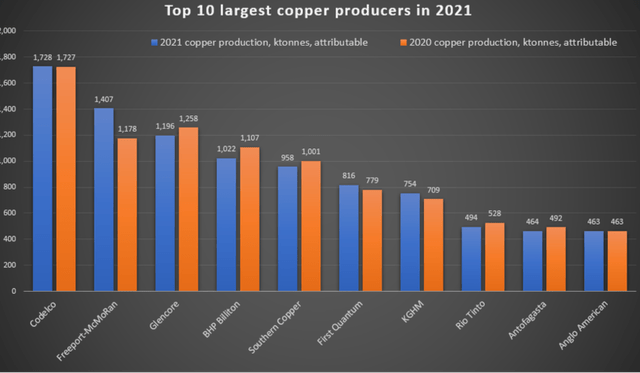

Ten Leading Copper Producers (Kitco)

The chart of the top copper-producing companies includes many that trade on the leading stock exchanges.

COPX is a diversified approach to investing in copper producers, limiting idiosyncratic risks

When investing in copper, I prefer a diversified approach to avoid the risks inherent in singular companies. Management, mines in specific regions, and overall geopolitical risks can cause copper mining companies to experience issues that weigh on earnings even when the metals’ price is rising. A portfolio of the leading copper producers’ shares mitigates some of those risks.

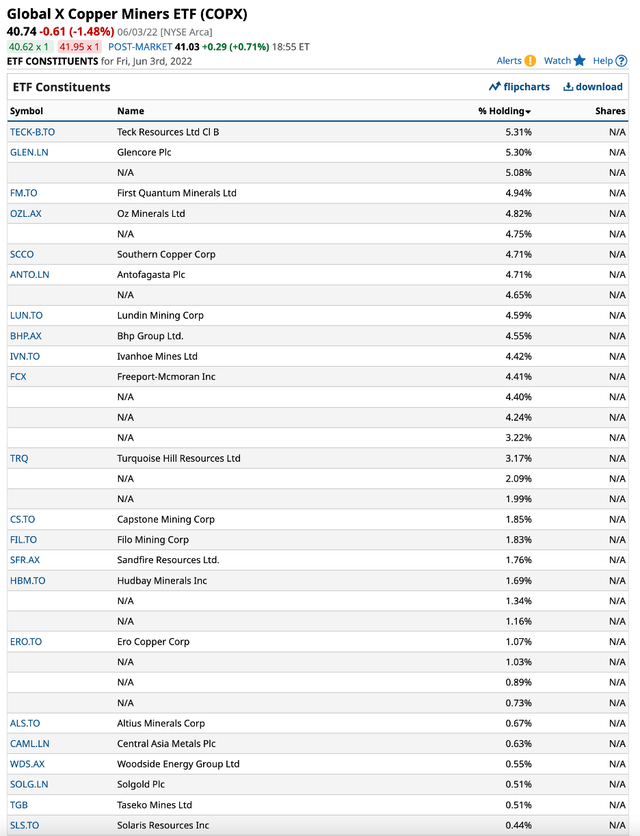

The top holdings of the Global X Copper Miners ETF product include:

COPX ETF Holdings (Barchart)

COPX’s Full portfolio: Barchart

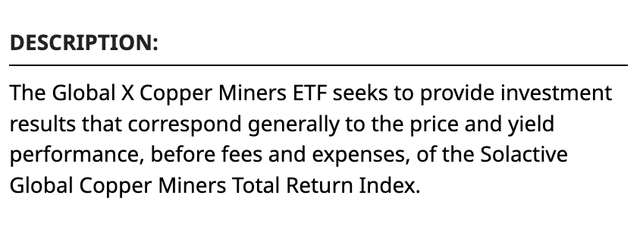

The fund summary states:

Fund Summary for the COPX ETF Product (Barchart)

At $41.25 per share, COPX had $1.915 billion in assets under management. The ETF trades an average of 505,605 shares each day and charges a 0.65% expense ratio. The ETF pays shareholders a blended $0.55 dividend, translating to a 1.33% yield, and holding the ETF for six months more than pays the annual management fee.

Copper rose from $2.0595 in March 2020 to $5.01 in early March 2022, a 113.7% rise.

Long-Term Chart- COPX ETF (Barchart)

Over the same period, the COPX copper mining ETF rose from $9.62 to $47.23 per share, or 391%. Mining companies tend to outperform the metal on the upside but often underperform during price corrections.

The green energy path, end of Chinese lockdowns, and inflationary pressures will likely push copper prices higher over the coming years. COPX is a product that will likely magnify the price action in the copper market.

In early June 2022, the end of Chinese lockdowns could be the most significant factor for the red metal that seems to have found a bottom at another higher low over the past weeks.

Be the first to comment