piranka

Confluent (NASDAQ:CFLT) provides a leading platform for the streaming of data. Their business is growing rapidly and they have a strong competitive position, but their relatively small user base and inefficient growth are sources of uncertainty. If Confluent can expand their customer base and control costs, the stock could reward investors when macro conditions improve.

Market

There is a paradigm shift occurring in software architecture, with messaging systems being used to remove data silos and connect applications. Hybrid and multi-cloud architectures are increasing the importance of data synchronization and the need for data streaming. Data-in-motion refers to connecting disparate systems using data streams between applications and infrastructure, which enables companies to react and respond to data in real-time.

Of the nearly 2,000 IT and engineering leaders surveyed by Confluent, more than 80% said real-time data streams are critical to building responsive business processes and rich customer experiences. 76% of customers believe they are likely to lose customers to competitors without insights provided by real-time data streams.

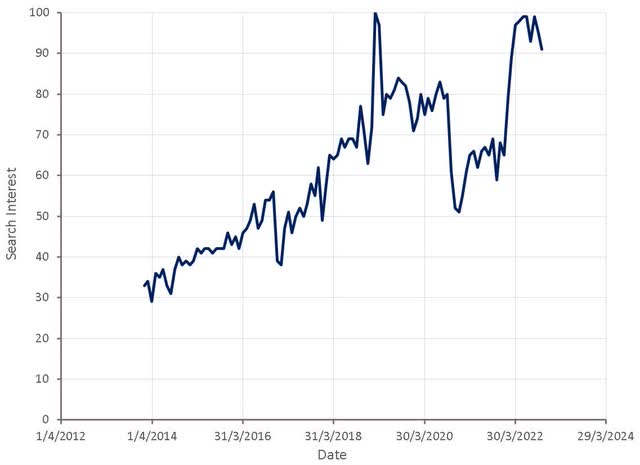

Apache Kafka is an open-source data streaming application that is used to connect components of a company’s IT architecture (databases, applications, systems, analytic tools, devices). It is like a centralized data pipeline that controls the flow of data in the organization. Kafka is replacing legacy messaging and middleware layers, like batch database processing and legacy ETL products. Kafka has become ubiquitous and is the de facto standard for data-in-motion. It is used by over 70% of the Fortune 500.

Figure 1: Apache Kafka Search Interest (source: Created by author using data from Google Trends)

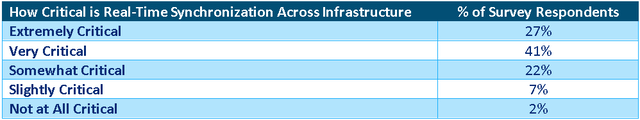

Most organizations now appear to recognize that real-time data synchronization across infrastructure is a critical capability. This should be a tailwind for streaming platforms like Kafka in coming years, as organizations seek to modernize their data infrastructure.

Table 1: How Critical is Real-Time Synchronization Across Infrastructure (source: Created by author using data from Confluent)

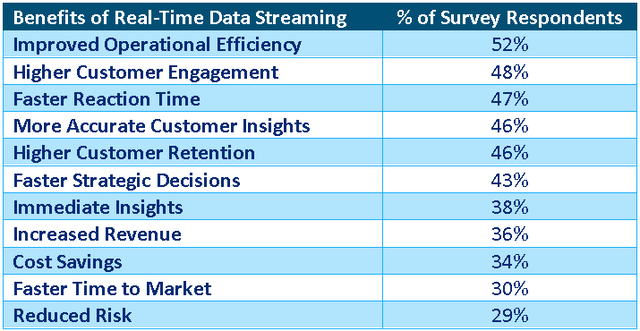

The most cited benefits of data streaming relate to improving efficiency, improving customer service and enabling faster decision making.

Table 2: Benefits of Real-Time Data Streaming (source: Created by author using data from Confluent)

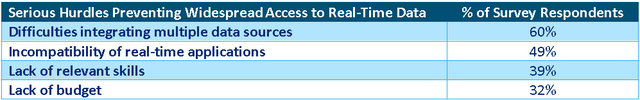

While data streaming is increasingly being recognized as a critical capability, integrating data from multiple sources remains a serious hurdle for most businesses, a problem that is addressed by Kafka.

Table 3: Serious Hurdles Preventing Widespread Access to Real-Time Data (source: Created by author using data from Confluent)

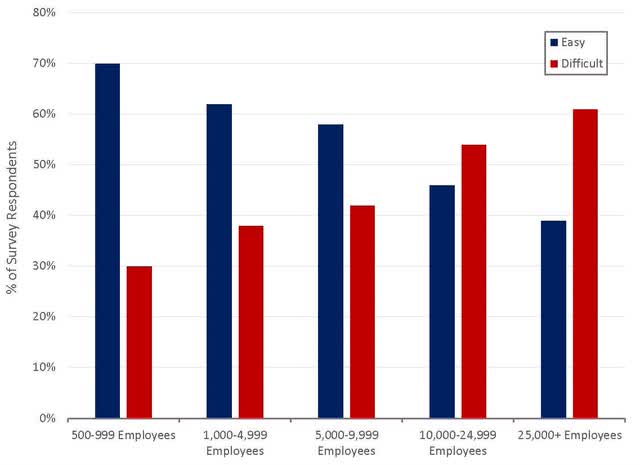

Integrating data from multiple sources also appears to be a problem that grows with scale, with larger organization more likely to state that they have encountered difficulties integrating real-time data from different applications.

Figure 2: How Easy is the Integration of Real-Time Data from Different Applications (source: Created by author using data from Confluent)

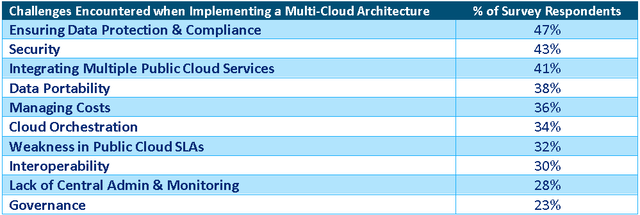

Many organizations would like to implement a multi-cloud architecture to avoid vendor lock-in, but there are a number of challenges commonly encountered when trying to do this.

Table 4: Challenges Encountered when Implementing a Multi-Cloud Architecture (source: Created by author using data from Confluent)

Confluent

Confluent’s software is a complete solution for working with data in motion (read, write, store, capture, validate, secure, and process continuous streams of data). It is a modern distributed system built to be secure, fault tolerant, and elastically scalable for cloud deployment. Confluent’s desire to be the central nervous system of the organization means that they need to be present wherever customers’ data resides (on-prem, cloud, hybrid cloud).

Confluent’s value proposition relative to Kafka is that their hosted version is faster and less expensive. Confluent has economies of scale on the cloud infrastructure and developer side. Confluent has invested more than 3 million engineering hours into Confluent Cloud over the past 5 years, with management believing it is now a 10x better Kafka service that is difficult to replicate.

Confluent customers often realize substantial cost savings when they adopt Confluent’s service. A Forrester study commissioned by Confluent identified TCO savings of more than 2.5 million USD for businesses that use Confluent, translating to an ROI of 257% in less than 6 months.

Confluent Cloud allows organizations to avoid investments in low-level operations, monitoring and scaling and instead focus on their business. Developers are a scarce resource, making this is a potentially attractive value proposition for many organizations.

While Confluent Cloud is driving the business (more than 50% of new ACV for the last 3 quarters has been from the cloud service ), Confluent Platform also continues to grow. Confluent Platform remains an important part of the business at it provides Confluent with an opportunity to upsell and cross-sell Confluent Cloud.

Confluent monitors the number of active unique IPs using the Kafka Java library and believes this provides a fairly rigorous measure of usage. Over the past 12 months, Kafka downloads grew more than 50% YoY. Confluent feel that Kafka does not have a close competitor in terms of scope of usage, breadth of ecosystem or developer mindshare.

Apache Pulsar is one of the most commonly mentioned competitors. Apache Kafka has sustained a higher growth rate than Pulsar, despite having a user base that is over 10x larger. Potential reasons for this include the ecosystem of integrations, the network effect inherent in data streaming and Kafka’s performance.

Confluent’s partner strategy is also maturing over time, which should be supportive of more efficient sales. Confluent recently introduced a cloud reseller program that allows customers to purchase Confluent Cloud directly from the consulting partners they already work with. Confluent have also expanded their collaboration with AWS by joining the marketplace channel program. Confluent was recently recognized by Microsoft (MSFT) and MongoDB (MDB) as one of their top partners for 2022. Confluent have also announced a multi-year strategic partnership with Microsoft which extends their existing relationship with joint technical, marketing and sales investments.

Confluent is also a member of the Data Cloud Alliance, an initiative that aims to make data more accessible across disparate systems. Members of the Data Cloud Alliance include databricks, dataiku, Elastic (ESTC), redis, MongoDB, Confluent, Accenture (ACN) and Deloitte. Given Google Cloud’s trailing position in the cloud market, it is in their best interest to facilitate the movement of data between clouds.

Confluent has taken steps to remove friction in the adoption of their software by allowing developers to sign-up without a credit card. This resulted in an acceleration of sign-ups in Q2 (up over 50% sequentially), but has also eliminated some preproduction pay-as-you-go customers who were paying on average less than a few hundred dollars per quarter. This is a potentially important initiative to expand Confluent’s customer base though.

Financial Analysis

Confluent continues to see strong demand despite economic headwinds, although management has pointed to sporadic delays in some deals. Confluent’s platform serves business critical operations and real-time customer experiences, generally making it a non-discretionary expense. This should help to buffer Confluent from macro headwinds to some extent. Confluent Cloud can also offer customers cost savings, making it a potentially attractive offer compared to developing internal services around open-source.

While Confluent has a sticky platform that is likely to witness fairly robust consumption, even through a downturn, changing data architecture may be a tough sell in a downturn.

Confluent’s growth is primarily being driven by their cloud service, with Cloud revenue growing 139% year-over-year and representing 34% of total revenue in the most recent quarter. Confluent Cloud has also accounted for more than 50% of new ACV bookings for three consecutive quarters. Cloud performance is being driven by healthy consumption across industries, with technology and financial services as particular areas of strength.

Although approximately 37% of Confluent’s revenue comes from international markets, foreign exchange is not expected to be a direct headwind to revenue as Confluent prices in USD globally.

For the full year 2022, Confluent expect revenue to be 567-571 million USD, representing YoY growth of 46-47%.

Figure 3: Confluent Revenue Growth (source: Created by author using data from company reports)

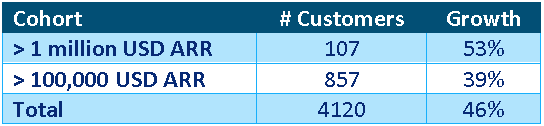

Confluent currently has a relatively small customer base, which may reflect their current value proposition being based around reducing the complexity and cost of self-managed data streaming. Confluent’s 100,000 plus USD ARR customer cohort contributed more than 85% of total revenue in the most recent quarter.

Confluent has both pay-as-you-go and committed contract customers, with the vast majority of revenue coming from committed customers. The PAYG customer count has been impacted by the recent paywall removal but the number of committed customers continues to increase. Confluent added 128 net new committed customers in the most recent quarter compared to 113 in the previous quarter and 80 a year ago.

Table 5: Confluent Customers (source: Created by author using data from Confluent)

Confluent’s dollar-based net retention rate has consistently been above 130%, driven by 90%-plus gross retention and strong expansion. NRR for Confluent Cloud is substantially higher than the overall NRR for the company (greater than 150%), and NRR for hybrid customers continues to be the highest.

Confluent has suggested that their retention rates are relatively high because it becomes difficult for customers to switch after they build a number of applications around the Confluent platform. At this point, swapping vendors becomes a strategic decision involving coordination between different parts of the customer’s business.

Confluent has also suggested that their customers’ consumption patterns may be similar to something like MongoDB, as they are generally serving production workloads in permanent applications. If this is the case, expansion rates could be expected to fall in a recession, as the business activity of some customers moderates.

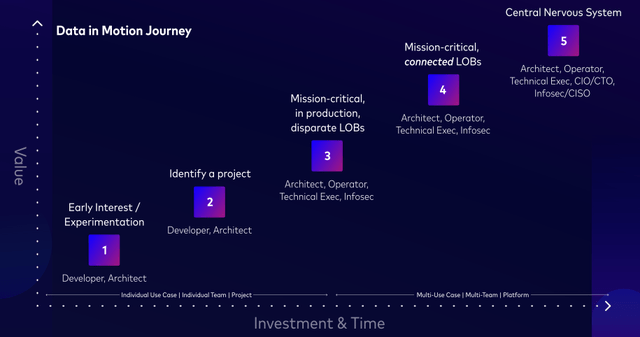

Confluent’s go-to-market effort is product-led and focused on growing usage over time. This aligns with how Confluent views the data-in-motion journey, with customers often starting with small experiments that eventually become defined projects in production, before data streaming eventually becomes ubiquitous. This scale up process should ensure that Confluent’s expansion rates remain robust over time.

Figure 4: The Data-in-Motion Journey (source: Confluent)

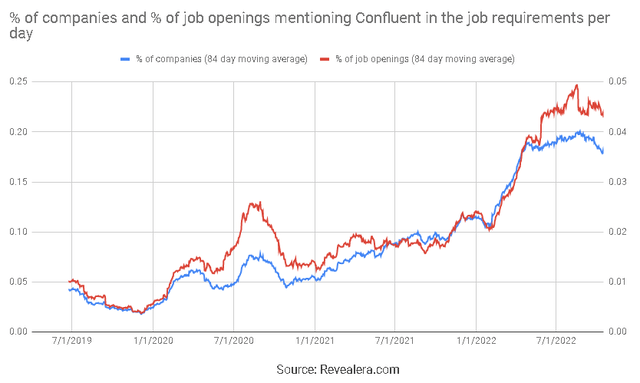

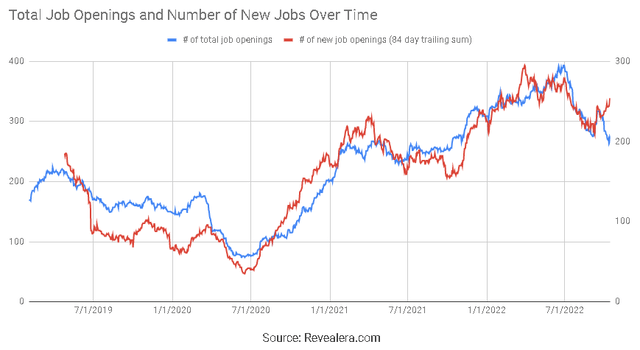

The number of job openings mentioning Confluent in the requirements has been trending upwards over time, potentially indicating increased customer adoption of the platform. The number of openings has dipped in recent months though, which could indicate a moderation in growth going forward.

Figure 5: Job Openings Mentioning Confluent in the Job Requirements (source: Revealera.com)

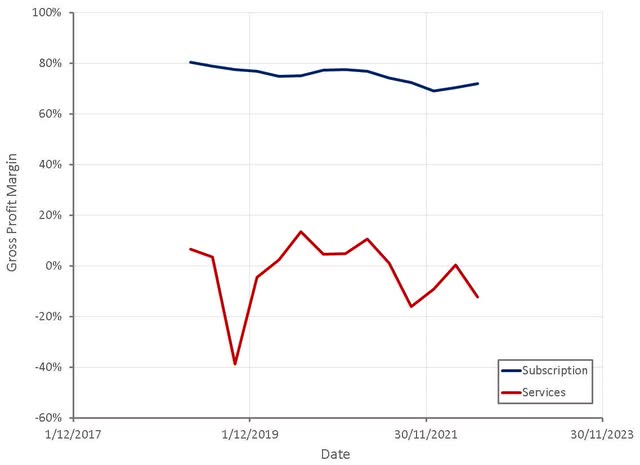

One of the concerns with Confluent’s business is their relatively poor margins. Confluent’s subscription gross margins have been declining over time as the relative importance of Confluent Cloud increases. Cloud gross margins have improved somewhat though due to continued efforts to optimize hosting costs, along with improved pricing from Confluent’s cloud service providers.

Figure 6: Confluent Gross Profit Margins (source: Created by author using data from Confluent)

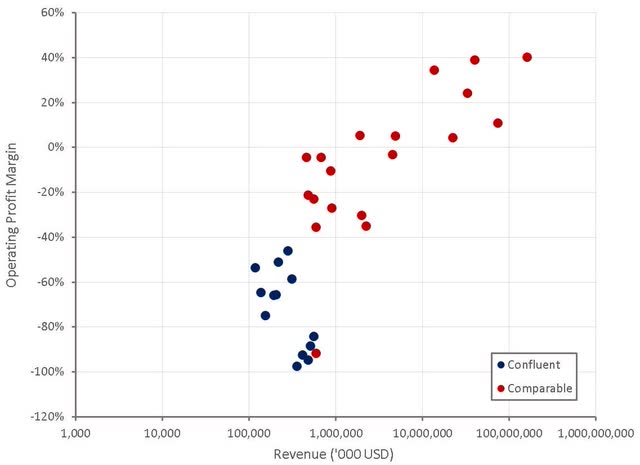

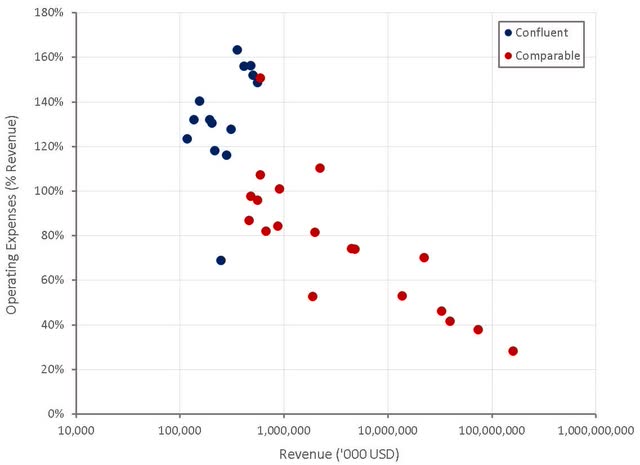

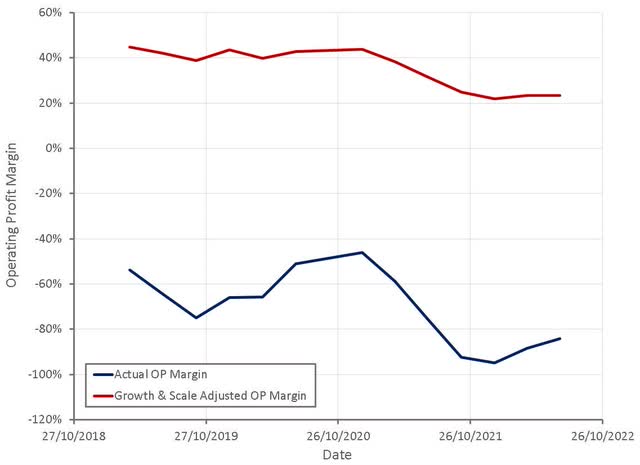

Confluent’s operating profit margins are also quite poor given the company’s size and growth. Much of this is due to Confluent’s high operating costs.

Figure 7: Confluent Operating Profit Margins (source: Created by author using data from company reports)

Confluent has adjusted spending levels to ensure they meet their operating margin targets and they are focusing investments on the highest ROI segments of the business. Absent a reduction in headcount or continued robust growth, Confluent’s operating expenses are likely to remain relatively high.

Figure 8: Confluent Operating Expenses (source: Created by author using data from company reports)

Adjusting Confluent’s operating profits by capitalizing intangible investments and accounting for operating leverage gives a clearer picture of the company’s potential profitability at scale, once growth has moderated. This indicates that Confluent will need to improve the efficiency of their operating expenses to achieve decent margins.

Figure 9: Confluent Adjusted Operating Profit Margins (source: Created by author using data from Confluent)

Despite high operating costs and the prospect of slower growth going forward, Confluent continues to hire fairly aggressively. This could be viewed as an indication of management’s confidence in the business, but it could result in a further deterioration in margins if growth does not eventuate.

Figure 10: Confluent Hiring Trend (source: Revealera.com)

Valuation

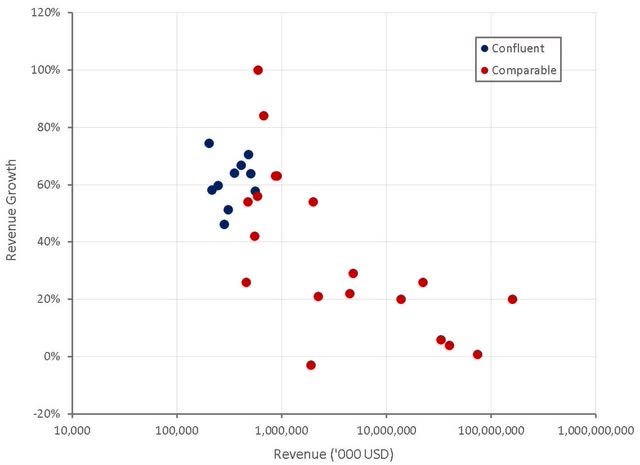

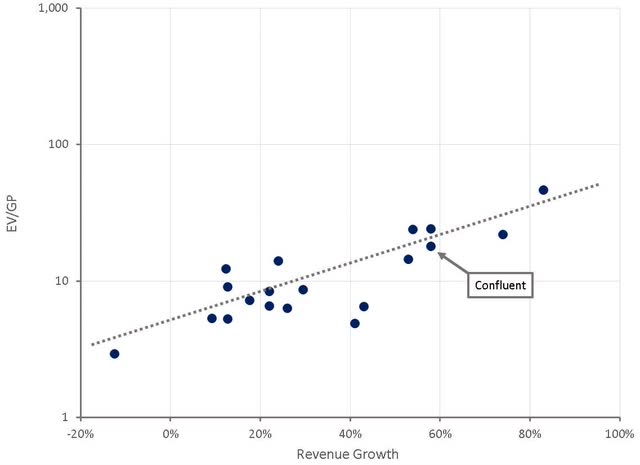

Confluent’s multiples are broadly in line with peers based on the company’s current growth rate and margins. Based on a discounted cash flow analysis I estimate that Confluent’s stock is worth approximately 32 USD per share. In the short term, movements in Confluent’s share price are likely to be dominated by interest rates and the company’s margin profile and growth. While the stock no longer looks particularly expensive, a deterioration in financial performance could still cause significant further downside.

Figure 11: Confluent Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Confluent has a strong competitive position and a large market opportunity ahead of it, but may find it more difficult to attract new customers through a downturn. Expansion rates are also likely to fall, and this, along with ongoing losses, presents further downside risk in the current market environment in my opinion.

Be the first to comment