Angel Di Bilio/iStock Editorial via Getty Images

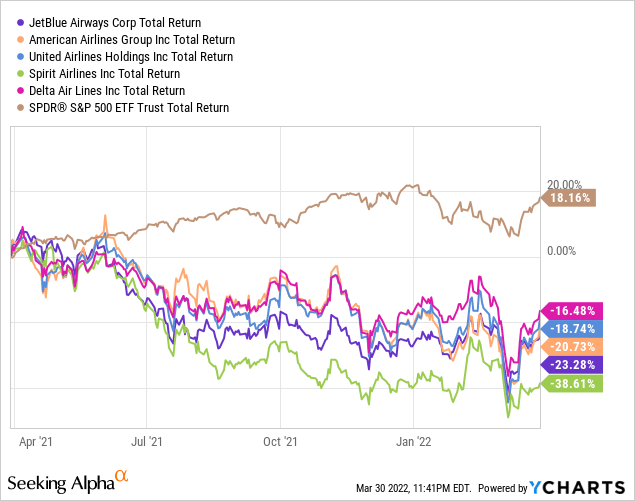

Over the last twelve months, JetBlue (NASDAQ:JBLU) has underperformed its peer group and the broader market. While the S&P 500 is up 18%, Delta Air Lines (DAL) is down 16%; United Airlines (UAL), down 19%; American Airlines (AAL), down 20%; JetBlue, down 23%. Only Spirit Airlines (SAVE) fell more than JetBlue, down 39%. At forward earnings of 10.2x, JetBlue now looks cheap; but, its peer group is cheaper still ranging from 7.2x-9.8x. Although business and personal travel is ramping up, it’s unlikely, in my view, that travel will return to pre-pandemic levels any time soon. In the new environment of telecommuting and work-from-home, there’s greater resistance to unnecessary travel. On the flip side, a recovering economy will see more individuals willing to take vacations.

According to Seeking Alpha data, the Street is split on the stock. 8 analysts rate the stock a “hold” or “sell”; 8 rate the stock a “buy”. This sentiment has held roughly steady going back a year ago; but, before then, almost everyone was sour on the stock as the pandemic continued to go from bad to worse. Business performance has understandably been weak over the past two years, as cancellations abounded. Revenue dipped from $8.1 billion in 2019 to $3.0 billion in 2020. Going forward, the financial trajectory of the business remains highly uncertain and, with no dividend and a beta of 1.38, it’s, by almost any measure, a risky investment.

DCF Analysis Indicates Significant Upside

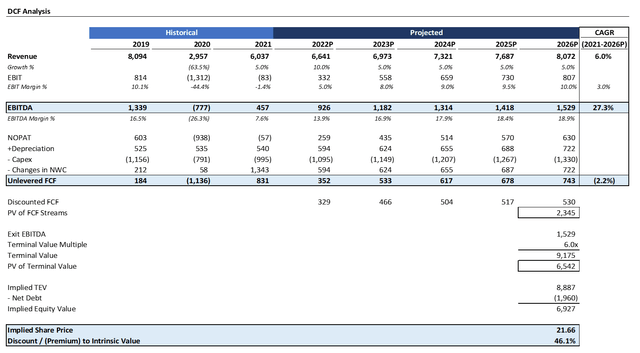

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. Given that the financial projection for JetBlue is so uncertain, the DCF here needs to be taken with a grain of sale. In my DCF analysis, I assumed a recovery to revenue and margins occurring 5 years out, by 2026. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 6x and a 7% discount rate, the stock has nearly 50% upside. The EBITDA multiple over the last decade and a half has ranged from 5-8x, and with multiples in the market so high, I feel like the 6x peg is relatively conservative. Again, the projection here is uncertain, but the fact that a 6x multiple and a recovery by 2026 produces a 50% upside suggests that JetBlue has discounted in the worst.

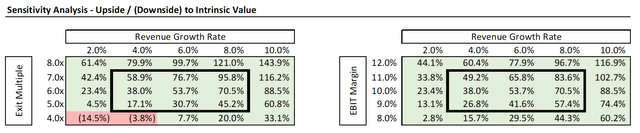

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, it would take a 2% growth rate and a multiple of 4x to produce a 15% downside, which is easily offset by the 7% returns implicit in the discount rate. There are simply too many more pathways for upside than downside in JetBlue’s case, that I believe, from a long-term investment perspective, it’s hard to not see favorable risk/reward. The near-term will undeniably be turbulent, but a 2% growth rate and a 4x multiple from this low trough is not a particularly high bar.

Upside Catalysts

The obvious criticism for anyone pushing the “deep value” case for JetBlue is that it is a value trap. There are several key levers that JetBlue needs to hit in order to change the tide. Firstly, management needs to properly address the labor shortage. It is currently in a hiring spree for 700 additional flight staff to meet a robust demand upswing in the summer time. Understandably though, after two years of upheaval, a changing labor market, and negative press coverage, finding willing talent won’t exactly be an easy task. Another key catalyst will be, of course, any data around increasing capacity and normalization of fuel costs. Management is guiding for capacity to be up 11-15% vs. 2019 in 2022. The company needs to streamline costs, invest in technology, and demonstrate improved productivity in order to thrive in the challenging environment.

And then, on the commercial front, management is focusing on capitalizing on the Northeast Alliance to unlock value and promote competition. Greater choice through improved fare options and loyalty rewards will be instrumental to attracting back flyers. In particular, according to McKinsey & Co., the emphasis needs to be on updating network strategies to eliminate duplicate hubs, offering smaller aircraft to service secondary cities, and increasing the availability of direct, non-stop flights. To JetBlue’s credit, the rollout of JetBlue Vacations, Paisly, and evolved insurance offering has yielded promising results, like 50% commissions growth vs. 2019 and accelerated take-rate for each key product category.

Omicron greatly impacted the first half of 1Q22, but trends have changed for the better. With the lifting of mask mandates and momentum in premium leisure products, I believe JetBlue’s inflection has not yet been appreciated by the Street. Management is guiding for sequential month-on-month improvement through the quarter and, were it not for Omicron, they would have actually generated higher revenue in the most recent quarter versus the first quarter of 2019.

Downside Catalysts

As much as I am optimistic about the long-run prospects of JetBlue, the company is not without its risk. After twenty years of service, JetBlue has prided itself off being a premium low-cost carrier with superior margins. However, that changed just before COVID, where the company fell to the middle of the industry pack in terms of margins, given its limited network compared to that of competitors. Towards that end of regaining its margin leadership, JetBlue has made an alliance with American Airlines to service American with its NYC routes in return for service beyond the Big Apple. While this idea is good in theory, it also makes me nervous. Should the company lose this partnership, the company will have lost much of its restructuring story. Combined with the high beta of the stock and weak secular trends, JetBlue is not for the risk-averse. Lastly, while JetBlue looks cheap, it is still at a slight forward earnings multiple premium to its competitors.

Conclusion

JetBlue may be a risky stock, but I believe the downside has already been factored into the stock price. As my sensitivity analysis shows, even the most pessimistic of forecasts still indicates that JetBlue has runway for upside. The company has executed in recent quarters with better-than-expected performance, and, with actionable levers in play to create value, I believe the upside story is more likely than further volume deterioration. As the company moves beyond its JFK core base, there’s an expansion story to had, particularly in Florida, California, and international openings. With the economy recovering and traveling resuming, I believe investors will start focusing more on this upside than in the past challenges.

Be the first to comment