schwartstock/iStock via Getty Images

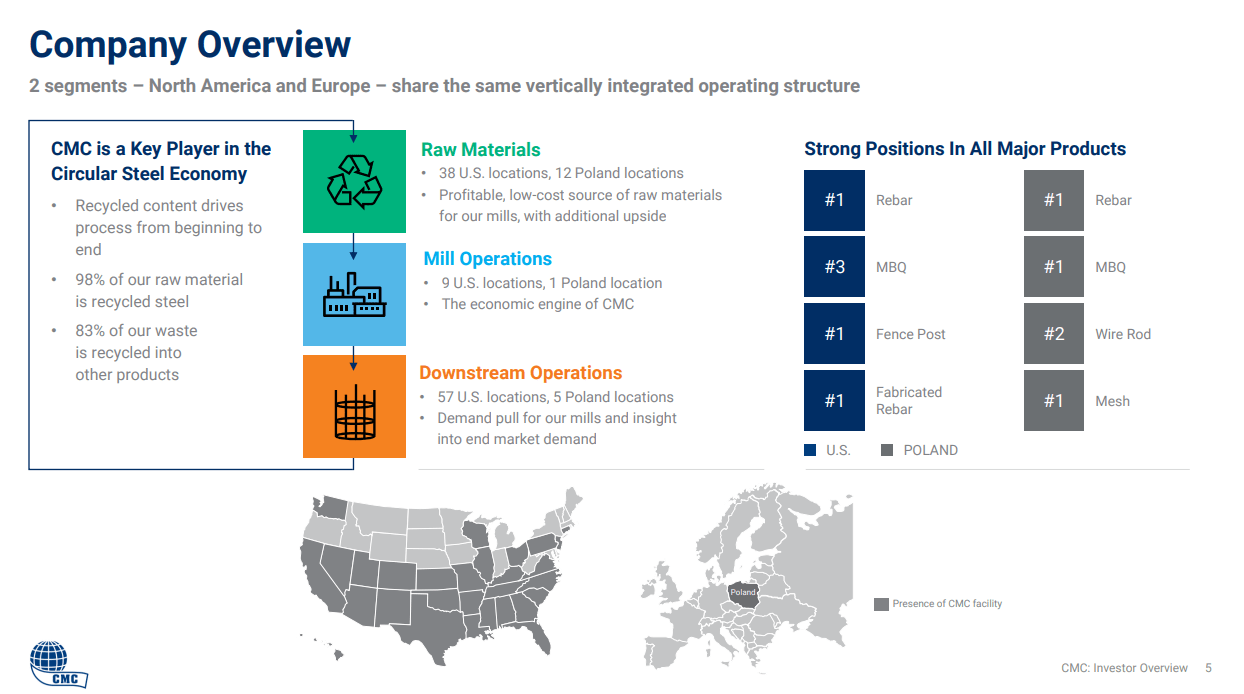

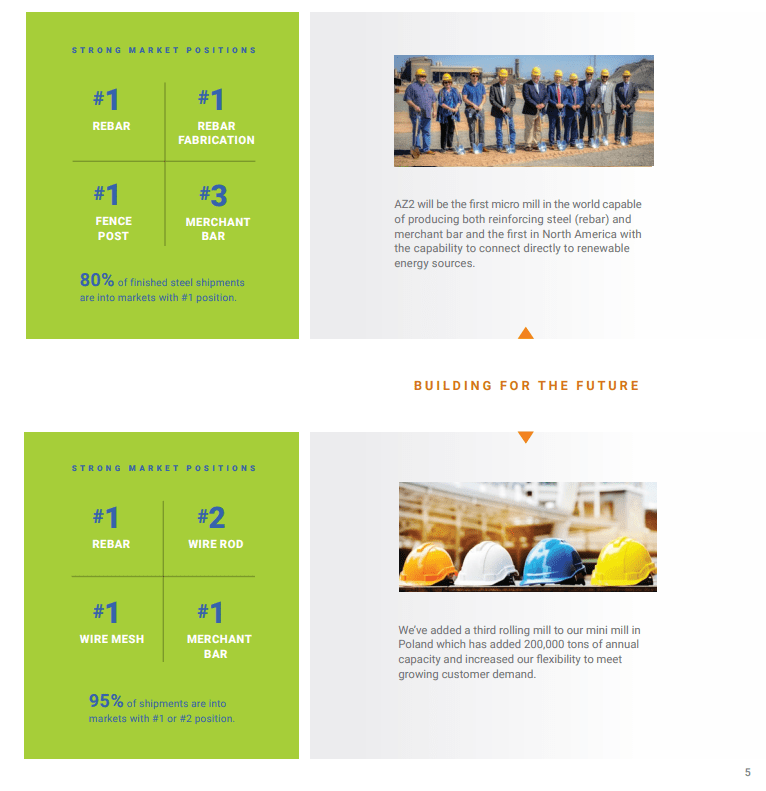

Commercial Metals Company (NYSE:CMC) is a key supplier to the construction and infrastructure markets in the United States and around the world. They hold strong market leading positions for rebar and concrete reinforcement in the United States and in Europe. The boring nature of the recycling and refining business has not stopped the company from posting great earnings and continuing to make money for investors. The company continues to grow and make investments into equipment and mills that will bring profits for many years to come. They are on track to finish their 3rd mirco mill and already have plans to construct a 4th in the next few years. Another potential catalyst for the company is the acquisition of Tensar which will be immediately accretive to the earnings of the company. This acquisition expands the company’s products and services and gives them more areas to grow in the future.

Commercial Metals Investor Presentation (Commercial Metals Company Website )

Introduction

“Commercial Metals Company manufactures, recycles, and markets steel and metal products, and related materials and services in the United States and internationally. The company processes and sells ferrous and nonferrous scrap metals to steel mills and foundries, aluminum sheet and ingot manufacturers, bronze and brass ingot makers, specialty steel mills, and other consumers. It also manufactures and sells finished long steel products, including rebar, merchant bar, light structural, as well as semi-finished billets for re-rolling and forging applications. In addition, the company provides fabricated steel products used to reinforce concrete primarily in the construction of commercial and non-commercial buildings, hospitals, industrial plants, power plants, highways, bridges and dams. The company also manufactures and sells strength bars for the truck trailer industry, special bar steels for the energy market, and armor plates for military vehicles. Further it manufactures rebars, merchant bars, and wire rods; and sells fabricated rebars, wire meshes, fabricated meshes, assembled rebar cages, and other fabricated rebar by-products to fabricators, manufacturers, distributors, and construction companies. It operates through four segments: Americas Recycling, America Mills, Americas Fabrication, and International Mill.”

Numbers/Outlook

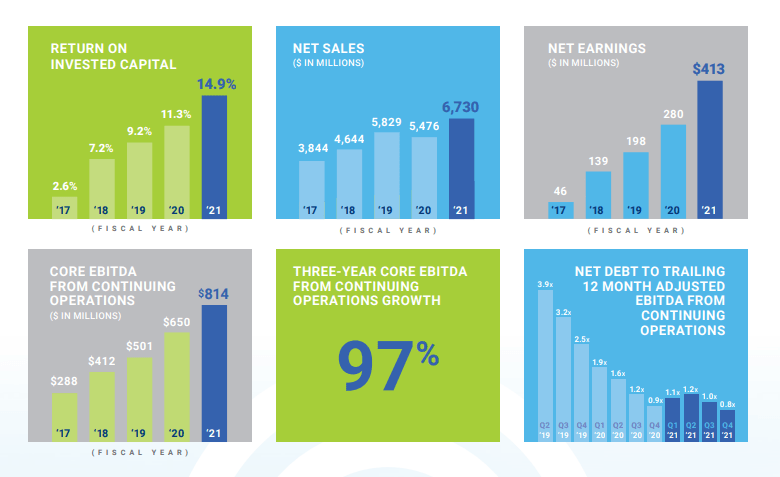

In 2021 Commercial Metals had full year results of $6.7B in revenues and net income of $412.9M which came out to $3.38 EPS diluted. The company has also reported for the first two fiscal quarters of 2022 results of $4B in revenues and net income of $616.2M or $5.02 EPS diluted. These results include gains on the sale of some real estate in Southern California for about $200M. Even excluding the real estate gains, the financial results so far for 2022 are good and the company anticipates a continued strong financial and operational performance throughout the rest of the year. The company pays a current dividend of 0.56 per share which is a 1.35% yield on the current share price.

Commercial Metals Annual Report 2021 (Commercial Metals Company Website)

The company is well positioned to continue to grow in the future. They have doubled their EBITDA from continuing operations in just the last couple of years and look to continue to benefit from that trend. The construction and infrastructure markets in which the company operates is valued at $7.28 trillion worldwide and it is set to grow at 7.3% CAGR from 2022-2030 to $14.41 trillion. The company has a strong position in the markets it operates and holds the #1 position in many of its product areas. The company will benefit from the growth in the overall industry as it holds these top positions. The market that the company operates in is highly fragmented but they compete mainly on the quality and price of the products across the industry and the company believes they are among the largest recycling operations in the U.S., as well as a significant percentage of the total U.S. output of rebar and merchant bar.

Commercial Metals Annual Report 2021 (Commercial Metals Company Website)

Potential Risks

Some of the main risks to the company are that the mills require continual capital investments and could cause an issue to the company if that investment could not be maintained. If that were the case then the mills may not be able to stay relevant and the company could not maintain the refining operations. Another risk factor to the company is hedging transactions from foreign currency markets, commodity prices, and interest rates. While these transactions are meant to reduce price fluctuations that can limit potential gains and also expose the company to losses.

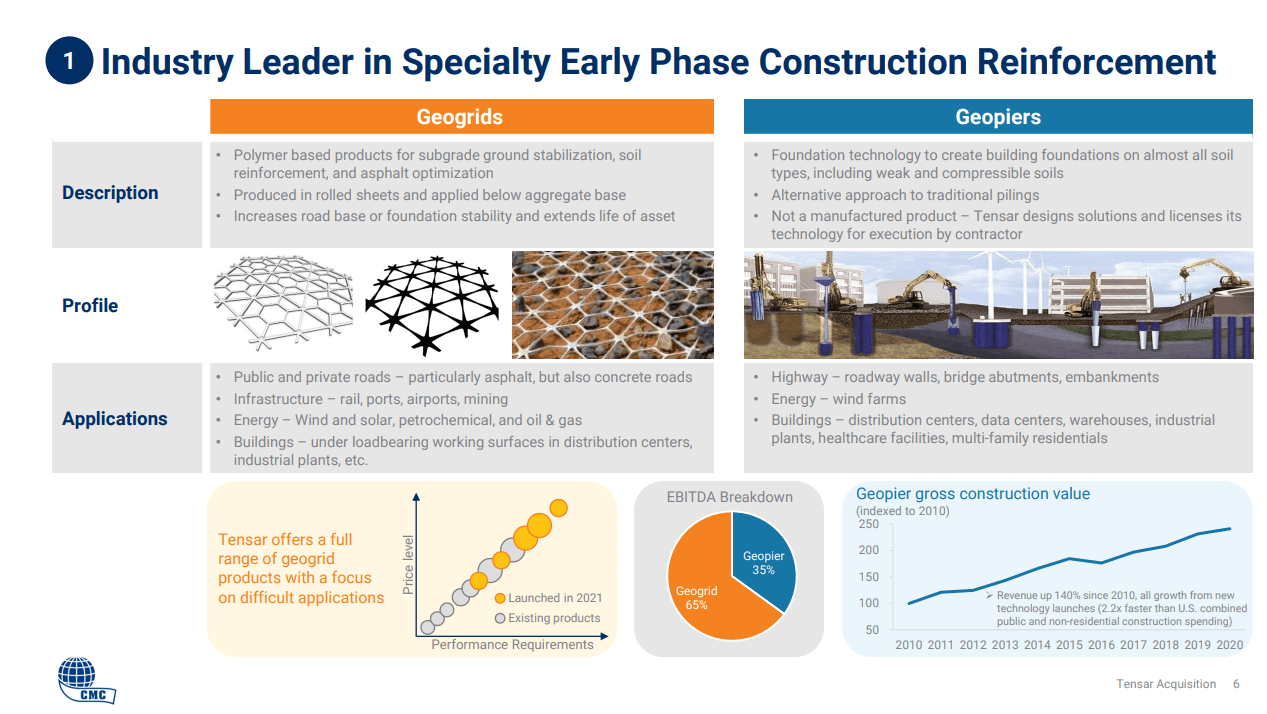

Tensar Acquisition

The company had previously announced the planned acquisition of Tensar for $550M. Tensar is an industry leader in specialty early-phase construction reinforcement. This brings CMC into potential projects earlier and lets them participate in more revenue per project rather than metal reinforcement for the concrete applications. This acquisition is set to be completed in the fiscal 3rd quarter and is anticipated to be immediately accretive to earnings in the first year.

Commercial Metals Company Investor Presentation (Commercial Metals Company Website)

Valuation

Commercial Metals currently has a market capitalization of $5B and a price to earnings (P/E) ratio of 5.66. While this P/E ratio is in line with CMC’s competition it seems like the ratios for the steel and steel fabrication industry are lower than they should be and this might be a potential opportunity for investors. If the rate of earnings stayed constant for about five and half years then the company would have earned enough cash per share to equal the full price per share. Nothing ever works out exactly like that but the idea that the price is so low compared to the earnings per share makes the shares attractive at these prices.

The company currently has a debt load of $1.5B but there is a history of stable cash flows and they also have current cash of $850M as a buffer to make those payments on time if regular cash flows were not as robust in the future.

Investor Takeaway/Conclusion

Commercial Metals Company looks like a great company. The company has experienced steady growth and profits over the last several years and looks poised for more growth to come. The valuation of the company seems like a great opportunity for investors. The price that you would pay for the shares at the current time seems low for the amount of earnings per share the company can generate. Even at a higher multiple for the P/E ratio of around 10 which is still low the share price would double from current levels. It seems like the company is overlooked because it is a small company but it seems to be proving itself. Eventually the share price will come to match the earnings that the company is making and make money for investors in the process.

Be the first to comment