Tim Boyle/Getty Images News

What stocks are holding up well in this current market volatility? That is often a good question active investors should ask themselves when sifting through the carnage to find good long opportunities.

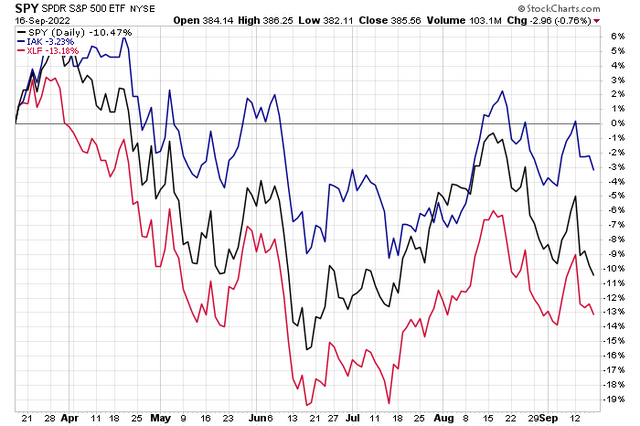

Take a look at what’s happening within the Financials sector. Insurance stocks keep seeing buyers pop up. The iShares U.S. Insurance ETF (IAK) is down just 3% over the past six months, beating the SPDR Financial Sector ETF (XLF). Both funds are outperforming the S&P 500 Trust ETF (SPY). One major insurance stock, popular in TV commercials, is up over that timeframe.

Spotting Relative Strength: Insurance Stocks In Favor

According to Bank of America Global Research, Allstate (NYSE:ALL) is the largest publicly-traded personal lines insurance company, with about 10% of the personal lines market (1 in 8 households). Allstate is primarily a captive agency writer. Besides a full array of personal lines P/C products (preferred, standard and nonstandard auto insurance, and homeowners’ insurance), the company also offers life insurance and annuity products. Its scale and product design should allow for strong returns in the personal lines insurance area. Moreover, ALL’s auto insurance business generates solid returns. Improving fundamentals in the home insurance space is bullish, too. Downside risks could arise from lower overall interest rates and negative impacts from rising auto accident numbers. It’s also unknown how autonomous vehicle progression impacts ALL’s business.

The Illinois-based $35 billion market cap Insurance industry company within the Financials sector trades at a high 39 trailing 12-month GAAP price-to-earnings ratio and pays an above-market average 2.6% dividend yield, according to The Wall Street Journal.

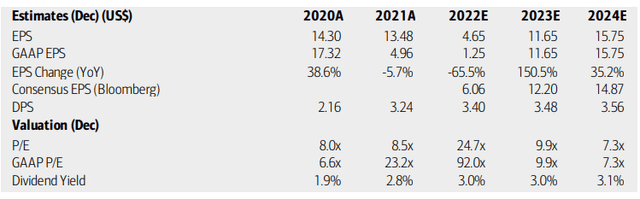

On valuation, BofA sees this year’s EPS dip as a blip on the radar. Earnings per share should rise substantially in 2023 and 2024. The Bloomberg consensus forecast generally backs up BofA’s estimates. Dividend investors can also look optimistically on ALL shares as dividends per share are seen as rising over the next two fiscal years. Using forward operating and GAAP earnings figures for 2023, ALL, in fact, trades at a very low P/E ratio.

ALL Earnings, Valuation, Dividend Forecasts

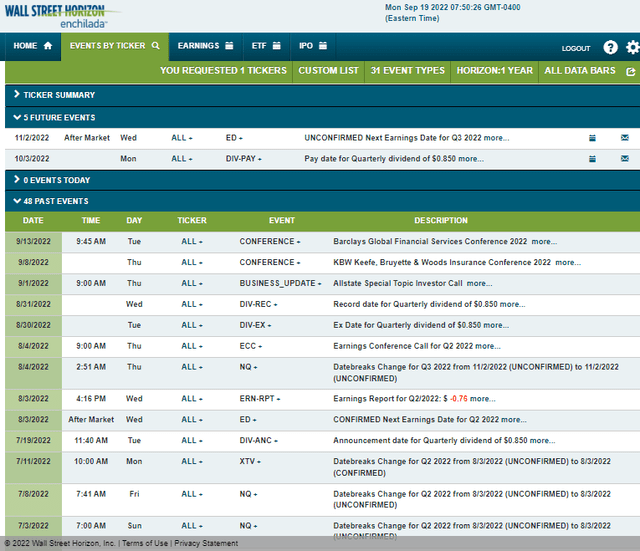

Looking ahead, Allstate’s corporate event calendar is light until its Q3 earnings date, which is unconfirmed to take place on Wednesday, November 2 after market close, according to Wall Street Horizon. There is a dividend payable date on October 3.

Corporate Event Calendar

The Technical Take

Allstate boasts tremendous relative strength thus far in 2022. Shares have returned more than 12% – compare that to its industry ETF, of which it is a 6% holding, which is up a fraction more than 1% year-to-date.

ALL’s chart shows some resilience on an absolute basis, too. Shares peaked in April above $140, but then dropped to a low near $111 by the summer. A bullish double bottom was set in place between July and August, then a higher low was made earlier this month before the stock jumped on big volume to finish off last week. This is not the kind of price and volume action we see in most parts of the equity market.

If ALL can climb above the key $133 resistance level, I think it will make a run at its all-time high notched back in April. Buying on a close above $133 would make sense or a long position now with a stop under $119 could play as well.

ALL: $133 Resistance After A Bullish Double Bottom

The Bottom Line

Allstate’s low valuation using normalized earnings, its relative strength vs the overall market, and a decent-looking absolute chart make me bullish on shares. Financials look to be a good spot to have exposure to, and insurance stocks in particular look good. Allstate is a solid play for such exposure.

Be the first to comment