adaask

Both Main Street Capital (NYSE:MAIN) and SLR Investment Corp. (NASDAQ:SLRC) are high yield business development companies (i.e., BDCs) (BIZD) that boast investment-grade credit ratings. In this article, we will compare them side by side and offer our take on which one is a better buy.

MAIN Vs SLRC – Balance Sheet

As was already stated, both boast investment grade credit ratings of Baa3 (Stable) or equivalent.

When we look at MAIN’s specifics, its 0.98x sticks out to us as on the low end relative to the broader industry. Furthermore, its liquidity of $518.4 million is pretty substantial relative to its market cap of $3 billion. Finally, it has little exposure to floating rate debt as only 20% of its total debt is floating rate, insulating it pretty well from the rising interest rate environment.

SLRC’s balance sheet is also quite strong, with an even lower leverage ratio of 0.96x, giving it significant room under its 1.25x leverage target range upper bound. It is also in good position to weather rising interest rates, with management stating on its latest earnings call:

our funding profile is in a strong position to weather a rising rate environment with $506 million up to $1 billion of funded debt comprised of senior unsecured fixed rate notes at a weighted average annual interest rate of 3.9%.

With both balance sheets in solid shape and at similar leverage ratios and credit ratings, we rate this category as a draw between them.

MAIN Vs. SLRC – Investment Portfolio

SLRC has a fairly defensively positioned investment portfolio given that 99.8% of its comprehensive debt portfolio is senior secured loans. On top of that, first lien senior secured loans make up a whopping 97.2% of its comprehensive debt portfolio, with the remaining 2.6% being second lien cash flow loans and second lien asset-based loans, which still have a degree of built-in conservatism. These loans also have a weighted average interest coverage ratio of 3.1x, which is pretty conservative.

In addition to the margin of safety built into the structuring of its loans, SLRC also employs significant diversification, with its investment portfolio spread across 780 distinct counterparties in over 100 industries.

This all has resulted in pretty low nonaccruals, currently standing at 0.6% of fair market value.

SLRC’s management emphasized on its most recent earnings call that the company is well-positioned for rising interest rates as well, stating:

our funding profile is in a strong position to weather a rising rate environment with $506 million up to $1 billion of funded debt comprised of senior unsecured fixed rate notes at a weighted average annual interest rate of 3.9%… if interest rates were to move another 100 basis points or 200 basis points, the portfolio at June 30, 2022, would generate $0.08 per share and $0.18 per share of incremental net investment income, respectively, on an annualized basis.

Meanwhile, MAIN has about 69% of its investments deployed into senior secured debt and 59% invested into floating rate debt. As a result, MAIN is also poised to benefit overall from rising interest rates. As its CEO stated on its Q2 earnings call:

One additional item that I wanted to touch on is the impact of rising interest rates. During the quarter, LIBOR rates increased by approximately 130 basis points from those in effect as of March 31st to June 30th. At the end of the second quarter, 80% of our outstanding debt obligations maintain fixed interest rates. On the other hand, approximately 75% of Main’s debt investments for interest rates at floating rates with weighted average contractual interest rate floor of low current market index rates. As a result, in a rising interest rate environment, our exposure to higher interest expense is largely mitigated and over time, increases to our interest income will exceed the increases to our interest expense. It is important to note that the majority of our variable interest rate investments are based on contracts which reset quarterly, whereas our credit facility resets monthly. As a result, we generally will have a quarterly lag in the realization of benefits from rate increases in our interest income and net investment income.

MAIN’s underwriting has generated strong results in the current environment, with nonaccruals at just 0.7% at fair value. One key difference to keep in mind is that MAIN has greater exposure to equity investments than SLRC, whereas SLRC is involved in more leases and loans. As a result, MAIN will likely outperform in economic expansions, whereas SLRC is probably more defensively positioned to weather economic downturns. Overall, we rate this segment a draw between the two given that their nonaccruals are in similar shape.

MAIN Vs. SLRC – Dividend Safety

MAIN’s dividend coverage is pretty solid at the moment thanks to distributable net investment income covering its total regular monthly dividends paid during the quarter at a 1.21x ratio, enabling it to even pay a special dividend. As management stated on its Q2 earnings call:

Based upon our results for the second quarter and the positive performance of our existing portfolio of companies, combined with our favorable outlook in each of our primary investment strategies and for our asset management business and the benefits of our efficient operating structure, earlier this week, our Board declared a supplemental dividend of $0.10 per share payable in September and an increase in monthly dividends for the fourth quarter of 2022 to $0.22 per share payable in each of October, November and December. These monthly dividends represent a 4.8% increase from the fourth quarter of 2021 and a 2.3% increase from the third quarter of 2022.The supplemental dividend for September is due to our strong performance in the second quarter, which resulted in DNII per share, it was over $0.13 or 21% greater than the monthly dividends paid during the quarter. This represents our fourth consecutive quarter of paying a supplemental dividend and result in total supplemental dividends paid over the last year of $0.35 per share, representing an additional 13% paid above our monthly dividends and an increase in total dividends paid for the trailing 12-month period of 18.5% over the prior year. We are pleased to have been able to deliver this significant additional value to our shareholders.

In contrast, SLRC is not currently covering its dividend. However, management believes it will be able to improve its coverage ratio moving forward, stating:

I think clearly, there’s a little bit more synergies that we expect from the Solar SUNS merger. The immediate one obviously came right through with the reduction in the management date. The additional opportunities here is clearly not only increased rates on the existing portfolio and yields, but new assets that we’ve been putting on. We did have an active quarter, but a lot of the activity came in late in the quarter.

So you’re not seeing that even though we ended the quarter at 0.96x leverage. You didn’t see the full earnings power of those additions. So that’s part of the bridge. The other part of the bridge is we’re obviously sitting at 0.96, which is the low end of our leverage range. So we see a little bit — based on our pipeline, we see a little bit of increase in the leverage, not material, but then we’ll give some portfolio expansion.

The additional lever that we just touched on is a more efficient vehicle for financing the lower-yielding cash flow assets, which you know in the past has been very accretive. People, including ourselves, that have used that structure. Additionally, as Michael mentioned, our commitment to the buyback will add a couple of cents there as well. So we do have a number of levers. And I think we like that. It’s not just one thing that we’re going to hit a button, and we’re going to get there, but we have multiple levers that we think will, in aggregate, exceed the dividend in terms of the earnings power of the platform.

As a result, we give MAIN the clear edge in this category.

MAIN Vs. SLRC – Track Record

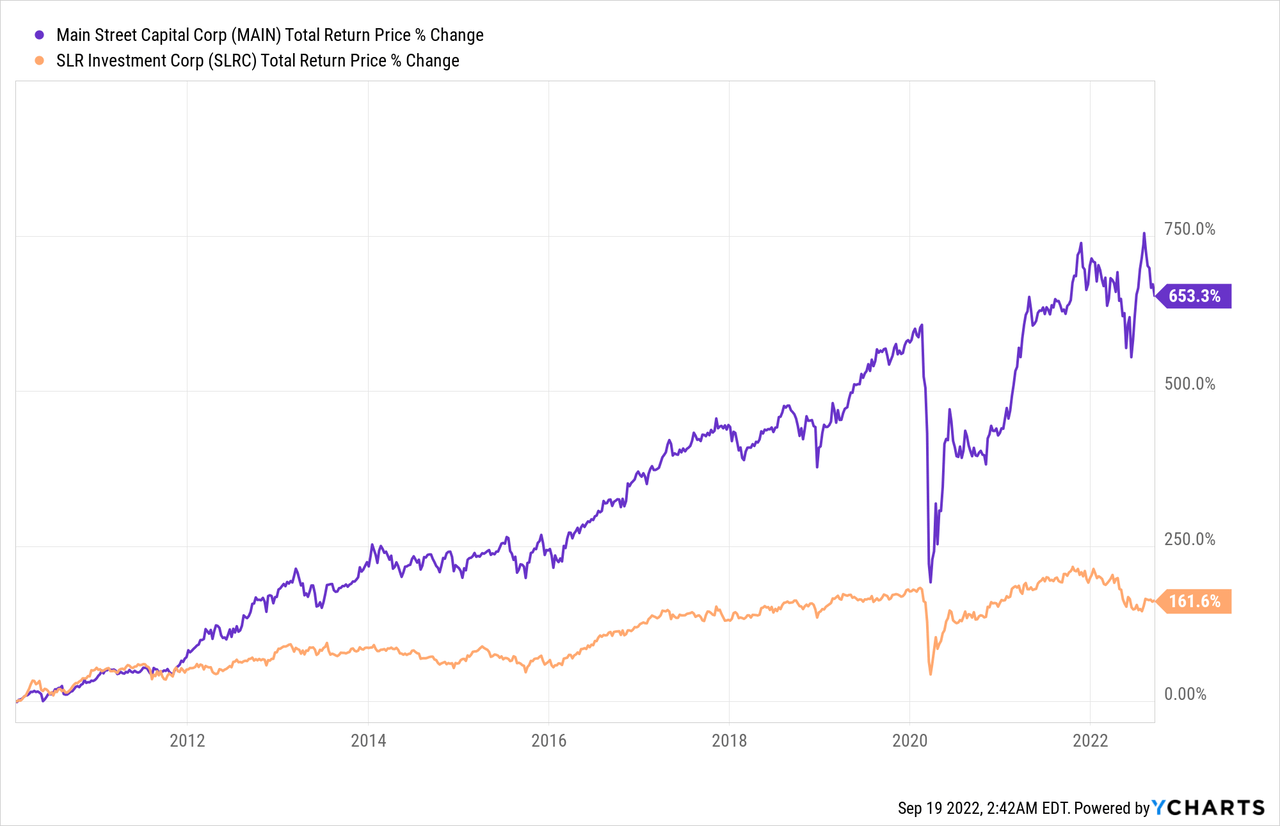

MAIN has a hands-down better track record than SLRC, as it has crushed SLRC since SLRC went public:

MAIN Vs. SLRC – Risks And Catalysts

As BDCs, the risks and catalysts facing MAIN and SLRC are very similar, though MAIN is more exposed to economic cycles given its greater focus on equity investments. However, both are positioned to benefit from rising interest rates as long as their counterparties are able to service the increased interest expense.

MAIN Vs. SLRC – Valuation

SLRC’s valuation is considerably cheaper than MAIN’s across a variety of metrics on both a relative and historical manner:

| Valuation Metric | SLRC | MAIN |

| P/E | 9.43x | 12.81x |

| P/E (5 Year Average) | 11.42x | 15.70x |

| Dividend Yield | 12.7% | 6.92% |

| Dividend Yield (5 Year Average) | 8.81% | 7.19% |

| P/NAV | 0.81x | 1.56x |

| P/NAV (5 Year Average) | 0.91x | 1.63x |

On top of that, SLRC is working to capitalize on its steep discount to NAV at the moment as management has announced a plan to repurchase $50 million in stock in the near future, which represents a considerable percentage (~6%) of its $823 million market cap.

When compared with MAIN’s excessively rich valuation metrics, SLRC clearly wins this segment hands-down.

Investor Takeaway

While MAIN’s track record and dividend safety are clearly superior to SLRC’s at the moment, SLRC still has some things going for it. First and foremost, SLRC is way cheaper than MAIN, and management appears committed to unlocking that deep value by repurchasing stock aggressively. Moreover, SLRC has greater exposure to asset backed loans and leases whereas MAIN has greater exposure to equity investments.

As a result, given that we are expecting an economic downturn in the coming quarters, we believe that SLRC offers investors a better risk-reward at the moment. At the same time, we recognize that MAIN’s long-term track record is excellent and expect it to be a decent long-term investment for patient investors. Overall, we rate SLRC a Buy and MAIN a Hold at current prices.

Be the first to comment