jfmdesign/iStock Unreleased via Getty Images

Conagra Brands (NYSE:CAG) has delivered good sales growth with minimal impact on profit margins. But the consumer staples sector has benefitted from an inflow of cash from investors looking for a haven during these turbulent times. The stock has run up a lot and is overvalued. The company has grown its dividend in the past few years but carries high debt. Long-term holders may be better off holding on to their shares. New investors or anyone looking to add to their holdings may be better off waiting for a lower valuation.

Lower elasticities and price increases drive sales.

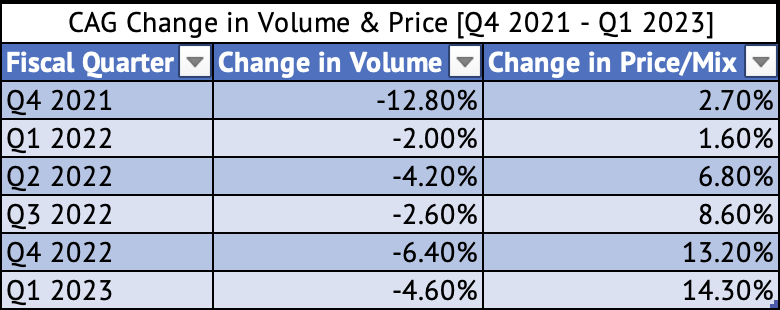

The company has seen good revenue growth in this slowing economy, driven by price increases. The company came off very high demand in 2020, so some of the drop in sales volumes in Q4 2021 can be attributed to the normalization of demand during that quarter. Overall, the double-digit price increases may be starting to take their toll on volumes with a steady decline. Across many companies in the consumer staples sector, volume declines have been muted in the face of these enormous price increases. So far, these muted price elasticities may have emboldened the company’s management. But consumers will get a sticker shock looking at their grocery bills, reducing consumption, and switching to lower-priced private label brands. However, private-label brands are facing the same inflationary pressures.

Sean Connolly [CEO] highlighted the lower price elasticities which helped drive sales growth in Q1 2023:

We had robust net sales growth across our portfolio, mainly due to the impact of our inflation-driven pricing actions coupled with ongoing limited elasticities.

Inflation is still hot, with a 7.1% year-over-year increase in November Consumer Price Index [CPI]. The Producer Price Index, which measures inflation from the perspective of domestically produced goods, services, and construction, increased year-over-year by 7.4% in November 2022. In a sign that inflation-related price increases are taking a toll, analysts note reduced spending during this year’s holidays.

Exhibit 1:

Conagra Quarterly Y/Y Change in Volume and Price (Conagra Investor Presentations, Author compilation)

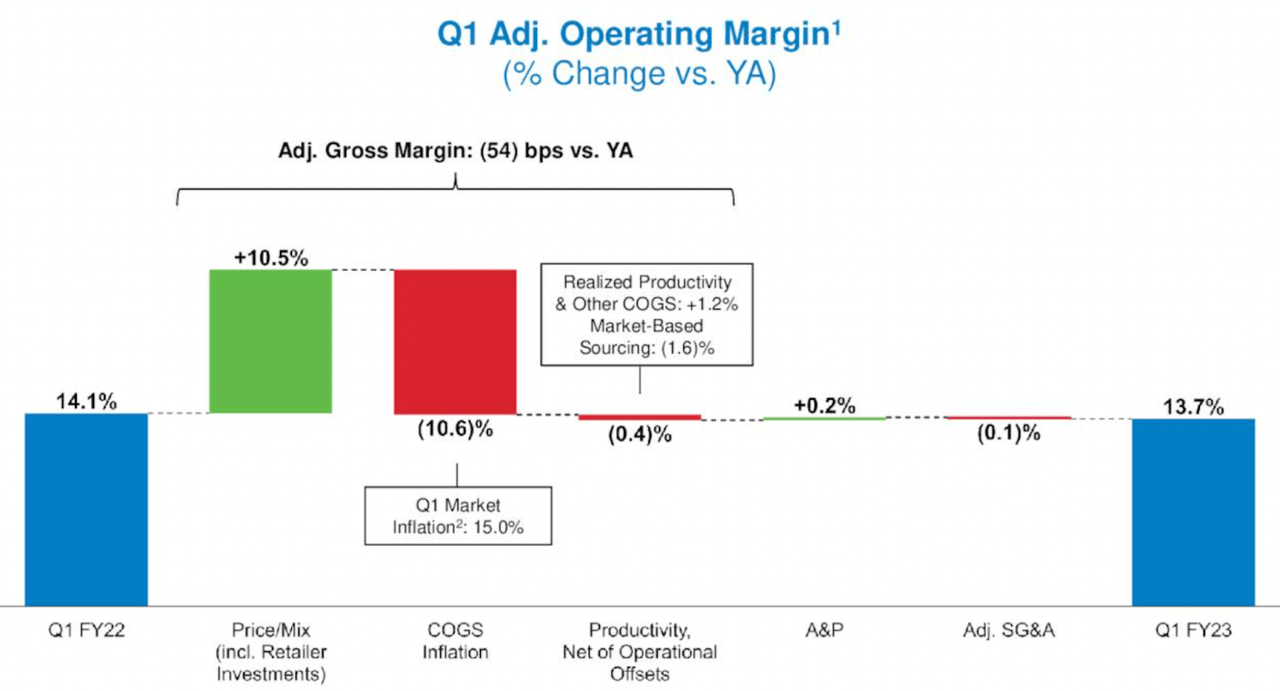

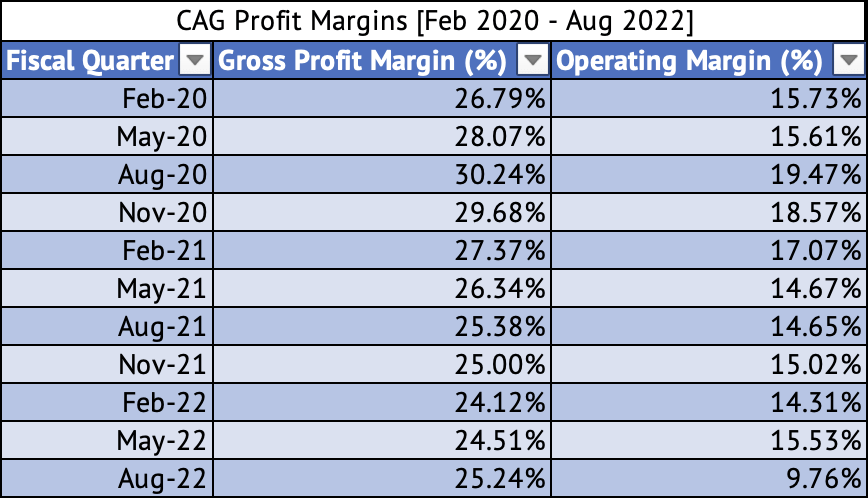

The company was able to mitigate most of the impact on its adjusted gross margins [non-GAAP] with the help of price increases. Its adjusted gross margin in Q1 2023 fell by 54 basis points compared to the previous year (Exhibit 2). The company found manufacturing issues in FY Q1 2023, which ended in August 2022, in some of its product lines that caused lost time, product loss, and supply chain inefficiencies, leading to decreased gross and operating profit margins (Exhibit 3).

Exhibit 2:

Conagra Q1 FY 2023 Change in Operating Margin (Conagra Investor Presentation)

Exhibit 3:

Conagra Quarterly Gross and Operating Margins (Seeking Alpha, Author Compilation)

Good dividend growth but a poor track record of share repurchases

The company has an ineffective share repurchase program. Conagra has spent $2.7 billion buying back its shares since 2013 (Exhibit 4), but its share count has increased by 64 million or 15% (Exhibit 5). The company issued shares worth $1.6 billion between 2013 and 2022; in effect, the company bought back shares worth $1.08 billion during the past decade.

Exhibit 4:

Conagra Share Repurchase an Issuance [2013 – 2022] (Seeking Alpha, Author Compilation)![Conagra Share Repurchase an Issuance [2013 - 2022]](https://static.seekingalpha.com/uploads/2022/12/19/saupload_-tDAytVrVEdulvxjSrYtiu-GLfURUwJD8MKFaxk6UbSqB2hNdCcoA0i7Id2f0kmUde3CCLngK6eJD-0LSE-GgcIHAF7biF4sZQ409ZWp9pRStAWOwOD0Ps7TE_NvTusRimkNR6B6O2XstG-Ifryf9YOq02XRuVPS2svxoEj-aSPSMVhfB7qQWmf_yHGblg.png)

Exhibit 5:

Conagra Dividends, EPS, and Outstanding Diluted Shares [2013 – 2022] (Seeking Alpha, Author Compilation)![Conagra Dividends, EPS, and Outstanding Diluted Shares [2013 - 2022]](https://static.seekingalpha.com/uploads/2022/12/19/saupload_rmaOPrVhGFhWItDqjac_bfmufWwcsDWhqP_ahWWXDw4CLAwCn34zUbLjTygq4jXhZOivDtbJzSEOHt8LX31Y_YwthpKRUN7e-QjBB1gAfRA1JyQwyvbQcuIIfQlA6yw26WTf3_hrP9KsFYAFlUjc6tpzUAkyDc3ItIDgUef_uNQlSLVXV4uxKP4rK4wq6w_thumb1.png)

The shares currently yield a respectable 3.47% but much less than the 2-year US Treasury yield of 4.3%. The company has grown its dividend from 0.85 per share in 2020 to $1.25 per share in 2022. Its forward dividend payout stands at $1.32, an increase of 55% in three years. The payout ratio stands at a manageable 51.9%. The company had TTM operating cash flows of $1.3 billion that can cover its total dividend payout of approximately $600 million.

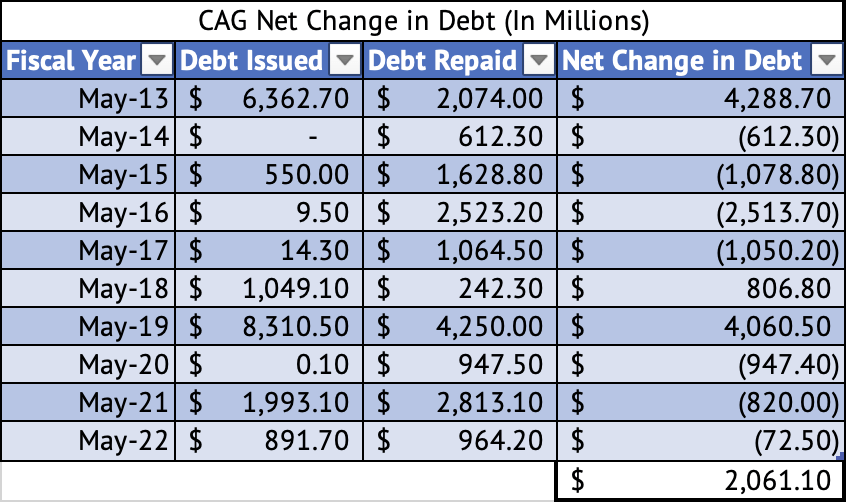

However, the free cash flow is a concern given its high debt levels. The company has seen a net increase in debt of $2 billion since 2013 (Exhibit 6). The company had net debt of $8.9 billion at the end of Q1 FY 2023, and its net leverage ratio on a non-GAAP basis stands at a high 3.9x.

Exhibit 6:

Conagra Debt Issues, Debt Repaid, and Net Change in Debt (Seeking Alpha, Author Compilation)

Conagra’s Monthly Return Analysis

Between June 2019 and November 2022, the company had an average monthly return of 1.09%, which is very similar to the return of the Vanguard S&P 500 Index ETF’s (VOO) monthly return of 1.1%. Yahoo Finance states a beta of 0.59, while a linear regression model of monthly returns of Conagra and the Vanguard S&P 500 Index ETF between June 2019 and November 2022 yields a beta of 0.34. This beta value from Yahoo Finance means that for every 1% change in the Vanguard S&P 500 ETF, Conagra’s monthly return changes by an average of 0.59%. Given the low beta, Conagra’s stock can limit losses in a portfolio during market turmoil.

Between July 2021 and June 2022, Conagra’s monthly returns have negatively correlated with the Vanguard S&P 500 Index ETF. The stock has returned 19.3%, while the Vanguard S&P 500 Index ETF has produced a negative 15.6% [based on the closing price on Dec 9, 2022]. Conagra has returned nearly 12% since the middle of November 2022 [Nov 14 – Dec 11, 2022], while the Vanguard S&P 500 Index ETF has been flat during this period. In short, the best time to buy Conagra would be when the S&P 500 Index is up.

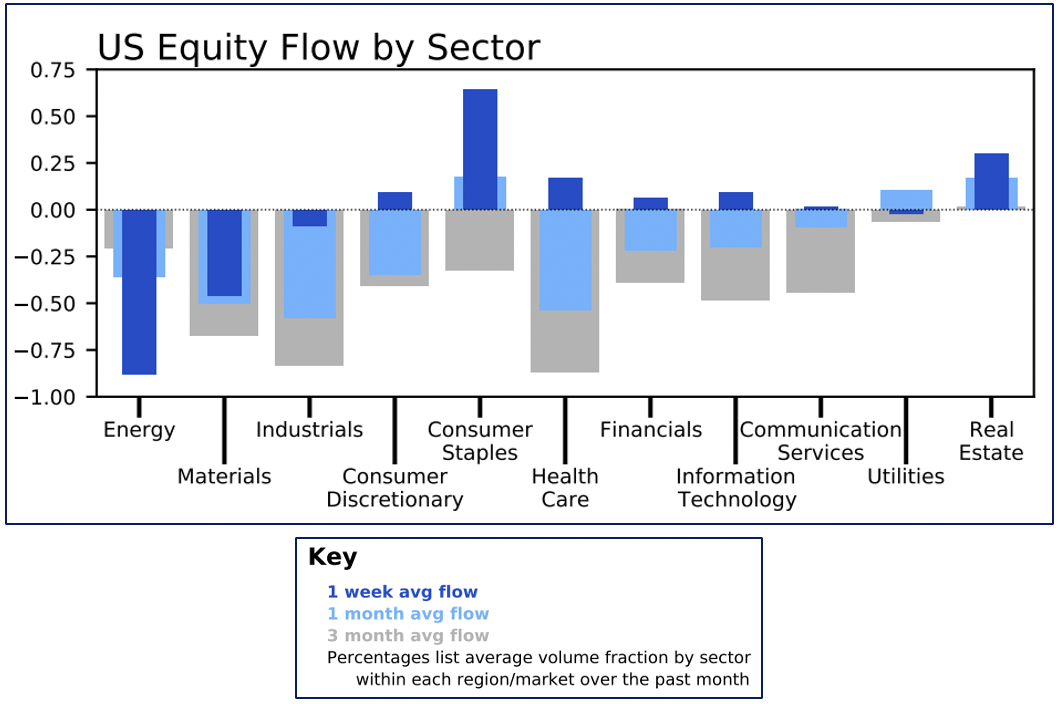

BNY Mellon, one of the largest custody banks in the world, has reported that the consumer staples sector has seen inflows in the past week and month, while the three-month trend is an outflow of dollars from that sector. Out of the eleven sectors of the US economy, only real estate saw a slight inflow of dollars during the past three months. The US energy sector has seen outflows of investment dollars (Exhibit 6) in the past week, month, and three months.

Exhibit 6:

U.S. Equity Flow By Sector (BNY Mellon)

This inflow of investment dollars into the consumer staples sector is due to investors’ lack of risk appetite. Once investors see clear signs of fading inflation and a peak in interest rates, they will be able to assess earnings growth better and evaluate the prospects of technology and other sectors of the economy. At that time, the consumer staples sector may see an outflow of dollars.

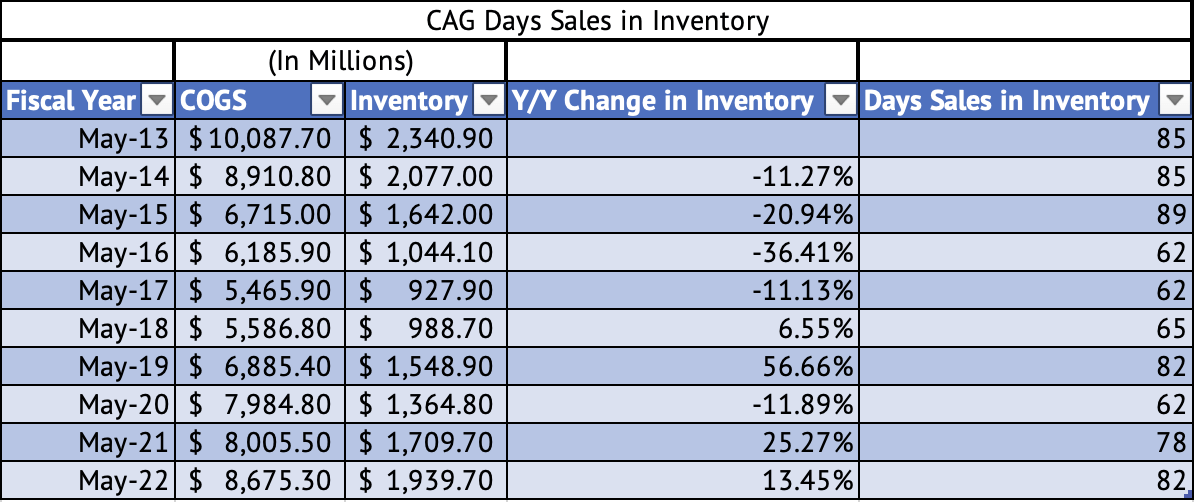

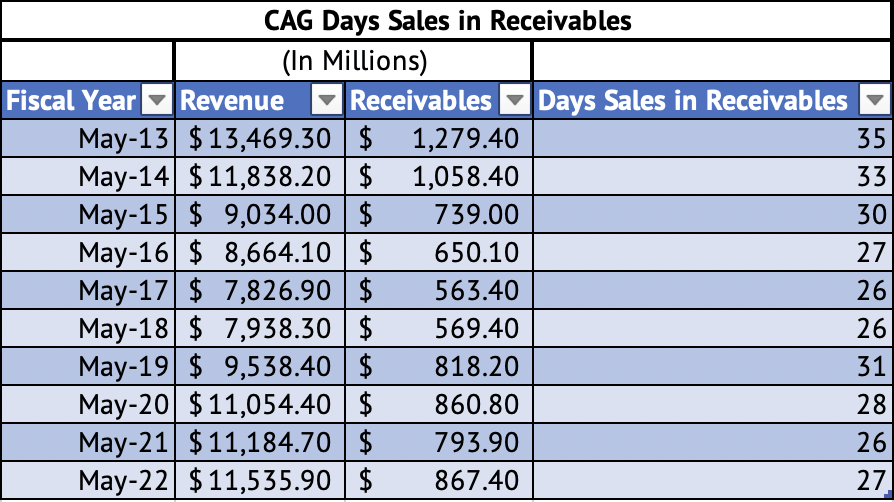

Inventory and Receivables Are Under Manageable Levels

Investors must keep an eye on inventory levels and outstanding receivables during these high inflationary periods with rising interest rates and faltering demand. Substantial growth in inventory can lead to a steep drop in operating cash flow, as was the case for Campbell Soup. Too much inventory can lead to more promotions which can negatively impact margins.

Conagra has kept both its inventory levels and outstanding receivables at manageable levels. The company saw an inventory increase of 25% and 13% in 2021 and 2022, respectively, compared to the previous years. But the company has shrewdly used price increases to mitigate the effects of the higher inventory costs. The company was carrying 82 days of sales in inventory in 2022 (Exhibit 7). Its average was 75 days over the past decade. At the end of 2022, the company had 27 sales days in receivables outstanding, compared to an average of 29 days (Exhibit 8).

Exhibit 7:

Conagra Days Sales in Inventory (Seeking Alpha, Author Calculations Using Microsoft Excel)

Exhibit 8:

Conagra Days Sales in Receivables (Seeking Alpha, Author Calculations Using Microsoft Excel)

Conagra is Richly Valued

The company is trading at a trailing GAAP PE of 31.9x, compared to a five-year average of 17.8x, and a forward GAAP PE of 19.8x, compared to a five-year average of 15.5x. The company’s stock is overvalued at this time. But, as an existing shareholder, I am reluctant to sell this stock. I continue to collect and reinvest dividends, although pausing dividend reinvestment may be an option to consider at these high valuation levels. So, this stock gets a hold rating for existing shareholders. New investors should wait for an attractive entry point.

Conagra’s price hikes have helped grow sales and maintain momentum in the market. But sales volumes have declined, and further price hikes may not be possible without further volume declines. High inflation remains a concern for the economy. The company offers a good dividend yield and has increased its dividend in the past few years, but its share buybacks have not reduced the share count. The company still carries high leverage. The stock is overvalued at current levels.

Be the first to comment