Jonathan Kitchen

Since I recommended people avoid the shares of Q2 Holdings, Inc. (NYSE:QTWO), the shares are down about 48.6% against a slightly positive 0.4% return for the S&P 500. On the theory that a stock trading at $25.85 is, by definition, a less risky investment than the same stock trading at $50.25, I thought I’d revisit this name to see if it’s finally worth “pulling the trigger.” I’ll make this determination by looking at the most recent financial results, and by looking at the stock as a thing distinct from the business. Additionally, in my previous missive on this name, I recommended people who insisted on staying long here do so by buying the November calls with a strike of $55, which were asked at the time for $8.50. I’m absolutely champing at the bit to write about how that trade, along with my other options recommendations, have worked out relative to stock ownership.

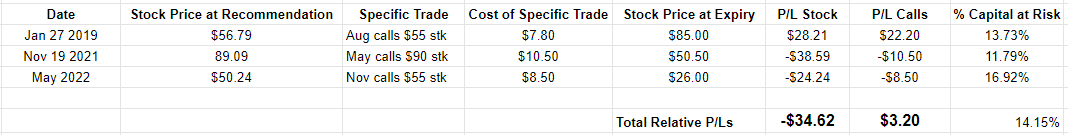

Welcome to the “thesis statement” portion of the article, where I regale you with the gist of my arguments about a given company and stock, in order to help keep you informed. I offer my thinking up front in this way so you won’t be obliged to wade through the entire article. I am obviously “all about” trying to save you Seeking Alpha readers time and effort. You’re welcome. The strong negative relationship between revenue and net income that we’ve seen since 2013 lingers. Given the very strong negative relationship (r=-0.91) between revenue and net income, it seems that the more this company sells, the more it loses. Although the stock has come down in price, it’s still not “cheap” in my view. For example, it remains about 11% more expensive than the much less risky S&P 500 on a price-to-sales basis. Finally, since I started writing about this stock way back in 2019, I have recommended people who insist on remaining long here express that perspective via call options. I’ve made this recommendation on three occasions, and the results are in: calls have outperformed stock ownership massively while risking only about 14% of capital. I wish it were possible to make a similar recommendation again today, but premia are a bit too expensive at the moment.

Financial Snapshot

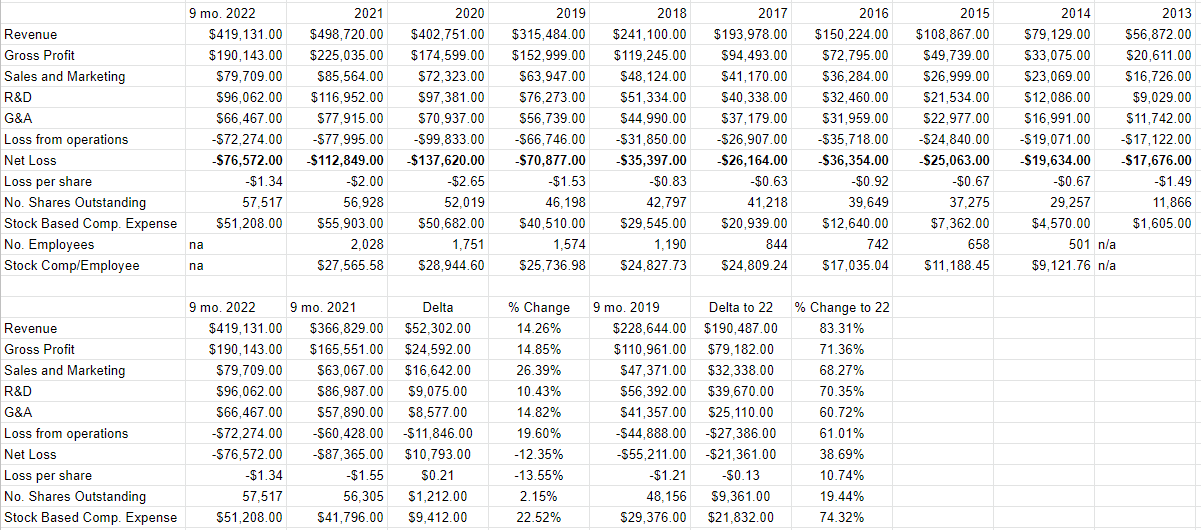

The phrase “the best predictor of future behaviour is relevant past behaviour” has been attributed to many, many people. I’ve read the quotation over names as diverse as Mark Twain, and B.F. Skinner. I think it’s so widely attributed because there’s a deep truth in it. I was thinking of this phrase as I reviewed the recent financial history at Q2. I’ve been posing a question to bulls ever since I started writing about this company, and I’ve yet to receive an answer. Here’s the question in case you missed it previously: if growing sales won’t lead to net income, what will? In fact, the disconnect between revenue and net income is so strong here that I think it’s fair to write that the more this company sells, the more it loses. For those of you who like quantifying such things, I calculated the correlation between revenue and net income and found that there’s a very strong (r=-0.91) correlation between sales and net income. It is literally the case that the more this company sells, the greater are its losses. Also, this is a relationship that has been in place since 2013, so I don’t think we can apply words like “anomalous” to my analysis. There seems to be something embedded in the business model, and I see nothing that’s going to break the trend.

Written yet another way, it’s impressive that revenue has grown at a CAGR of about 27.3% between 2013 and 2021. The problem is that owners of a business aren’t compensated with sales. They’re compensated by what’s left over after employees, suppliers, and landlords have been paid. Also, of course, various governments need to wet their beaks. I mean, they need a taste. Owners are compensated with the residual, and, since 2013, the “residual” has been negative. Sales growing at such an impressive compounded rate haven’t been sufficient to make up for the fact that “sales and marketing”, “R&D”, and “G&A” expenses have grown at CAGRs of 20%, 33%, and 23.4% respectively over the same time period.

It’s not all bad at Q2, though, as the capital structure remains fairly robust. As of the latest quarter, there’s about $192.5 million of cash on the balance sheet, against total liabilities of $903 million. This means that cash represents about 21.3% of the capital structure, which is fairly decent in my view. Given that I’m in the mood to be a total “downer”, though, I’m obliged to point out that the balance sheet has deteriorated massively over time. For instance, as of the third quarter of 2018, the company had cash of $211.8 million and total liabilities of $275 million. In other words, at the time, cash represented about 77% of the capital structure. So, the capital structure remains fairly strong. The most recent full year saw losses of just under $113 million, so I don’t know how much longer this will be the case, though.

Another bright spot involves employee compensation. While the share price has collapsed over the past while, we can all take heart in the fact that stock-based compensation has exploded higher yet again. For the first nine months of the year, stock-based compensation crested $51 million, which was up about 22.5% from the previous year, and was about 74% higher than it was in 2019. Also, given the very fair-minded nature of modern corporate capitalism, I’m sure that all of the approximately 2,100 employees share this bounty equally. If I were a shareholder, my faith that the lowliest office worker also did well by the “stock-based compensation” expenses would help lessen the sting here a little bit.

If my position on the matter hasn’t been made abundantly clear yet, I’m of the view that this business remains un-investable. That written, I understand that the crowd has a tendency to drive mediocre businesses to new highs on occasion, and I understand that some people remain bullish on this name. Additionally, at some point, even a mediocre business can be a good investment at the right price. I want to see how near (or far) we are from the “right” price.

Q2 Financials (Q2 investor relations)

The Stock

My regular readers know that I consider the “business” and the “stock” to be quite different things. For example, a business might invest in R&D and other elements, put those elements together, and then sell the results at a loss. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for digital banking services, etc. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. There are a few other variables that affect the stock that don’t affect the business (analyst opinion, the crowd’s changing appetite for “stocks” as an asset class, etc.), but suffice to say that the business and stock are different things, and the latter is sometimes a poor proxy for the former.

This disconnect between the two can be frustrating, but it’s also the source of potential profit. This is because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

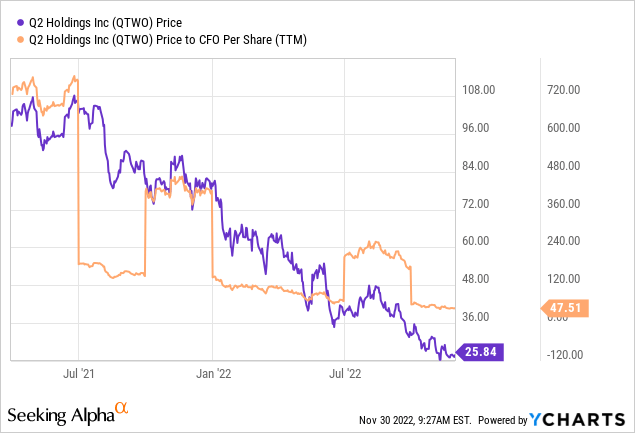

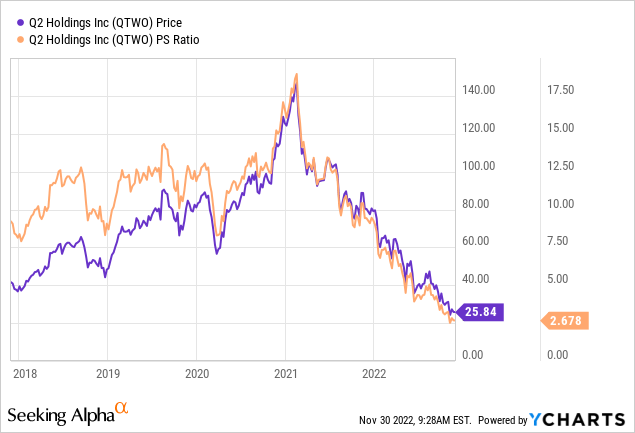

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you need to be reminded if you don’t have your copy of “The Almanac of Doyle’s Trades” handy, I recommended that people continue to eschew Q2 shares because they were trading at a price-to-sales ratio of about 5.8 and a price to CFO of 94.24. Fast forward about six months, and the shares are now about 49% cheaper on a price to CFO basis, and about 54% cheaper on a price-to-sales basis, per the following:

In my view, “cheaper” is not the same thing as “cheap”, though. Although the market is paying much less for $1 of sales from this company, it is still spending about 11% more than for the (much less risky) S&P 500. Given all of the above, I must recommend people continue to avoid this name.

Options Update

In each of my previous three missives on this name, I have recommended people who insist on buying this stock on merger speculation, for instance, express their bullishness with call options. The following table reveals how those trades have worked out so far. Since the table may not be obvious, I’ll offer the highlights here. The three call options I recommended managed to squeeze out a small profit, in spite of the fact that the last two batches have expired worthless. The stock, on the other hand, has cratered in price. This relative outperformance of calls happened in spite of the fact that, on average, calls required an average of about 14.15% of the capital at risk. I think this pretty definitively reveals that if you want to speculate in a stock like this one, the best way to manifest that perspective is via call options.

Relative Performance of Calls v Stocks since Jan 2019 (Author calculations)

While I absolutely love trying to repeat success when I can, I can’t recommend calls at the moment, as the premia being demanded is too great in my view. For example, the February Q2 call with a strike of $25 is currently asked at $5.60. This is about 22% of the price of the stock, so it’s not worth it in my view. I would recommend putting in a bid of about $3.50 on these, but I can’t guarantee that such an offering price would be accepted. That would, in my view, be the only way to “play” this investment going forward.

Be the first to comment