Jesse Grant/Getty Images Entertainment

Investment Thesis

Beyond Meat (NASDAQ:BYND) is a great company with an industry leading set of products. I believe the plant based product category is going to have strong long term growth. However, I think this business’s economics are fundamentally flimsy. Declining growth and poor margins make the risk to reward unfavorable. I’m avoiding this company at the current time.

Broad Growth Headwinds

Beyond Meat is a classic growth company. The business is deeply unprofitable but has strong revenue growth. It relies on this growth to scale and on that scale to achieve profitability.

This is why the company’s recent growth slowdown is so concerning. The business reported a top line decline year over year during the last quarter. This is the second revenue decline in the past three quarters. Growth has slowed across geographies. The company’s retail and foodservice segments are both reporting increasingly flat results.

Management attributes some of these declines to the broader economic environment. In the face of inflation and high energy costs, consumers are trading down to cheaper products. Since Beyond Meat sells premium products, it is a lot more vulnerable to an economic pullback. On their last earnings call, management discussed this dynamic.

If you look at the price of our ground beef today on retail average 12 weeks using spend data, we’re selling at $8.35 a pound. If you look at the USDA ground beef data, for the month of June the price per pound was $4.9, so you have $8.35 per pound price versus a $4.90 per pound price. I can talk a lot about all the different influences and things that are going on in the economy. But that is a very difficult proposition when consumers have very high levels of inflation going on, and they’re buying our in grocery is declining.

The business’s international segments took the largest hit so far. International revenues were down more than 7% year over year. This was mostly driven by a 17% decline in international retail sales of the company’s products.

The company is also experiencing some unusual competitive headwinds. Management said that their category is seeing a lot of discounting. This is a different dynamic than other food companies are reporting, but it makes some sense. Beyond Meat operates in an area with a lot of early stage competitors. These competitors are under pressure too. They are liquidating inventory to raise cash. This puts downward pressure on the prices of all products in the category. These pressures are likely to further hurt Beyond Meat’s top and bottom lines.

By themselves, these growth numbers aren’t terrible. Flat revenue growth would be passable for a more defensive food company. But Beyond Meat is a deeply unprofitable growth company. It needs continuous fast growth to justify its valuation. So I believe the business needs to either return to strong growth or become profitable to avoid significant downside.

Profitability In Focus

The worst part of the company’s last report was the business’s declining margins. Margins had already been under pressure, but during the last quarter the company reported a negative gross profit. Management attributed this to a poor demand forecast forcing deep discount inventory liquidations.

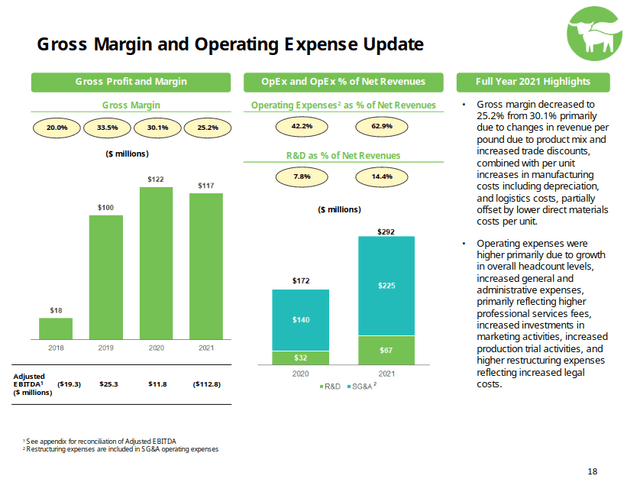

Beyond Meat 2021 Investor Presentation

In response to these headwinds, management announced some measures to improve profitability. The company cut its operating expenditure run rate by 15% and cut its headcount by 4%. Management also reduced its capital expenditure guidance. CapEx is now projected to decline by 40% year over year.

These strike me as steps in the right direction. Management seems to have spent years pursuing a “growth at all costs” strategy. Now, they have identified a poor demand environment and are pivoting accordingly. But you have to consider that the company’s TTM profit margin is -72%. This isn’t a business that can just tweak its way to profitability.

As I see it, Beyond Meat is fighting an uphill battle. The company positions its products as alternatives to traditional meats. But right now, customers are looking for lower cost options. I think Beyond Meat can’t really compete on price without selling their products below cost. Furthermore, management has repeatedly declared their intent to compete on price. This means that a lot of potential cost savings are unlikely to improve the company’s margin profile.

I think that Beyond Meat’s products are solid. There is clearly a growing demand for plant based meats. The company’s products are some of the most well known in this category. However, the economics of these products aren’t great. I think that the company’s future is too dependent on factors outside of management’s control.

Cash Burn, Dilution, and Valuation

Beyond Meat is burning cash at a decent rate. Even as the business cuts expenditures, it is still burning up to $100 million each quarter. This gives the company a little over a year to turn things around.

I think it’s almost inevitable that Beyond Meat will have to raise more cash to fund operations. In the past, management made the smart move of issuing $1 billion in convertible notes during the height of the growth stock mania. But now it seems unlikely that the company will get good terms for future debt offerings.

I think the most likely scenario is that the business will be forced to dilute investors. This may also happen during a time when shares are trading at all-time lows. Plus, the company is trading at a forward EV/Sales of 3.8 times and has severely negative gross margins. I think that this is expensive for a company without the potential for high gross margins. Even without the cash burn issues, I believe there could be further room to fall.

While I am bearish, I think shares may have some upside potential. I think the business could eventually be a good acquisition target for an established food company. A larger conglomerate would have established production and marketing infrastructure. This acquirer could use their economies of scale to cut distribution costs and improve profitability.

Also, the stock fits the profile of a meme stock quite well. It has very high short interest, poor fundamentals, and a recognizable brand name. Stocks like this can defy their fundamentals for extended periods of time. This is the primary reason I don’t want to short the stock.

Final Verdict

Beyond Meat is an industry leader in a growing market. However, the business is seeing a sharp decline in growth and decreasing demand. The company’s fragile business economics make this a very risky stock. I think that the company’s future is too dependent on an economic recovery.

I do think there may be some potential for upside. But I don’t think speculation about an acquisition or “meme potential” are reasons to buy. I would want to see cash burn get under control before I’d consider buying. I recommend avoiding this stock, especially in the current environment.

Be the first to comment