Brett_Hondow

Introduction

Even though Conn’s (NASDAQ:CONN) stock is seriously down -68% YTD, in my personal opinion, now is not the time to go long. First, amid high macroeconomic uncertainty and declining consumer confidence, the company continues to experience negative revenue trends in 2Q. In addition, although the company manages to maintain the gross margin by working with suppliers and increasing prices, the growth of SGA (% of revenue) costs continues to have a negative impact on operating margin.

Survey of Q2 results

On August 30, 2022, the company released weak financial and operating results for the 2nd quarter of 2022. The company continues to face pressure on revenue growth and margins.

Company’s presentations

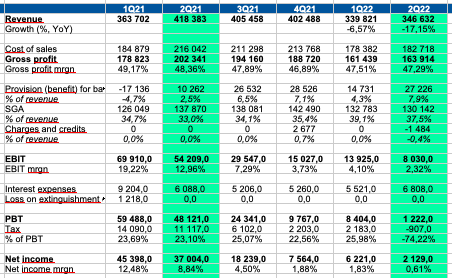

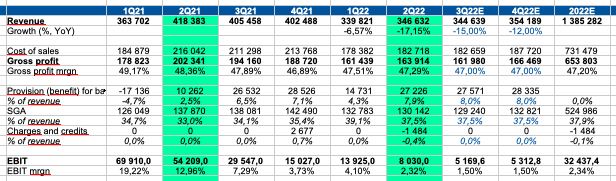

Thus, in Q2 22, revenue decreased by 17.1%, same store sales decreased by 22%. Retail revenue fell 19.4% (more than total sales) due to a strong 22% drop in same store sales.

Gross margin declined 48.3% in Q222 to 47.3% in Q2 2022 as the company was able to pass on higher prices to the end consumer, but pressure was put on rising logistics costs (freight, fuel and deleveraging of fixed distribution costs).

Operating margin decreased significantly from 13% in Q2 2021 to 2.3% in Q2 2022 due to an increase in SGA expenses (% of revenue) from 33% to 38% and an increase in Provision (benefit) for bad debts c 2.5% to 7.9%. Despite the fact that the company managed to reduce variable costs (advertising, labor costs), this was offset by an increase in fixed costs (rent and utilities).

Product mix

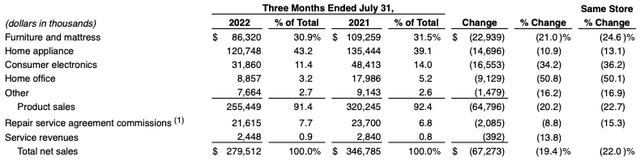

The company’s product mix continues to change. Revenue in the home office category was expectedly down 51% as covid restrictions eased in major markets.

Further, we see a serious decrease in revenue in the consumer electronics segment by 34% and in furniture and mattress by 21%. I believe that rising interest rates and monetary tightening will continue to have a negative impact on consumer spending in major categories, as lower real incomes and consumer confidence have a strong impact on consumer discretionary spending.

Also, the share of service revenue increased from 6.8% to 7.7%, which supported the gross margin, in accordance with the comments of the company’s management.

3Q estimates

In line with current macroeconomic trends, I believe rising inflation and declining real incomes will continue to put pressure on revenue growth in the coming quarters. In addition, in my opinion, the company will not be able to significantly reduce costs (% of revenue) due to rising prices for rent and utility bills, and increased competition for labor may also have a negative impact. Thus, I believe operating margins will be under pressure in the coming quarters.

Personal calculations

Debt

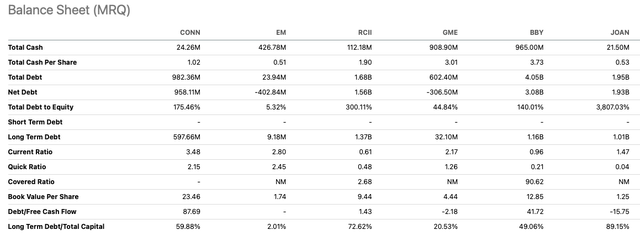

Despite the fact that the company continues to reduce the level of debt, the current level of debt remains significant relative to peer companies.

Total debt to Equity: 175%

Current ratio: 3.48

Debt/Free Cash Flow: 88

Valuation

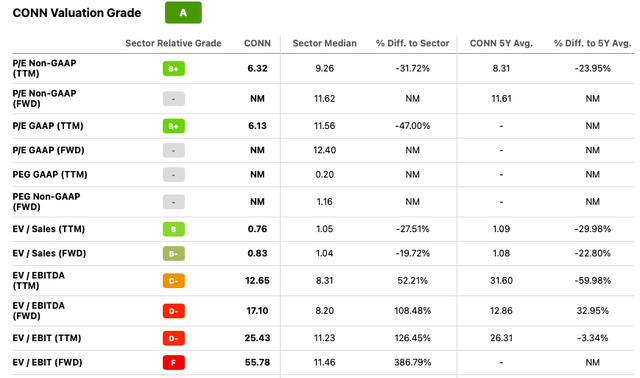

At this point, I would like to focus on the company’s earnings by multiples, because valuation using the DCF model is difficult due to the inability to make accurate forecasts of income and loss levels.

Based on EV/EBITDA (FWD) multiples, the company is valued at a multiple of 17.1, well above the average of 12.9

Drivers

Macro: improved macroeconomic conditions, rising real incomes and lower inflation could have a positive impact on consumer spending and the company’s top line growth.

Margin: effective cost control and the transfer of costs to the end user can support the operating profitability of the business.

Risks

Macro: macroeconomic conditions continue to have a negative impact on consumer spending, as a result, the company’s revenue continues to be under pressure

In addition, in my personal opinion, the decline in real incomes will continue to have a negative impact on consumer spending in the discretionary segment.

Cost pressure: increasing competition for labor, rising prices for advertising, rent and logistics may continue to put pressure on the company’s profitability.

Margin: a negative change in the product mix and a decrease in the share of service revenue may have a negative impact on the operating profitability of the company

Competition: I believe that large companies that occupy a leading position in the market are more efficient at the moment. First, market leaders have greater purchasing power. Secondly, it is easier for market leaders to realize economies of scale in order to maintain profitability.

Conclusion

I believe that now is not the best time to buy, despite the fact that the company’s quotes have declined significantly. In my personal opinion, consumers continue to be under pressure from high inflation and a decline in consumer confidence, which is negative for the growth rate of electronics and home appliance spending. I think the company’s revenue growth will continue to be under pressure. In addition, the deleverage effect and rising fixed costs will continue to have a negative impact on the company’s operating margin.

Be the first to comment