jiefeng jiang

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Beware A B-Wave On The San Diego Coastline

Semiconductor companies are cyclical. Repeat after us. Semiconductor companies are cyclical. Their stocks are volatile as a result. Now say it again. Oh, unless you are old, like us, in which case you will remember when semiconductors were scary places to invest, not only-up like the Nvidias (NVDA) or AMDs (AMD) of 2020-2021.

Such companies have cyclical fundamentals because semiconductor devices are hard to manufacture, requiring huge levels of prior investment in fabrication plants which if you are not very careful have a short shelf life (ergo a high depreciation charge and untimely replacement requirements) because innovation in the sector is rapid indeed and so product cycles are short.

If you taught the sector in business school you would say:

- Requires hordes of PhD-level brains to design new devices, ergo, short supply of designers commanding big pay levels.

- Requires generational levels of capex every few years (in CPU and other leading-edge device manufacturing plants) or hand-me-down process node updates every few years (in less demanding environments such as for analog/mixed-signal devices).

- Is subject to rapid ramp-up in demand driven by consumer and enterprise sentiment plus fashion.

- But can only respond to this demand slowly due to the manufacturing capex and ramp-up time, so has to control demand as best it can through marketing.

Or, in short, urgh, let’s go take Subscription Software 101 and all get rich more easily.

If you’re going to invest in chip companies then timing matters. You want to catch them as demand for their latest generation of products swings up, and when the stocks have yet to move up ahead of that demand. If you’re doing all your own work from the ground up in semiconductor companies, the ground you must cover includes which chip companies are winning what slots with which handset or PC or server or network equipment vendor, plus, who is fastest to process node X, or, how the endless litigation in semiconductor intellectual property is affecting company A or B. And then a gazillion other very hard questions. And maybe you can do it better than Chad down the street, maybe you can’t.

Alternatively you can make a bet that Big Money has done all this work already, and is ahead of the story – since stocks usually run ahead of the news, not in response to it – and take a look at two indirect methods of observation instead. One, the financial fundamentals, and two, the stock chart.

If you have been watching the Qualcomm (NASDAQ:QCOM) stock chart this last year or so, you could have made some money on the way up and the way down. In our Growth Investor Pro service here on Seeking Alpha we had success with QCOM on the way up from $125 or so to $190 during 2021; and as the stock peaked we said, yikes, look out below, and called short down to $150, an idea which did well. As is normal for semiconductors, the stock was one of the first to go over the top and dive headlong into the abyss when the market turned.

Since then the stock has reached a low of $120ish, bounced, made a local high in the $160 zip code, and then meandered around waiting for earnings.

In our ratings for long-term stock picks we use just three labels.

Accumulate – meaning, we think it’s a good idea to be buying piecemeal on red days to build a stake in anticipation of the stock moving up.

Hold – do nothing, whether you own the stock already or not.

Distribute – sell gradually on green days in anticipation of the stock moving down.

Going into QCOM earnings we had the stock rated at Distribute, and that’s for the simple reason that we thought the stock had yet to correct enough following the Q4 2021 peak in markets. We use the Elliott Wave and Fibonacci method to try to estimate larger-degree stock moves up and down, and to our eye QCOM was not poised to make a move up. On the contrary, pre earnings we thought the stock had simply put in what you may call a dead cat bounce, a bear rally, or a B-wave. And B-waves and the like – they can be dangerous, because they have you believe that everything is alright now, when in fact, in fact, the market is preparing to give you an absolute pasting with a C-wave.

We thought QCOM was setting up for an A-B-C down-up-down move and we thought it incomplete. In other words, more risk to the downside than upside.

Earnings came along and we saw nothing in its financials to dissuade us of this notion.

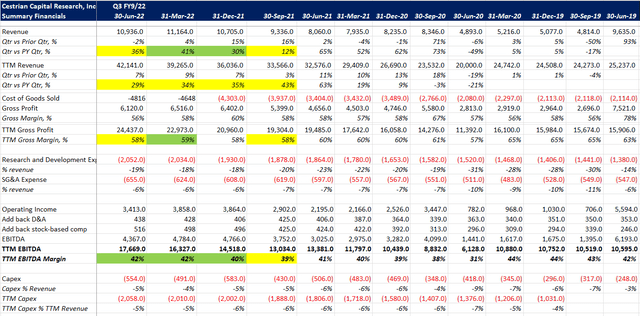

QCOM Fundamentals (Company SEC Filings, YCharts.com, Cestrian Analysis)

QCOM Fundamentals ((Company SEC filings, YCharts.com, Cestrian Analysis))

Revenue growth slowing, cash flow margins down (note, we exclude the $1bn of non-operating income arising from the reversal of a recent regulatory penalty on account of it being, you know, non-operating), leverage up (it’s still modest at 0.5x TTM EBITDA but up is up), all told? Not good. And with semiconductor companies you don’t have much in the way of forward contracted revenues to fall back on. The numbers you see are the numbers you see.

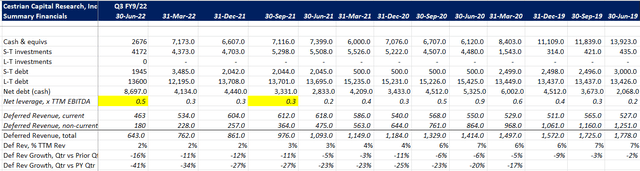

Valuation isn’t silly, but isn’t a bargain either.

QCOM Valuation (Company SEC filings, YCharts.com)

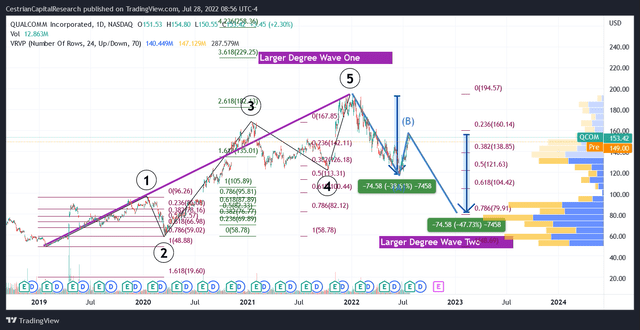

The QCOM chart to us still looks like it has plenty of risk to the downside. We’ll post this Crayola cornucopia here and then walk you through it.

QCOM Chart (TradingView, Cestrian Analysis)

OK, if you are neurotypical, here’s what that chart says:

5 waves up from the 2018 lows to the 2021 highs. Those 5 waves follow standard Fibonacci extensions and retracements quite well. Together that comprises a larger-degree Wave One up. What comes next? A Wave Two, which can typically fall to between the 0.618 and 0.786 retracements of that Wave One up. So far though, QCOM has reached only the $120 zone, which is shy of those ideal downside targets. And further the stock does not appear to have delivered an A = C correction in that move down.

A what now?

When stocks fall in a corrective manner you very often see them fall, rise, then fall again. That’s an A, B, C wave. And more often than can be a coincidence, before the corrective move is over, A = C, meaning, the share price move in the A leg down is similar to the share price move in the C leg down. If the recent high in QCOM – that $160ish – represents the top of the B leg, and if we do indeed get an A=C correction, then QCOM could fall to the low $80s/share. Not will do so, not is necessarily likely to do so, but it could do so if following the technical route it is on. And for that reason we prefer to stay away. If we had a position in QCOM – which we don’t – we would either be lashing it to the mast with stops, or just plain ol distributing – selling – the thing.

So for now we retain our Distribute rating. Now, things change fast and so in our Growth Investor Pro service we expect to move to Hold once it looks like the move down is done, then at some point back to Accumulate, since semiconductors are cyclical and all, and when the upcycle comes, most certainly offer a little in the way of free money. But for now? Distribute.

Cestrian Capital Research, Inc – 28 July 2022.

Be the first to comment