Warchi/E+ via Getty Images

By Derek Deutsch | Mary Jane McQuillen

Crosswinds Creating Idiosyncratic Opportunities

Market Overview

Rapidly tightening financial conditions and rising recession risks pressured U.S. equities in the third quarter. Virtually all areas of the market fell, with the benchmark Russell 3000 Index declining 4.46%. The Federal Reserve raised the federal-funds rate 1.50% in the quarter and signaled further hikes, and higher rates for longer, would be necessary to tame inflation, even at the expense of an economic slowdown. Treasury yields rose, which, combined with economic tribulations abroad — a spiraling energy crisis in Europe and slowing growth and COVID-19 lockdowns in China — helped the U.S. dollar surge.

The quarter also saw the largest climate legislation in U.S. history. The U.S. passed the Inflation Reduction Act (IRA), providing major support for clean energy production and consumption, electric vehicle (EV) adoption, energy efficiency and a host of climate-friendly businesses and developing technologies, areas that have been a main focus of the ClearBridge Sustainability Leaders Strategy since its inception.

From a sector perspective, the energy (+3.42%) and consumer discretionary (+3.40%) sectors delivered the only positive returns in the Russell 3000 Index. They were helped, respectively, by a tight energy market and positive financial results from two outsize consumer discretionary constituents, Amazon.com (AMZN, which we own) and Tesla (TSLA, which we do not). Amazon.com has been a standout in e-commerce with fulfillment productivity improving efficiency and employee engagement as it stays ahead of inflationary pressures with better route density and higher package velocity. Amazon is also growing its advertising business ahead of peers and diversifying its advertising offerings into video.

At the other end of the market, sharply rising interest rates caused trouble for yield-sensitive sectors such as communication services (-12.03%), where cable and telecom stocks, as well as mega cap advertisers like portfolio company Alphabet (GOOG, GOOGL), are also facing tough comps versus the pandemic period when demand for broadband/digital media soared and e-commerce boomed. The real estate sector (-10.89%) also had a difficult quarter amid rising interest rates and signs of a deteriorating housing market.

Against this backdrop, the ClearBridge Sustainability Leaders Strategy outperformed its benchmark Russell 3000 Index, led by our stock selection in the information technology (IT), industrials and health care sectors.

In IT, Enphase Energy (ENPH) delivered a strong quarter driven by secular growth in global rooftop solar, increased penetration into Europe, where demand accelerated, and a continued ramp up in battery storage sales. ON Semiconductor (ON), which makes semiconductor components, has bucked the chip industry downcycle via its exposure to automotive end markets, and particularly to the growing amounts of semiconductors used in EVs. Keysight Technologies (KEYS), which provides electronics test and measurement equipment and software to the communications and electronics industries and is positively levered to the growth of 5G, has been executing well, and the 20% of its revenues it received from China should further help as China rolls back COVID-19 restrictions.

Industrials holdings such as process and motion control company Regal Rexnord (RRX) and HVAC and transport refrigeration company Trane Technologies (TT) also performed well, lifted by strong execution as both beat earnings and revenue expectations. Both companies should also benefit from the IRA as they enable greater energy efficiency in a variety of settings: Regal Rexnord innovates through best-in-class engineering capabilities to help customers achieve their energy efficiency objectives; Trane’s products enable lower energy demand and emissions in HVAC systems and buildings, where it estimates ~15%–25% of all GHG emissions are emitted.

Farm equipment manufacturer Deere (DE) continues to benefit from both a strong farm economy and product innovations that directly benefit farmers’ productivity while also reducing their environmental footprint. The company has also demonstrated excellent execution, highlighted by capturing market share and maintaining margins despite dealing with a labor strike and elevated supply chain costs.

Strong earnings and raised guidance from Progyny (PGNY), the leading provider of fertility benefit management services to self-insured employers, drove our outperformance in the health care sector. Progyny’s offering is an increasingly important, albeit relatively underpenetrated benefit for employers, particularly those seeking to improve access and support diversity, equity and inclusion initiatives. Its mission is to improve the employee experience around fertility issues in order to aid clients in employee recruitment and retention. The company offers a rare win-win-win for employers, employees, health systems and doctors, with clear savings and quality improvements.

Detractors came from a mix of sectors: a hawkish Fed contributing to a surge in the U.S. dollar creates foreign exchange difficulties for multinational firms like Microsoft (MSFT) and Nike (NKE), which generate significant revenues overseas. Aluminum packaging producer Ball (BALL) missed earnings expectations and is feeling the effects of inflation as its customers pass on higher costs to end consumers, curtailing volumes. Rising inflation pressuring consumer budgets for discretionary purchases, as well as volatile currency markets, weighed on global entertainment company Hasbro (HAS), which owns Monopoly, My Little Pony, Nerf, Play-Doh and other games and brands.

Intel (INTC) delivered a disappointing revenue miss and lowered full-year revenue and earnings guidance as COVID-19-driven demand for PCs abated (where Intel enjoys half its sales) and a delay in its flagship Sapphire Rapids CPU hurt its data center business. Despite these issues, we still believe Intel is an attractive turnaround story with substantial upside. There were a few positives in the quarter: Intel confirmed its process technology roadmap is on track (which should allow it to catch up to Taiwan Semiconductor (TSM) in coming years) and the CHIPS and Science Act passed in August should provide billions of dollars to the company as it solidifies its position as the lone domestic provider of leading-edge semiconductor manufacturing.

Portfolio Positioning

We were active in repositioning the portfolio in the quarter as market crosswinds opened idiosyncratic opportunities, adding two new industrials companies. Bloom Energy (BE) is an electrical equipment company that makes solid-oxide fuel cell systems for on-site power generation, serving a variety of industries. Its fuel cells convert natural gas, biogas or hydrogen into baseload (non-intermittent) electricity without combustion, so there is low or no carbon emission. We expect significant upside through its ability to support the growing hydrogen economy, with a large opportunity for this in South Korea and meaningful policy support in the U.S. via the IRA, while other markets include biogas, carbon capture and marine transportation. Its natural gas energy server business is growing in the U.S. amid higher grid reliability concerns.

Shoals Technologies (SHLS) manufactures electrical balance of systems (EBOS) components for ground-mounted solar projects and has been gaining market share for quality of service and price. Shoals is also starting to develop an EV charging infrastructure business. We previously owned Shoals and sold our position earlier this year as supply chain issues were negatively affecting margins. Improving supply chain dynamics should support the stock, and tax credits for clean energy production and investment in the IRA should further act as a tailwind for Shoals.

We also pivoted our holdings in NextEra Energy (NEE) to better take advantage of the IRA’s provisions for renewable energy, swapping our shares for those of NextEra Energy Partners (NEP), a growth-oriented and renewables-focused company formed by NextEra Energy, its sponsor and general partner, to own, operate and acquire contracted renewable energy generation assets located in North America.

Meanwhile, cost inflation, exacerbated by the Ukraine war and the inflexibility of consumer staples company Hain Celestial’s (HAIN) supply chain, have pressured near-term earnings power as well as Hain’s margin outlook; we exited our position.

Outlook

Looking ahead, with tighter monetary conditions slowing economic activity and weighing on investor sentiment, we should continue to see volatility as falling markets attempt to find a durable bottom. That said, with household leverage historically low, the impact of higher interest rates on consumers may be blunted. Wage gains are also helping the consumer to weather the increases in energy prices and inflation overall. Our diversified portfolio is designed to capitalize on the stability and growth prospects of quality companies helping to solve global sustainability challenges. While we expect challenging market conditions to persist in the short to intermediate term, we feel our portfolio should generate superior results through the cycle and are especially optimistic about the impact of the IRA on many of our holdings over the long term.

Portfolio Highlights

The ClearBridge Sustainability Leaders Strategy outperformed its Russell 3000 Index benchmark during the third quarter. On an absolute basis, the Strategy had a positive contribution from one of 10 sectors in which it was invested (out of 11 sectors total): the industrials sector. The main detractors were the materials, consumer discretionary and real estate sectors.

On a relative basis, overall stock selection and sector allocation contributed positively to performance. Stock selection in the IT, industrials, health care, financials and communication services sectors, an underweight to the communication services sector and an overweight to the consumer discretionary sector aided relative results. Conversely, stock selection in the consumer discretionary and materials sectors and a lack of energy holdings were detrimental.

On an individual stock basis, Enphase Energy, Regal Rexnord, ON Semiconductor, NextEra Energy and Progyny were the largest contributors to absolute performance in the quarter. The main detractors from absolute returns were positions in Microsoft, Ball, Intel, Hasbro and McCormick (MKC).

ESG Highlights

Inflation Reduction Act Deepens the Decarbonization Bench

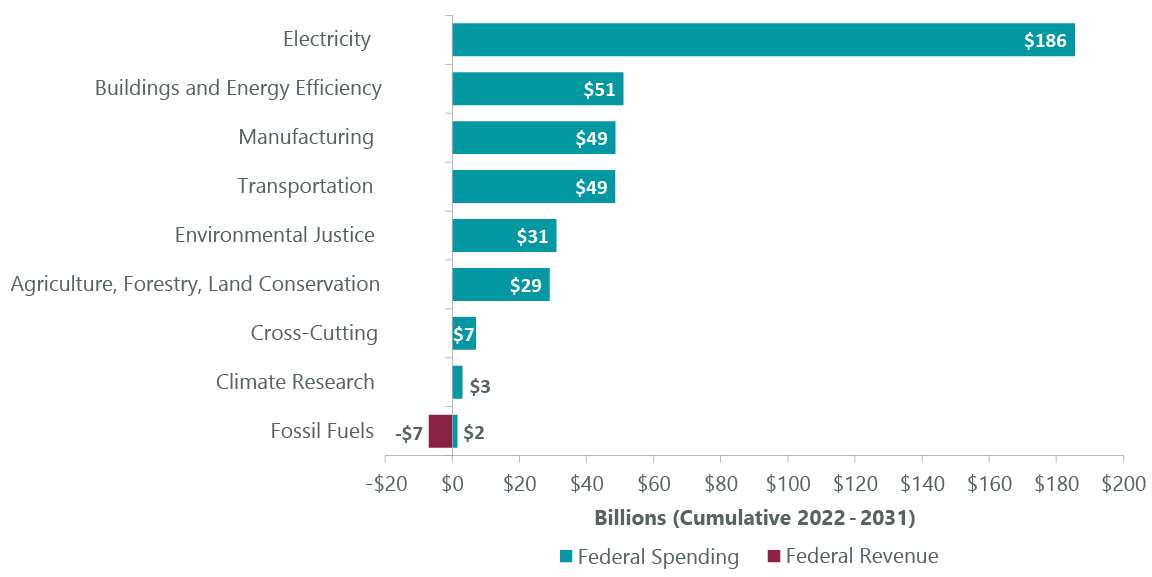

The U.S. Inflation Reduction Act, signed into law on August 16, 2022, is the most significant climate legislation in U.S. history and should have ramifications for companies across several sectors. Most of the act consists of spending or tax credits for energy and climate — worth around $390 billion over 10+ years, with the largest portion going to clean energy production and investment (Exhibit 1). It also offers strong tailwinds for ClearBridge holdings in the renewable energy and EV supply chains, as well as those that are helping the climate with solutions in buildings and energy efficiency.

Exhibit 1: Inflation Reduction Act Energy and Climate Spending

Sources: Congressional Research Service, ClearBridge Investments.

At a high level, the act includes $127 billion for extending and expanding production tax credits (PTC) and investment tax credits (ITC) for zero-carbon electricity generating technologies like solar, wind, biomass and geothermal. PTC include credits of $26/MWh (inflation-linked) for producing zero-carbon electricity for the first 10 years of a project’s life. ITC provide an upfront tax credit equal to 30% of construction costs that the developer can claim immediately to offset the cost of building the plant.

These tax credits will phase out beginning the later of 2032 or when the U.S. power sector emits 75% less carbon than 2022 levels — meaning that the credits could remain in place well beyond 2032. This long-term visibility is a significant positive for the sector.

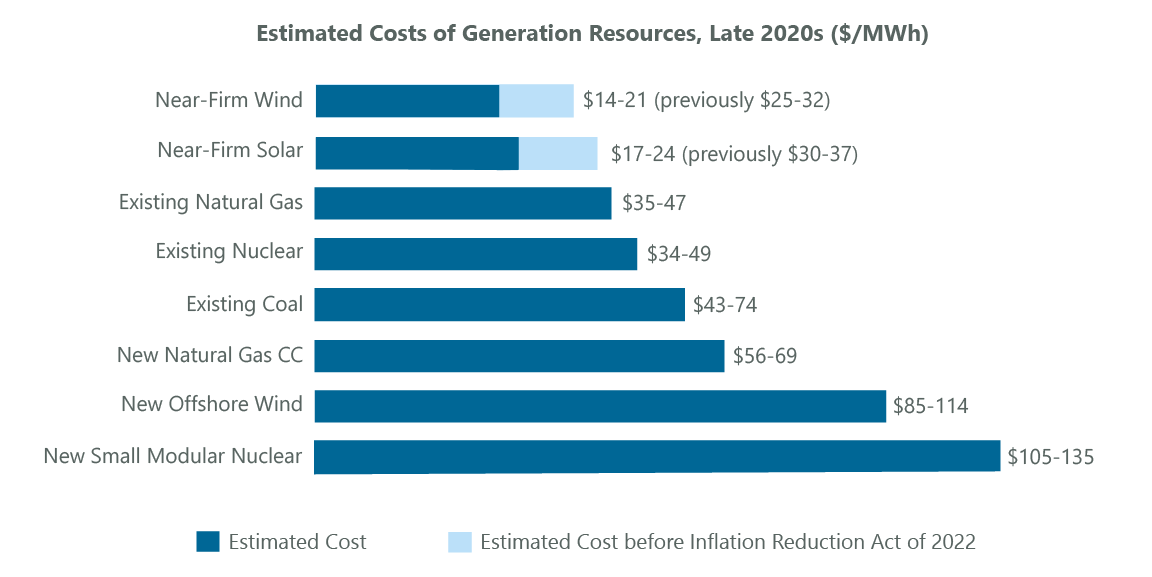

The tax credits have also been expanded to include standalone energy storage, a huge boost for this technology that should lead to significant increases in battery installations. Wind and solar were already highly competitive relative to other sources of electricity generation, and the extension of the ITC and PTC should turbocharge those economics (Exhibit 2).

Exhibit 2: IRA Turbocharges Wind and Solar Cost Competitiveness

Shown for illustrative purposes only. Note: Natural gas, nuclear, coal and natural gac CC estimated costs were unchanged. Source: NextEra Energy.

The PTC and ITC now come with an extra 10% bonus credit if domestic content thresholds are met for manufactured components in the project (generally 40% of the total cost for most projects, 20% for offshore wind, must be produced in the U.S.), which will help U.S. manufacturers.

ClearBridge Holdings Leading Decarbonization Drive

ClearBridge portfolio companies have been adding value with innovation and competitive business models in these areas for years and are well-positioned to benefit from the credits. Shoals Technologies, for example, is developing products that will make utility scale projects more efficient. Its main factory in Tennessee also employs a very diverse workforce. Also with a strong presence in the U.S., Enphase Energy designs and manufactures microinverters for residential and small commercial solar PV systems and has made strides in evolving from a solar inverter maker into a “home energy management” company that can act as the brains for the home’s energy system, including microinverters for solar, as well as storage and energy management software.

The PTC and ITC extensions are also positive for utilities with renewables portfolios, improving long-term visibility for their efforts to decarbonize their power mixes. ClearBridge holding NextEra Energy is exemplary in leading utilities in decarbonization through both of its subsidiaries. The company’s regulated utility in Florida will be able to broaden its already aggressive solar capacity buildout targets in the state. The company’s unregulated subsidiary Energy Resources, one of the largest renewable project developers in North America, should see higher demand for solar, wind and batteries going forward on more attractive subsidized economics of renewable power. NextEra also has a “real zero” strategy to eliminate carbon emission from its operations, a topic ClearBridge actively engaged the company on after it formally announced targets for Scope 1 and 2 emissions reductions in its operations and purchased power and without using offsets. The plan has five-year milestone targets, e.g., a 70% reduction in emissions by 2025. NextEra Energy Partners is even more levered to the increasing spending on and demand for renewable energy the IRA should drive.

The credits also broadly offer new opportunities for investments in storage, EV charging infrastructure, hydrogen and carbon capture and storage, the latter two topics we have written about as having the ability to decarbonize heavy transport and offering meaningful opportunities to industrial gas companies and a variety of smaller innovators, though carbon capture at scale remains a challenge.

At the same time, while the ITC and PTC extension boosts demand for renewables given the economics were already attractive, the speed of deployment may not be meaningfully impacted in the short term due to other constraints like permitting and interconnection.

Transport Incentives Call Out Minerals, Batteries, Hydrogen

Seeking to decarbonize transportation, the act earmarks $9 billion in tax credits for EV purchases, including the first-ever tax credit for the purchase of used EVs. Currently, the EV tax credit includes a cap of 200,000 vehicles sold per manufacturer, meaning companies like ClearBridge holdings General Motors (GM) and Tesla would no longer qualify. The legislation eliminates this cap. The credit only applies, however, to vehicles assembled in North America and those whose batteries include a large percentage of components manufactured or assembled in North America. General Motors, for example, will get a tax credit for each domestically produced kWh of battery cells; the company has already built several battery plants with more on the way in Michigan, Ohio, and Tennessee, which puts it ahead of the competition in the ability to realize this tax credit.

Further, the EV batteries must also contain a large (and gradually increasing) percentage of critical minerals and components sourced from within the U.S. or from countries with U.S. free trade agreements (i.e., not China). This provision underlines the importance of metals and minerals necessary for the energy transition. Electrification requires large amounts of copper, for conducting electricity, and battery materials such as cobalt and lithium, for storing it. Mining these minerals entails substantial ESG risks. Extractive industries are, by nature, tough on the environment. Further, many mines operate in emerging economies with substantial risks due to reduced labor protections and lax governance and environmental regulations.

The minerals provision in the act should help raise standards and transparency for procuring metals and minerals necessary for the energy transition, leading to better environmental efficiency of operations, land usage and impact, water usage and labor conditions, four areas ClearBridge focuses on when engaging companies in extractive industries.

ClearBridge has visited and engaged with holding MP Materials (MP), for example, a U.S. mining company with a facility that supplies neodymium and praseodymium, two rare earth minerals used to make powerful magnets found in 90% of EV motors. The facility recycles all water from its process such that recycled water meets 95% of the facility’s water needs, while the rest comes from groundwater. In the recycling process, wastewater is piped to an on-site water treatment plant where it is treated using reverse osmosis and then reused. In a recent engagement with the company, we encouraged it to disclose the groundwater extraction quantities that make up the other 5% and compare these to peers.

For heavy transport, there are demand-side incentives for commercial EVs, EV fleets and charging infrastructure for the U.S. Postal Service. Funding also exists for zero-emission school buses, garbage trucks and tow trucks. On the supply side, the act creates a production tax credit for clean hydrogen.

The credit of $3.00/kg for green hydrogen should be a gamechanger for hydrogen economics in the U.S., with ClearBridge holdings such as Air Products and Chemicals (APD), Linde (LIN) and Air Liquide (OTCPK:AIQUF) well positioned to drive development of blue and green hydrogen.

Making Infrastructure and Buildings More Energy Efficient

The act includes roughly $5 billion in funding across multiple federal agencies to help procure low-carbon industrial materials for transportation and building infrastructure projects, whether federal agencies are looking to construct high-performance green buildings, rebuild a road or school after a natural disaster, launch a sustainable building pilot, make a community more climate resilient or refurbish existing federal buildings.

Also on the buildings front, $12.5 billion in tax credits will go to residential energy efficiency. Households can save up to 30% with tax credits for home construction projects on windows, doors, insulation and other weatherization measures that prevent energy from escaping homes. One area here ClearBridge has been following closely has been heat pumps; this is an energy-efficient alternative to furnaces and air conditioners that uses outside air to both heat a home in the winter and cool it in the summer. According to ClearBridge holding Trane Technologies, under ideal conditions, a heat pump can transfer 300% more energy than it consumes. In contrast, a high-efficiency gas furnace is only about 95% efficient. Further, heat pumps are powered by electricity, creating substantial potential fuel savings. Assuming the electricity comes from clean energy sources, heat pumps are also much more “green.”

Heat pumps gained prominence in June when President Biden invoked the Defense Production Act of 1950 to call for more domestic production of heat pumps to reduce American energy bills, fight climate change and free up U.S. natural gas to support allies in Europe. The IRA, which provides $500 million in funding for expanding production of heat pumps as well as processing critical minerals, should be a plus for manufacturers and ClearBridge holdings like Trane and Johnson Controls (JCI).

Bloom Energy has also been capitalizing on the need for lower-carbon energy at corporate facilities for some time, with customers including Home Depot (HD) and Walmart (WMT). Its emerging electrolyzer business will help develop the hydrogen economy and benefit from the hydrogen tax credit in the IRA as well.

Renewables Demand Strong Despite Higher Inflation and Macro Uncertainties

Renewable energy is gaining social acceptance, even more so now that energy price volatility, energy security via diversified and renewable sources as well as reducing energy bills are all top of mind for consumers, companies and policymakers. In this way, higher inflation and macroeconomic uncertainties, while they roil equity markets at large, have reinforced the case for the energy transition. The IRA adds extra force to this movement.

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment