Aranga87/iStock via Getty Images

This article was originally published on October 15, 2022 for Marketplace subscribers and free trials.

Introduction

It’s been year since our last article on ConocoPhillips (NYSE:COP). In that time the company has rallied well past our YE 2022 expectation of $100 per share on the strength of rising oil prices and superior performance. Here’s a comment from that year ago article – (If you are new to my work, definitely give that last article a read as I went into a fair amount of technical detail describing the value of the Shell acquisition to COP.)

Given the momentum that energy companies are displaying at present, we can easily see a 7X multiple being obtained when the Shell deal closes. This would land the stock in the $95-$100 range. Given its reserves, daily production, and the stock prices of competitors like Pioneer Natural Resources (PXD) $174-ish, and EOG Resources (EOG) $84-ish, I may be low-balling this one just a bit. (Source)

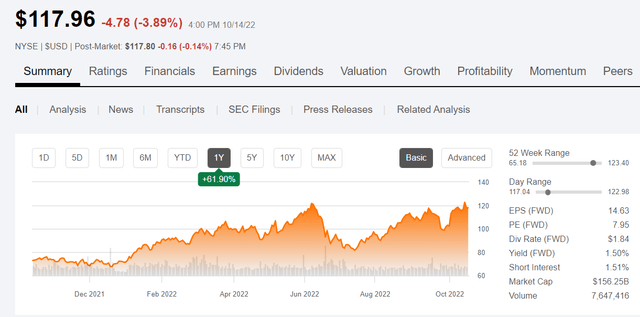

COP price chart (Seeking Alpha)

The quote above from the linked article was certainly prophetic. I low-balled this stock badly, as it peaked in June at ~$120, and has recently returned to that level. Doubling from the level a year ago in the present surge, the market seems to be ratifying the strategic moves the company has made over the last year.

The company has made a number of moves over the last year to bolster its ability to increase production should market conditions dictate, and lower costs for times when oil prices dip.

The company’s moves in recent times have taken it decidedly toward natural gas as the almost universal appeal of this form of hydrocarbon has captured the world’s attention over the last year. CEO Ryan Lance, comments regarding gas globally-

We have a lot of capacity in the gas space, both LNG and natural gas. We’ve got a very large position in North America, both between Alaska, Canada and the U.S. Lower 48, and we wanted to augment that with additional LNG liquefaction capacity. So we’ve been looking at this for quite some time, and the opportunity presented itself with Sempra.

So, yes, there’s some added scope. And clearly, we’ve signaled for quite some time that we wanted to participate in the expansion projects in Qatar. We think that’s some of the lowest-priced gas in the world, and it’s going to fit well globally. It could be directed to both Asia and to Europe going forward. (Source)

Recent weakness in the market gave investors a chance to scoop up shares at the $100 level, before an amazing one-week 20% pop higher. In this article we review the core thesis for gas and COP’s moves to enhance its position in this commodity.

The macro thesis for gas

Gas is the most versatile fuel we have. People had forgotten this in the glow of the “Green” phantasm, that is now evaporating like ectoplasmic goo from the Ghostbusters movies. Nature has harshly reminded everyone one about the importance of energy density and “on demand” availability-from sources sometimes called “dispatchable.” Not only is gas sought in its own right, it is indispensable as a backup for intermittent sources like solar and wind. Nuclear plants take years to build, and, until recently, have been side-lined (unfairly I think), based on preconception and fears from decades ago. Nukes aren’t coming to the world’s energy rescue anytime soon.

The Hydrogen Economy will never grow legs and walk. H2 is one area where the dishonesty of green energy falls so obviously on its face, it’s hard to believe it’s put forward as a serious proposition. H2 is obtained primarily from natural gas currently, although many companies are building electrolyzers to separate it from water…using “free” wind energy. I’ve made my thoughts about wind energy pretty well known in past articles. And, there the H2 problems begin.

H2 requires 6X the energy input to be condensed to liquid for transport. In fact 33% of the total energy contained in H2 is spent condensing it. To maintain it as a liquid requires cooling to -423 F. More energy input vs. gas which only requires -260 F. In FCEV’s it’s stored as a gas to get around the physics of keeping it as a liquid. It gets worse. Being the lightest element in the Universe, H2 has only about 1/6 the energy density by volume of natural gas-methane. There’s more, but let’s consider the point made. There is no technological fix for this situation.

As a pertinent side note to the above diatribe, physics is boring for a lot of people, and the extent to which this misguided H2 concept has run amok in governmental and corporate circles, is mute testimony to the validity of Maitland Jones rebuttal to his firing this month by NYU. Physics is supposed to be hard, and it doesn’t seem like anyone who is sanctioning these future albatrosses has ever taken anything but Physics for Dummies. (I am getting on a rant here, aren’t I? I’ll stop.)

We’ve chronicled the vapidity of the relying on wind, and solar-even with battery backup. I doubt that these two sources will ever contribute much more to the energy mix, than they do now. There is a lot of grass roots push back for new wind and solar installations that has the potential to bend the growth curve toward the X axis. We think the shape of the curve will soon begin to look like a parabola. Noted investor and energy ETF founder of Strive Asset Management, Vivek Ramaswamy agrees with me. In an article carried in the Wall Street Journal this week, he commented-

Warren Buffett, who last year criticized BlackRock-backed ESG mandates at Berkshire Hathaway as “asinine,” has quietly amassed U.S. energy exposure, going from no reported publicly traded holdings at the start of this year to a 20.9% stake in at least one large publicly traded U.S. energy company as of late September. If other market participants defect from the ESG-driven consensus, that will drive energy-sector outperformance. Trends already point in that direction: May 2022 marked the first month in three years that ESG funds saw their inflows decline.

That leaves gas and LNG as the mainstay for home and office heating demands that are on the increase world-wide. Either directly or as an intermediate fuel generating electricity. Quo Erat Demonstradum-QED! We will move on.

Recent moves by COP in gas and LNG

The big buy from Shell of its Permian acreage last year really put gas in the spotlight for COP. It’s almost unfair to call this a “buy.” Shell let go of an asset that’s very gassy in nature for a song relatively speaking. They wanted it off their books to make the Dutch court and activist investors happy. It had nothing to with economics except for COP. In 2020 they had 785 bn BOE booked for gas, whereas in 2021 that figure came to 2147 bn BOE. I think it’s fair to say that year-to-year a lot of that increase is attributable to the Shell buy. If all that gas were to be produced it would have a value of ~$90 bn USD (using some very elementary arithmetic to make the point.) If I was an investor in Shell, I would be quite put out reading this factoid.

In another sweet deal for COP, $1.65 bn was spent to increase their stake in APLNG, an Australian based consortium producing LNG on Australia’s NE Queensland coast, taking coal-seam gas and liquifying it for sales into Asia. This investment will pay out in distributions of $1.8 bn by the end of 2022.

COP has also made an HOA-Heads of Agreement for a stake in Sempra Energy’s proposed Port Arthur LNG plant. All that Delaware basin gas has to go somewhere, and COP expects to ship much of it abroad as LNG.

Qatar intends to be the low-cost LNG producer globally. COP recently bought into their North Field East Expansion project, the world’s largest LNG project. Ryan Lance, CEO addresses this buy in the Q-2 call-

We’ve signaled for quite some time that we wanted to participate in the expansion projects in Qatar. We think that’s some of the lowest-priced gas in the world, and it’s going to fit well globally. It could be directed to both Asia and to Europe going forward. (Source)

This all adds up to strong execution in my book. All of these projects and investments are on solid ground, with the possible exception of Port Arthur LNG. I haven’t looked into the viability of that, but I am willing to assume if COP is attaching their name to it, Port Arthur LNG will come to fruition.

ConocoPhillips Q2 results and guidance

COP generated a return on capital employed of 24% on a trailing 12-month basis. On a cash adjusted basis, that improves to 27%. This was driven by strong realized prices and production of almost 1.7 million barrels of oil equivalent per day. Production volumes in the second quarter were reduced by scheduled turnaround, as well as some unplanned weather and other minor impacts. We should see a modest pickup for Q-3.

Lower 48 production averaged 977,000 barrels of oil equivalent per day for the quarter, including $634,000 from the Permian, 233,000 from Eagle Ford and 91,000 from the Bakken. Operations across the rest of their global portfolio also ran well, leading to generation of $7.8 billion in cash from operations in the quarter, excluding working capital. This includes roughly $750 million in distributions from APLNG.

COP also invested $2 billion back into the business in the second quarter, resulting in free cash flow of $5.9 billion. That more than covered the total $3.3 billion they returned to shareholders in the quarter, as well as the $1.9 billion used to reduce total debt. These actions taken in combination with the $600 million in disposition proceeds and the repurchase of approximately $300 million in long-term investments, resulted in ending cash of $8.5 billion as of June 30.

For the second half. Third quarter production guidance was given in the range of 1.7 million to 1.76 million barrels of oil equivalent per day, and reduced their full year production from 1.76 million to 1.74 million per day. That’s primarily related to risking of projected production from Libya in the second half of the year.

Now in conjunction with these changes, we reduced DD&A guidance from $7.7 billion to $7.6 billion for the year. We also increased full year 2022 adjusted operating cost guidance to $7.5 billion from the prior $7.3 billion. Now this is reflecting commodity-related price impacts. Operating capital guidance for the year remains unchanged at $7.8 billion.

COP returned $3.3 billion to shareholders in the second quarter, ended the quarter with $8.5 billion of cash and short-term investments and increased their full year return of capital target to $15 billion. They have also reduced total debt by $3 billion year-to-date.

Risks

The usual risks apply to COP. If oil and gas fall, so does COP. They are probably more exposed to political risk than some with their federal land acreage in the Permian, and Australian operations. The Aussies are just as sold on green energy as the Europeans and have some of the same hopium-based ideas. It hasn’t been working out well for them… surprise, surprise, but who knows if they take a lesson, or double-down as the Euro folks seem to be doing.

Your takeaway

With an EV of ~$165 bn, COP is selling pretty cheaply at ~3.5 EBITDA. Their flowing barrel calculation is also barely acceptable in the range of $97K per barrel.

I don’t think I am a buyer quite yet though. With the volatility of the oil market these days, we could see a round trip to the $100 level. The recent weakness and problems with the WAHA hub might also assist in that regard when earning are released. $100ish would be my entry point to start or add to a new position in the company.

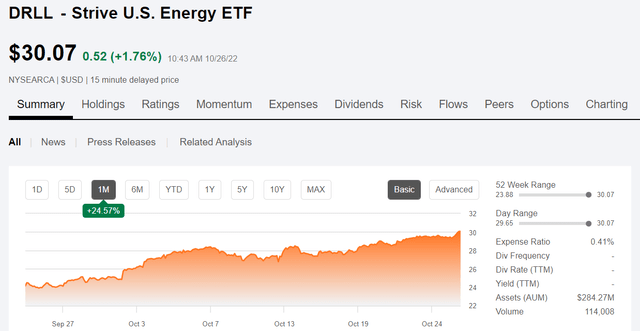

Since this article was first written a couple of weeks ago, the energy industry has caught a bid. As evidenced by the rise in the Strive U.S. Energy ETF (DRLL) which tracks major E&P companies. Meaning that low entry point I stipulated above could be a long time coming around.

DRLL price chart (Seeking Alpha)

In that scenario, we counsel patience. It’s a cyclic industry and entry points are critical for long term profits.

Be the first to comment