NicoElNino/iStock via Getty Images

The most recent quarterly earnings release from Copart, Inc. (NASDAQ:CPRT) was very impressive. Sales growth reached the levels that we haven’t seen very often. With that, I would like to remain cautious on this name. The recent increase in inventory and decrease in accident frequency could bring revenue growth down. If management continues to grow inorganically, the stock price will likely trend higher. However, without sufficient inorganic growth, M&A failures, or negotiations with independent subhaulers, the stock price could trend down to $49 per share.

Copart: Impressive Sales Growth As Well As Decrease In Accident Frequency

Founded in 1982, Copart offers online auctions and vehicle remarketing services all over the world. Dealers, rebuilders, exporters, and the general public have access to their bidding processes.

Company’s Website

Company’s Website

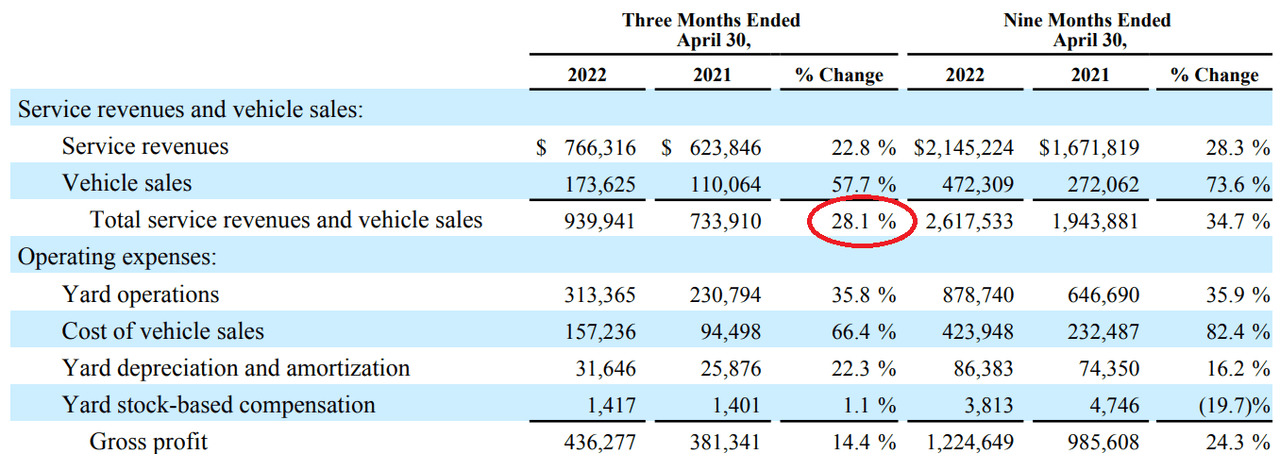

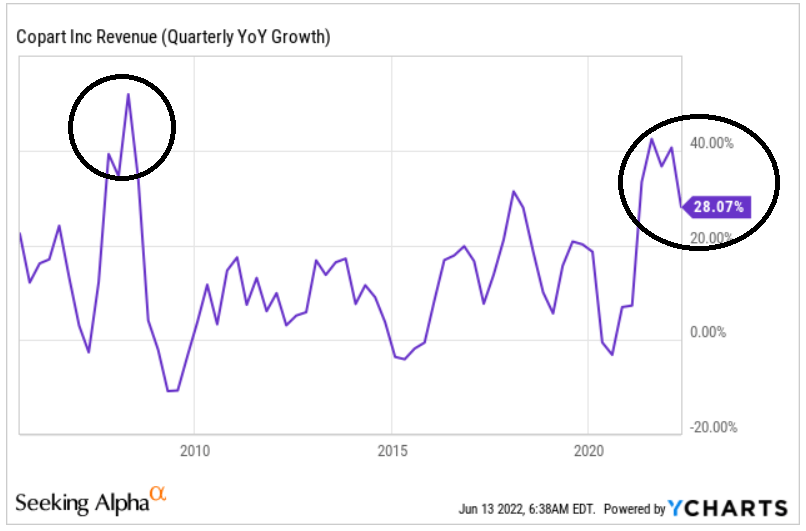

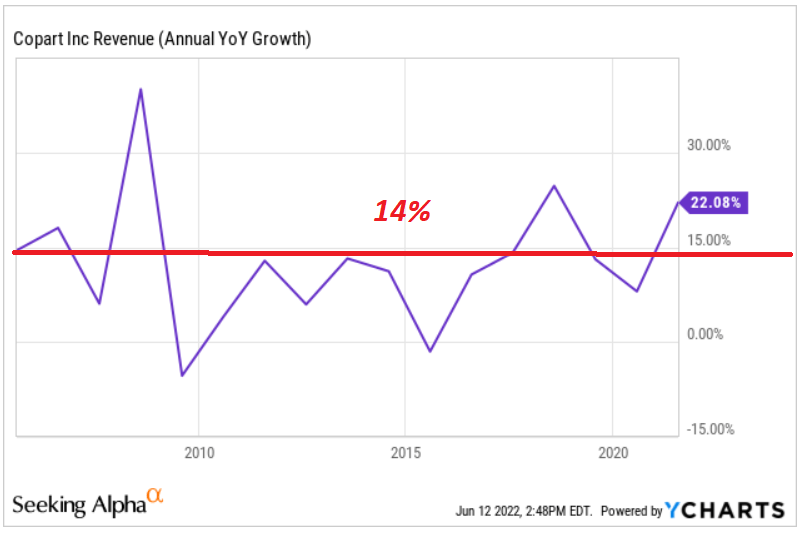

In the nine months ended April 30, 2022, Copart reported 34.7% sales growth, and gross profit increased by approximately 24%. The increase in sales growth was also larger right before 2020 and before 2010.

10-Q

Ycharts

It is beneficial for investors that Copart also reported CFO’s growth, and management continues to invest in capacity expansion. Pessimistic investors may wonder whether Copart reached a peak in business growth. With that, the recent investments in capital expenditures indicate that management is optimistic.

Operating cash flow for the quarter increased by $48 million year-over-year to $417 million, driven by stronger earnings. We invested $79 million in capital expenditures in the quarter and over 80% of this amount was attributable to capacity expansion. Source: Q3 2022 Earnings Call Transcript

With that about the most recent results, let’s also mention that Copart’s global inventory increased as accident frequency is decreasing. In my view, management could suffer significantly if frequency and miles driven trend down.

We’d also note, however, the record high used vehicle prices have, for the past few quarters, negatively impacted total loss frequency and had tempered overall insurance volume growth relative to what it otherwise would have been.

Our global inventory at the end of April increased 5.3% from last year and 7% excluding low-value units from wholesalers and charities. The increase in inventory is largely a function of accident frequency and miles driven returning to normal, offset by a decline in total loss frequency. Source: Q3 2022 Earnings Call Transcript

Balance Sheet: The Total Amount Of Cash Could Help Finance More Inorganic Growth

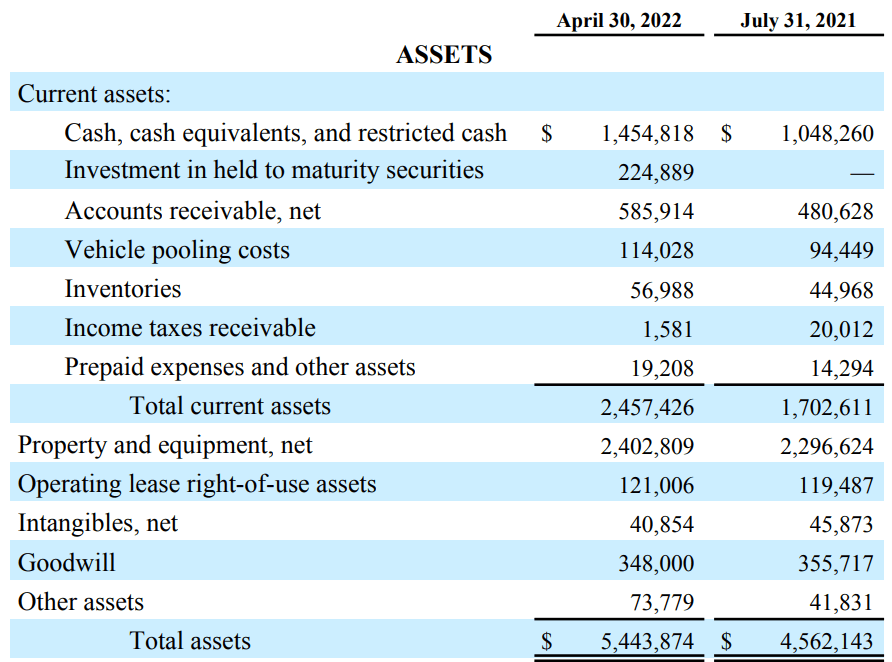

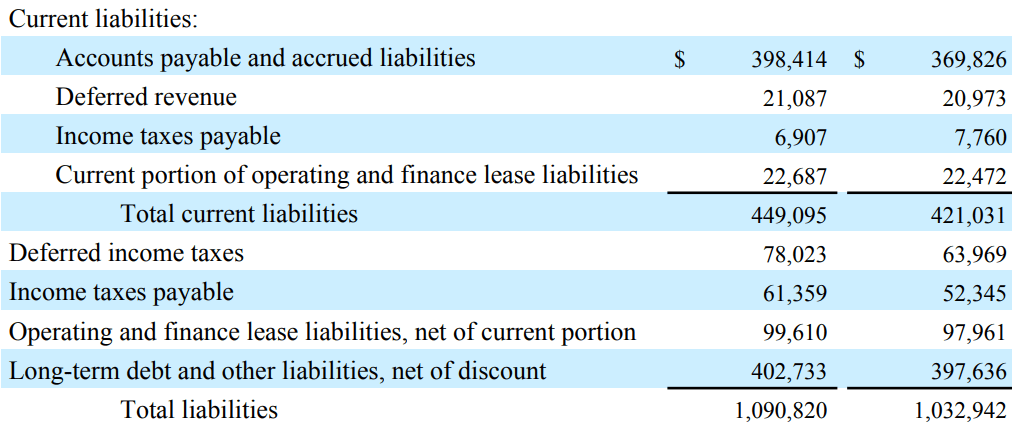

As of April 30, 2022, Copart reports $1.45 billion in cash and $224 million in liquid investments. Copart’s financial position appears beneficial. The balance sheet also exhibits an asset/liability ratio of 4x-5x, so I believe that investors will likely not be afraid of Copart’s total amount of liabilities.

10-Q

Copart’s debt includes $402 million in long-term debt and $99 million in finance lease liabilities. The net debt is negative. In my view, management has sufficient cash to make more acquisitions as well as to enhance sales growth.

10-Q

My Base Case Scenario With Less Inorganic Growth Implied A Valuation Of $130

Copart noted in the last annual report that inorganic growth was one of Copart’s most relevant strategies. When Copart enters a new market, management acquires a competitor, and offers its bidding technology and know-how. In my view, the combination of technology developed in the United States and the network of clients in the new market explains the company’s business success.

We believe our business has grown as a result of acquisitions, increases in overall volume in the salvage car market, growth in market share. Source: 10-k

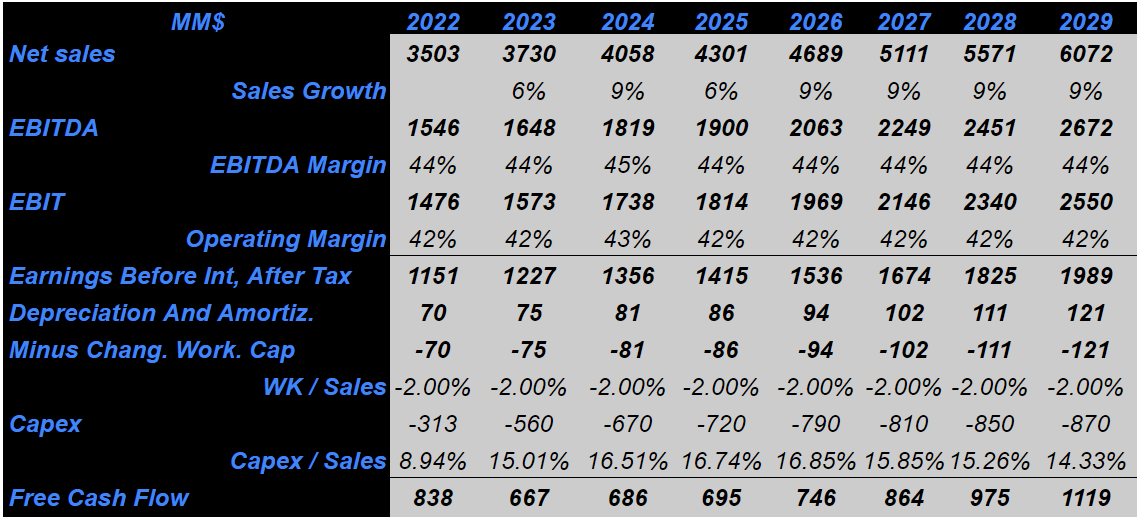

Under this scenario, I assumed that inorganic growth will not be as intensive as in the last ten years. I assumed that management will likely remain a bit more conservative because of the decrease in accident frequency. As a result, I don’t expect double digit revenue growth.

With that about inorganic growth, I envision new supply agreements with insurance companies. Note that Copart recently entered into new territories outside the United States. In my view, it is time for management to enlarge its network of sellers organically.

Our broad global presence enhances our ability to enter into global, national, or regional supply agreements with vehicle sellers. We actively seek to establish supply agreements with insurance companies by promoting our ability to achieve high net returns and broader access to buyers through our national coverage and electronic commerce capabilities. By utilizing our existing insurance company seller relationships, we are able to build new seller relationships and pursue additional supply agreements in existing and new markets. Source: 10-k

Copart’s previous sales growth ranges from 0% to more than 30%. However, I would say that most revenue growth y/y ranged between 14% and 9%. In my view, Copart could achieve 9% sales growth from now until 2029.

Ycharts

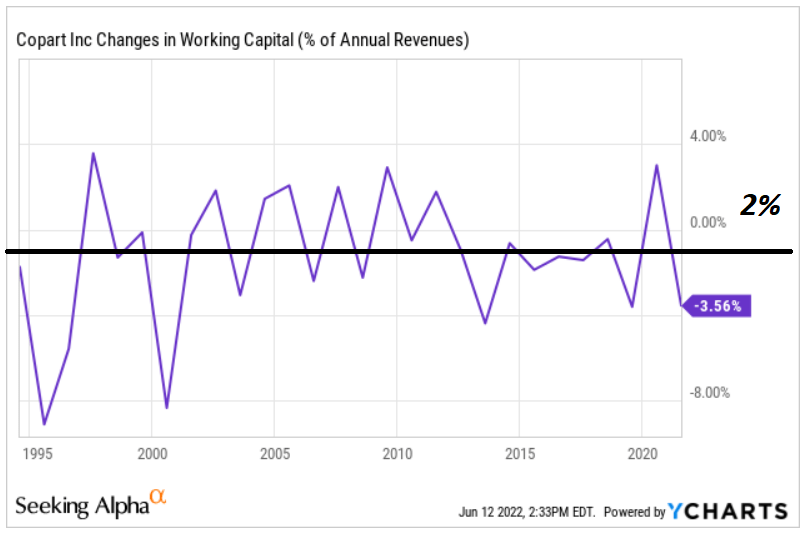

In the last 21 years, changes in working capital/sales ratio changed quite a bit. However, I believe that forecasting a ratio of 2% will likely be close to reality.

Ycharts

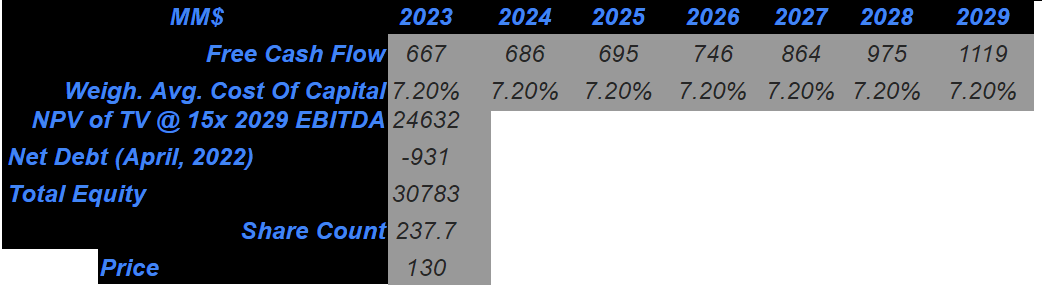

Under my base case scenario, from 2025 to 2029, I included an EBITDA margin of around 44% and operating margin of 42%. Also, with changes in working capital over 2% and capex/sales close to 16%-15%, 2029 free cash flow could exceed $1.1 billion.

Arie Investment Management

My CAPM model includes a beta of 0.85-0.95, cost of equity of 6.8%-7.8%, and cost of debt after tax of 3.4%. My numbers are not far from the figures reported by other investment analysts. Finally, the implied equity would stand at $30 billion, and the fair price would be $130.

Arie Investment Management

Vehicle Sellers Could Cancel Agreements, Or Exposure To Countries Outside The United States Could Bring The Stock Price Down To $49

Copart could suffer if a significant number of customers decide to terminate agreements with the company. As a result, revenue growth will likely decline. Let’s note that management claimed that the risk of not signing new agreements could also diminish the supply of vehicles.

Vehicle sellers have terminated agreements with us in the past in particular markets, which has affected revenues in those markets. There can be no assurance that our existing agreements will not be cancelled. Furthermore, there can be no assurance that we will be able to enter into future agreements with vehicle sellers or that we will be able to retain our existing supply of salvage vehicles. Source: 10-k

From 2007 until now, Copart’s international expansion has been quite ambitious. Management acquired many players in Europe and the Middle East, which may pose relevant risks in the near future. If certain transactions don’t close properly, or the synergies expected are not achieved, future free cash flow expectations would decline. Besides, if management does not find new targets, I would expect a significant decline in sales growth, which would lower the company’s fair valuation.

In fiscal 2007 and fiscal 2008 we made significant acquisitions in the U.K., followed by acquisitions in the U.A.E., Brazil, Germany, and Spain in fiscal 2013, expansions into Bahrain and Oman in fiscal 2015, expansion into the Republic of Ireland and India in fiscal 2016, and an acquisition in Finland in fiscal 2018. In addition, we continue to evaluate acquisitions and other opportunities outside of the U.S. Acquisitions or other strategies to expand our operations outside of the U.S. pose substantial risks and uncertainties that could have an adverse effect on our future operating results. In particular, we may not be successful in realizing anticipated synergies from these acquisitions, or we may experience unanticipated costs or expenses integrating the acquired operations into our existing business. Source: 10-k

Copart makes agreements with independent subhaulers. Considering the recent increase in the gasoline price and increase in salaries, subhaulers may try to renegotiate with Copart. In the worst case scenario, Copart may suffer an increase in its operating expenses, which would lead to a decrease in the free cash flow expectations. If a sufficient number of equity researchers notice the decrease in the free cash flow margin, the stock price will likely decline.

We rely primarily upon independent subhaulers to pick up and deliver vehicles to and from our storage facilities. Our failure to pick up and deliver vehicles in a timely and accurate manner could harm our reputation and brand, which could have a material adverse effect on our business. Further, an increase in fuel cost may lead to increased prices charged by our independent subhaulers, which may significantly increase our cost. We may not be able to pass these costs on to our sellers or buyers. Source: 10-k

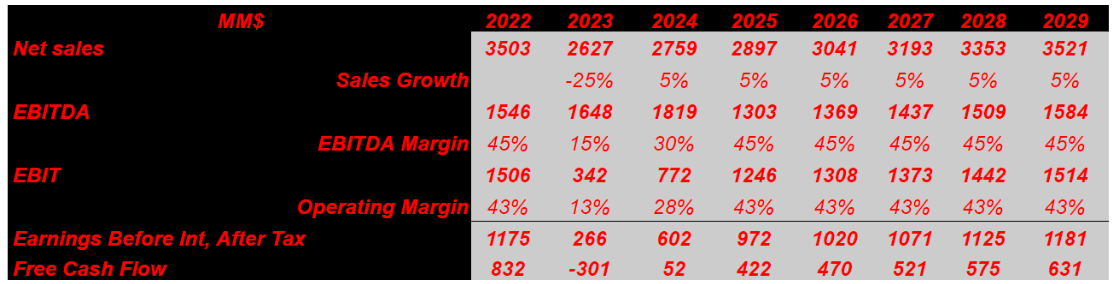

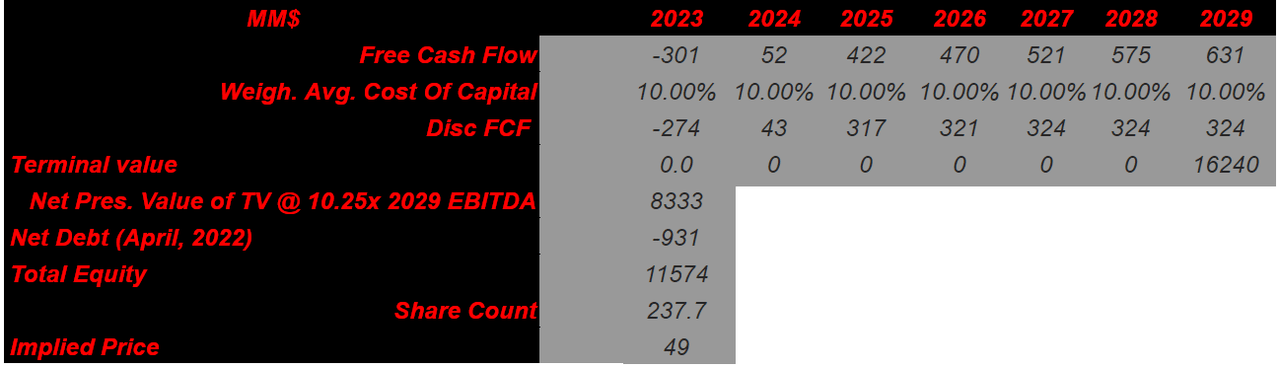

In the worst case scenario, I included 2023 sales growth of -25% in 2023 and 2023 operating margin of 13%. My numbers would also include 2029 EBIAT of $1.1 billion and 2029 free cash flow of $631 million. My figures are significantly lower than that in the base case scenario, but I believe that it is likely that Copart reports these figures.

Arie Investment Management

With a weighted average cost of capital close to 10% from 2023 to 2029 and an exit multiple of 10.25x, the implied stock price would be $49.

Arie Investment Management

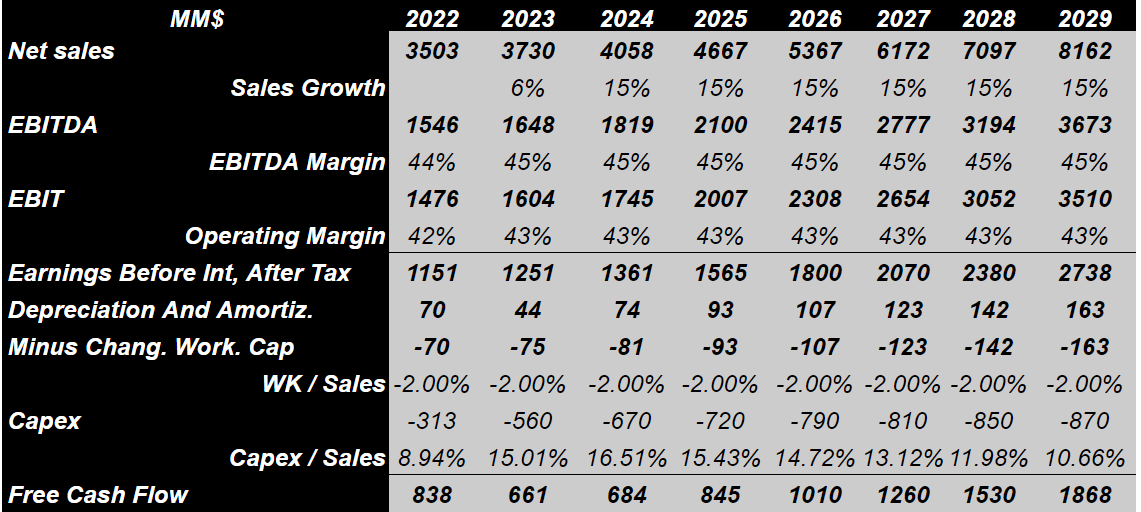

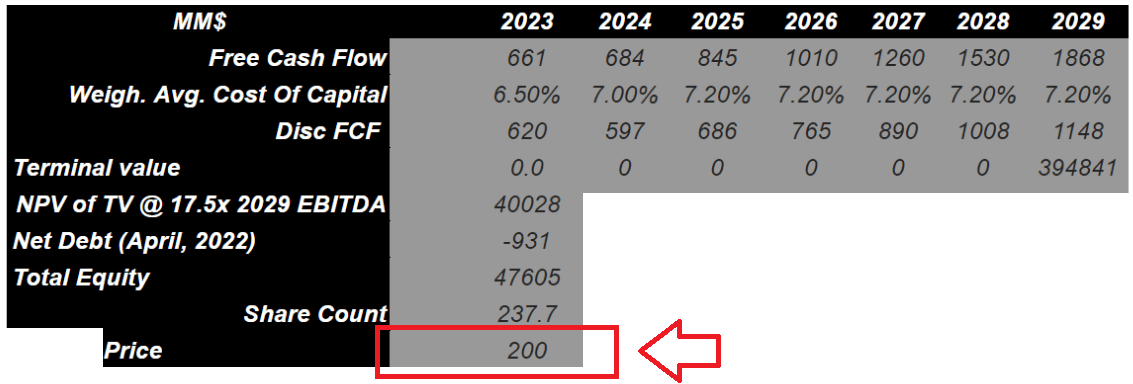

With More M&A Growth And More Software, Copart’s Stock Price Could Reach $200

Under my best case scenario, Copart would find a significant number of targets in new jurisdictions in Asia and Latin America. As a result, sales growth will likely remain very elevated. Besides, the gross selling price will likely continue to increase as inflation continues to creep up higher in the United States and elsewhere.

Finally, under this optimistic case, I also assumed that Copart will likely offer new value-added services and new bidding technologies. Among the new services, Copart intends to offer new software that can integrate information systems of clients into that of Copart. New products will likely bring more sales growth.

This includes, for our sellers, real-time access to sales data over the internet, the ability to respond on a national scale, and for our members, the implementation of VB3 real-time bidding at substantially all of our facilities, permitting members at any location worldwide to participate in the sales at our yards. We plan to continue to refine and expand our services, including offering software that can assist our sellers in expediting claims and salvage management tools that help sellers integrate their systems with ours. Source: 10-k

Under the best case scenario, I believe that sales growth of 15% from 2024 to 2029 is not that unlikely. The resulting 2029 EBIAT would be close to $2.71 billion, and 2029 free cash flow could stay close to $1.87 billion.

Arie Investment Management

Under my CAPM model, in this case scenario, I used a weighted average cost of capital of 6.5%-7.2%. My numbers include an equity valuation of $47 billion and a fair price of $200.

Arie Investment Management

Conclusion

Copart delivered significant sales growth in the most recent quarter. However, a recent increase in inventory because of a recent decline in accident frequency was reported. Even considering that further acquisitions could bring the stock price up, I would remain cautious. Negotiations with independent subhaulers may be likely if the price of gasoline increases. Besides, failure of certain mergers and acquisitions could bring the free cash flow down. In my view, very conservative individuals may pass on this company. Certainly, there are some potential risks.

Be the first to comment