TomasSereda

By Alex Rosen

Summary

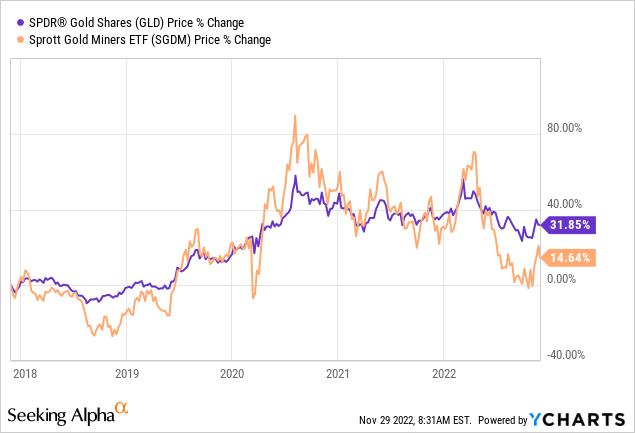

Sprott Gold Miners ETF (NYSEARCA:SGDM) tracks an equity index of gold mining firms predominantly in Canada. The fund is a pure mining play, with 100% of the assets invested in mining companies. Over the past year, it has had a rough go (-10.99%) as has most of the broader market, but it has been a solid, if not stellar, fund over the past five years, returning 4.25%.

Despite the fact that SGDM is a gold mining fund, it is very unlikely to hit it big. Focusing on Canada and the U.S. suggests steady, if not exciting returns, but also no real risk of political instability and insurgency suddenly disrupting the mining process.

Strategy

According to the prospectus, “The Index uses a transparent, rules-based methodology that is designed to emphasize larger-sized gold companies with the highest revenue growth, free cash flow yield and the lowest long-term debt to equity. The Index is reconstituted on a quarterly basis to reflect the companies with the highest factor scores”.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Industry

-

Sub-Segment: Gold Miners

-

Correlation (vs. S&P 500): Medium

-

Expected Volatility (vs. S&P 500): Medium

Holding Analysis

With 100% of the fund committed towards the mining sector, SGDM makes no bones about what it does. Focusing on Canada and the U.S., SGDM is all in on getting the gold. The fund holds a tight collection of 34 assets, with the top 10 accounting for two thirds of the fund. The top holdings are Newmont Corp (NEM), the world’s largest gold mining firm based in the U.S., Barrick Gold (GOLD) a Canadian based gold and copper mining firm, and Franco-Nevada Corp (FNV) another Canada based mining company.

The fund is divided among large, medium and small cap companies, with the large cap accounting for 47.5% of the total assets.

Strengths

A single focus fund, regardless of the focus, has to live and die by that commodity. When gold demand is up, SGDM will make money; when gold demand is low, it will struggle.

For investors looking not at the global retail price, but the specific North American sector, SGDM can provide that demand.

Weaknesses

There is a lot going on in the global gold market these days. Russian mercenaries are running all around Africa buying and taking as much gold as they can carry. China jumped on the opportunity to extract Uganda’s massive gold strike.

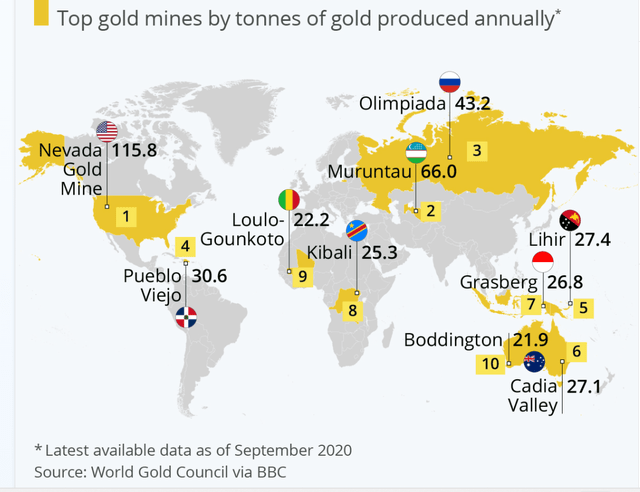

While the U.S. and Canada certainly have their fair share of gold to dig up, the rest of the world has plenty of gold as well. The map below shows where the largest gold mines are, or were as of 2020. After Nevada, the next nine are all spread out in regions not covered by SGDM. Of course, global gold mining is not the primary focus of SGDM, but at the same time, by focusing only on U.S. and Canadian companies, they sure do miss out.

Where’s the gold (World Gold Council via BBC)

Opportunities

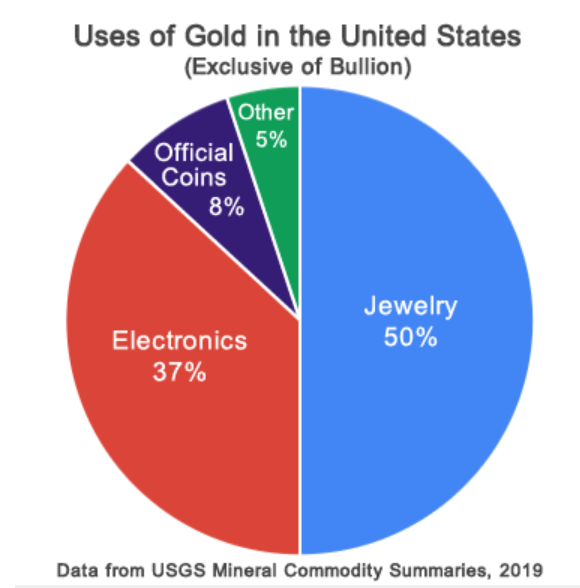

The prospect of steady reliable returns in a very mature, high demand industry is always appealing. Further, the gold of today is not your grandfather’s gold. The digital age has seen an explosion in the use of gold in electronics. It is fair to say that it is the most useful mineral found in the earth today. While the majority of it is still used for jewelry, the demand within the electronics sector is growing.

Gold, Not just for Jewelry (Geology.com and USGS)

Threats

The extraction of gold can be a costly process with adverse environmental and health risks. As stated before, there is no global shortage of gold, and more and more is found every day. It is not hard for me to envision a day where American and Canadian mines are shut down, not because of lack of capacity, but rather because of a combination of government interference, environmental concerns, and operating costs. In other words, the mining companies just may decide to take their toys and go elsewhere.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

A fund that has 100% concentration in one industry and focused almost exclusively on two countries is not that hard to read. What they do and where they do it are well established. All that’s left is to choose the companies that go into the fund. SGDM’s transparent rating system makes it very easy to track how they have chosen the holdings and how they weight them

ETF Investment Opinion

While we are not overly excited about SGDMs returns, we do see value in holding this fund. It has been fairly consistent over the last five years returning on average 4.5%. If you are holding shares in SGDM and are concerned about the future, keep holding. While past performance is no guarantee of future results, as long as SGDM doesn’t radically alter its model, it should stay around where it has been. We rate SGDM a Hold for now.

Be the first to comment