Kirill Gorshkov/iStock via Getty Images

In my last article on InPlay Oil (OTCQX:IPOOF), InPlay Oil: volatile but profitable, I estimated a fair value of $5.29 for the stock. Buying IPOOF at the time of publication of my article would have made you a 30% profit by now. Still, it’s not late. Due to the Invasion of Russia to Ukraine and the increasing economic recovery, which pushed oil prices and oil demand forward, Oil stocks are opportunistic. In this article, considering different scenarios for WTI oil price in 2022, I make a comparison between IPOOF and two other Canadian oil and natural gas producers, Cardinal Energy (OTCPK:CRLFF) and Obsidian Energy (NYSE:OBE), based on their potential average daily production, reserves, sales, NPV, and NAV/share. Also, using the Comparable Company Analysis (CCA) method and Discounted Cash Flow (DCF) method, I estimate the fair value of these three Canadian oil stocks.

2021 financial results

As oil prices increased in 2021 due to the economic recovery and increased demand from industrial countries, oil stocks benefited from the market conditions. InPlay Oil, reported a profit of CAD$1.61 per diluted share in 2021, compared with a loss of CAD$1.65 per diluted share in 2020. Also, InPlay Oil’s total average production increased from 3985 boe/d in 2020 to 5768 boe/d in 2021, up 45%. Cardinal Energy, another Canadian oil and natural gas company, benefited from the oil market condition in 2021. CRLFF reported a profit of CAD$1.84 per diluted share in 2021, compared with a loss of CAD$3.20 per diluted share in 2020. CRLFF’s petroleum and natural gas revenues increased from CAD$223.2m in 2020 to CAD$445.1m in 2021, up 99%. Obsidian Energy reported a 2021 net income of CAD$5.34 per diluted share, compared with a 2020 net loss of CAD$10.53 per diluted share. The Canadian oil and natural gas producer’s revenue increased from CAD$275.4m in 2020 to CAD$477.5m in 2021, up 73%. Oil prices jumped in 2022 due to the invasion of Russia to Ukraine, which made the market conditions better for oil and natural gas companies.

Estimation of IPOOF, CRLFF, and OBE’s 2022 sales and NAV

For oil and natural gas stocks, the dominant element in 2022 is the war between Russia and Ukraine. If the war continues, oil and natural gas prices will grow further. Below are some of the predictions for oil prices in 2022:

- U.S. Energy Information Administration (EIA) forecasts that the price for WTI oil will be $112 per barrel in the second quarter of 2022.

- Goldman Sachs forecasts a Brent spot price of $135 per barrel in 2022 due to a great energy supply shock.

- In its worst-case scenario, Barclays forecasts that oil prices could top $200 per barrel in 2022 if the Ukraine crisis goes further.

- Rystad Energy predicts that oil prices could reach $240 per barrel if more western countries join the United States to impose oil sanctions on Russia.

- Morgan Stanley’s chief commodities strategist predicts that oil prices could reach $120 per barrel.

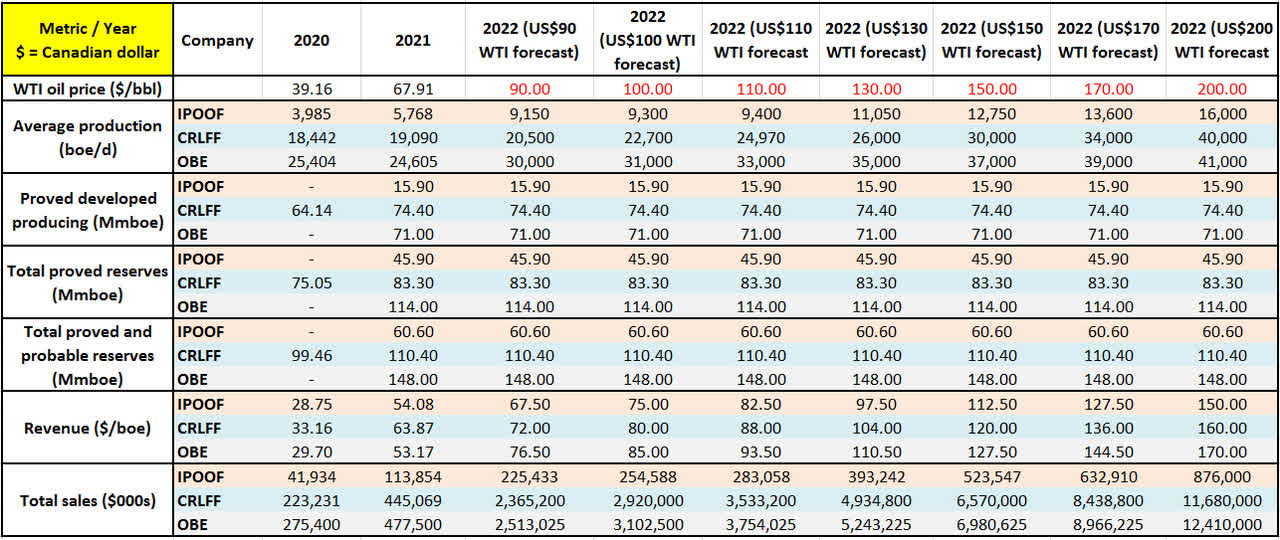

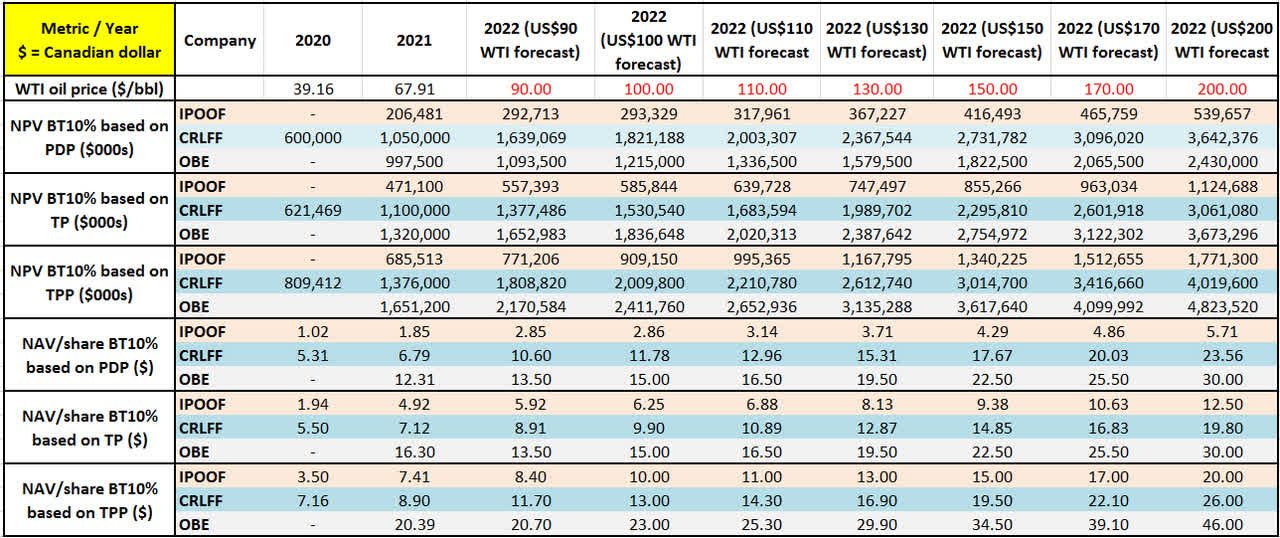

Using different scenarios for WTI oil price in 2022, I estimate the average production, revenue, and total sales of IPOOF, CRLFF, and OBE (Table 1). InPlay Oil predicts a 2022 average production of 9150 (boe/d), compared with a 2021 average production of 5768 (boe/d), up 59%. Cardinal Energy predicts a 2022 average production of 20500 (boe/d), compared with a 2021 average production of 19090 in 2021, up 74%. Obsidian Energy predicts a 2022 average production of 29600 (boe/d), compared with a 2021 average production of 24605 (boe/d), up 20%. The companies’ predictions are based upon oil prices of around $90 per barrel in 2022. However, with higher oil prices, the average production of IPOOF, CRLFF, and OBE will be higher.

Based on a WTI oil price of $110 per barrel in 2022, I estimate an average production (boe/d) of 9400, 24970, and 33000 for IPOOF, CRLFF, and OBE, respectively. Also, I estimate revenue (CAD$/boe) of 82.5, 88.0, and 93.5 for IPOOF, CRLFF, and OBE, respectively. I estimate 2022 total sales of CAD$283m, CAD$3533m, and CAD$3754m for IPOOF, CRLFF, and OBE, respectively. Thus, compared with CRLFF and OBE, IPOOF will experience a higher increase in average production. However, CRLFF and OBE will experience a much higher increase in their total sales.

Based on a WTI oil price of $130 per barrel in 2022, I predict IPOOF’s average production surge to 11050 (boe/d). Also, I predict CRLFF and OBE’s average production will increase to 26000 (boe/d) and 35000 (boe/d), respectively. I estimate that IPOOF, CRLFF, and OBE’s 2022 total sales will be CAD$393m, CAD$4934m, and CAD$5,243, respectively.

Table 1 – Estimation of IPOOF, CRLFF, and OBE’s 2022 production and sales

Author’s calculations based on IPOOF, CRLFF, and OBE’s 2021 presentation

Considering different scenarios for WTI oil price in 2022, I estimate IPOOF, CRLFF, and OBE’s NPV (before tax 10%) and NAV/share (before tax 10%) based on proved developed producing (PDP) reserves, total proved (TP) reserves, and total proved plus probable (TPP) reserves. Table 2 shows that in 2021, OBE had the highest NAV/share compared with CRLFF and IPOOF. With a WTI oil price of CAD$110 per barrel, IPOOF’s NAV/share based on total proved reserves will be CAD$6.88 in 2022. CRLFF’s NAV/share based on total proved reserves will be CAD$10.89 in 2022. Finally, OBE’s NAV/share based on total proved reserves will be CAD$16.50 in 2022. With a WTI oil price of $200 per barrel in 2022, IPOOF, CRLFF, and OBE’s NAV/share based on total proved reserve are CAD$12.5, CAD$19.8, and CAD$30, respectively.

Table 2 – Estimation of IPOOF, CRLFF, and OBE’s 2022 NPV and NAV/share

Author’s calculations based on IPOOF, CRLFF, and OBE’s 2021 presentation

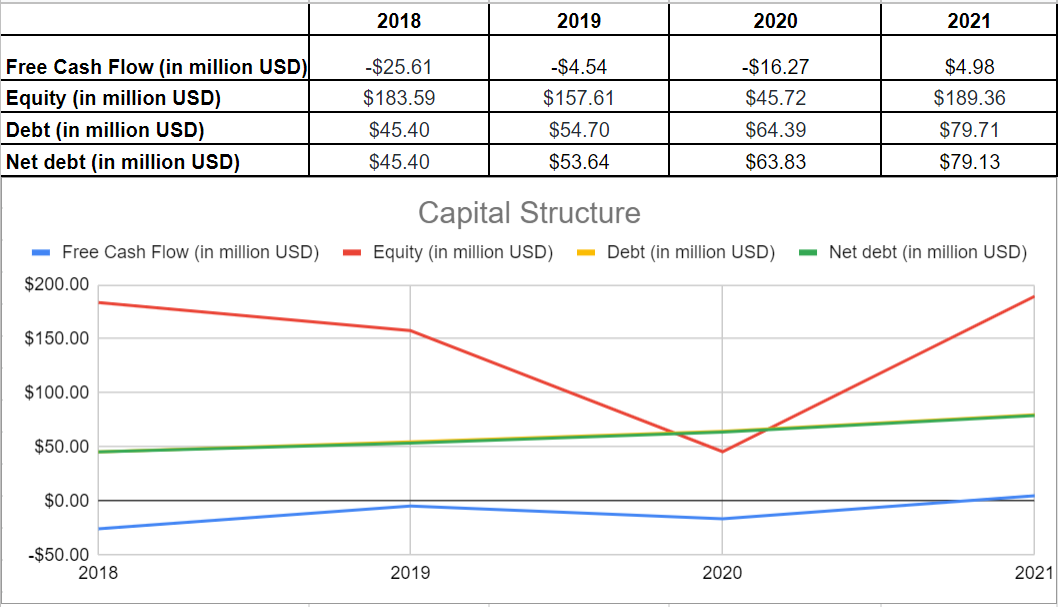

Analyzing IPOOF, CRLFF, and OBE’s capital structure shows that after a severe drop in total equity in 2020, down 70% from $157.61m in 2019 to $45.72m in 2020, InPlay Oil raised back to $189.36m in 2021. Also, we observe that in 2021, IPOOF’s total debt and net debt shrunk to $79.71m and $79.13m, respectively. Moreover, in 2021, the company increased its free cash flow considerably from -$16.27m in 2020 to $4.98m in 2021 (see Figure 1).

Figure 1 – InPlay Oil’s capital structure

Author (based on Seeking Alpha data)

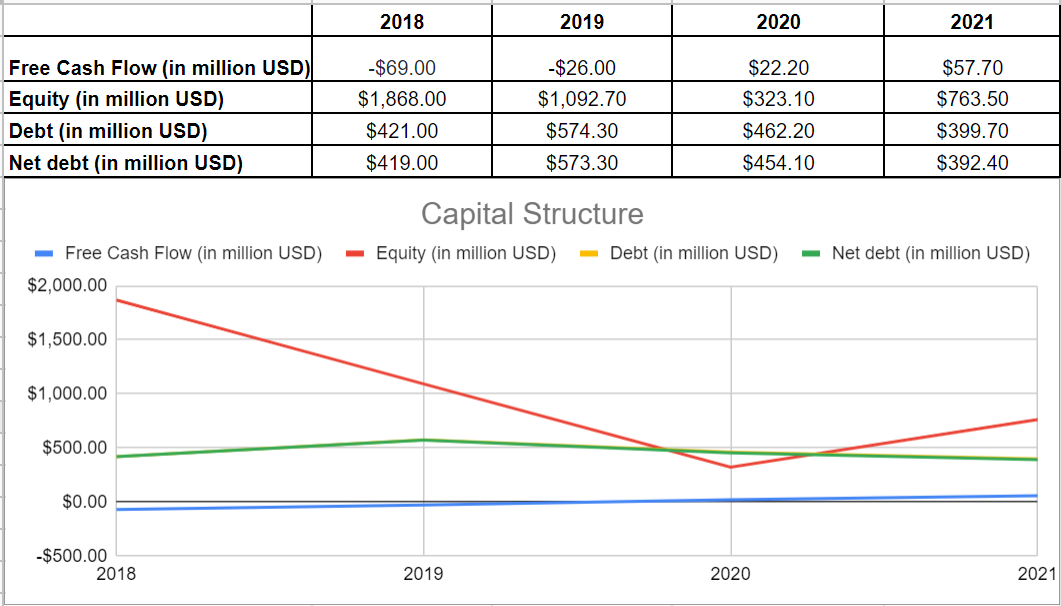

According to Obsidian Energy’s capital structure, its total debt decreased from 574.3m in 2019 to $399.7m in 2021. Also, OBE’s current net debt is well beneath its net debt of $573.3m at the end of 2019, before the COVID-19 pandemic. Meanwhile, after a severe drop in total equity, down 70% from $1092.7m in 2019 to $323.1m in 2020, the company’s total equity increased to $763.5m in 2021. (see Figure 2).

Figure 2 – Obsidian Energy’s capital structure

Author (based on Seeking Alpha data)

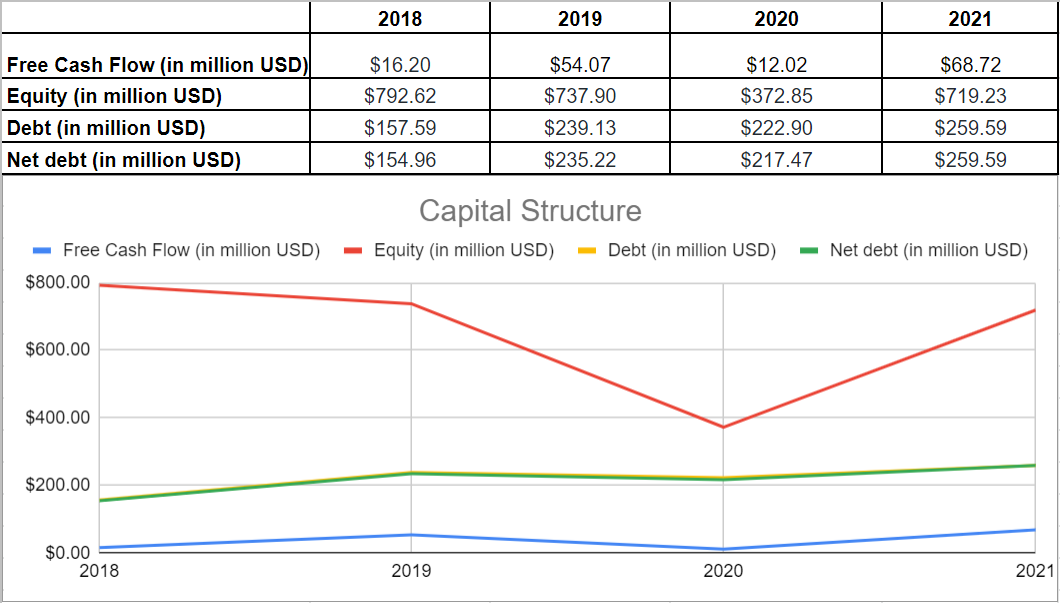

Cardinal Energy’s free cash flow increased considerably from $12.02m in 2020 to $68.72m in 2021. The company’s total equity dropped deeply to $372.85m in 2020. However, its total equity was well higher than its total debt of $222.9m in 2020. CRLFF’s total equity raised by 92% during 2021. Moreover, in 2021, CRLFF’s total debt and net debt increased by 16% and 19%, respectively (see figure 3).

Figure 3 – Cardinal Energy’s capital structure

Author (based on Seeking Alpha data)

Valuations

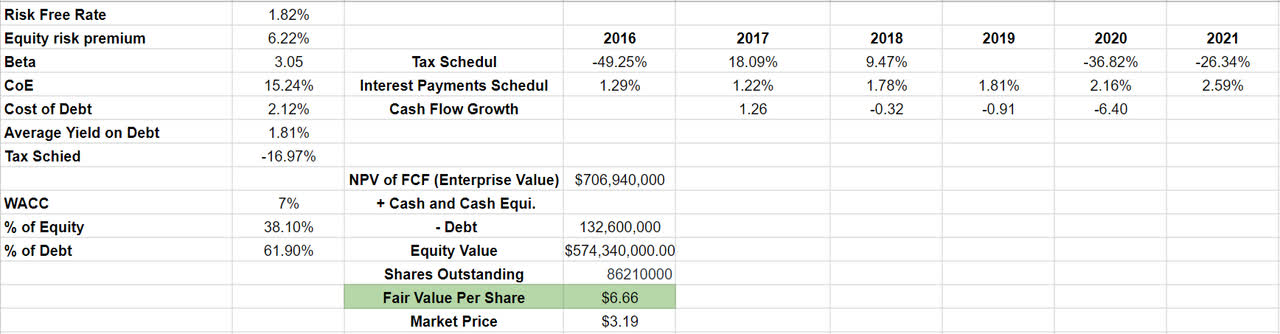

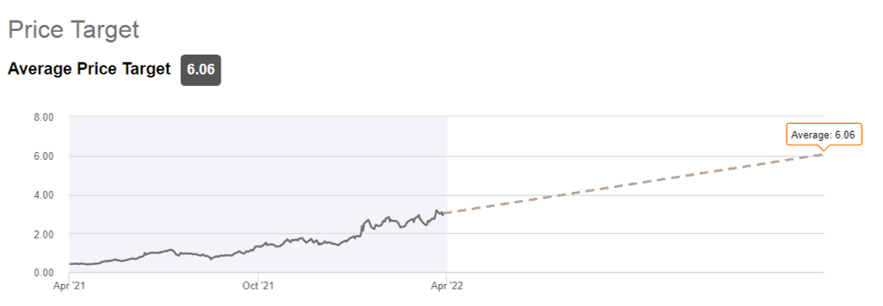

In my last article on IPOOF, I said the stock is worth $5.29. Since then, IPOOF brought a 30% profit for its investors. Analyzing IPOOF’s recent financial statements shows that the stock is still relatively attractive. To evaluate IPOOF, I used Discounted Free Cash Flow and Comparable Companies Analysis methods. Both methods represent that the stock is a Buy. Despite being a bit conservative, the DCF model uses financial numbers according to future available facts. DCF model indicates that IPOOF’s fair value is more than $6 per share (see Table 3). This result is in the same line with the Wall Street analysis price target (see Figure 4).

Table 3 – IPOOF stock valuation based on DCF model

Author’s calculations

Figure 4 – Wall Street analysis price target

Seeking Alpha

I provide a table that contains a brief comparison between InPlay Oil, Obsidian Energy, and Cardinal Energy (see Table 4). The following table bodes their fair value (based on the DCF model). As you can see, all three stocks look attractive. InPlay Oil has the highest upside potential of 88%, and then Obsidian Energy and Cardinal Energy have 84.3% and 35.5% upside potential, respectively.

Table 4 – IPOOF vs. peers’ stock valuation

Author’s calculations

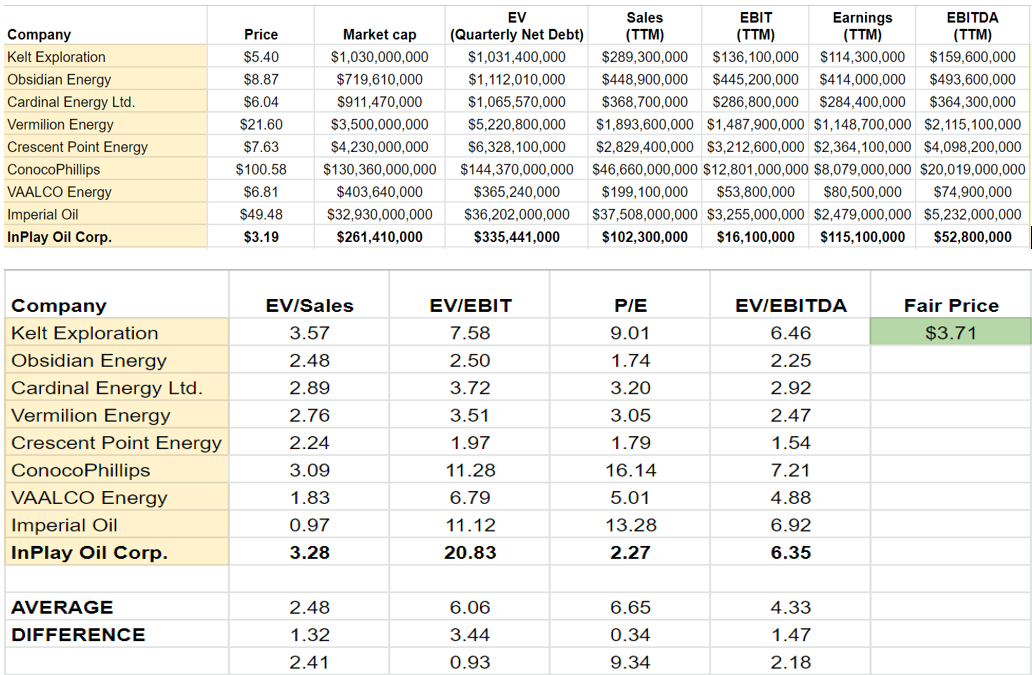

As IPOOF has the highest upside potential, I also used the CCA method to evaluate the stock. Compared to its peers in the oil and gas industry, IPOOF is undervalued. IPOOF’s Price-to-Earnings ratio is about 65% lower than the peer’s average of 6.65x. On the other hand, the company’s EV/sales ratio is 3.28x, about 30% higher than the peer’s average of 2.48x. A higher EV/sales ratio may indicate that investment will not benefit immediately. Thus, based on the following method, InPlay Oil’s stock price is worth around $4 (see Table 5). However, the company’s forward financial statements and the projected oil price indicate that the stock price will grow and beat $4.

The EV/EBIT ratio for Obsidian Energy is 2.50x, which is far lower than the peer’s average of 6.06x. It represents that its share price might be lower than its fair value and is a sign of being undervalued. Also, its P/E ratio is 73% lower than the average of 6.65x. The EV/EBITDA of Cardinal Energy is 32% lower than its peer’s average, which is 2.92x and 4.33x, respectively.

Table 5 – IPOOF stock valuation based on CCA method

Author’s calculations based on Seeking Alpha data

Risks

If the war between Russia and Ukraine stops, the oil prices could drop below $80 per barrel, decreasing the NPV of oil companies. Also, if the United States eases oil sanctions against Iran, a 1.3 mb/d of Iranian crude oil supply will help oil prices to decrease. Thus, make sure you keep an eye on the Russia-Ukraine war and political tensions between the United States and Iran. Furthermore, environmental regulations will tighten the operating activities of oil companies.

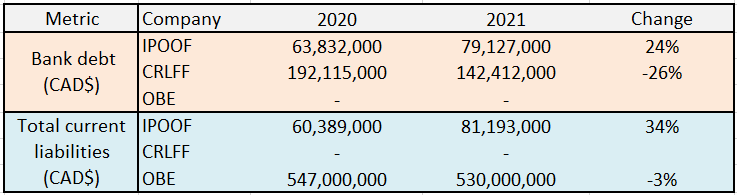

From the micro view, buying in IPOOF is riskier than CRLFF and OBE. As table 6 shows, IPOOF’s bank debt increased by 24% in 2021. Also, IPOOF’s current bank debt increased 38% YoY. Moreover, InPlay Oil’s total current liabilities increased from CAD$60m in 2020 to CAD$81m in 2021, up 34%. On the other hand, CRLFF managed its liability risk by decreasing its bank debt by 26% in 2021. Also, OBE decreased its total current liabilities by 3%. However, I should notice that OBE’s total current liabilities to total sales is 1.11x, compared with IPOOF’s current liabilities to total sales of 0.71x. Thus, in terms of current liabilities to total sales ratio, IPOOF is less risky than OBE. IPOOF’s bank debt to total sales ratio is 0.70x, compared with CRLFF’s bank debt to total sales ratio of 0.32x. Thus, based on the bank debt to total sales ratio, CRLFF is in a better position than IPOOF.

Table 6 – Bank debt and total current liabilities of IPOOF, CRLFF, and OBE

Author (based on IPOOF, CRLFF, and OBE’s FY 2021 financial report)

Summary

With upside potentials of 88% and 84%, InPlay Oil and Obsidian Energy are opportunistic stocks for investors optimistic about the oil industry. However, Obsidian Energy is less risky than IPOOF. Also, Cardinal Energy can make a 35% profit for its investors. Based on bank debt to total sales ratio, buying CRLFF is a less risky investment than buying IPOOF. In a word, I’m bullish on IPOOF, OBE, and CRLFF. IPOOF has higher upside potential; however, buying OBE is a better investment as it is less risky.

Be the first to comment