JJ Gouin/iStock via Getty Images

On Thursday, February 2, 2023, crude oil and natural gas exploration and production giant ConocoPhillips (NYSE:COP) announced its fourth-quarter 2022 earnings results. At first glance, these results were mixed as ConocoPhillips missed the expectations of its analysts in terms of earnings but still managed to deliver a revenue beat. We do, however, see the growth in earnings that we have seen from pretty much every other company in the energy sector. The company has also guided for a relatively small production increase during 2023. If crude oil prices stay in their current range, this will likely result in some further growth this year. There is no guarantee of this though because the United States is looking ever more likely to enter into a recession in the next several months if it has not already. The long-term story remains very strong no matter how we look at it though since the fundamentals point to generally high energy prices going forward. ConocoPhillips could be one possible way for investors to take advantage of this today as the stock looks undervalued at the current level.

Earnings Analysis

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from ConocoPhillips’ fourth quarter 2022 earnings results:

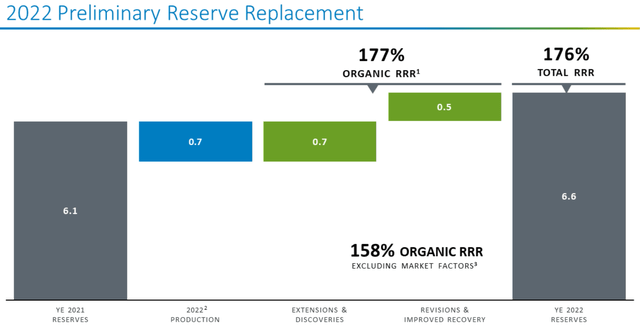

ConocoPhillips brought in total revenues of $19.128 billion in the fourth quarter of 2022. This represents a 23.79% increase over the $15.452 billion that the company brought in during the prior-year quarter. The company reported an operating income of $5.299 billion in the most recent quarter. This compares rather favorably to the $4.793 billion that the company reported in the year-ago quarter. ConocoPhillips produced an average of 1.758 million barrels of oil equivalents per day during the reporting period. This represents a 9.33% increase over the 1.608 million barrels of oil equivalents per day that the company reported during the equivalent period of last year. The company reported a very impressive 176% reserve replacement ratio for the current year. ConocoPhillips reported a net income of $3.249 billion during the fourth quarter of 2022. This represents a 23.68% increase over the $2.627 billion that the company reported in the fourth quarter of 2021.

It seems essentially certain that the first thing that anyone reading these highlights will notice is that essentially every measure of financial performance showed improvement compared to the prior-year quarter. This is unlikely to be a surprise to anyone as one of the major news stories during 2022 was the high energy prices. Indeed, crude oil prices were higher in the fourth quarter of 2022 than they were during the prior-year quarter, although crude oil prices were nowhere near as high as they were earlier in the year:

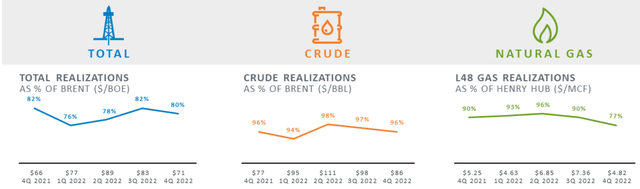

The fact that crude oil prices were higher than they were in 2021 is the biggest reason why nearly all upstream exploration and production companies, including ConocoPhillips, delivered better financial performance than in the same period of last year. It should not be difficult to see why this would be the case. After all, if the company received higher prices for its products than it did in the past, then all else being equal it will have higher revenue. The higher revenue means that more money is available to cover the company’s expenses and ultimately make its way down to its profit and cash flow. We can see these higher prices in ConocoPhillips’ realized prices. During the fourth quarter, the company received an average of $71 per barrel of oil equivalent that it sold compared to $66 per barrel of oil equivalent that was sold during the year-ago quarter:

We do, interestingly, see a slight decline in the company’s realized natural gas prices compared to the prior-year quarter. This was disappointing, particularly since natural gas prices a year ago were not significantly different from prices in the fourth quarter. This is a problem that is likely going to get worse for ConocoPhillips in the near term though. The first quarter of last year saw a very severe spike in natural gas prices due to the Russian invasion of Ukraine and the resulting sanctions and tensions that led to very tight natural gas supplies across Europe. So far this year, natural gas prices have been declining due largely to the mild winter that we have experienced. With that said, about 52% of ConocoPhillips’ production is crude oil so prices of that commodity are somewhat more important to the company. Admittedly though, so far crude oil prices have also been lower in 2023 compared to the same period in 2022 so that will apply some downward pressure on the company’s near-term financial performance.

One other thing that benefited ConocoPhillips’ earnings during the most recent period is that its production was higher than a year ago. As stated in the highlights, the company produced an average of 1.758 million barrels of oil equivalents in the current period compared to 1.608 million barrels of oil equivalents a year ago. It should be fairly easy to see why this would contribute to improved earnings. After all, the higher production meant that the company had more products that it could sell and convert to revenue. The higher revenue once again means that the company has more money to cover its expenses and make its way down to the bottom line.

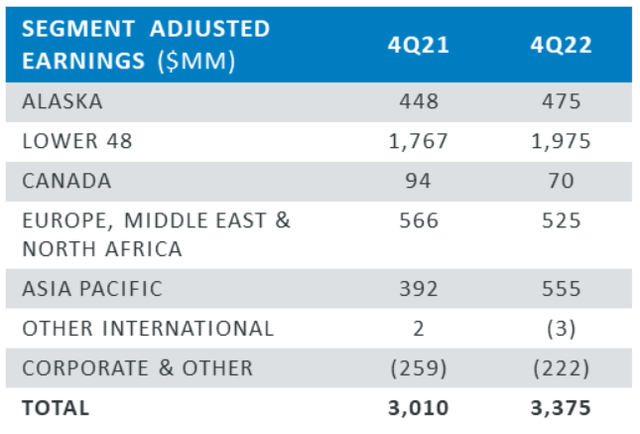

ConocoPhillips primarily operates in the lower 48 states, which primarily consist of the various American shale plays. The company does have operations in other areas, but North American shale comprises the overwhelming majority of the company’s profits:

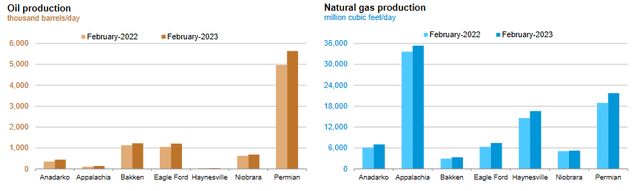

This is hardly surprising as the various shale plays around the United States have been a significant source of production growth for many energy companies over the past two years. As we can see here, production has increased year-over-year in every one of these basins:

U.S. Energy Information Administration

There are some good reasons for this. One of them is that it is much easier to quickly change production levels in these plays. It does not cost billions of dollars to drill a shale well as it does for a large offshore project. In addition, we frequently see offshore or major onshore projects taking several years to bring to a production state. Once again, this is not true in North American shale. That is one reason why the United States is rapidly becoming the world’s swing producer.

ConocoPhillips achieved record levels of production in the United States during the course of 2022. However, the company is not resting on its laurels. Indeed, it appears likely to grow this production further in 2023. The company reported in its fourth quarter report that it has cored up 25,000 acres in the Permian Basin, which provides it with about a year’s worth of drilling opportunities. Admittedly though, the company has not stated when it plans to begin this drilling program. It did provide guidance toward an annual average production of 1.76 to 1.80 million barrels of oil equivalents per day over the full-year 2023 period, however. That would represent a mild increase over the 1.758 million barrels of oil equivalents that the company produced on average during the fourth quarter of this year, which was above the company’s average 2022 production level.

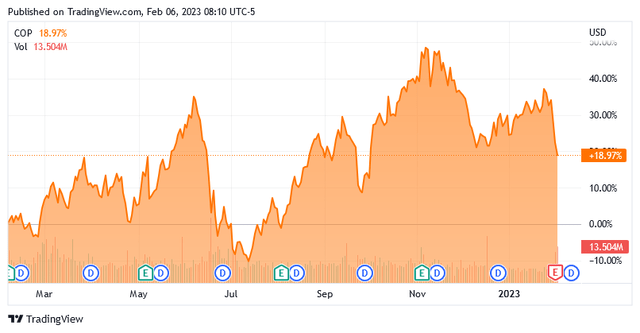

However, one thing that we do note is that the company’s production guidance is not very much above its average production level during the fourth quarter. This is something that may be confusing considering that crude oil prices are likely to remain high over the course of this year. In fact, as I pointed out in a recent blog post (that is linked in the introduction), it is rather unlikely that West Texas Intermediate crude oil will drop below $72 per barrel in the near term. Thus, we would think that energy companies would be rapidly growing production in order to take advantage of the high-price environment. Prior to the pandemic, many energy companies did exactly that but now they are taking a more cautious approach. One of the reasons for this is that the growing popularity of environmental, social, and governance principles in the halls of some of the largest asset management firms has made it more difficult for traditional energy companies to obtain capital. As I pointed out in a previous article, the shale oil industry was one of the largest issuers of high-yield debt prior to the pandemic. This industry was consuming enormous amounts of capital in order to grow its production. The new environment has made it much more difficult to raise the money to do that so now many shale companies, including ConocoPhillips, are opting to strengthen their balance sheet and fund all their operations without outside capital. In addition to this, investors are demanding that the energy industry deliver higher returns than it did during the 2010s. It has largely succeeded at this as the traditional energy industry was the best-performing sector in the economy during 2022 and ConocoPhillips itself is up 18.97% over the past twelve months:

This unfortunately means that we are not going to see a surge in production and today’s tight balance between hydrocarbon supply and demand is likely to remain. That means that any decline in energy prices will likely be short-lived. While this admittedly is not particularly good for consumers, it is fairly good for investors in ConocoPhillips as the company will be able to generate fairly high free cash flow. It did in fact manage to do that as the company had a levered free cash flow of $15.739 billion over the twelve-month period that ended on December 31, 2022. In fact, the company has managed to post positive free cash flow in every quarter since the final quarter of 2020. In the interest of keeping the table readable on the page, I will only include the company’s free cash flow figures for the past year:

|

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

|

|

Levered Free Cash Flow |

$2,354.6 |

$6,388.6 |

$5,296.0 |

$1,701.6 |

|

Unlevered Free Cash Flow |

$2,465.9 |

$6,513.0 |

$5,427.9 |

$1,837.3 |

(all figures in millions of U.S. dollars)

The company’s full cash flow statement, including free cash flow figures, can be found here. It is quite nice to see that the company is generating solid free cash flow since that was a problem for most shale companies prior to the pandemic. The reason that it is nice to see is that ultimately it is free cash flow that allows a company to reward its shareholders. This is the money that is generated by the firm’s ordinary operations and is left over after it pays all of its bills and makes all capital expenditures. Thus, this is the money that can be used to reduce debt, buy back stock, or pay a dividend. ConocoPhillips has certainly been doing this as the company paid out $5.7 billion in dividends over the past year, giving the stock an annualized yield of 4.11% based on the $1.11 per share dividend that was declared alongside the fourth-quarter results. This is a bit lower than the annualized yield boasted by some other shale producers but it is certainly better than the yield of the S&P 500 Index (SPY).

Reserves Update

One other very nice thing that we saw in these results was ConocoPhillips achieving a 176% reserve replacement ratio for 2022.

Many investors overlook an energy company’s reserves and reserve replacement ratio when analyzing a traditional energy company but they are very important figures. This is because the production of crude oil and natural gas is by its nature an extractive process. ConocoPhillips and its peers literally obtain the products that they sell by pulling them out of reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, they will eventually run out. Thus, the company must continually obtain new sources of resources, through acquisitions or discovery, or it will eventually run out of products to sell. A company’s reserve replacement ratio is the figure that tells us how successful the company was at this task. As we can clearly see above, ConocoPhillips managed to replace all of the resources that it pulled from the ground and then some so the company clearly had a great deal of success at this task over the year. This is something that we can appreciate as it increases the overall longevity of the company. As long-term investors, we obviously like to see that a company in which we are invested will be able to operate for the long term.

Financial Considerations

It is always important to look at the way that a company finances itself before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the proceeds to repay any maturing debt, which is a process known as “rolling over” debt. Unfortunately, this can cause a company’s interest expenses to increase following the rollover, depending on certain conditions in the market. In addition to this, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes the company’s cash flows to decline could push it into financial distress if it has too much debt. This is something that could be an especially big concern for a company like ConocoPhillips considering the volatility that we frequently see in commodity prices.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity can cover its debt obligations in the event of a liquidation or bankruptcy, which is arguably more important.

As of December 31, 2022, ConocoPhillips had a net debt of $7.400 billion compared to $48.003 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.15 today. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity Ratio |

|

ConocoPhillips |

0.15 |

|

Exxon Mobil (XOM) |

0.06 |

|

Chevron Corporation (CVX) |

0.05 |

|

Diamondback Energy (FANG) |

0.38 |

|

Devon Energy (DVN) |

0.51 |

As we can clearly see, ConocoPhillips generally compares reasonably well to its peers in this regard. The company is not the least levered on the list but it is well below the level of some of its peers. Overall, though, we can clearly see that the company has sufficient assets to cover its debts even in a worst-case scenario. We can therefore conclude that the company’s debt is quite reasonable and poses no particular outsized risk to its investors.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of an exploration and production company like ConocoPhillips, one metric that we can use to value it is the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to the company’s forward earnings per share growth. However, as I pointed out in a recent blog post, pretty much everything in the traditional energy industry is undervalued despite the fact that many companies outperformed the market over the past year. As such, it makes the most sense to compare ConocoPhillips to its peers in order to determine which company offers the most attractive relative valuation today.

According to Zacks Investment Research, ConocoPhillips will grow its earnings per share at an 18.26% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.50 at the current stock price, which is a clear indication that the stock looks undervalued today. Here is how that compares to the company’s peers:

|

Company |

PEG Ratio |

|

ConocoPhillips |

0.50 |

|

Exxon Mobil |

0.48 |

|

Chevron Corporation |

0.76 |

|

Diamondback Energy |

0.27 |

|

Devon Energy |

0.15 |

Admittedly, ConocoPhillips is not the cheapest company here but I did not really expect it to be. After all, the company is larger and better followed than some of its smaller peers that only operate in one or two American shale plays. The company’s valuation does compare reasonably well to its giant peers like Exxon Mobil and Chevron. The company clearly deserves a place in a diversified energy portfolio alongside the other companies on this list due to its reasonably comparable valuation and the diversification benefits that it brings.

Conclusion

Overall, ConocoPhillips’ fourth-quarter 2022 earnings results were quite respectable. We do see the company following the current industry trend of delivering somewhat modest forward production growth, but ultimately that should prove to be a net positive for maintaining the high energy prices that have benefited ConocoPhillips and its shareholders over the past year. The company managed to achieve great success at replacing the resources that it extracted from the ground yet still maintained a reasonably low amount of debt. When we combine this with an attractive valuation, there is overall a lot to like here.

Be the first to comment