Henrik5000/E+ via Getty Images

Investment Thesis

While Cooper Standard’s (NYSE:CPS) high degree of leverage is concerning for investors, there are reasons the sell-off in Cooper’s share price seems to be overdone. Firstly, the company’s substantial operating leverage means that the forecasted increase in OEM auto production will have an outsized on Cooper’s bottom line. Additionally, the cost-cutting and contract negotiations Cooper Standard has engaged in during the past couple of years make it well-positioned to emerge from the global automotive industry slowdown better than before. For these reasons, now looks to be a good time to begin accumulating a small starting position in Cooper Standard stock.

Company Overview

Cooper Standard is an automotive supplier that designs and manufactures parts for a diverse customer base of OEMs, like Ford (F), GM (GM), and Stellantis (STLA). Cooper is the global leader in sealing systems that protect vehicle interiors from the outside elements (50% of revenue). They are also the number two global supplier of fuel and brake delivery systems (25% of revenue) and a top player in the fluid transfer systems market (19% of revenue).

Financial History

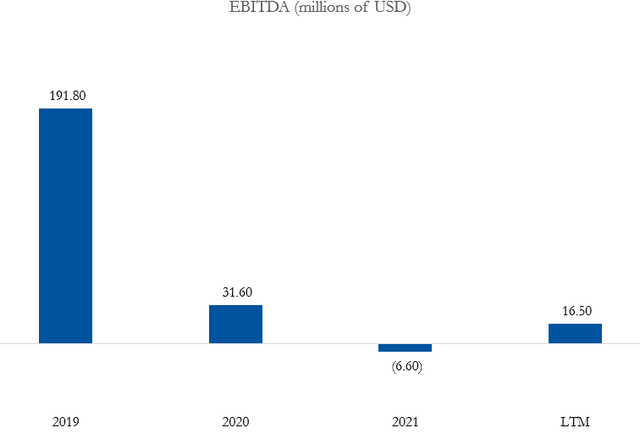

The aforementioned macroeconomic challenges with inflation and stunted automotive production have significantly impacted Cooper’s business. This is clearly depicted in the company’s declining EBITDA since the pandemic hit the automotive market in 2020.

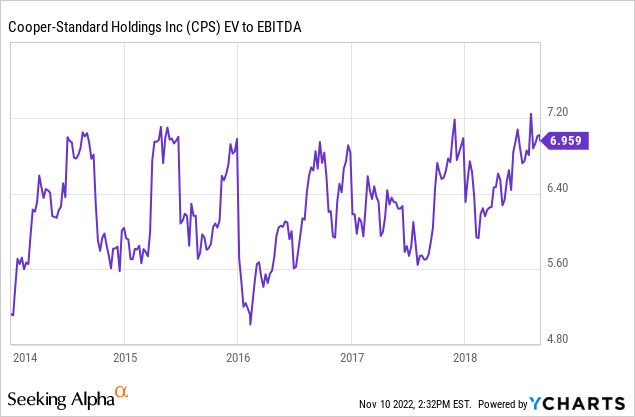

This over 90% drop in EBITDA between the LTM and FY2019 is largely due to the inherent fixed costs necessary in the automotive supply industry. In fact, revenue only declined by around 20% in this same time period. The discrepancy between these two figures implies that Cooper currently has a degree of operating leverage around 4.5x (-90%/-20%). This means that if Cooper can turn its business around and modestly grow its revenue, it will see an outsized benefit on the EBITDA front. Historically, EBITDA has been an excellent predictor of Cooper’s share price. As can be seen in the graph below, before the pandemic, Cooper almost exclusively traded around 6x EV/EBITDA.

Revenue Growth

This raises the question, how can Cooper raise its EBITDA to drive its future share price growth? Obviously, with its high degree of operating leverage that was explored earlier, revenue growth is the most straightforward way to go about this. Cooper Standard is well positioned here on multiple fronts. Firstly, management has been able to renegotiate their contracts with some OEMs to be indexed with inflationary costs, thus increasing Cooper’s revenue. Historically, most automotive suppliers have between 40% and 60% of their contracts indexed. Cooper has jumped from being an industry laggard having only 30% of its OEM contracts indexed to a leader with ~70% of contracts indexed in Q2 2022.

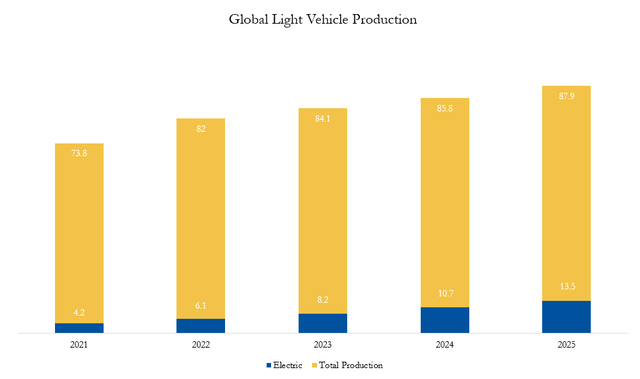

Looking more toward the macro automotive market, things are beginning to look up for Cooper. Industry experts are forecasting that pent-up demand caused by supply disruptions experienced during the pandemic will bolster global auto production as supply chains begin to normalize. During the past couple of years, the lack of available new car inventory pushed consumers toward used offerings, driving the average vehicle age in the US to a record high of 12 years old. This latent demand for vehicles is part of the reason behind IHS’ forecast for light vehicle production to increase at a CAGR of 5% between 2021 and 2024, returning to pre-pandemic levels by 2023. Obviously, because Cooper supplies critical components needed in all light vehicles, they stand to benefit from this industry growth. Furthermore, because of their high degree of operating leverage, they will see an outsized benefit on an EBITDA basis.

On a longer-term horizon, increasing adoption of BEVs should provide another avenue for Cooper’s growth, particularly in their fluid transfer systems segment. This is because the large batteries critical to EVs require extensive cooling solutions. Due to these increased cooling needs, Cooper estimates it can sell an additional 20% of content per vehicle (CPV) to OEMs. This is a more conservative estimate than some of Cooper’s competitors, like TI Fluid Systems (LON: TIFS), who are touting that EVs could potentially double fluid transfer systems CPV. Nevertheless, with IHS’ projection of EV production to grow at a CAGR of 33.8% through 2025 along with legacy OEMs beginning to electrify their fleets, Cooper stands to benefit from significant revenue growth and the resulting EBITDA margin expansion.

IHS – Global Light Vehicle Production – EV Share (Millions of Units)

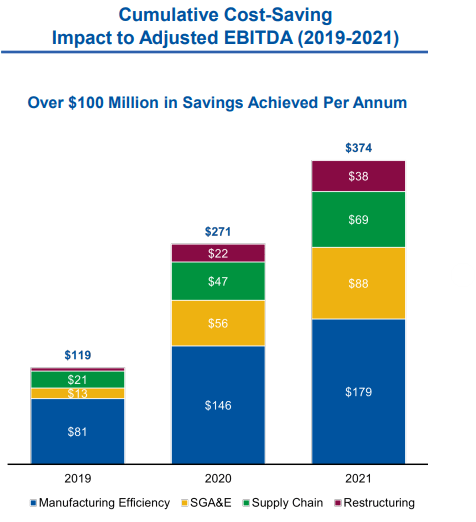

Cost Control

Turning away from revenue and towards managing costs, things continue to look good for Cooper. As can be seen in the company-provided diagram below, management has utilized this difficult time in the automotive industry to optimize their fixed costs and streamline their profitability. Since 2019, these cost optimization initiatives have saved nearly $400 million in impact to adjusted EBITDA. Looking forward, the company states that they will continue to focus on lean manufacturing initiatives and SGA&E rationalization. As macroeconomic conditions begin to normalize, Cooper Standard’s cost-cutting will allow it to emerge as a leaner and more agile company, increasing its margins and competitiveness.

CPS Q2 2022 Earnings Presentation

Valuation

Currently, analyst consensus predicts that the company will be able to return to its pre-pandemic EBITDA level of around $300 million within the next few years. This is in line with the argument made throughout this investment thesis as car production is set to accelerate soon, EVs will provide another avenue for growth, and many costs have been optimized during the pandemic. As explored earlier, the company historically trades at 6x EV/EBITDA. With an EBITDA of $300 million, this multiple would imply a future enterprise value of $1.8 billion. In line with IHS, management, and analyst consensus, let’s assume that Cooper returns to $300 million in EBITDA in 2.5 years. Discounting this future implied EV into present value by the company’s cost of capital (9%) implies a present enterprise value of $1.45 billion. Subtracting debt and adding back cash gives an implied market cap of $556 million or share price of $32. Due to significant risks still hanging over the company (see next section), I do not believe this $32 share price will be realized anytime soon, but this valuation exercise shows how if the company executes in the way described throughout the investment thesis, shareholders are in for massive gains.

Risk – Excessive Leverage

While this article has painted a fairly rosy picture for Cooper Standard, it is important to note some significant red flags and risks. Most importantly, the company has massive amounts of debt ($1,126 million to be exact). Currently, the company has hired Goldman Sachs in a bid to try and refinance their debt. However, with interest rates as high as they are now, the company will likely be shelling out significant amounts of cash for the foreseeable future. This extreme amount of debt creates a high degree of financial leverage (market cap is only $133 million). Combining this with the sizeable operating leverage highlighted in the investment thesis and the massive upside associated with the projected share price of $32 starts to make some sense.

Conclusion

Despite these significant leverage concerns, the company seems to be entering a more favorable macro environment where all of this leverage could result in substantial returns for shareholders. Furthermore, the strides the company has made in regard to its costs and contracts position it well to capture this industry-wide growth. For this reason, I believe it makes sense to start building a small starter position in Cooper Standard as we wait to see how OEM production and their debt situation play out over the next few quarters.

Be the first to comment