MarsBars

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on September 17th, 2022.

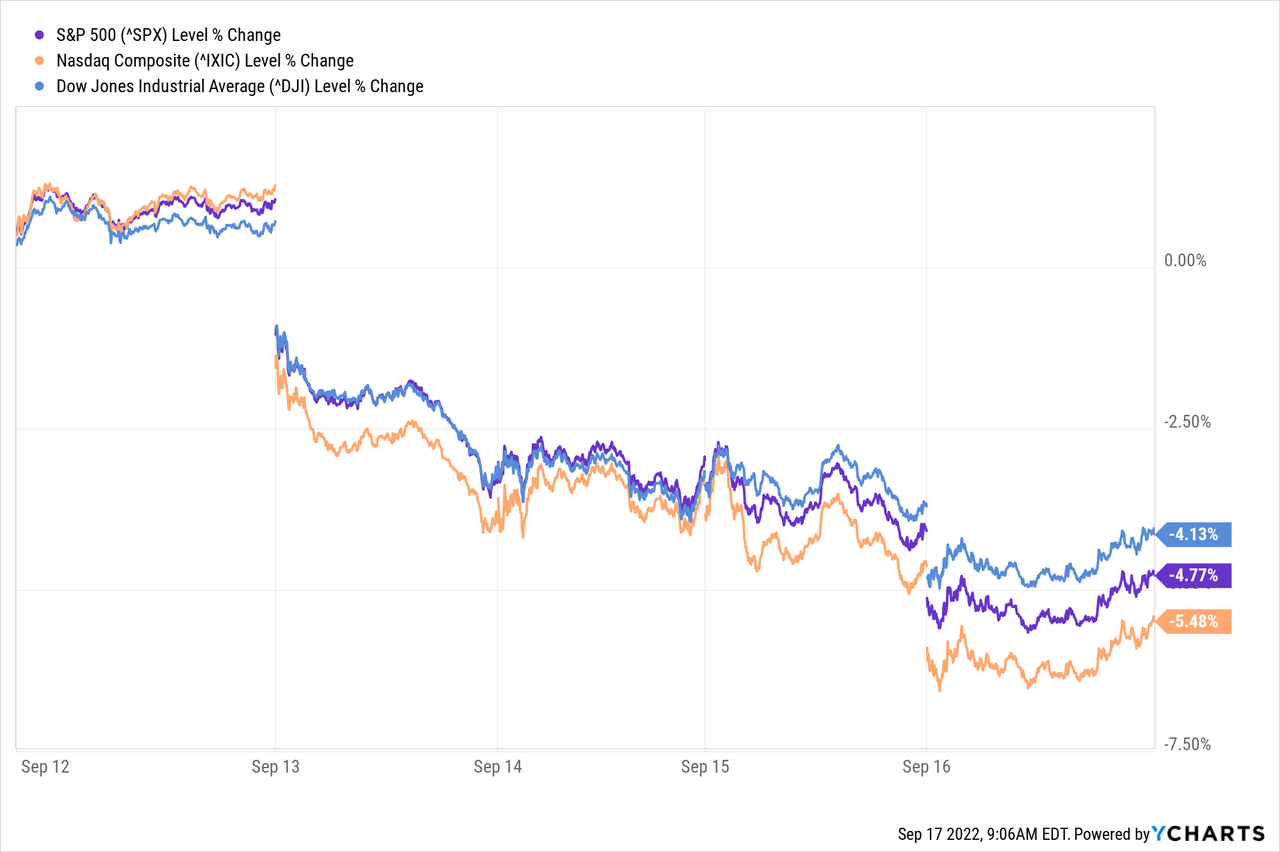

It was quite the finish heading into this final stretch. The market had significant weakness through this week, finishing much lower more broadly. A hotter-than-expected inflation report kicked it off. Then it was further sent lower by warnings from FedEx (FDX).

YCharts

Despite these sharp moves lower, we still haven’t revisited the June lows we saw earlier in 2022. However, we have given up much of the gains we saw through the summer rally. Tech continues to be hit the hardest and is a place most investors don’t want to move into. That being said, one of our trades that expired worthless this week was Micron Technology (MU).

I tend to want to invest in the beaten-down areas, so selling puts while MU is over 40% down from its 52-week high is enticing to me. I know writing calls and puts is a rather short-term approach, but at the core of my investing, I am a longer-term investor when holding positions. I can hold them for years waiting for a rebound if that’s what it takes.

Additionally, we also had written puts on Trinity Capital (TRIN) expiring worthless this week. We had our covered calls on AT&T (T) expire worthless, too, as that stock continued to get hammered into the weakness. This is a natural departure from when these telecom giants were seen as stable giants.

For Stanford Chemist’s trades, we had a more unusual situation with Easterly Government Properties (DEA). Several of us had our puts here assigned early. That is a fairly rare event and usually happens more often with covered calls heading into an ex-dividend date if a shareholder wants those shares early to qualify for that. That being said, shares had sunk for DEA significantly, and ultimately assignment would have happened if held through to the expiration. I’m happy to hold these shares and look for opportunities to write puts.

Also, another Stanford Chemist idea was Alibaba Group Holding (BABA). It was a fairly volatile ride, but these written puts finished out-of-the-money, locking in the premium for investors who participated. The trade was entered in early March of 2022 and spent most of the time above the $80 strike. However, the volatility through the period, besides just the broader market pressures, was pressured by U.S./China relations.

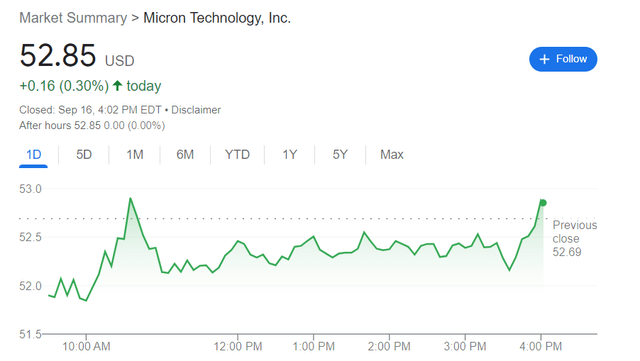

Micron Technology

Now this one was definitely exciting; I think it was one of the most exciting trades that I’ve participated in simply because it came down to the final minutes of trading. With the broader market pressures in the last week, it collapsed our ~11% buffer from the time we wrote the puts. Shares were trading around $58.93 when the trade was entered, and the strike I selected was $52.50.

The stock spent much of the day below that strike price on the final day of trading except for two spikes above. One of those spikes is in the final minutes of trading for the day. And that’s all that really counts, where it finishes up in the last second.

Options stop trading at the end of the day along with the market, but after-hours trading also matters. If a stock finishes out-of-the-money, it won’t be automatically exercised. However, if a stock collapses in after-hours trading, puts can still be exercised by the put buyers. Therefore, a put seller would still be obligated to take those shares at the agreed-upon strike. If it finishes out-of-the-money at the end of the day, it greatly diminishes the chances of that happening because it goes from an automatic exercise to a manual one.

We collected $0.55 per share or $55 per contract in this trade. Over 21 days that led to a potential annualized return or PAR of 18.21%. We’ve had a previous trade on MU, and that was almost exactly one year ago. That one ended up expiring worthless, too. However, it was at a much higher strike price of $65 then.

With our latest trade, we collected the equivalent of 4.78x the regular quarterly dividend of $0.115. Of course, we also did that in only 21 days.

What’s Next For MU?

MU continues to be an attractive name. In my opinion, it is a cheap tech stock, but it is that way because it’s cyclical. MU needs a strong economy to continue being as profitable as it is, or that cheap P/E can go higher on a dropping “E” part of the equation. The current forward P/E comes in at just 6.35.

That being said, that’s where my long-term investing mindset kicks in. While I would write covered calls on this name, utilizing our option wheel strategy, I’m also okay with holding it long-term.

The commitment to return capital to investors via buybacks and dividends is also a huge bonus. I believe the dividend is safe as the coverage is significant at a payout ratio of just ~5.5%. It would take a deep recession to change my outlook to believing that MU’s dividend wouldn’t be safe. I suspect they will also continue to grow the dividend, as they have indicated previously.

As we discussed at Investor Day, we are committed to returning to shareholders all of the free cash flow generated over the cycle through a combination of dividends and share repurchases. Share repurchases will be both programmatic and opportunistic, and we expect to purchase more as the stock trades at bigger discounts to intrinsic value.

That leads me to why I will look at writing more puts on this name. It had been around a year since I wrote puts, but that’s because the stock made significant runs higher from that previous trade. Now, if we remain depressed, we’ll get the opportunity to write puts more regularly. I like the stock below $60.

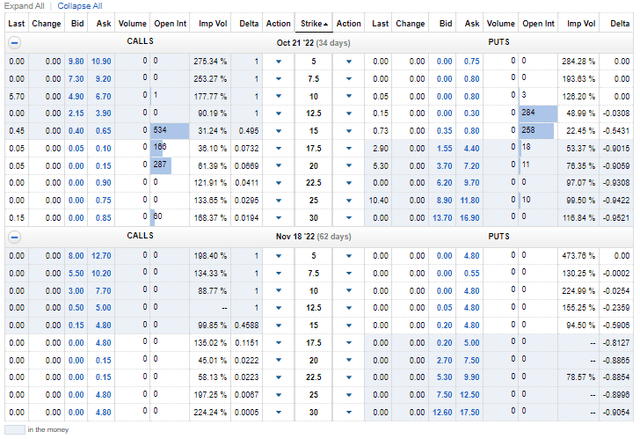

We have to keep in mind that they are expected to report their earnings on September 29, 2022. I’ll be looking at expirations after that date. So we will get some juiced-up premiums due to that catalyst for volatility. With that, here are a couple of ideas for more put writing opportunities going forward:

- October 21, ’22 expiration, $50 strike collecting $2.12 (last bid) would be a massive PAR of 45.51%, but there would be almost no downside protection.

- October 21. ’22 expiration, $42.50 strike collecting $0.51 (last bid) would be a more moderate PAR of 12.88% but leaves a significant ~19.5% cushion.

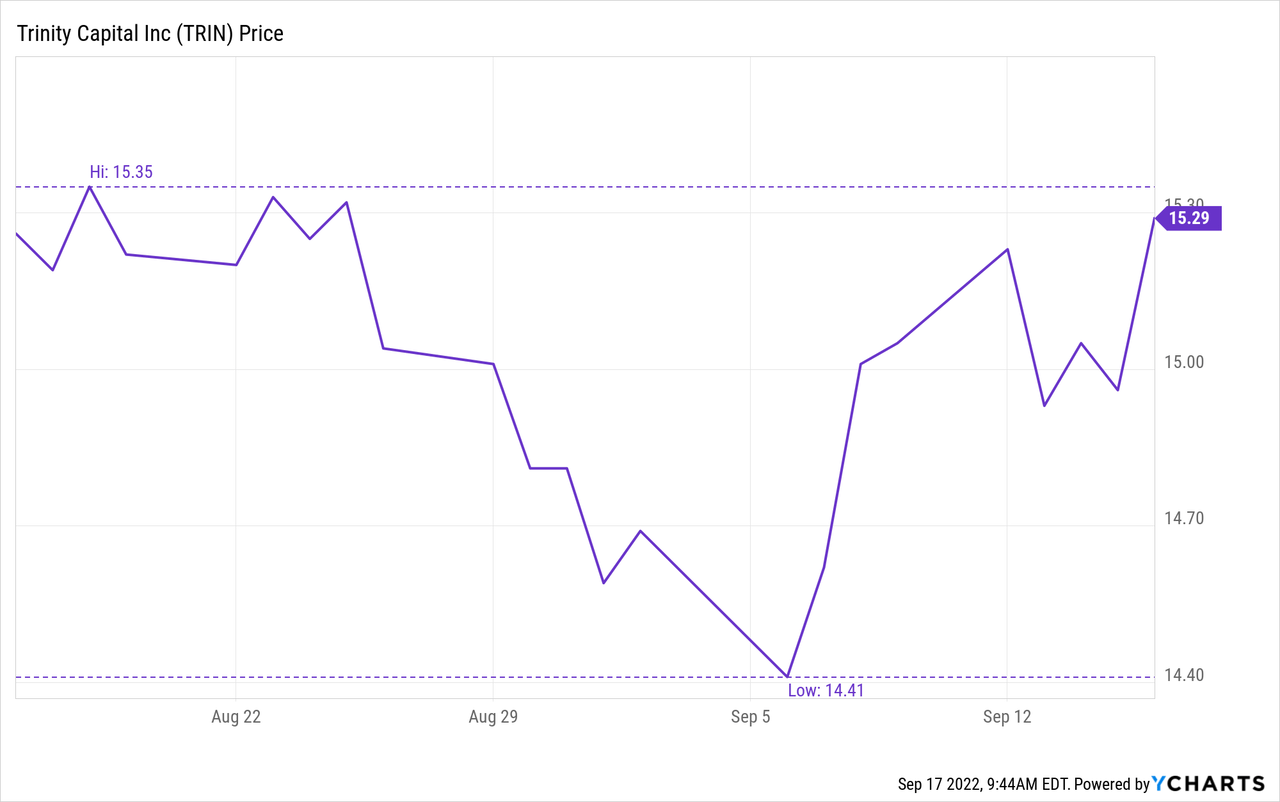

Trinity Capital

TRIN was also another fairly exciting trade. The shares of this BDC had actually been under our $15 strike through most of the final weak. It was on the final day that the stock started trading over the strike and never fell. We entered this trade on August 16, 2022. We collected $0.41 over 31 days, reaching a PAR of 32.18%. That PAR was quite significant and was because we wrote at-the-money puts.

YCharts

A potential reason that shares of TRIN jumped could be that they announced yet another dividend boost to their regular quarterly payout. They also announced their $0.15 supplemental that was previously intended. It just sounds so much sweeter when it’s officially declared.

- Trinity Capital declares $0.45/share quarterly dividend, 7.1% increase from prior dividend of $0.42. In addition, the company declares a supplemental cash dividend of $0.15 per share.

Despite the headwinds the venture capital space faces, they remain confident they can continue to boost their dividend. It isn’t even a stretch, as their NII last came in at $0.51. So we are seeing a dividend covered when they just raised more capital through a secondary offering they can put to work.

Speaking of that secondary offering, that’s exactly where the opportunity opened up. This is exactly what I wrote up more in-depth previously on why I was buying and, at the same time selling puts on the name. Ultimately, the trade expired worthless, so we pocketed the premium. However, if assigned, the breakeven on this trade would have been pushed down to $14.59.

What’s Next For TRIN?

I’m long shares of TRIN already, as discussed. However, with the latest trade expiring worthless, there is still some room to add more to my position. One of the problems with TRIN or just BDCs, in general, is the lack of options liquidity. There is generally zero volume and fairly limited open interest on most strike prices.

Therefore, we are limited in our choices of wanting to do any options trading on these names. You might be able to get into a trade, but getting out of one can be just as difficult. So I would stress that one really needs to be okay with entering a trade but potentially not being able to get out. With that, I think the $15 strike on the October 21, ’22, expiration could be interesting. The bid-ask spread is wide at $0.35 and $0.80. If we could get another $0.40+, I would be happy.

The idea here is that even though there would be a limited downside cushion before the strike price was breached, it would also lower our breakeven. It is essentially lowering the cost basis to a level that isn’t currently available, with shares trading at $15.29. That’s one of the basic advantages of writing puts to enter into a position.

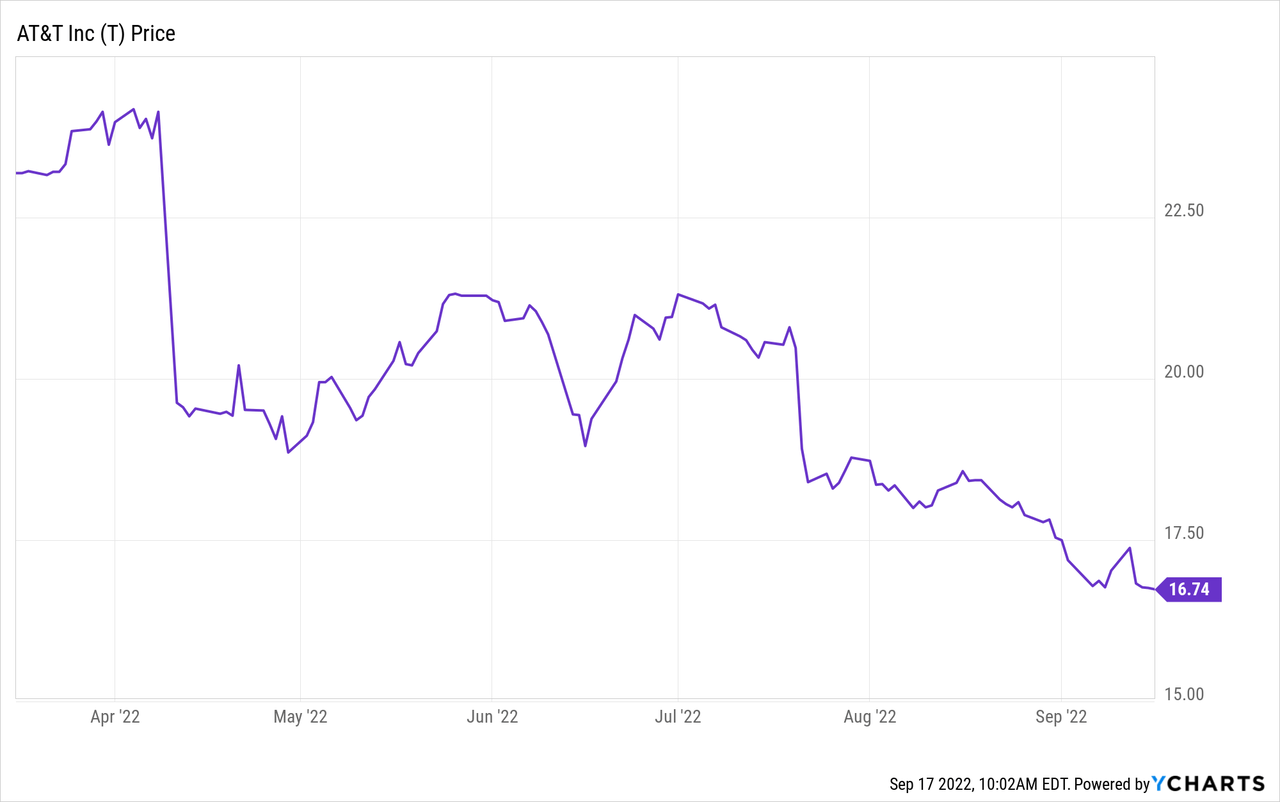

AT&T

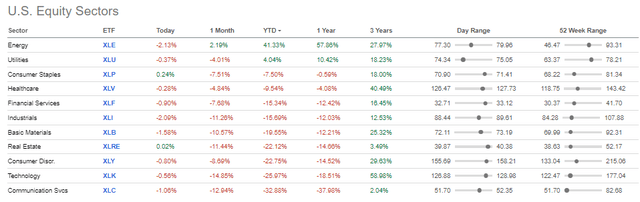

I’d be lying if I said I’m not getting at least a bit frustrated with these telecom plays now. I’m not throwing in the towel yet, but between AT&T and Verizon (VZ), there is quite a bit of capital tied up. The telecommunication services sector is deeply in the red, even surpassing the technology sector collapse.

Sector Performance (Seeking Alpha)

Earlier this year, we had shares of VZ assigned to us. We were then able to write some covered calls, collecting $0.30 in June with an expired trade and then another $0.37 when a trade expired in July. Now, shares have just fallen rapidly. To a point now where writing calls isn’t viable, and I’ve been patiently waiting for a bit of rebound that hasn’t been happening.

AT&T is in a similar situation; we had shares assigned due to written puts in mid-August. Then we could write calls on AT&T shortly after that, which is this latest trade that has expired worthless. On August 15, 2022, we sold calls at a strike price of $19.

The duration of this trade was 32 days, working out to a PAR of 11.41%. The $0.19 collected amounted to a dividend equivalent of 0.69x the $0.2775 regular dividend. Although, we did this over 32 days instead of the ~90 days for a quarterly dividend.

With the completion of this trade, we’ve now taken the breakeven on these shares down to $18.57. We originally collected $0.24 when selling the puts, and now the $0.19 we collected.

What’s Next For AT&T?

Longer term, I’m happier to hold VZ than AT&T. VZ is already a Core position, so simply adding to it previously was fine. However, despite the massive drop in AT&T, the stock continues to slide lower after its spin-off of WarnerMedia to help form Warner Bros. Discovery (WBD) earlier this year.

YCharts

I don’t see the dividend in jeopardy as some investors do. So I’m happy to continue to hold but would be anxious to write more calls for our option wheel strategy. Now, nothing seems overly tempting as I’d want to write calls at $19 or above. To get some worthwhile premium, one would have to go into 2023.

For example, the March 17, ’23, $19 strike had a bid of $0.36. That’s 181 days away and below what the equivalent dividend amount would be during that time. I tend to write covered calls only when the dividend yield is surpassed.

If I was more anxious to offload shares of AT&T, then writing puts at an $18 strike for the same expiration could collect $0.61. That would be enough to push the premium collection above our breakeven of $18.57. However, it would mean basically breaking even on these shares if they were called away too.

I’m content to sit, collect the dividend, and wait for the market to rebound. When that happens, I believe that AT&T (and VZ) will also be able to claw back some of their declines. That could present much more attractive choices for selling options.

Be the first to comment