Cindy Ord

Thesis

Comcast Corporation (NASDAQ:CMCSA) stock has fallen further since our last update, encouraging investors to leverage on the downward momentum to add exposure. Notably, the market sent CMCSA spiraling down a further 17% from our previous article, underperforming the market significantly.

However, we assess the recent move as consistent with a massive capitulation to force out weak holders at the worst possible moments, taking out the critical lows over the past six years. Therefore, we believe the selling frenzy could have caused many long-term holders to sell in panic, which augurs well for the holders who stayed behind resiliently.

We will highlight in our article why CMCSA’s current support zone is highly critical for the buyers to defend. Notwithstanding, we are confident that it should firmly help CMCSA stanch further downside. However, investors must be prepared for an extended consolidation phase, as the price action is predicated on its long-term chart.

Therefore, CMCSA could remain volatile over the next three to four months. However, we believe long-term investors can consider using the downside volatility to “test long” and add exposure, given our conviction of its long-term bottom at the current levels.

We reiterate our Buy rating on CMCSA.

Hard To Explain Why The Market Turned So Pessimistic

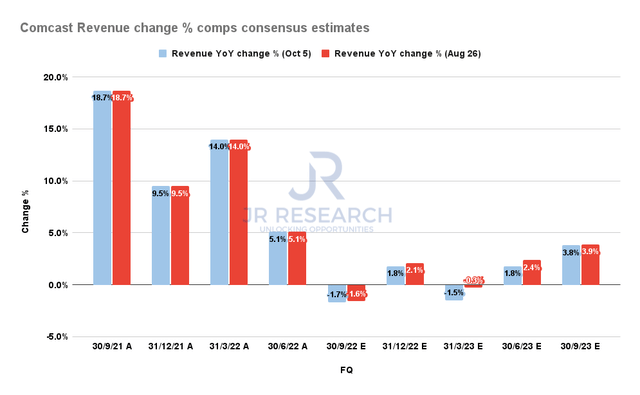

Comcast Revenue change % comps consensus estimates (S&P Cap IQ)

Given the steep selloff over the past month or so, we revisited our assumptions on whether there were significant cuts to the consensus estimates (bullish) that could invalidate our previous thesis.

Comcast’s revised revenue estimates were indeed lowered to reflect the near-term macroeconomic uncertainties. However, we didn’t discern anything sinister under the hood that could suggest Comcast deserved such a battering.

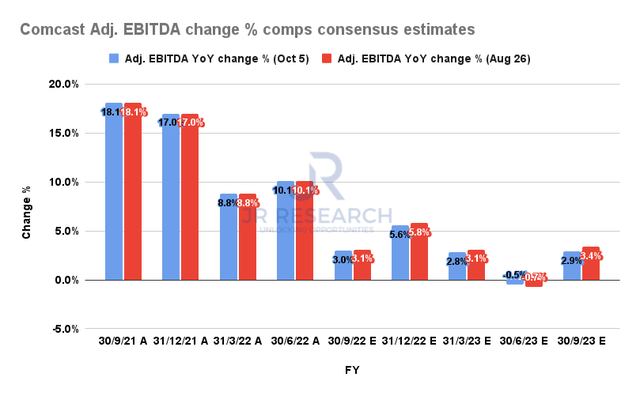

Comcast Adjusted EBITDA change % comps consensus estimates (S&P Cap IQ)

We also checked its adjusted EBITDA estimates and gleaned that there was nothing significant to suggest that CMCSA deserved the recent de-rating. Therefore, it’s pretty hard to analyze what went wrong from its underlying metrics to justify the market’s pessimism.

But, CMCSA’s Price Action Unveils Critical Clues

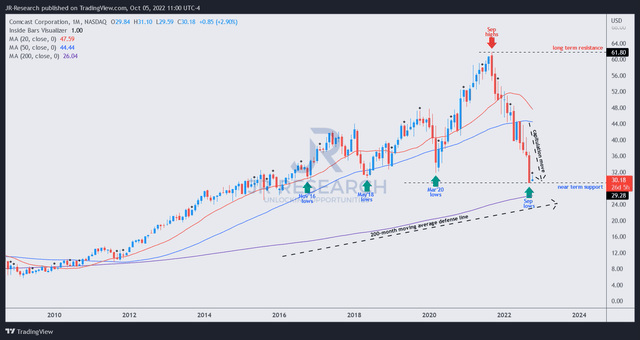

CMCSA price chart (monthly) (TradingView)

As seen in CMCSA’s long-term chart, the move from June to September was massive and rapid, forcing the price action away from its critical 50-month moving average (blue line).

Losing the support of that blue line is highly significant for CMCSA. Why? Note that buyers have consistently returned to support CMCSA’s long-term uptrend whenever the selling pressure forced it down toward its 50-month support zone over the past ten years. It also occurred during the March 2020 COVID bottom, as buyers stanched further selling downside below its coveted blue line.

Notwithstanding, before investors push the panic button again, we highlight several critical factors why we are optimistic at the current levels.

Note that the lows from November 2016, May 2018, and March 2020 were effectively taken out by the rapid downshift from June 2022 through September. Little wonder long-term investors panicked as they saw their gains dissipate rapidly in a few months, turning into losses. Hence, we believe the recent massive downside could be attributed to the market forcing the selling overdrive against these investors, who likely went into the “sell first, ask questions later” mood.

However, after breaking those lows, the selling downside appears to have subsided last week.

Nevertheless, it’s still too early to suggest a bullish reversal, forming a validated bear trap (indicating the market denied further selling downside decisively). Still, we believe CMCSA could continue to consolidate, working its way out of the selling pressure, with buyers likely accumulating at the current levels.

Moreover, its final line of defense: the 200-month moving average (purple line), is in line to bolster the consolidation zone, which could take place over the next three to four months. Hence, we urge investors to remain patient if they decide to add at the current levels.

We expect further near-term downside volatility to force more holders to give up their shares, with price action likely moving sideways for a few months to tire these investors out.

We reiterate our Buy rating on CMCSA.

Be the first to comment