Diego Thomazini

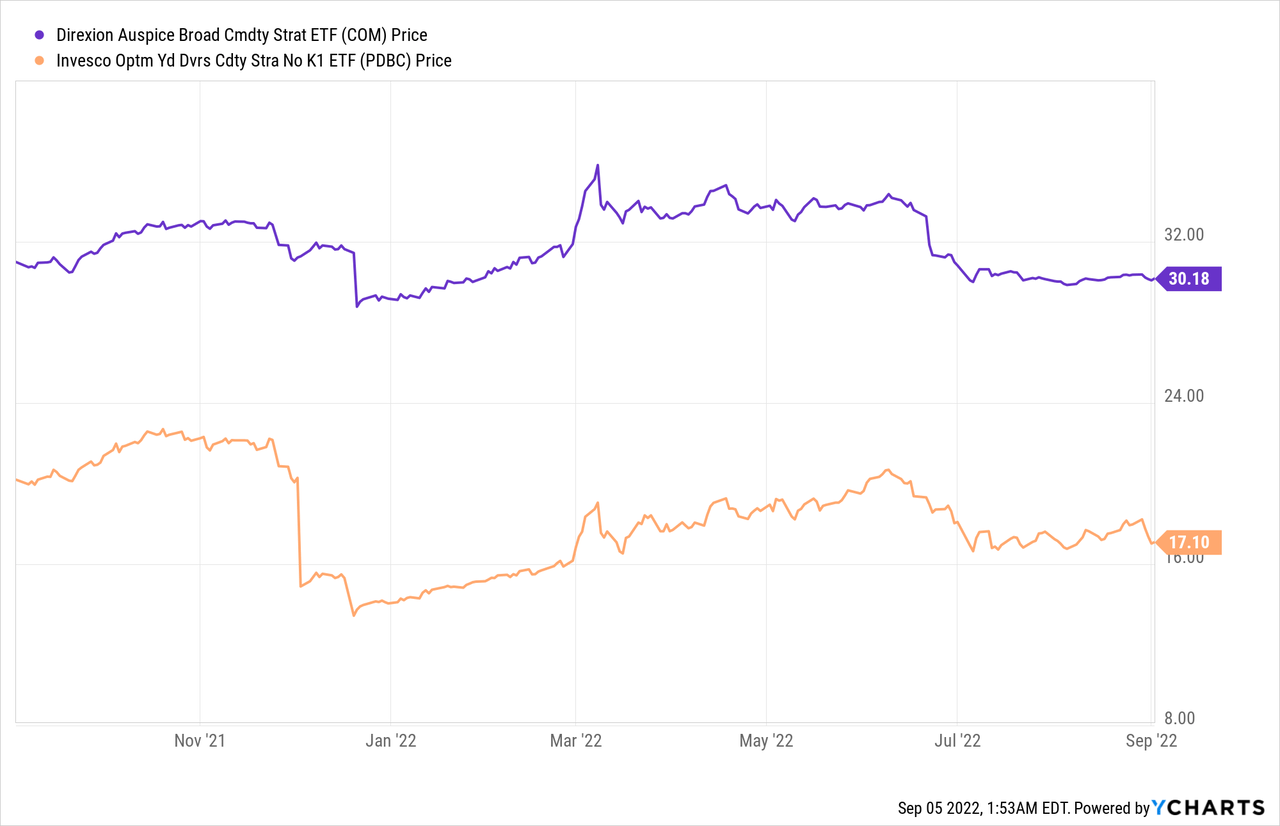

The Direxion Auspice Broad Commodity Strategy ETF (NYSEARCA:COM), which allows investors to take advantage of rising commodity prices, is now back to its February levels as shown in the blue chart below after reaching a high of $36 during the first half of this year. That period was dominated by supply turbulence and inflationary shocks triggered by the Ukrainian conflict.

The orange chart above also shows the performance of the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC), which has also followed more or less the same trend and is currently trading at around $17.

The reason for this is that these two exchange-traded funds (“ETFs”) both hold a broad range of commodities. For those who want to diversify into this asset class, my objective is to assess which one is best suited to navigate in the current marketplace, one where inflationary pressures remain high while recession risks have increased and not forgetting rapidly varying demand-supply dynamics.

I start with COM, which also uses a non-K-1 generating approach to commodity investing and tracks the Auspice Broad Commodity Index.

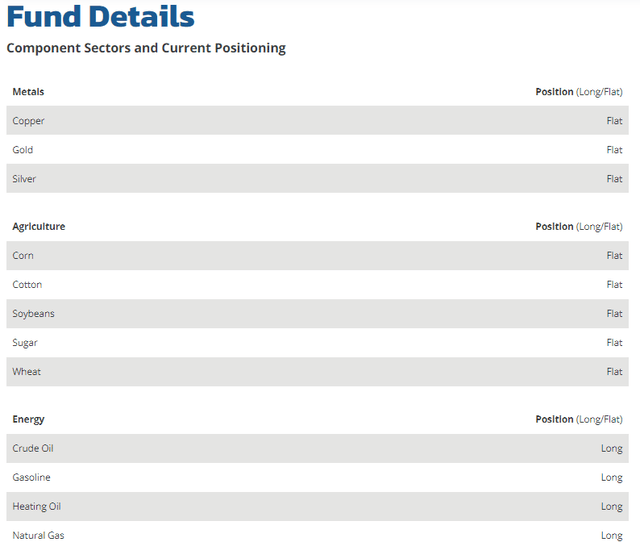

The composition of the Direxion ETF

First, commodities are raw materials or natural resources, which, after extraction, are used for the manufacture of finished goods. In this respect, there are four main categories of raw materials, with the first being industrial (or base) metals such as copper, aluminum, etc., which are mainly used for manufacturing activities. Second, are the precious metals that are considered rare due to their high production costs and extraction difficulties, like gold, silver, palladium, or platinum. COM provides exposure to both of these two categories through copper, gold, and silver as shown in the table below.

COM’s details (www.direxion.com)

The fund which provides exposure to 12 commodities in all, also includes energy raw materials, also termed fossil fuels, with examples being oil or natural gas. These seem abundant amid all those supply and demand talks but the fact remains that their quantity is limited on this planet. COM also includes refined products like gasoline and heating oil.

Last, there are the agricultural raw materials: wheat, corn, cotton, sugar, and soybeans whose prices in the commodity market are affected by several factors such as weather conditions as well as agricultural production. Examples are a variation in seasons and temperature which have significant consequences on the production (supply) and thus impact the price of these products while bumper harvests can flood the market with cheap supplies. Moreover, natural disasters as well as man-made ones as in Ukraine play a considerable role in determining prices.

Comparing Performances: COM Vs PDBC

These prices eventually determine the value of the ETF over a period of time as with other investment vehicles which hold commodities. However, in addition to allowing investors to profit from rising commodity prices, COM mitigates market fluctuations risks by going “flat” as shown in the above table. This means converting to cash when an individual commodity price is experiencing downward trends.

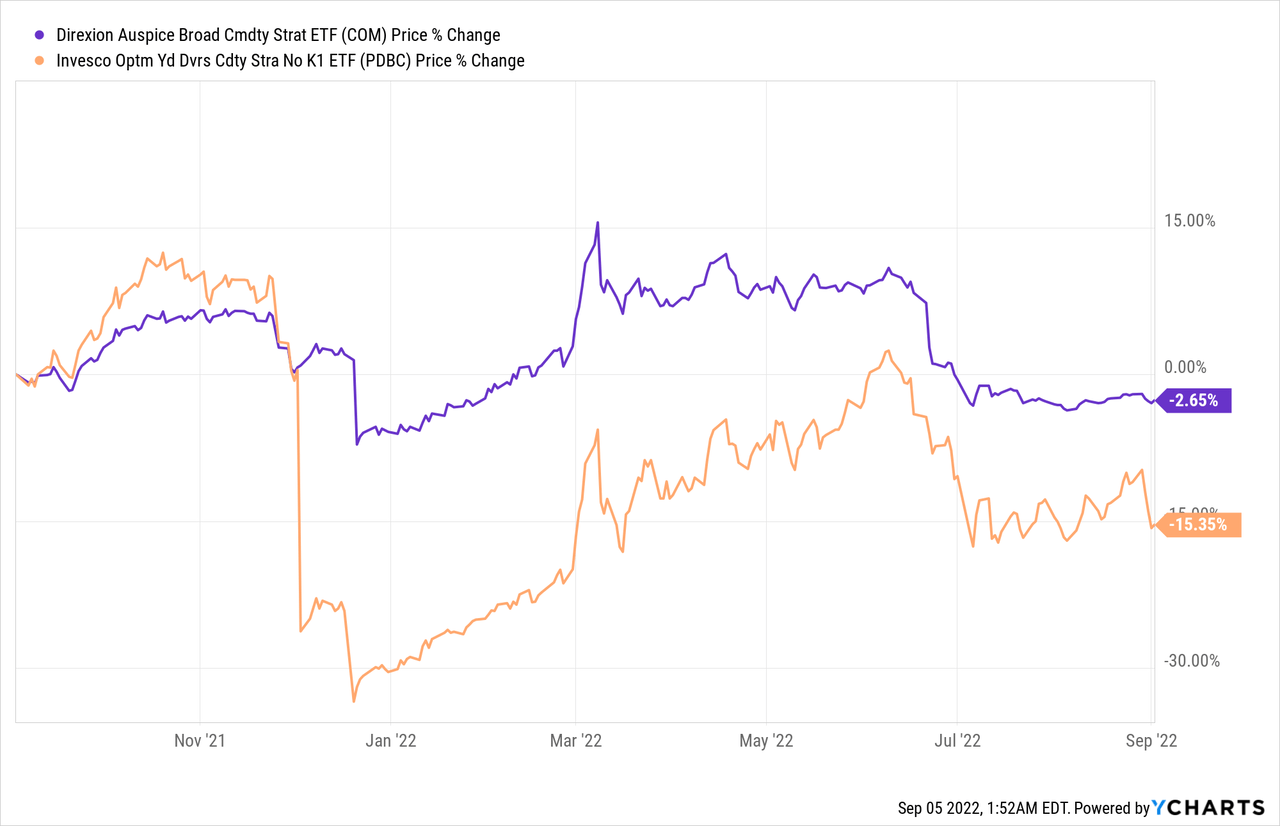

This ability to provide investment returns with lower risk differentiates it from long-only commodity strategies, which I further verify by performing a one-year price performance comparison with PDBC as per the chart below. In this case, the fact that the Direxion ETF (in blue) has suffered less than its Invesco peer (in orange) confirms its ability to provide a more balanced return while mitigating risks.

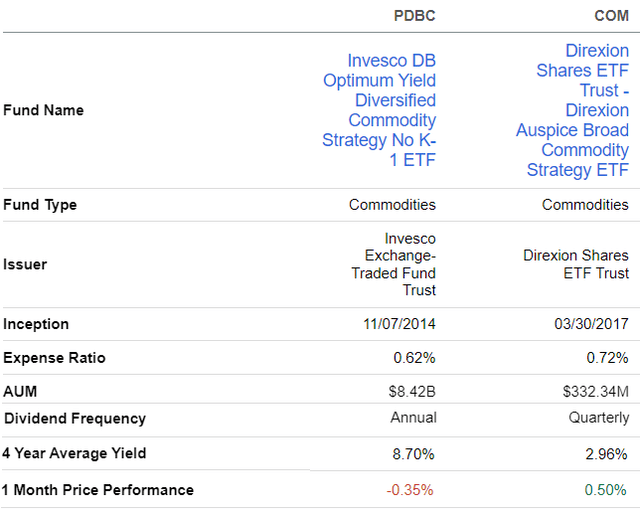

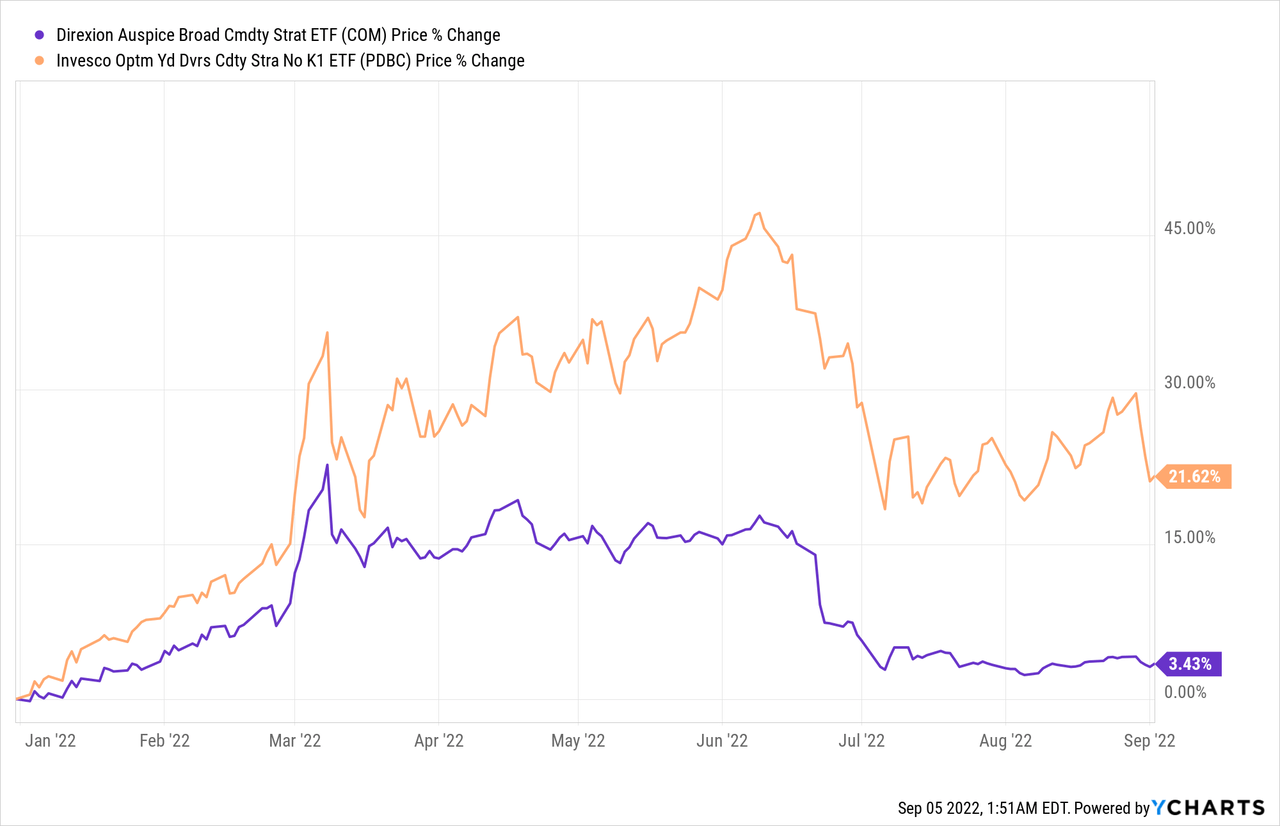

On the other hand, when comparing the year-to-date price performances, PDBC is the winner with gains of more than 21.6%, compared only to 3.43% for COM as shown in the table below. This is explained by the surge in agricultural commodity and energy prices following the beginning of the war in Ukraine. This unfortunate event literally shook up the world’s financial markets and brought to light the issues of energy and agricultural dependence of European countries. Some will remember how nickel trading had to be halted on the London Metal Exchange (“LME”) after prices doubled in the first week of March.

These periods of volatility and surge in prices were a boon for PDBC.

PBDC Holdings and Demand-Supply Dynamics

Therefore, as an actively managed fund, both through direct investment and derivatives (such as futures contracts), as well as investing in commodities through other funds, the Invesco ETF can offer better returns, but over a shorter period of time. This is because it makes use of swap mechanisms. Noteworthily, the period of time when it outperformed COM coincided with a general uptrend in the price of agricultural commodities, industrial metals, and especially oil.

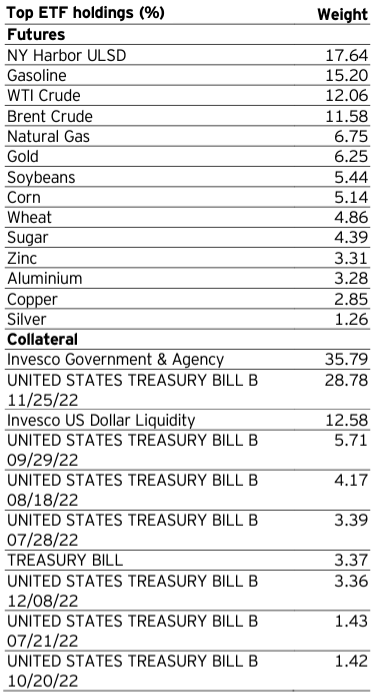

For this purpose, PDBC tracks the DBIQ Optimum Yield Diversified Commodity Index Excess Return. This is a rules-based index composed of futures contracts of 14 of the most heavily-traded and important physical commodities in the world as shown in the table below.

Holdings as of June 30, 2022 (www.invesco.com)

Looking into the difference in holdings, PDBC provides exposure to two additional base metals, namely aluminum and zinc as shown in the table above. As for COM, it provides exposure to an additional agricultural commodity in the form of cotton.

Now, the World Bank had predicted a 40% surge in cotton prices in April, for this year, mostly due to weather patterns in the U.S. and India, two of the world’s largest producers. However, this has not yet materialized due to COVID-induced lockdowns dampening demand from China, as one of the top consumers. Going forward, as the world’s second-largest economy gradually resolves COVID infection problems, cotton prices are likely to recover.

Now, in addition to COVID, China has also been subject to hot weather which has impacted manufacturing activities in some parts of the country which depend on renewable energies like hydroelectricity. This is also causing volatility in base metal prices as the country remains a massive consumer of everything from copper and aluminum to nickel.

Conclusion

Therefore, there are short-term uncertainties that are likely to keep a lid on the price of base metals, but, the longer-term picture appears brighter with renewal energy projects favoring copper, a metal that is used in everything from wind turbines to solar panels in large amounts.

As for energy, interruption in the flow of natural gas to Europe and less supply as a result of reduced withdrawals of oil from the U.S. strategic petroleum reserve is likely to lead to higher prices. However, China has extended lockdowns which negatively impacts demand and there could be an agreement with Iran to offset the cuts in OPEC’s supply. These issues, while not forgetting recession concerns that are detrimental to demand, are likely to constitute headwinds for energy prices.

Thus, there is no clear path that indicates an increase in commodity prices in the short to medium term, especially for base metals and energy as was the case in the first half of the year. The same is the case for agricultural commodity prices after shipments of grains were able to leave Ukraine last month.

Furthermore, in addition to demand-supply dynamics, and the war in Ukraine, the hot topic for this year remains the Federal Reserve’s rate hike in order to tame inflation. This has weighed adversely on gold prices which are going through a difficult period. Additionally, a stronger dollar is not conducive to higher commodity prices.

In these circumstances, it is better to opt for the Direxion ETF which provides a more balanced risk-return approach to commodity investing. To this end, in addition to its better one-year performance as shown in the chart above, COM has managed to deliver a better one-month return as shown in the table below.

Comparing key metrics (www.seekingalpha.com)

This said, the Direxion ETF charges slightly higher than PDBC, which is more popular in view of its AUM (assets under management). The Invesco ETF also pays higher dividend yields too, but, investors should note that distributions vary depending on the fund’s performance. It also makes sense for those who have more of a trader profile and want to benefit from shorter-term market moves.

Conversely, for those wishing to invest in commodities for the longer term, COM makes better sense, and with floods impacting Pakistan which is the world’s fifth largest producer of cotton, it should benefit from higher agricultural commodity prices too.

Finally, COM and PDBC are suitable for investors with different time horizons, and given the uncertainties I have elaborated upon in this thesis, I do not foresee an upside for any of these this year except in case there is a pickup in economic activities in China or clear signs that the U.S. is moving away from a recession. There may be some uptrend caused by news updates like OPEC cutting supply, but this is not sufficient to have a bullish position on either.

Be the first to comment