Sakorn Sukkasemsakorn

A Quick Take On Confluent

Confluent (NASDAQ:CFLT) went public in June 2021, raising approximately $828 million in gross proceeds from an IPO that priced at $36.00 per share.

The firm has developed a platform providing data infrastructure that speeds data communications across the enterprise.

My outlook for CFLT is on Hold until the firm can make progress in reducing its operating losses.

Confluent Overview

Mountain View, California-based Confluent was founded to create a platform enabling companies to more easily build and deploy data-driven applications for real-time use.

Management is headed by co-founder and CEO Jay Kreps, who was previously a software architect at LinkedIn and was one of the creators of Apache Kafka, which Confluent uses as the basis for its system.

Kafka is used by many companies for high-performance data streaming applications, among other uses.

The company’s primary offerings include:

-

Confluent Cloud – SaaS platform

-

Confluent Platform – Self-managed system

The firm pursues relationships primarily with large and medium-sized companies through a direct sales and marketing approach.

As of March 31, 2022, Confluent had over 791 customers with $100,000 or more in annual recurring revenue across numerous industries including financial services, retail and ecommerce, manufacturing and media & entertainment.

Confluent’s Market & Competition

According to a 2020 market research report by Allied Market Research, the global market for big data as a service was an estimated $5 billion in 2018 and is forecast to exceed $61 billion by 2026.

This represents a forecast of very strong CAGR of 36.9% from 2019 to 2026.

The main drivers for this expected growth are the continued transition of enterprises to cloud applications and the need to drive efficiencies across all aspects of the enterprise.

Also, as companies transition to cloud infrastructures, their systems are becoming more complex, and there is a substantial need for vendor reduction to improve integration and lower complexity.

The infrastructure as a service market [IaaS] is expected to grow by $136 billion from 2021 to 2025, representing a CAGR of 27%, according to ResearchAndMarkets.

Major competitive or other industry participants include:

Confluent’s Recent Financial Performance

-

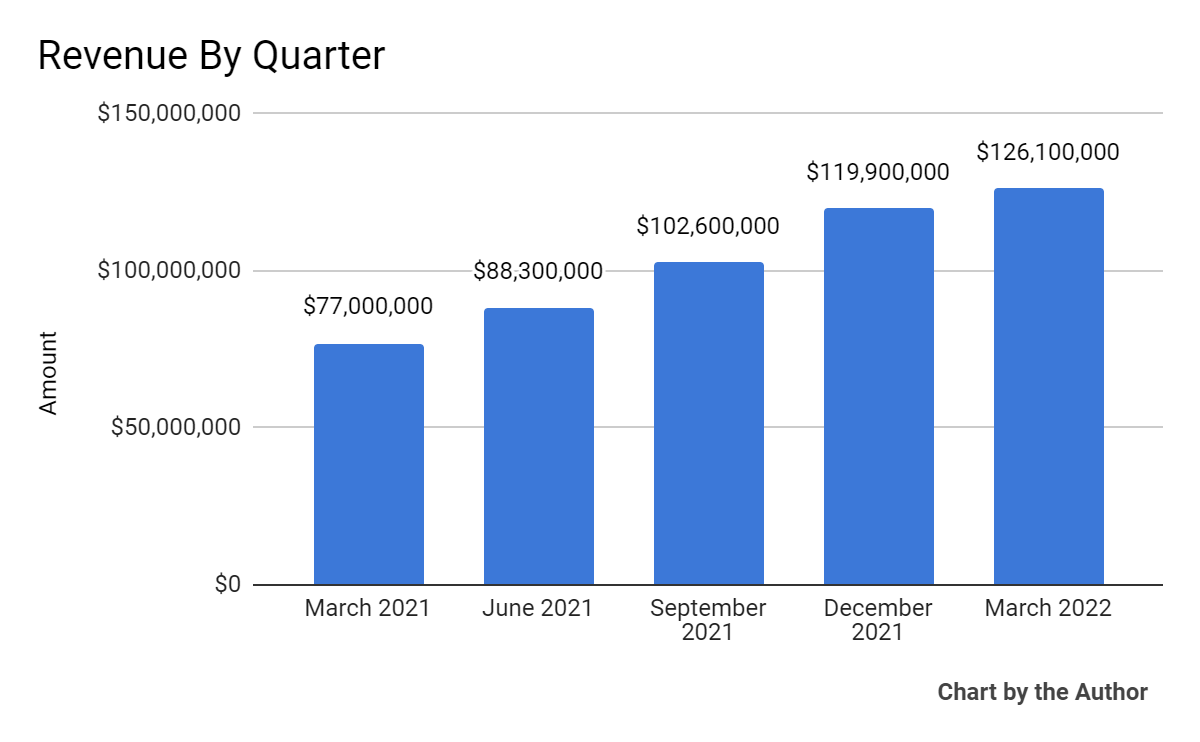

Total revenue by quarter has risen steadily over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

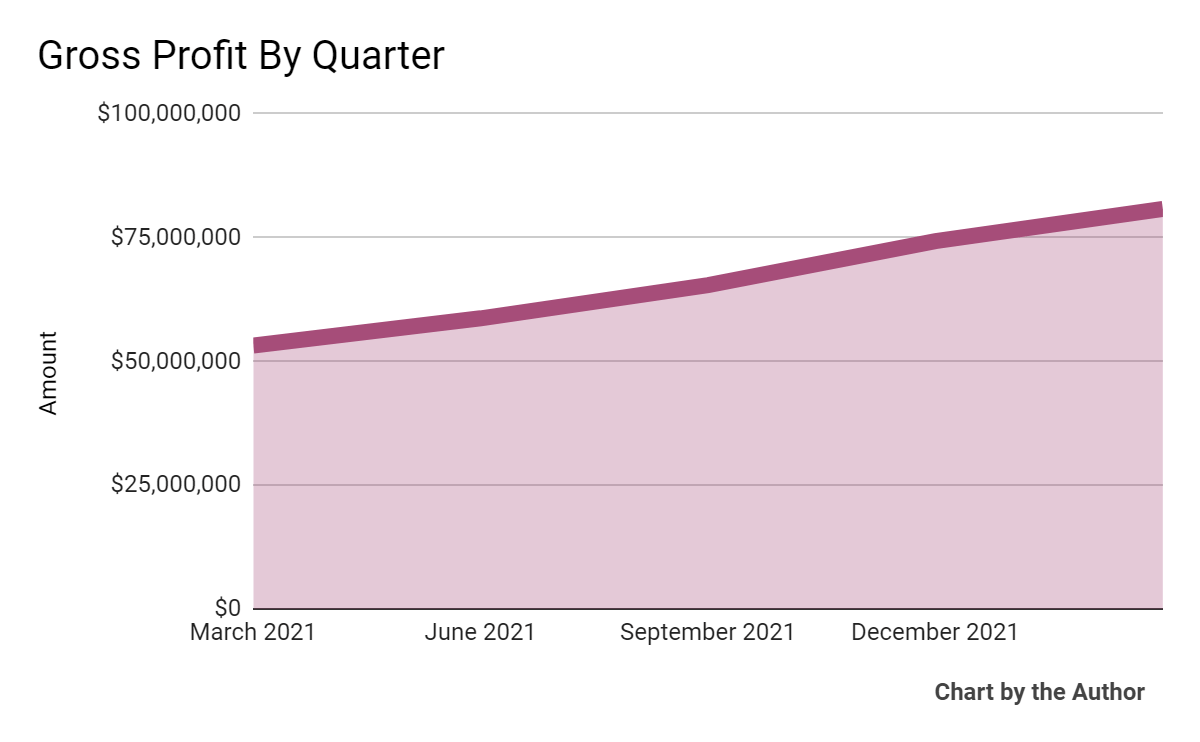

Gross profit by quarter has also grown considerably:

5 Quarter Gross Profit (Seeking Alpha)

-

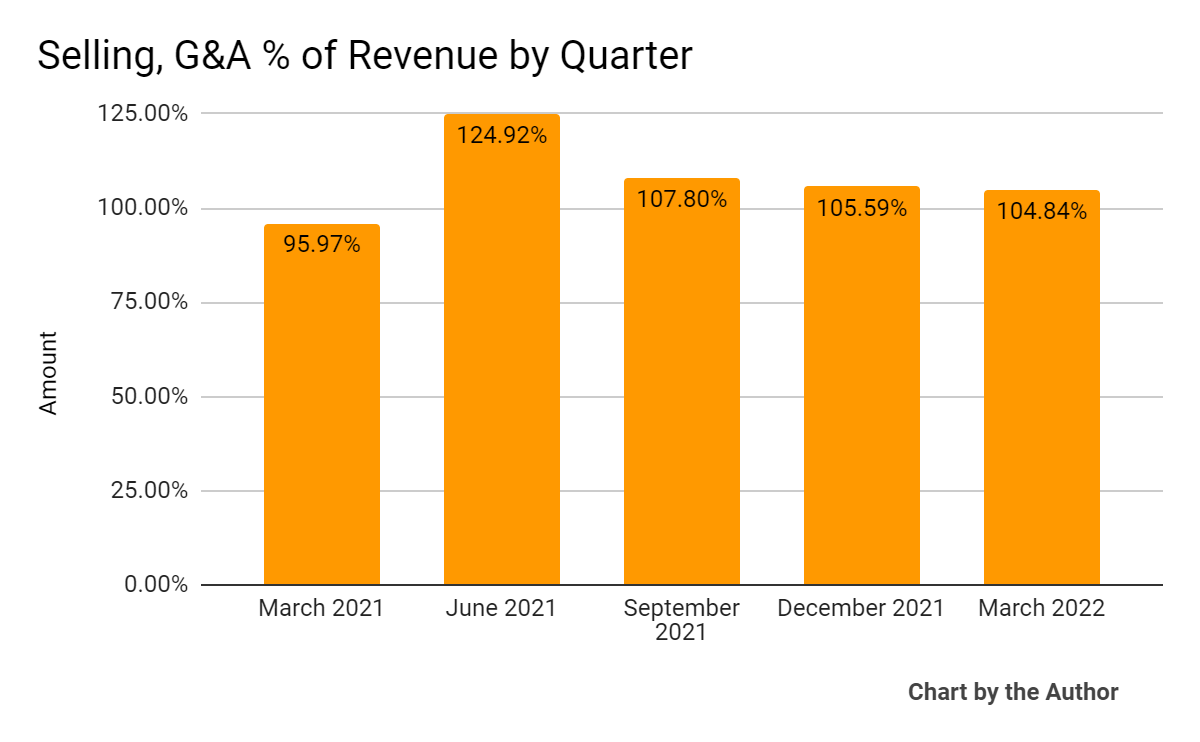

Selling, G&A expenses as a percentage of total revenue by quarter have remained high in recent reporting periods:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

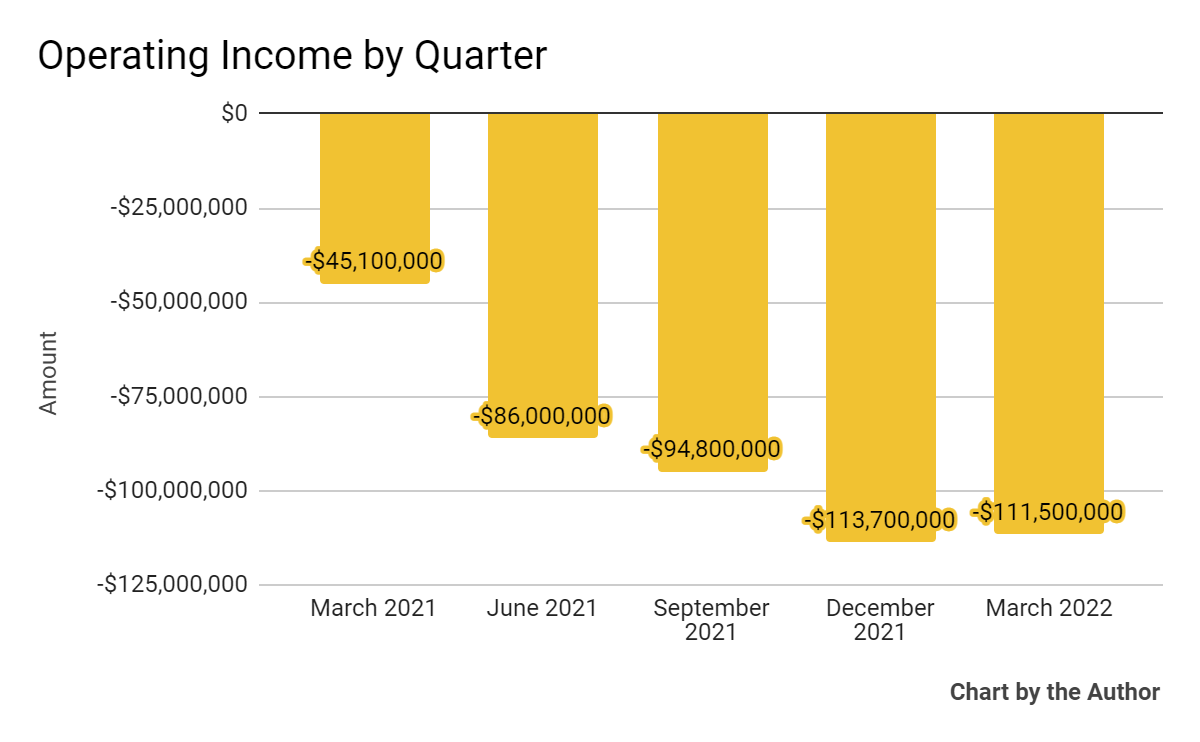

Operating losses by quarter have worsened in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

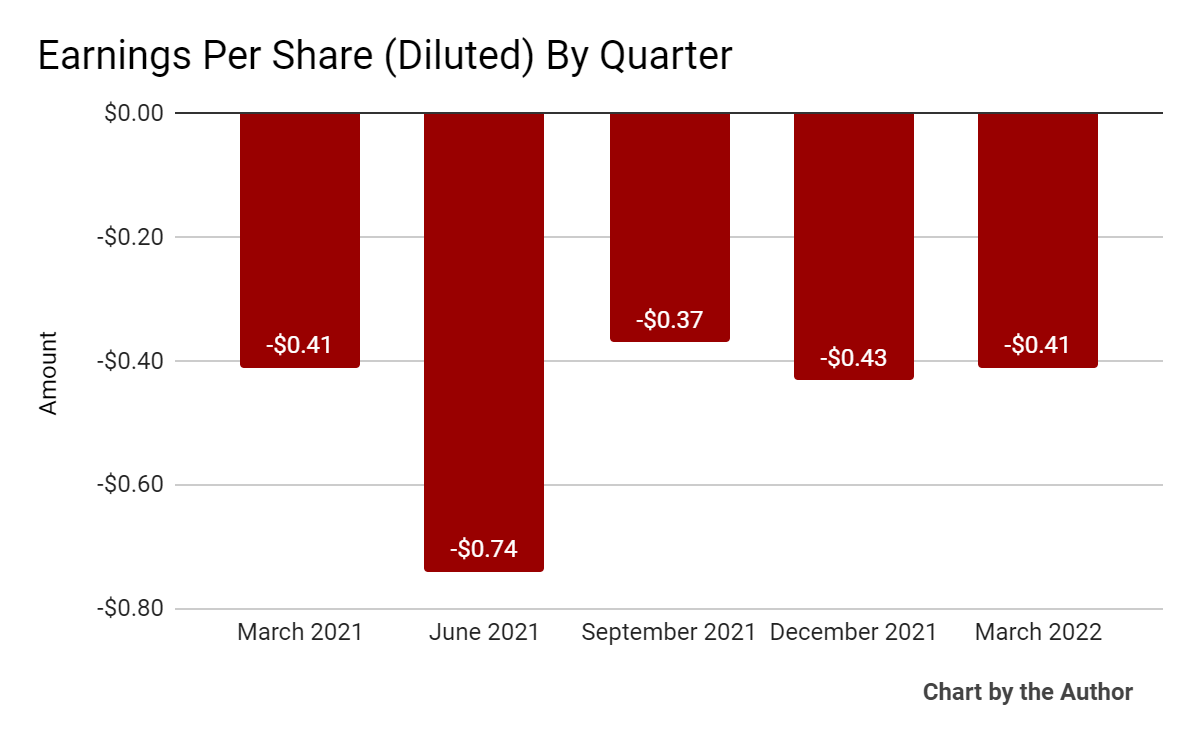

Earnings per share (Diluted) have remained substantially negative, as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

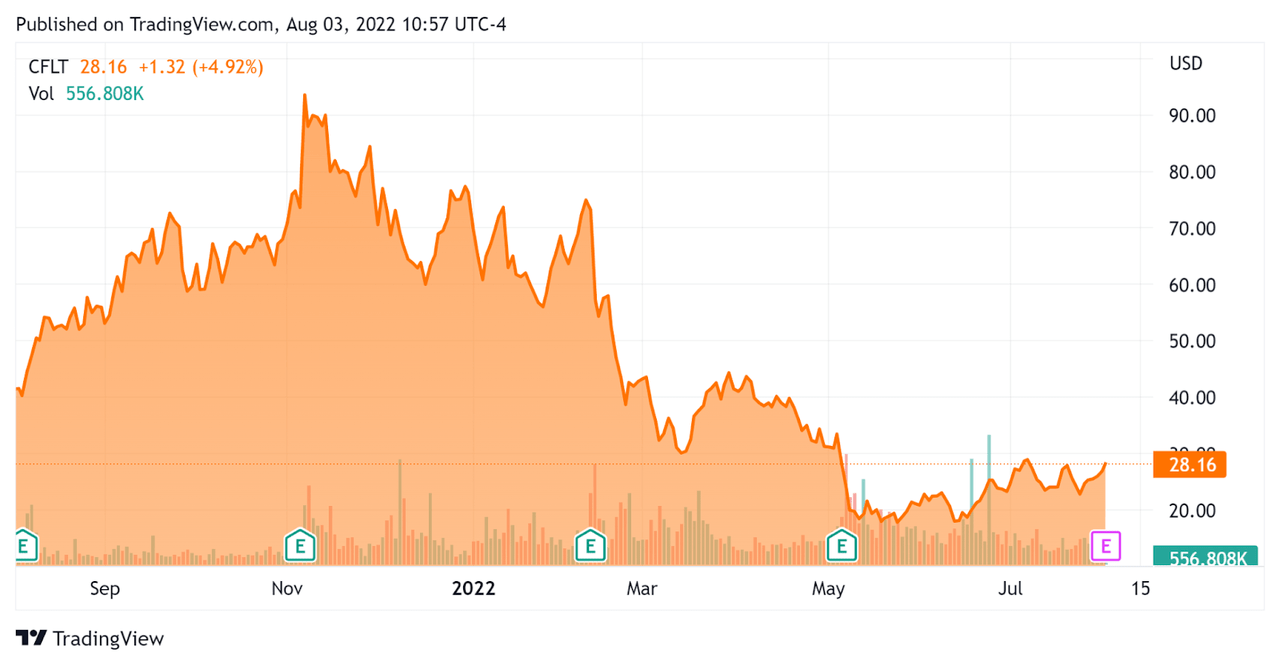

In the past 12 months, CFLT’s stock price has fallen 31.4% vs. the U.S. S&P 500 index’ drop of around 6.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Confluent

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$6,600,000,000 |

|

Market Capitalization |

$7,470,000,000 |

|

Enterprise Value / Sales [TTM] |

15.10 |

|

Revenue Growth Rate [TTM] |

66.34% |

|

Operating Cash Flow [TTM] |

-$140,100,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.95 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

CFLT’s most recent GAAP Rule of 40 calculation was negative (26%) as of Q1 2022, so the firm needs significant improvement, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

66% |

|

GAAP EBITDA % |

-92% |

|

Total |

-26% |

(Source – Seeking Alpha)

Commentary On Confluent

While the firm is scheduled to release its Q2 2022 results on August 3 after market close, in its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the closing of the ‘largest deal with Confluent Cloud in our company’s history.’

The company is seeing clients running its products across different environments, which management believes is a major trend as clients employ different environments for their particular requirements.

CEO Kreps highlighted its land and expand strategy that is focused on making it simple for prospective client developers to try out its products.

As to its financial results, total revenue rose to $126 million, a 64% year-over-year growth rate, while exceeding the top end of its previous guidance.

Overall, the company produced a net retention rate of over 130% for the fourth quarter in a row, an impressive figure indicating strong product/market fit and highly efficient sales efforts.

However, CFLT continues to produce high and increasing operating losses and negative free cash flow margin of 46.3%.

For the balance sheet, the firm finished the quarter with $2 billion in cash, equivalents and marketable securities, while using $55.9 million in free cash flow.

Looking ahead, management said it intends to accelerate margin improvement in 2023 to a negative 38% (non-GAAP).

Regarding valuation, the market is valuing CFLT at an EV/Sales multiple of around 15.1x.

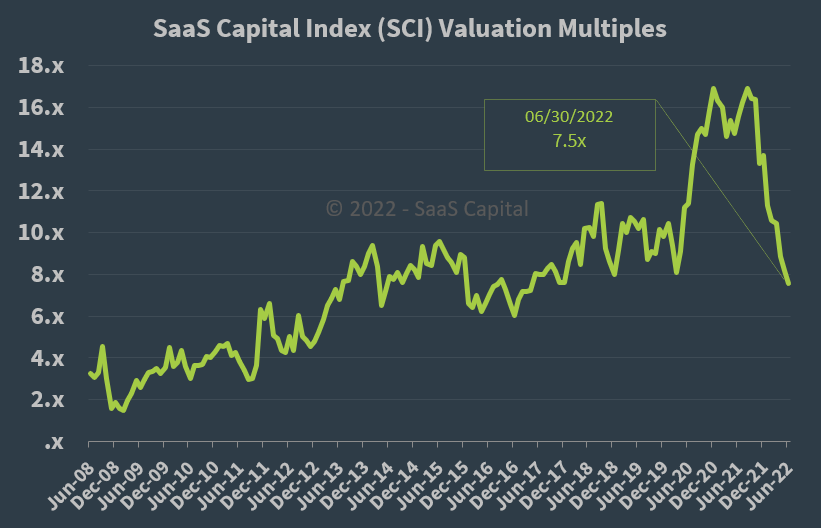

The SaaS Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x on June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, CFLT is currently valued by the market at a significant premium to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

A potential upside catalyst to the stock could include an improving cost of capital environment which could increase its valuation multiple.

However, given management’s lack of serious discussion about controlling costs or making a move toward operating breakeven, the market will likely continue to punish money-losing tech stocks despite their growth trajectory.

Therefore, my outlook for CFLT is on Hold until the firm can make progress in reducing its operating losses.

Be the first to comment