nicoletaionescu/iStock via Getty Images

By Jill Mislinski

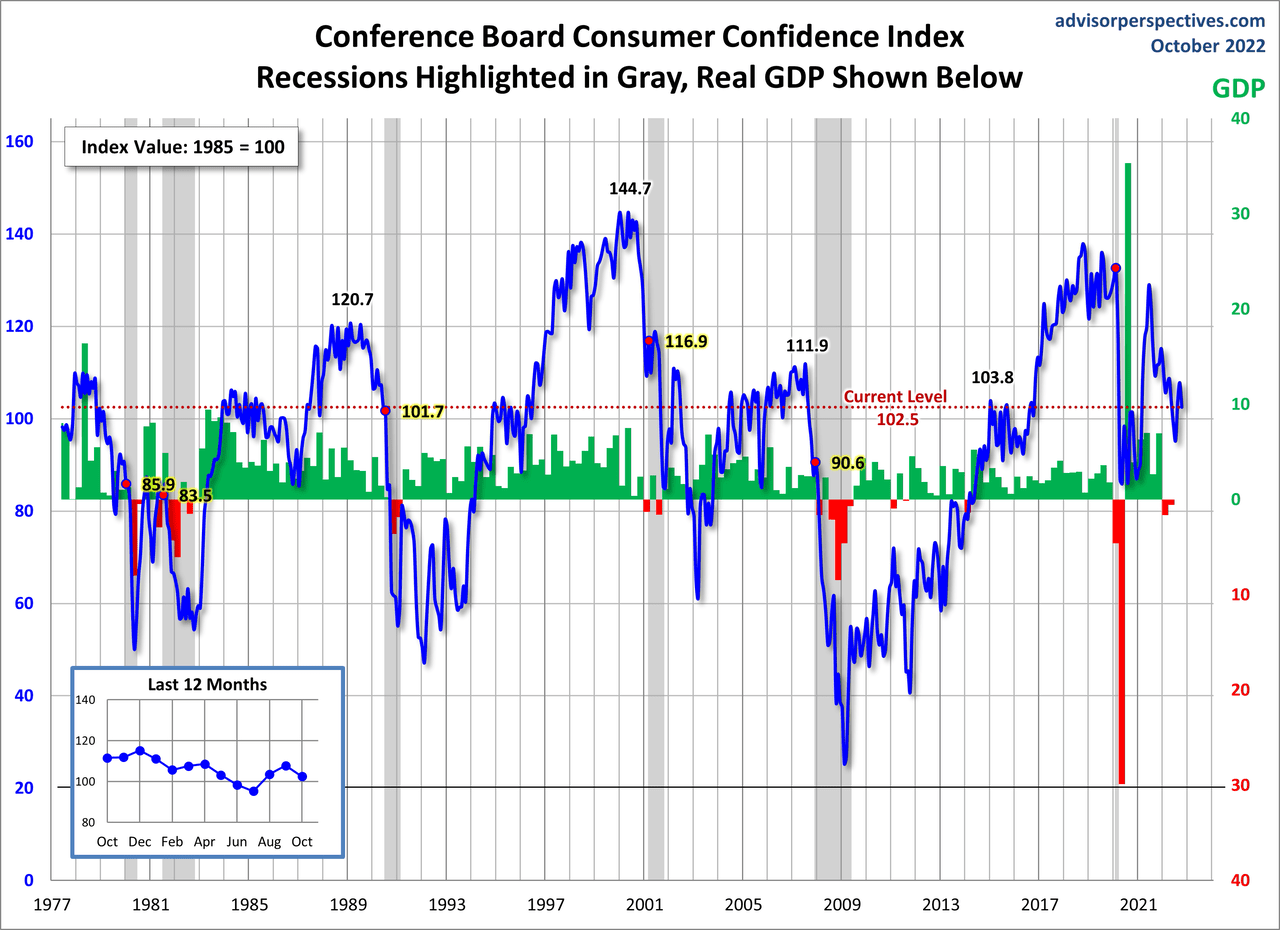

The headline number of 102.5 was a decrease of 5.3 from the final reading of 107.8 for September.

The Conference Board Consumer Confidence Index® decreased in October after back-to-back monthly gains. The Index now stands at 102.5 (1985=100), down from 107.8 in September. The Present Situation Index-based on consumers’ assessment of current business and labor market conditions-declined sharply to 138.9 from 150.2 last month. The Expectations Index-based on consumers’ short-term outlook for income, business, and labor market conditions-declined to 78.1 from 79.5.

“Consumer confidence retreated in October, after advancing in August and September,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index fell sharply, suggesting economic growth slowed to start Q4. Consumers’ expectations regarding the short-term outlook remained dismal. The Expectations Index is still lingering below a reading of 80-a level associated with recession-suggesting recession risks appear to be rising.”

“Notably, concerns about inflation-which had been receding since July-picked up again, with both gas and food prices serving as main drivers. Vacation intentions cooled; however, intentions to purchase homes, automobiles, and big-ticket appliances all rose. Looking ahead, inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers. And, given inventories are already in place, if demand falls short, it may result in steep discounting which would reduce retailers’ profit margins.” Read more

Putting the Latest Number in Context

The chart below is another attempt to evaluate the historical context for this index as a coincident indicator of the economy. Toward this end, we have highlighted recessions and included GDP. The regression through the index data shows the long-term trend and highlights the extreme volatility of this indicator. Statisticians may assign little significance to a regression through this sort of data. But the slope resembles the regression trend for real GDP shown below, and it is a more revealing gauge of relative confidence than the 1985 level of 100 that the Conference Board cites as a point of reference.

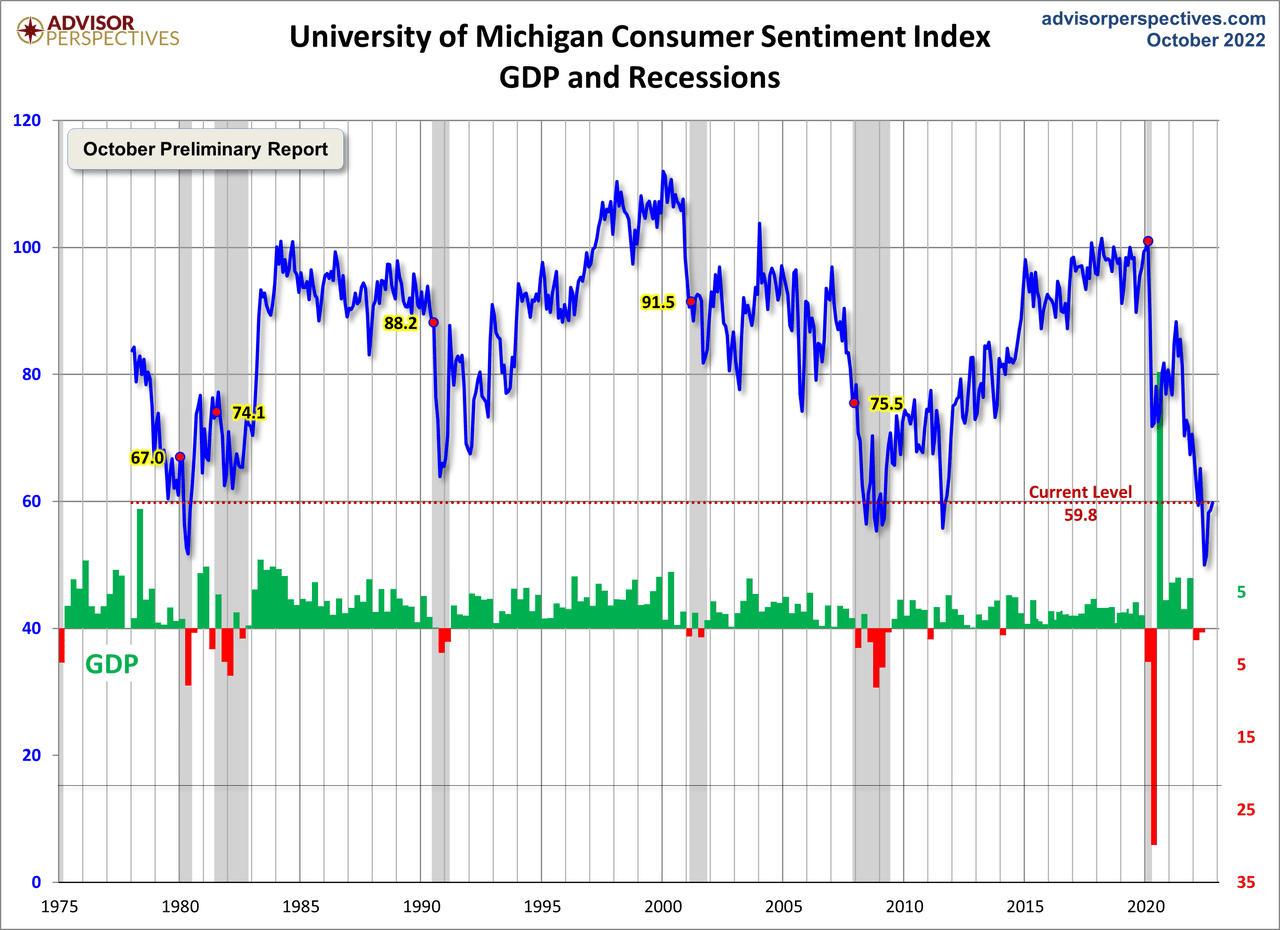

For an additional perspective on consumer attitudes, see the most recent Reuters/University of Michigan Consumer Sentiment Index. Here is the chart from that post.

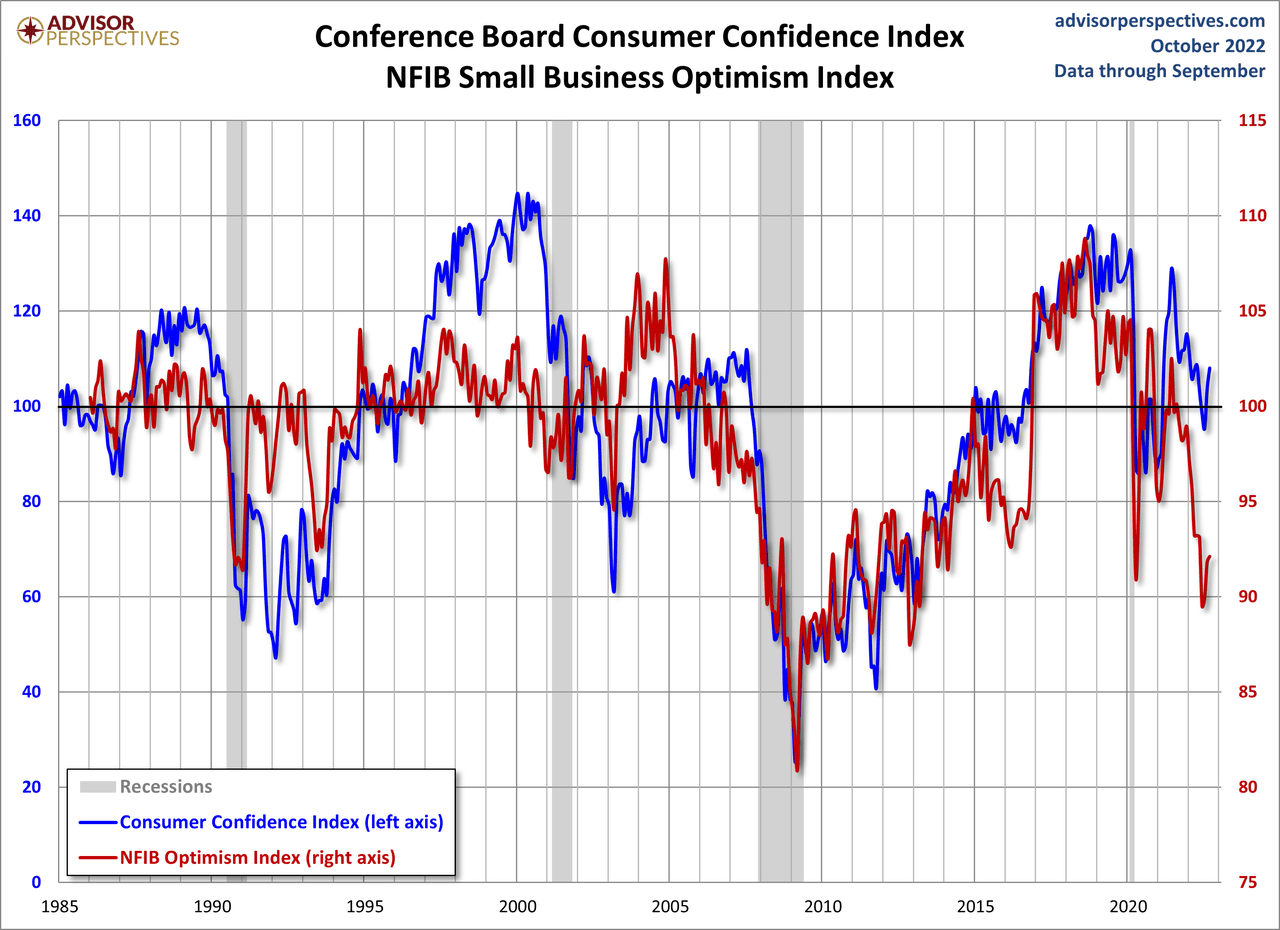

And finally, let’s take a look at the correlation between consumer confidence and small business sentiment, the latter by way of the National Federation of Independent Business (NFIB) Small Business Optimism Index. As the chart illustrates, the two have tracked one another fairly closely since the onset of the Financial Crisis, although a spread appears infrequently, with the most recent spread showing up 2015 through present.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment