Scharfsinn86

This article first appeared in Trend Investing on August 17, 2022; but has been updated for this article.

Lithium demand and prices remain very strong. This supports the outlook for any lithium junior miners that can make it to production in the next 2 years. The linked article below gives our views, which forecasts:

Looking out to 2025, our model forecasts deficits each year. From 2026 to 2030 the lithium market is forecast to need huge amounts of new supply to match surging demand. Growing deficits look likely.

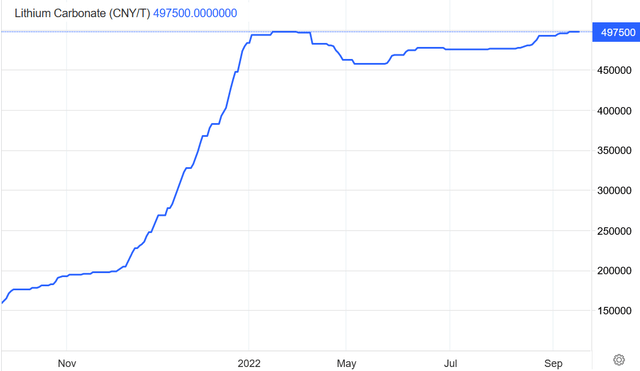

China spot Lithium carbonate price 1 year chart – Price = CNY 497,500 (USD 71,003)

The following 6 lithium junior miners are all fully-funded to meet production within the next 2 years. All going well they will be the next 6 lithium producers.

A comparison of the 6 fully-funded lithium juniors that will likely be the next lithium producers in 2022-2024

The six companies are:

- Argosy Minerals Limited [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

- Lithium Americas [TSX:LAC](LAC) (“LAC”)

- Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

- Sigma Lithium Resources [TSXV:SGML] (SGML)

- Sayona Mining [ASX:SYA] (OTCQB:SYAXF)/ Piedmont Lithium [ASX:PLL] (Nasdaq:PLL) – NAL operation [SYA 75%, PLL 25%]

- Liontown Resources [ASX:LTR] (OTC:LINRF)

Comparison table

| Company |

Estimated production start |

Market Cap (US$) |

Current Price |

Price target, Upside /downside from current price |

| Argosy Minerals | Q3, 2022 | 505m | A$0.56 |

(Trend Investing PT) A$1.43 (end 2026) 2.6x |

| LAC | Q4, 2022 | 3.84b | C$37.83 |

+29% |

| Core Lithium | Q4, 2022 | 1.67b | A$1.44 |

+14% |

| Sigma Lithium |

late 2022, early 2023 |

2.58b | C$27.76 |

+21% |

|

Sayona Mining (75% NAL) |

Q1, 2023 | 1.46b | A$0.26 | No PT available |

|

Liontown Resources |

H1, 2024 | 2.46b | A$1.66 |

37% |

Notes

No Argosy Minerals price target available, so the PT is that of Trend Investing. Assumes Argosy Minerals is selling lithium carbonate at US$30,000/t in 2026 (12,000tpa production).

Comments

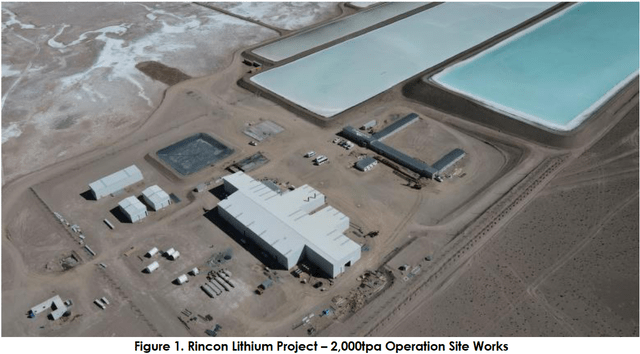

Argosy Minerals has the lowest market cap by far (US$505m) out of the 6 juniors. This is partly explained by the fact that Argosy’s initial start-up production is only 2,000tpa lithium carbonate, well below all the others. However by 2025/26 they plan to expand to 12,000tpa and if successful look very well valued today, especially given their imminent start to production (95% of total development works now complete at their Rincon Lithium Project). Argosy also 100% own the early stage Tonopah Lithium brine Project in Nevada USA. More details on Argosy here.

Lithium Americas has the highest market cap at US$3.84b, however they have huge potential to expand production in the years ahead with their multiple projects/investments and large lithium resources. Some details here.

Core Lithium has potential to expand their resource and grow their production further, as well as benefit soon from current spodumene prices of CNY 35,622 (~US$5,081/t), so valuation is still reasonable.

Sigma Lithium has the fastest planned ramp up of lithium production from their project in Brazil which looks set to soon be a very large spodumene producer.

Sayona Mining has very large resources well located in Canada. We do have some concern over how their off-take deal from NAL (Sayona Quebec “SYQ”) is priced given spodumene is now selling at ~US$5,081/t (Eg: PLL has right to 50% of half of SYQ off-take (minimum price of US$500/t and a maximum price of US$900/t). Piedmont Lithium (PLL) stated in June 2022:

Piedmont and Sayona confirmed the terms of the spodumene concentrate offtake agreement between SYQ and Piedmont. Under the offtake agreement, Piedmont is entitled to purchase the greater of 113,000 metric tons per year of spodumene concentrate or 50% of production from the NAL project. The agreement also covers concentrate produced from ore mined at SYQ’s Authier Project. Purchases are subject to market pricing with a price floor of $500 per metric ton and a price ceiling of $900 per metric ton. Under the terms of the offtake agreement, if Sayona and Piedmont jointly construct and operate a lithium conversion plant in Quebec, then spodumene concentrate produced from the NAL project would be preferentially delivered to that chemical plant upon start of operations. Any remaining concentrate not delivered to a jointly owned conversion plant would first be delivered to Piedmont up to Piedmont’s offtake right and then to third parties. Sayona and Piedmont expect to begin a series of technical studies with respect to lithium conversion in Quebec and will update the market in the coming months.

Note: Bold emphasis by the author.

Liontown Resources has a massive project in Western Australia with great off-take partners including LG Energy Solutions (“LGES”), Ford (F) and Tesla (TSLA).

Comparing the 6 juniors discussed above to the existing smaller volume producers of Livent Corp. (LTHM) (market cap US$5.97b) and Allkem [ASX:AKE] (OTCPK:OROCF) (market cap US$6.36b), all of the above 6 have significantly lower market caps.

Risks

- Lithium prices falling.

- Technology change – Lithium could be replaced by other battery electrolytes such as sodium. Looks very unlikely for now for most electric cars, possible for stationary energy storage.

- The usual mining risks – Permitting, funding, delays, production start-up, upfront CapEx costs blow out, OpEx costs blowout, partner risks. LAC’s 2nd project (Thacker Pass) is lithium clay so some additional risk there as well as permitting risk.

- Business risks – Management, debt, liquidity, and currency risk.

- Sovereign risk – Higher risks in Chile, Argentina, Brazil, China etc than in Australia, Canada, USA, and Europe.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

- The Potential Next New Lithium Producers In 2022 And 2023 Revealed (this article discusses in more detail 5 of the 6 lithium juniors covered in this article)

-

Why Argosy Minerals Is My Number 1 Lithium Stock Pick In 2022

Argosy Minerals looks set to be the next lithium producer with their Rincon Lithium Project 95% complete

Source: Argosy Minerals update September 1, 2022

Lithium Americas (49%) and Ganfeng Lithium (51%) JV at the massive Cauchari-Olaroz Project in Argentina

Lithium Americas company presentation

Source: Lithium Americas company presentation

Conclusion

Our view continues to be that it is wise to own the near term lithium producers as the lithium pricing environment should remain high for some years to come, due to excess demand and limited new supply coming on each year. Currently most analyst’s models are assuming much lower lithium prices than the current spot and contract prices. Our view is that high lithium prices should hold for some times resulting in a re-rating higher for the lithium producers and near term producers.

The next 6 lithium producers are most likely to be Argosy Minerals, Lithium Americas, Core Lithium, Sigma Lithium, Sayona Mining (75% NAL, Piedmont Lithium 25%), and Liontown Resources in that order. All are fully-funded to production.

As for valuation it largely depends on your view on lithium prices from here. If prices stay very high (US$70K/t Li carbonate/ LiOH, US$5K/t spodumene) then all 6 should do very well indeed and are undervalued today. If prices were to drop back very significantly then expect they may pullback in their stock prices. Our view is that they are all rated as ‘accumulate’ with a bright future ahead.

Risks revolve around executing their production start-up on budget and on time and achieving their stated expansion plans. Also lithium prices falling, which we see remaining strong this decade.

As usual all comments are welcome.

Be the first to comment