As the Ukraine Invasion rages on, energy prices continue to remain elevated, and will continue to be a major factor to watch for investor portfolios in the short to medium term. John Moore/Getty Images News

Recessions. Inflation. Ukraine. COVID. Energy Prices.

All keywords trending strongly across the news spectrum currently, giving investors major concerns about what the short and medium-term futures are for their portfolios. Will the combination of raised interest rates and record inflation smash consumer spending? How deep will the recession be? Has the Fed truly lost control? Will the Ukraine war carry on and will Putin raise the stakes?

But with all the disorder and confusion in the market as it tries to make sense of the world at large, an opportunity for investors presents itself in the Energy sector, which is historically well insulated from inflation and interest rates, while geopolitical turmoil is driving energy prices higher to the benefit of the industry.

So I’m exploring the list of the top 65 oil and gas exploration and production companies to uncover opportunities for investors and try to find a number of well-priced firms worth further consideration.

The next firm in the spotlight is Continental Resources, Inc. (NYSE:CLR), a firm focused on the exploration and production of crude oil and natural gas in the US. We’ll break down the firm’s base financial health, take a look at its broad-based valuation attractiveness, and attempt to price the firm against its peers.

(Data & prices correct as of pre-market 6th September 2022)

(The Top Oil and Gas Exploration and Production Stocks referred to can be found on this Seeking Alpha screener)

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Oil & Gas? Download my research for free here

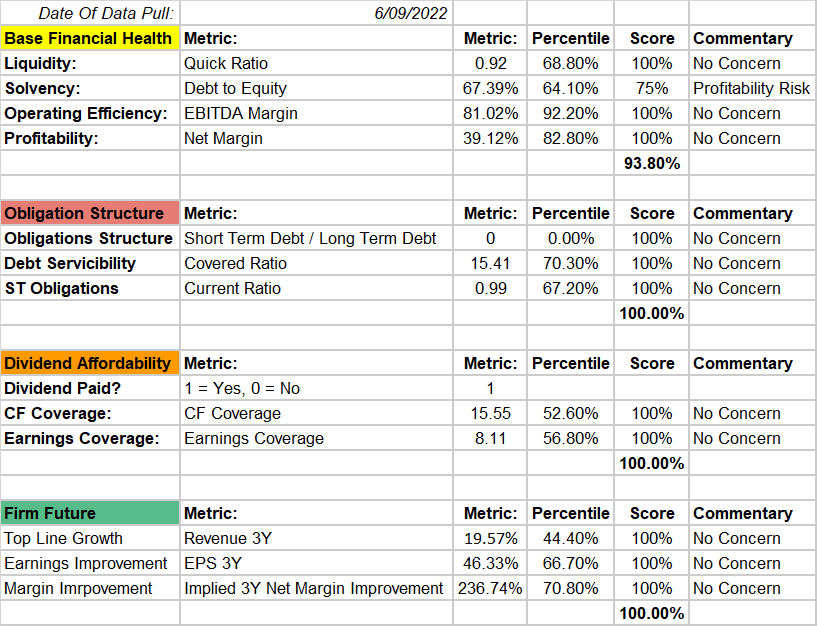

Continental Resources’ Base Financial Health

First is a breakdown of CLR’s financial health metrics, and here we see near-perfect scores, with the only item of any noteworthy consideration being the firm’s debt to equity ratio, which only presents a small profitability risk, but by no means is significant.

We have no concerns in all other areas of the business’ financials.

Author, Seeking Alpha

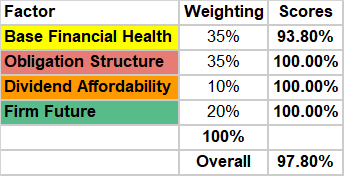

Summarizing the metrics and weighting the scores, CLR walks away with a 97.8% financial health score, with only a very reasonable debt as a mark against the firm.

Author, Seeking Alpha

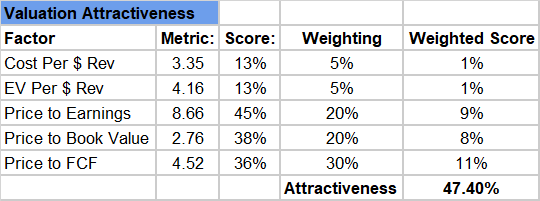

Assessing Continental Resources’ Pricing Attractiveness

The next step is to assess CLR’s valuation attractiveness. To explain this assessment, we’re not trying to value the firm, but rather, assess if the firm is largely fairly valued compared to its peers on an “at a glance” basis. Here we’re looking to see if there are any “extreme” valuation metrics to be aware of, in the context of the peer group.

After applying weights to each of these metrics, the market appears to be pricing CLR at a premium compared to the industry peer group, with a weighted valuation attractiveness score of 47.4%

Author, Seeking Alpha

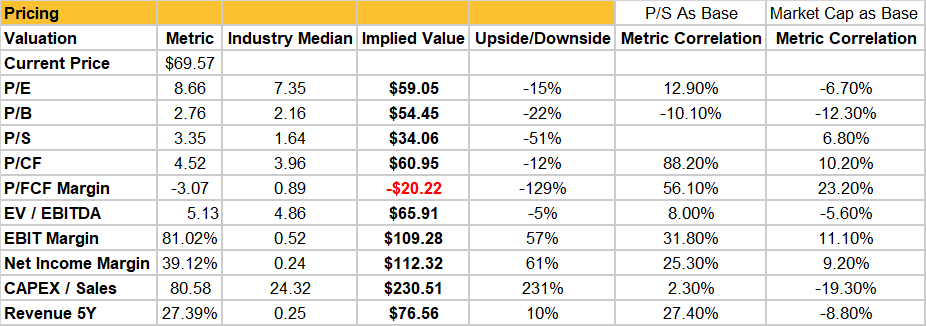

Finding An Appropriate Valuation Method For Continental Resources

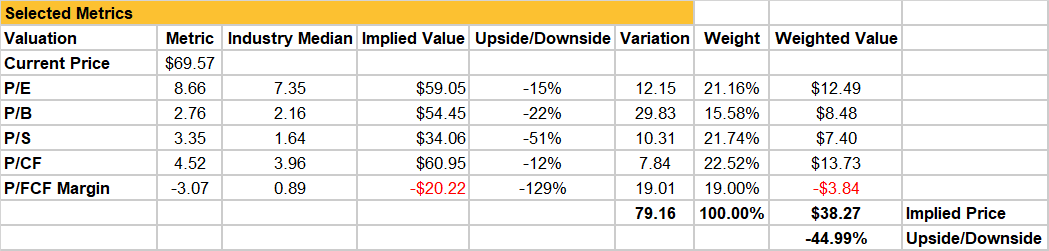

Now we will attempt to find a pricing mechanism for CLR that gives us a price target based on peer comparison. Having already determined which metrics are good indicators for the industry, we can eyeball the total list of normal and abnormal metrics and jump straight into the more focused list of valuation metrics.

Author, Seeking Alpha

Here we see why the valuation attractiveness score suggested the firm’s current valuation is priced at a premium. We can see that on a price-to-earnings or free cashflow basis, the firm is reasonably priced, but in terms of price to revenue and price to free cash flow margin, there is a suggestion that the firm could suffer price weakness.

The weighted price target points to a 45% downside risk at $38.27, quite a severe downward pricing revision, but this is brought on by the firm’s poor cashflow margins, book valuation and premium price to revenue.

Author, Seeking Alpha

Closing Remarks

My analysis leads me to believe that investors may see value in CLR beyond the financial statements as shown above, including some very strong future expectations of growth and profitability, however on a peer comparison basis, the firm appears to be significantly overpriced.

I would rate CLR as a moderate sell or hold, depending on your expectations for oil prices in the short to medium term, but reiterate I have no concerns about the firm’s financial health and see no obvious threats for the firm in its financials on face value.

With my own views around the likelihood of an impending Fed-driven recession, paired with the energy market’s historical outperformance in high-inflationary environments and geopolitical instability driving higher energy prices, I do see a period of opportunity ahead for energy firms.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced are sourced from third-party sources including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

Be the first to comment