iambuff/iStock via Getty Images

Confluent (NASDAQ:CFLT) provides a leading platform for the streaming of data. Their business is growing rapidly and they have a strong competitive position, but like many growth stocks they have been pressured in recent months on valuation concerns. Confluent currently has a small user base, which is somewhat unusual for an open-source software company given that they typically rely on bottom-up adoption for growth. If Confluent can continue to grow their customer base and get a better handle on costs, the stock could reward investors handsomely in the long run. The stock is now more reasonably valued than it has been, but is still far from cheap and will likely continue to be highly dependent on the macro environment in the short term.

Event Streaming

The volume and variety of data being generated globally is growing rapidly as a result of applications like IoT and connected sensors. According to IDC, there will be 55.7 billion connected devices worldwide by 2025, 75% of which will be connected to an IoT platform. Data generated from connected IoT devices is projected to be 73.1 zettabytes by 2025, a 4x increase since 2019.

Capturing the value of this data is becoming increasingly difficult with existing data infrastructure though, as databases are simply too slow to meet the needs of real-time applications. In addition to increasing volumes of data, the rise of microservices is making applications more modular, which increases the complexity of data flows and in turn the potential for delays.

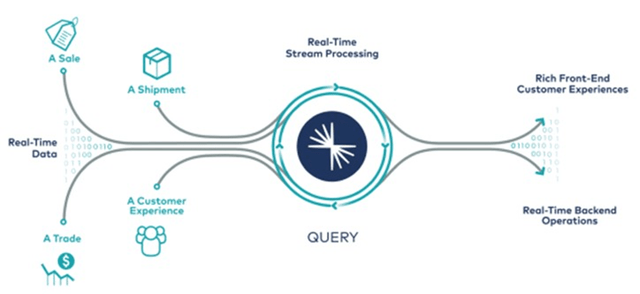

Traditional database technologies were architected for stored data and despite significant developments in scalability and speed, they cannot harness data-in-motion. Querying traditional databases results in a point in time snapshot that may readily become obsolete. A system built from these databases also requires separate point-to-point connections between every component, an n-squared problem, which may force a company to resort to periodic data dumps and batch processing. Data-in-motion utilizes what is basically an event log to continuously stream data to where it is needed in the organization.

Figure 1: Data-in-Motion (source: Confluent)

Disconnected organizations built around data silos are becoming obsolete and modern businesses need data to be integrated across the organization and available in real-time. Confluent envision their software as providing the data infrastructure that acts as the central nervous system of the organization, connecting disparate software systems (applications, systems and data layers) and allowing them to react intelligently in real-time.

Figure 2: Event Streaming as the Central Nervous System of the Modern Enterprise (source: Confluent)

In addition to changing data requirements, organizations are moving towards multi-cloud and hybrid cloud infrastructure. According to a recent survey, more than 75% of organizations are pursuing a multi-cloud model. The global public cloud services market is expected to be worth 628 billion USD in 2024, growing approximately 21% annually between 2020 and 2024. Despite this growth, over the past 5 years only 17% of system infrastructure software spend has been directed towards public cloud services and many organizations continue to operate large on-premises deployments. This means that cloud services still have room to expand and that the need for data movement across public clouds and on-premises is increasing.

Apache Kafka

Apache Kafka is a widely used open-source software which Confluent is commercializing. Confluent’s founders developed Kafka at LinkedIn in 2011, and since then it has become a critical technical skill in the industry, with an estimated 70% of the Fortune 500 having used it.

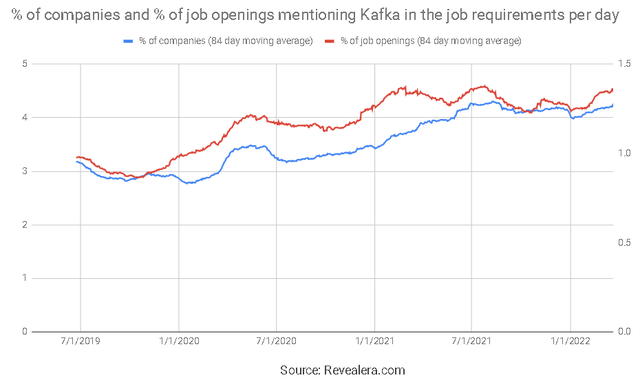

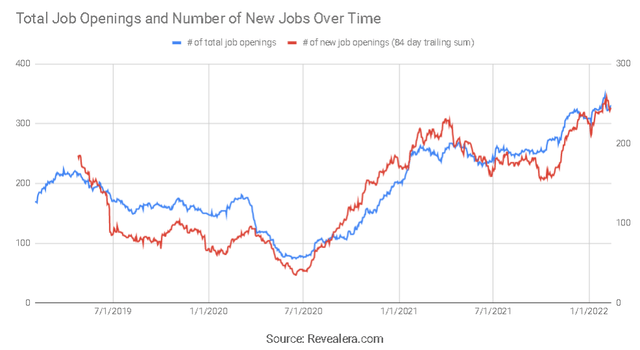

Figure 3: Job Openings Mentioning Kafka in the Job Requirements (source: Revealera.com)

Kafka also has a robust developer community, with more than 60,000 meet-up members across over 200 global meet-up groups. A thriving community is important for an open-source project as it can add to the functionality of the software and for Confluent it provides a base of potential future customers.

Kafka is a data streaming application rather than a database and it is used to connect components of a company’s IT architecture (databases, applications, analytic tools, etc.). It is like a centralized data pipeline that controls the flow of data in the organization. Kafka is not a replacement for centralized data stores though as they are easier to interface with and to query. Kafka simply fulfills a different need. A database passively stores data and waits for a query, whereas Kafka processes data in real-time in response to events that occur within the business. This helps to support a modular architecture based on microservices and serverless functions by supporting the flow of information between components. Kafka use cases include:

- Service bus – messaging backbone between microservices

- Logging and telemetry – sending messages asynchronously

- Transaction processing

- Data archival – sending data to external storage

- Event streams – tracking triggered events or data changes

- Event processing – real-time query and analytics

Kafka is differentiated by features that make logs fast, cheap and scalable enough to be used at massive scale. Some of the tricks that Kafka utilizes in support of this include:

- Partitioning the log

- Optimizing throughput by batching reads and writes

- Avoiding needless data copies

Connectors allow the exchange of data with a variety of sources:

- File-based sources

- Data messaging formats

- Object stores

- Databases

- Serverless platforms

- Observability platforms

- SaaS services

ksqlDB is a database that unifies the processing of stored and streaming data by translating the SQL interface of traditional databases to data streaming. This minimizes the learning curve for developers and allows applications to readily utilize data streams. KSQL was created to allow the querying of data streams in real-time using a database friendly SQL language. Data runs through the KSQL query though rather than the query running on the database.

Confluent

Confluent’s mission is to set data-in-motion, a reference to their use of Kafka to improve the flow of data within organizations. Confluent believes that their software can make data-in-motion the central nervous system of every company in the world, which positions them to expand into adjacent categories. Significant milestones in Confluent’s history include:

- September 2014: Founded by Jay Kreps, Jun Rao, and Neha Narkhede

- January 2015: Announced Confluent Platform 1.0

- November 2017: General availability of Confluent Cloud

- December 2017: First customer over 1 million USD in ARR

- March 2018: General availability of ksqlDB

- April 2019: Exceeded 100 million USD in ARR

- September 2019: 50% of all customers on Confluent Cloud

- November 2019: Confluent Cloud available on AWS, GCP, and Microsoft Azure

- March 2020: Exceeded 1,000 customers

- March 2021: Exceeded 2,500 customers

Confluent’s software is a complete solution for working with data-in-motion (read, write, store, capture, validate, secure, and process continuous streams of data). It is a modern distributed system built to be secure, fault tolerant, and elastically scalable for cloud deployment. Confluent’s software is likely to be useful in any application where a large volume of events are created that need to be actioned in real-time, including:

- Financial services – payments and fraud detection

- Retail and ecommerce – transactions

- Manufacturing

- Media and entertainment

Confluent’s software can be deployed both in the cloud and on-premises. While Confluent Server is based on Kafka, it was re-architected to operate at cloud-scale whilst remaining interoperable with Kafka. The cloud-native offering works across multi-cloud and hybrid infrastructures, delivering scalability, elasticity and security.

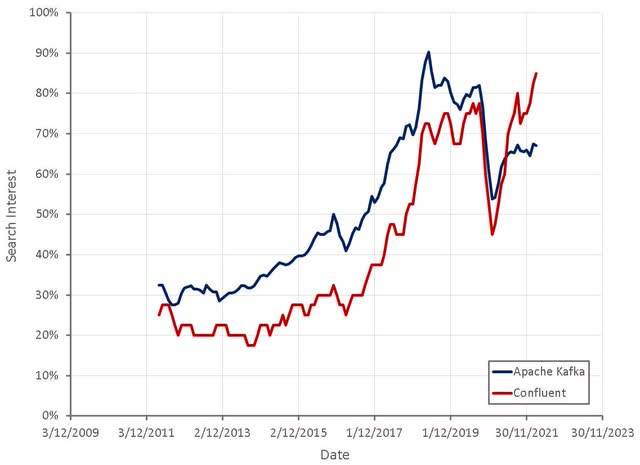

Figure 4: Google Search Interest for Apache Kafka and Confluent (source: Created by author using data from Google Trends)

Confluent’s solution has three elements:

- Cloud-Native – fully-managed service that is scalable and secure.

- Complete – platform leveraging capabilities from Kafka, combined with Confluent’s proprietary capabilities.

- Everywhere – hybrid and multi-cloud offering.

Confluent also offers a Community License that makes many of the features developed at Confluent available. Developers can modify the source code for such features but cannot use them to provide competing SaaS offerings, an approach similar to Elastic (ESTC) and MongoDB (MDB). This provides Confluent with a user base which is familiar with the software and can potentially be converted to paying customers.

Confluent has added substantial functionality to their software to differentiate it from Kafka. Proprietary features which add value include Confluent control center, Confluent operator, self-balancing clusters, tiered storage, structured audit logs, RBAC, schema validation, and multi-region clusters. Most of these features are aimed at making Kafka more secure and easing the burden of managing complex deployments. Confluent also now has over 100 Pre-Built Connectors and they continue to develop and work with partners who develop enterprise-ready connectors. The extent to which Confluent can differentiate their software from Kafka is an important contributor to the success of an open-source business model.

Market

Confluent believe their product roadmap targets the following markets:

- Application Infrastructure & Middleware

- Database Management Systems

- Data Integration Tools and Data Quality Tools

- Analytics and Business Intelligence

The aggregate total addressable market for these 4 markets is approximately 149 billion USD according to Gartner’s 2021 estimates. These are very broad markets though and as a provider of relatively niche products, Confluent is only ever likely to capture a small portion of this total.

Confluent estimate that they currently address approximately 50 billion USD of this total:

- Application Infrastructure & Middleware – 31 billion USD

- Database Management Systems – 7 billion USD

- Analytics and Business Intelligence – 7 billion USD

- Data Integration Tools and Data Quality Tools – 4 billion USD

Confluent believes their addressable market will grow to approximately 91 billion USD by 2024. Given the estimated addressable markets of other data infrastructure companies, Confluent’s estimates appear to be optimistic.

Financial Analysis

Confluent’s revenue growth has remained extremely robust, even as the business has scaled. They are guiding for a significant slowdown in 2022 though (40% growth). This is likely conservative, but the question is how conservative.

Figure 5: Confluent Revenue Growth (source: Created by author using data from Confluent)

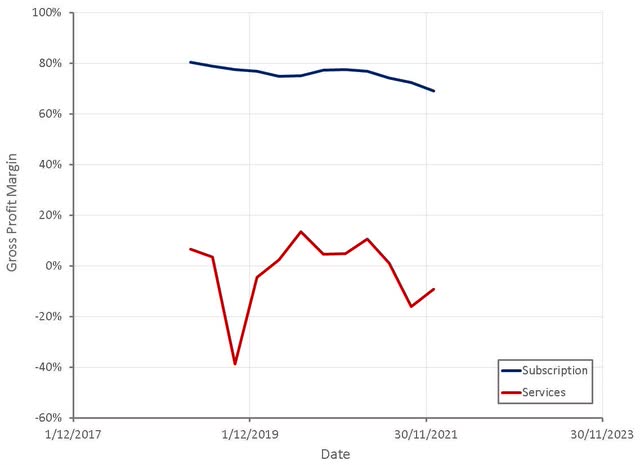

Approximately 90% of Confluent’s revenue comes from subscriptions, with the other 10% from services. Most of Confluent’s subscriptions have one-year terms and are billed annually in advance per software instance. A software instance is a component of the platform running on either a physical or virtual machine. As a result, Confluent should have reasonable visibility into near-term growth.

Cloud is a major growth driver for Confluent and should continue to be so going forward. International geographies only contribute approximately one third of Confluent’s revenue, which is broadly in line with many SaaS peers, and provides another growth avenue.

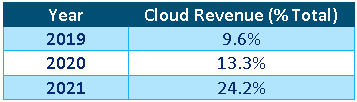

Table 1: Confluent’s Cloud Revenue (source: Created by author using data from Confluent)

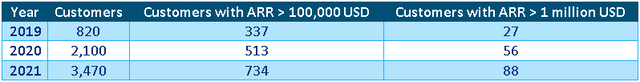

Confluent still has a relatively small customer base but a large portion of these are large customers. There is a significant opportunity for continued growth through expansion of the customer base, but this is dependent on how widely adopted event streaming software becomes and the value of the proprietary software over the open-source version.

Table 2: Confluent’s Customers (source: Created by author using data from Confluent)

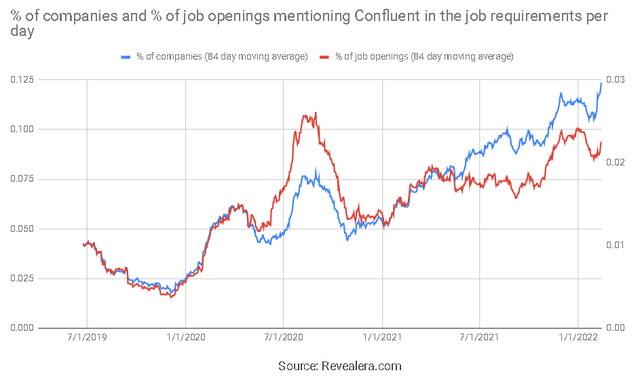

Hiring data indicates that adoption of Confluent’s software continues to grow steadily and assuming Confluent can continue expanding within their existing customer base, they are likely to handily beat projected revenue growth.

Figure 6: Job Openings Mentioning Confluent in the Requirements (source: Revealera.com)

Confluent has a diversified customer base, with no single customer contributing a material percentage of revenue. Large customers are important though, with Confluent’s 136 Fortune 500 customers contributing approximately 35% of revenue in the three months ended March 31, 2021. There is a considerable gap between Fortune 500 companies who utilize Kafka and those that are paying Confluent customers though, which calls into the question the value of Confluent’s proprietary features.

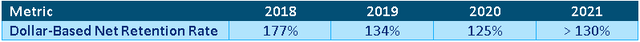

Confluent’s go-to-market strategy aims to take customers from initial experimentation through to enterprise-wide adoption, which appears to be a fairly high-touch approach. This makes sense given that Confluent believe they are a mission critical platform and have high average revenue per customer. It should also lead to strong net retention rates.

Confluent’s net retention rate declined significantly between 2018 and 2020, a fact they have attributed to existing customers contributing a larger portion of revenue and larger initial deal sizes. Despite this, Confluent’s net retention rate is still relatively strong and in line with their longer term target of approximately 130%.

Table 3: Confluent’s Net Retention Rate (source: Created by author using data from Confluent)

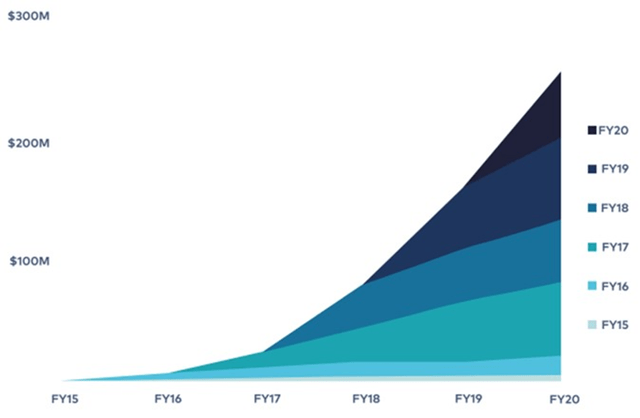

Figure 7: Confluent ARR by Cohort (source: Confluent)

Confluent has approximately 2,000 employees and is continuing to hire aggressively, with much of this increase in headcount directed towards sales and marketing. Sales and marketing headcount increased from 415 employees at the end of 2019 to 579 employees in 2020 and 684 employees as of March 2021.

Figure 8: Confluent Hiring Trend (source: Revealera.com)

Confluent’s margins are one of the most concerning aspects of the company. Their subscription gross margins are relatively low and declining, possibly driven by increased adoption of their cloud hosted solution. Gross margins are trending towards what would be expected from an infrastructure company rather than a provider of differentiated software. Confluent’s ability to expand into higher value adjacent opportunities will be an important determinant of long-term gross margins.

Services are also dragging on margins as they are performed at approximately breakeven and are merely a means to support the subscription business rather than create value in their own right. The importance of services will continue to decline though as the subscription business grows.

Figure 9: Confluent Gross Profit Margins (source: Created by author using data from Confluent)

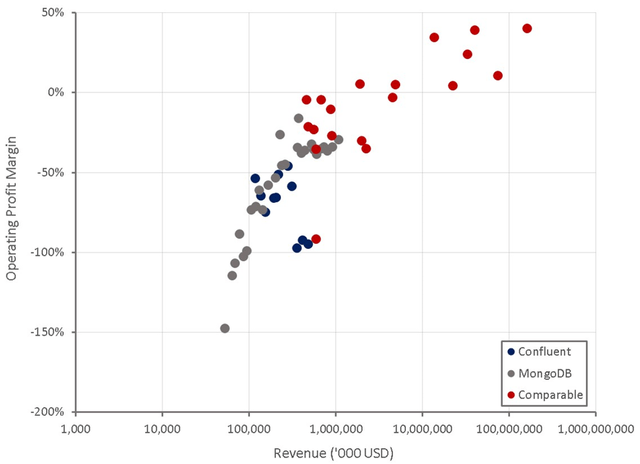

Confluent is also incurring large operating losses, driven in large part by excessive stock based compensation. Confluent must get operating expenses under control while maintaining growth, particularly in the current environment where companies generating losses are punished by the market.

Figure 10: Confluent Operating Profit Margins (source: Created by author using data from company reports)

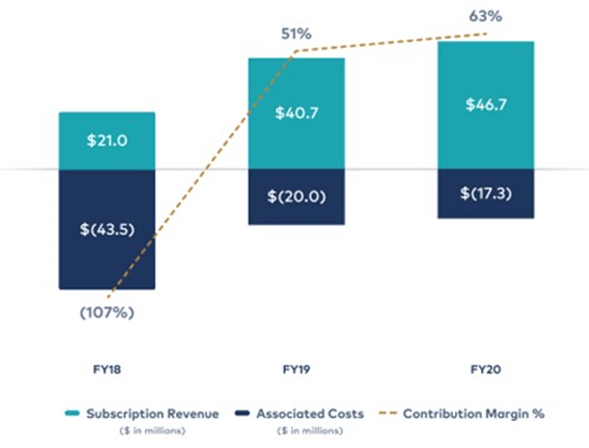

A contribution margin analysis indicates that Confluent’s margins at scale should be reasonably strong, although this will ultimately be determined by their competitive position. Contribution margin is defined as the subscription revenue from the customer cohort less the associated cost of subscription revenue and estimated allocated sales and marketing expenses. Contribution margin percentage is defined as the contribution margin divided by the subscription revenue associated with a cohort in a given period.

Figure 11: Confluent Contribution Margin Analysis (source: Confluent)

Competition

Confluent believe that on-premise competition primarily comes from internal IT teams developing their own data infrastructure using open-source software (Apache Kafka). There are also legacy products that have launched comparable functionality including TIBCO Streaming, Cloudera Dataflow, Red Hat (IBM), AMQ Streams, and Oracle (ORCL) Cloud Infrastructure Streaming.

Cloud competition comes primarily from hyperscalers (Amazon (AMZN), Microsoft (MSFT), Google (GOOG)). They have developed data ingestion and streaming products like Azure Event Hubs (Microsoft), Amazon Kinesis and Amazon DynamoDB Streams (AWS), and Cloud Pub/Sub and Cloud Dataflow (Google).

Apache Pulsar is a competing open-source data pipeline platform. It has in stream processing similar to Kafka Streams and is utilized by companies like Tencent (OTCPK:TCEHY), Overstock (OSTK), Verizon (VZ), MercadoLibre (MELI), Nutanix (NTNX), and Splunk (SPLK). StreamNative was formed by the original developers and offers a hosted SaaS version of the software.

Valuation

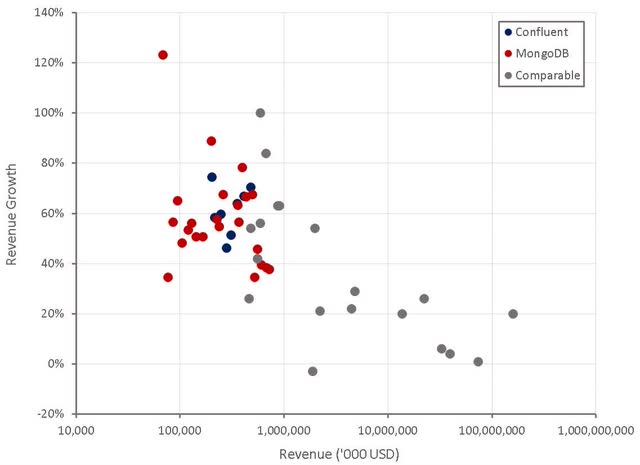

If Confluent can control expenses while maintaining robust growth in coming years, the stock likely provides reasonable value at current prices. Based on a discounted cash flow analysis I estimate that Confluent’s stock has an intrinsic value of approximately 60 USD per share.

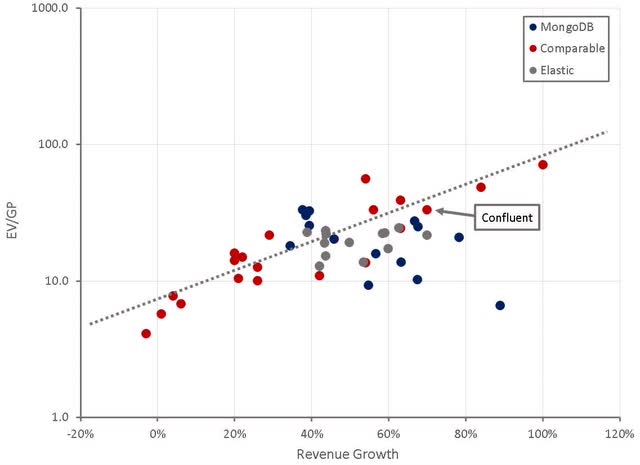

On a relative basis I think there are better priced stocks though. Compared to open-source peers, MongoDB and Elastic, I believe Confluent has a stronger business than Elastic but a significantly weaker business than MongoDB. As such, it would make sense for Confluent to trade on multiples closer to Elastic than MongoDB.

Figure 12: Confluent Relative Valuation (source: Created by author using data from Yahoo Finance)

Conclusion

Confluent has a clear vision to sell investors and their financial performance has been strong in recent years. The efficiency of their growth is somewhat concerning though, due in large part to excessive stock-based compensation. While I believe Confluent is reasonably priced for long-term investors, there are significant short-term risks due to the macro environment. Supply chain issues could leave inflation elevated for longer than expected, leading to lower valuations for growth stocks. There is also increasing risk of a recession in the next 1-2 years, which could be harmful to the valuation of growth stocks.

Be the first to comment