jetcityimage

Investment Thesis

Rent-A-Center, Inc.’s (NASDAQ:RCII) management’s most conservative estimate of 2022 free cash flow (“FCF”) is $390 million, well above the company’s 2021 FCF of $330 million. And, although analysts expect a modest FCF decline from 2022 to 2024, FCF is still expected to remain above 2021 levels. Given the Acima Segment’s secular tailwinds (which account for >50% of the company’s revenues), it is a reasonable assumption that FCF should grow at a moderate rate from 2022 to 2026. However, even if FCF manages to decline to 2021 levels and maintain itself, RCII would still be severely undervalued, with an FCF multiple of approximately 4.

Background

Rent-A-Center, Inc. is a lease-to-own (LTO) retail company with 2,435 locations in the United States, Puerto Rico, and Mexico as of 2021. In December of 2020, RCII announced that it would be acquiring Acima Holdings LLC, a rapidly growing LTO technology company with a presence in both brick-and-mortar and e-commerce platforms. This transaction was completed with $1.65 billion in cash and stock.

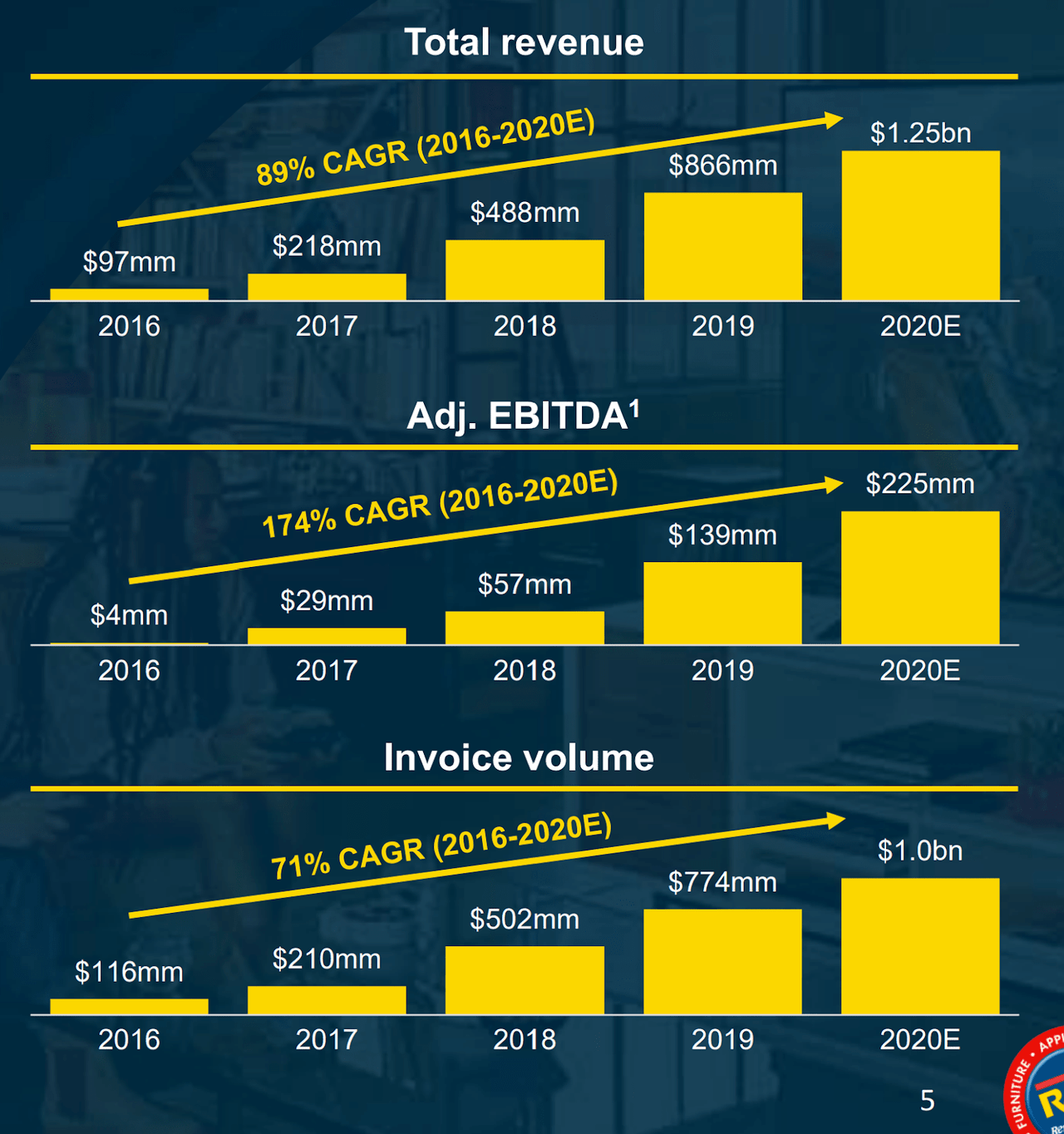

It is notable that immediately following the acquisition, in 2021, the company’s Acima segment (which consists of its preexisting LTO fintech company preferred Dynamix and Acima Holdings) already constituted >50% of the company’s revenue. Given that Acima Holdings achieved an 89% CAGR from 2016-2020, RCII’s Acima segment is poised for continued growth, although at reduced levels. While this was an acquisition of a fast-growing business, it was not an acquisition of an unprofitable and speculative type. In fact, Acima immediately contributed to increased EPS and FCF for RCII.

Acima Holdings Operating Performance (Acima Acquisition Presentation)

Prior to the Acima acquisition, the company’s income had been slowly but steadily declining. While such a decline was not precipitous, it at least, in part, justified the company’s low valuation. However, on news of the Acima acquisition, the stock increased from <$20 to >$60. However, due to macro factors and recent earnings declines, the stock is once again trading around $20 a share.

Earnings and Free Cash Flow

While the company’s revenue had been declining, its earnings had actually increased, that is, until the last nineteen months. Namely, in 2016 RCII lost about $105 million, and by 2020 it had >$200 million in earnings. However, the company’s 2020 earnings were $131 million and its trailing twelve-month earnings are <$90 million.

However, such figures are obfuscated by the company’s enormous depreciation and amortization. For example, in 2020 RCII’s total depreciation and amortization rose by approximately $113 million, more than accounting for its decline in earnings. However, the company’s normalized capital expenditures for the last 6 years are only $45.45 million, and never reached beyond $70 million. Conversely, the normalized depreciation and amortization over the past 6 years have been $85.27 million, reaching approximately $170 million in 2021 with only $62.45 million in corresponding capital expenditures. These figures suggest that the company’s declining earnings have been a product of accounting necessity rather than business reality.

One may wonder what the actual operating results of the company have been during such accounting confusion. And, in fact, the company’s declining revenue has not actually harmed the company’s operating income. From 2016 to 2020 operating earnings grew from $104.92 million to $272.85 million. In the same time period, its EBITDA grew from $184.46 million to $329.51 million. Furthermore, the enormously accretive acquisition of Acima Holdings contributed to tremendously improved operating results in 2021 that were not reflected in the company’s earnings due to the aforementioned depreciation and amortization costs. In 2021 alone, RCII produced $493.14 million in EBITDA and $323.21 million in operating earnings.

Rent-A-Center’s Free Cash Flow does not demonstrate the impressive growth that the company’s EBITDA and operating earnings do. Rather, it shows remarkable consistency. In fact, from 2018 to 2020 the company’s normalized FCF was $198.59 million and such FCF never deviated more than $10 million from the mean. However, the Acima acquisition proved to be even more accretive to the company’s FCF than to its operating earnings or EBITDA as the acquisition increased FCF by >60% to $329.51 in 2021.

Secular Growth

Acima is a rapidly growing LTO operation with massive secular tailwinds in the virtual LTO space. This is evidenced by the company’s 89% revenue CAGR from to 2020. Although this growth had slowed to 40% in 2020. While this growth is certainly unsustainable, the secular tailwinds that propelled it are still in place. As the LTO business becomes more virtual, RCII is now prepared to take advantage of it through the Acima segment.

The acquisition doesn’t just provide room for growth but for operational synergies as well. Acima provides RCII with a “sophisticated underwriting and decision engine” that is presumably superior to RCII’s prior decision-making process. It also allows for “expanding digital payment solutions and communication along with a superior back-end infrastructure” further enhancing RCII’s virtual LTO capabilities. With the acquisition of Acima Holdings, the Acima segment of RCII now constitutes >50% of its revenue, and a prior adjusted EBITDA growth rate of 62% in 2020, an unduly conservative growth rate for RCII, taking into account an inevitable decline in its brick-and-mortar profitability due to its revenue decline, is 10%. In fact, its year-over-year FCF growth has already been >50% in the first quarter of 2022, even though management is only predicting modest annual FCF growth of 18%. However, this increased FCF has come at a cost. The $1.65 billion purchase price for Acima cost RCII $1.27 billion in cash, which, along with share buybacks, has contributed to its current debt of $1.7 billion. G

Balance Sheet

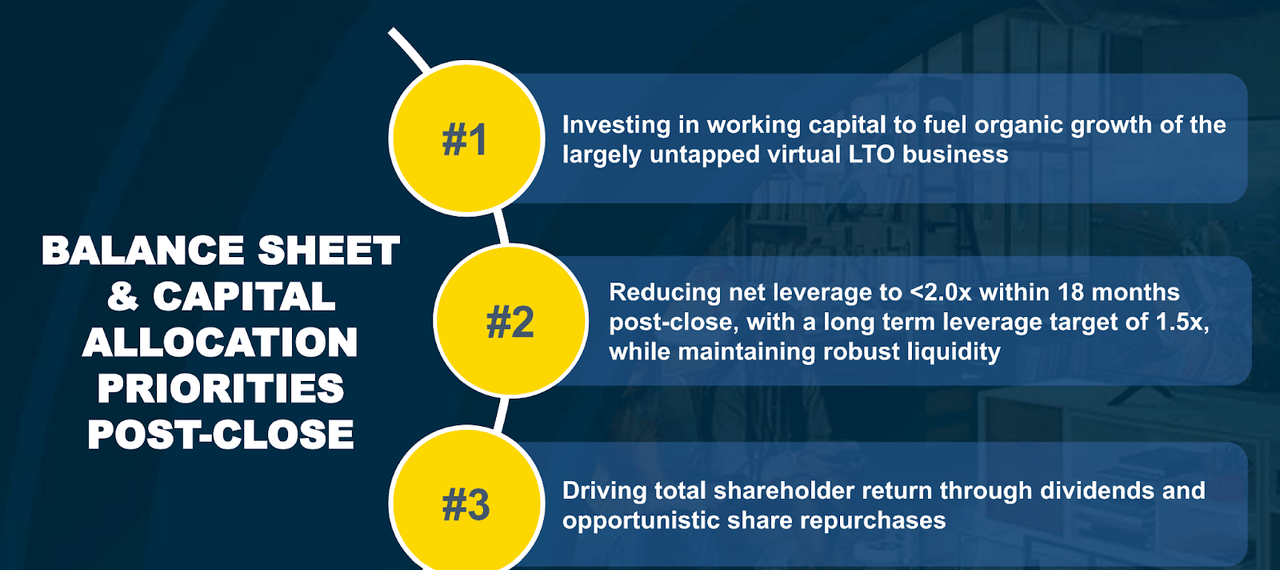

The company’s $1.7 billion in debt is still well above the company’s target of <2.0x Adj. EBITDA based upon management’s 2022 projections. While the Acima Acquisition has contributed to the company’s profitability it has, in fact, badly damaged its balance sheet. However, the company is reducing net debt at an average of approximately $85 million a quarter. At this rate, the company should reach its target of debt <2.0x Adjusted EBITDA in about 2 years. Management’s original target for achieving the aforementioned ratio was 18 months from December of 2020.

While shareholders may shun the lack of debt reduction, it may actually free up more cash for accretive share buybacks. At present levels, I believe RCII is significantly undervalued, and because LTO is not necessarily harmed by recessions, excess liquidity is, in my opinion, unnecessary for the company to have. Therefore, RCII should instead return capital to shareholders by way of share repurchases.

RCII Capital Allocation Priorities (Acima Acquisition Presentation)

Risks

One may also counter that a recession will reduce FCF in the near term, however:

“The lease-to-own industry can benefit during recessionary economic cycles or credit constrained environments because it provides credit constrained customers with a viable option to obtain merchandise they may not otherwise be able to obtain through other retailers offering traditional financing options,”

as RCII’s management would suggest. This is also evidenced by the fact that RCII’s EBITDA remained remarkably stable during the Great Recession, and its FCF even peaked at $384.7 million in 2008. This shows that recessionary pressures may even be beneficial for RCII in the short term.

It is also, of course, possible that the Acima segment fails to grow RCII’s profitability and stabilize and eventually grow its previously declining revenue. While such outcomes are unlikely, they are certainly possible. In addition to the risks of the Acima segment’s underperformance, there is the risk that poor operating performance from RCII holistically will leave the company unable to shoulder its newly increased debt load.

Even if the company is able to pay off its debt, if it instead decides to participate in further share repurchases, as I suggest, the equity and debt markets may view this unfavorably, further reducing its share price, even if the intrinsic value of the individual shares increase. For these reasons, only long-term investors willing to ride out the travails of the company’s uncertain capital allocation strategy and the risk of underperformance should purchase RCII common stock. This is because the lack of a clear catalyst in this situation makes this investment a pure-play value stock.

Valuation

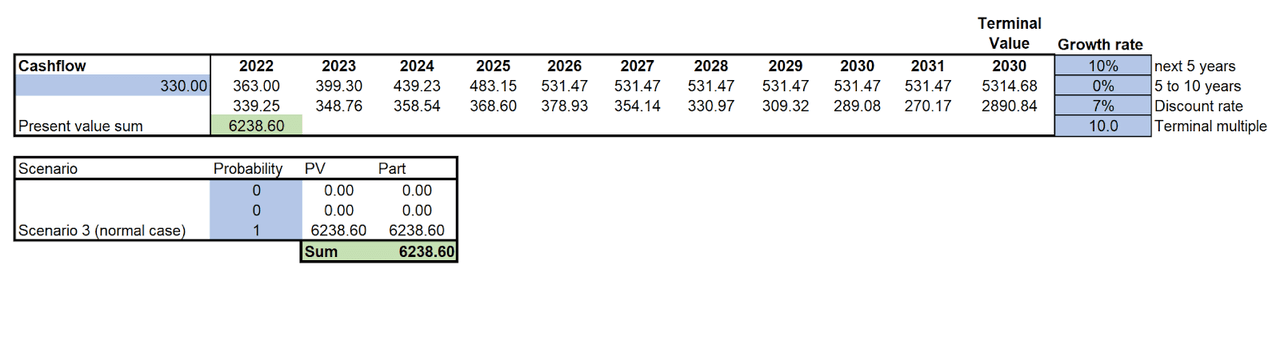

To value RCII I used a standard discounted cash flow model and presumed 10% FCF growth for the next 5 years, and then projected no growth from 2027-2031. To arrive at my discount rate, I used the cost of equity. Namely, I used the current rate of the 10-year yield plus the highest expected rate of return on equities over the next decade (according to Vanguard), multiplied by RCII’s beta of 1.66 and rounded up to 7% due to the likelihood of increasing rates during the next few quarters.

It should also be noted that although I’m calculating the value of the equity, I used simple FCF instead of levered FCF because it is unpredictable as to whether or not management will continue to forego share repurchases and de-lever the company or whether it will use its excess cash for share repurchases at such attractive levels. Therefore, using simple FCF is the only predictable way to gauge the intrinsic value of RCII.

A potential shortcoming of this valuation is its terminal multiple, namely an FCF multiple of 10 when its current Trailing twelve-month FCF multiple stands at <4. However, as recently as September 2021 its current-year projected FCF multiple was approximately 12. And it was largely because of macro factors that the stock price has deteriorated to its present levels, suggesting Mr. Market may come to a more reasonable stance on this stock when the macro environment normalizes.

RCII Valuation – In Millions USD (Excel)

Conclusion

This DCF values RCII at $6.238 billion, or approximately 5.2x its current valuation. This may make one skeptical as when price and value converge by a factor of >5, maybe Mr. Market is seeing something that the individual investor is not. However, when a business with no imminent prospects of a decline in FCF is trading at about 4x forward FCF with secular tailwinds, one can reasonably conclude that a stark-raving bargain is at hand.

Be the first to comment