Justin Sullivan/Getty Images News

By Brian Nelson, CFA

In a prior note, we talked about how Procter & Gamble’s (PG) shares may have peaked for this market cycle. But P&G isn’t the only bellwether encountering pain with respect to rising input costs. In many ways, Colgate-Palmolive (NYSE:CL) may fare worse than Procter & Gamble in this inflationary environment. The toothpaste maker released its calendar first-quarter report April 29, and while Colgate-Palmolive revealed 4% organic growth in the period, GAAP earnings per share declined a whopping 18%, with earnings per share falling 8% for its core business. The culprit? 220 basis points of pressure on its gross margin from the same period a year ago due to inflationary pressures. Here’s what management had to say in the first-quarter 2022 earnings press release:

While our growth continued on the top line, our profitability was impacted by significant increases in raw material and logistics costs worldwide, and we expect the difficult cost environment to continue for the next several quarters. We remain sharply focused on our revenue growth management, including additional pricing, and funding-the-growth and other productivity initiatives. As we manage through this difficult time, we are committed to executing our plans with the right balance of pricing, productivity and brand support.

As we look around the world, there is still much uncertainty stemming from the COVID-19 pandemic, supply chain disruptions, the war in Ukraine and volatility in consumer demand and currencies. Despite this environment, we are encouraged by our growth momentum, the strength of our innovation pipeline and the progress we are making on our digital transformation, all of which add to our confidence that we have the right strategies in place to continue to deliver sustainable, profitable growth over the long term.

Procter & Gamble and Colgate-Palmolive aren’t the only ones in the consumer staples space that are feeling the pinch from higher inflationary pressures either. From where we stand, it’s clear that pricing increases across the consumer staples space aren’t preserving the gross margins of many consumer staples names, by any stretch, indicating that the worst of gross margin pressure may still be ahead, especially as consumers may balk at price increases that still fall short of offsetting higher input costs. Price-driven revenue expansion, as many in the consumer staples arena are experiencing, should translate into higher gross margins, but that’s just not happening, unfortunately.

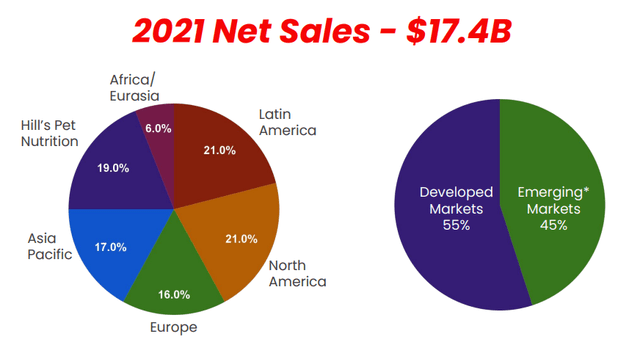

With that said, Colgate-Palmolive remains one of the strongest consumer staples names out there, and frankly it’s hard not to stand in awe of the company’s scale and diversified product line-up. As a $17.4 billion consumer products giant, the company has ~34,000 workers and serves over 200 countries and territories. It will take more than a rough patch in terms of margins to derail this storied company. Our fair value estimate of Colgate-Palmolive stands at ~$70 at the time of this writing, so we only see modest downside risk to shares, which are trading in the mid-$70s. A lofty dividend yield of ~2.5% means that shareholders get paid to wait as Colgate-Palmolive works through inflationary pressures like many of its peers.

Colgate-Palmolive‘s Investment Considerations

Colgate-Palmolive is a well-diversified consumer products giant. (Image: Colgate-Palmolive’s Investor Overview, May 2022 )

Colgate-Palmolive is a leader in oral/personal care with the top toothpaste, manual toothbrush, and liquid hand soap brands across the world. Its portfolio includes Colgate Total, Colgate Plax, and Palmolive along with its Hill’s Pets Nutrition segment. Colgate is the most penetrated brand in toothpaste, according to the firm. The company was founded in 1806 and is headquartered in New York, New York.

Colgate is prioritizing growth at its e-commerce businesses while improving its marketing strategies, with a focus on social media and living streaming opportunities. The company’s international growth runway is immense. It operates across four main categories: ‘Oral Care,’ ‘Pet Nutrition,’ ‘Personal Care,’ and ‘Home Care,’ and it has driven considerable growth in base business EPS, advancing the measure to $3.21 per share in 2021 from $2.83 in 2019. Diluted earnings per share faced considerable pressure during the first quarter of 2022, however, something that investors should not take lightly.

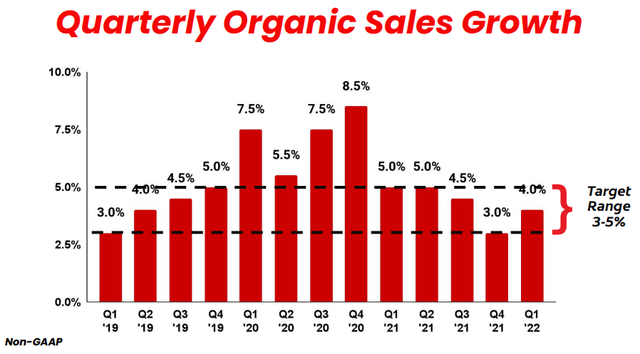

Colgate-Palmolive has been able to drive organic sales at a nice pace for some time now. (Image: Colgate-Palmolive’s Investor Overview, May 2022 )

Core drivers of Colgate’s profitable growth moving forward include customer engagement, pricing, and revenue growth management. The company’s organic sales growth rates have impressed of late and digital media investments are being prioritized to keep the momentum going in the right direction. 2021 e-commerce growth was an impressive 27%, accounting for 13% of total sales. Cost inflation headwinds are building in the near-term, however. Management has pointed to “significant increases in raw material and logistics costs worldwide,” and that it expects “the difficult cost environment to continue for the next several quarters.” Investors should expect a tough environment during 2022.

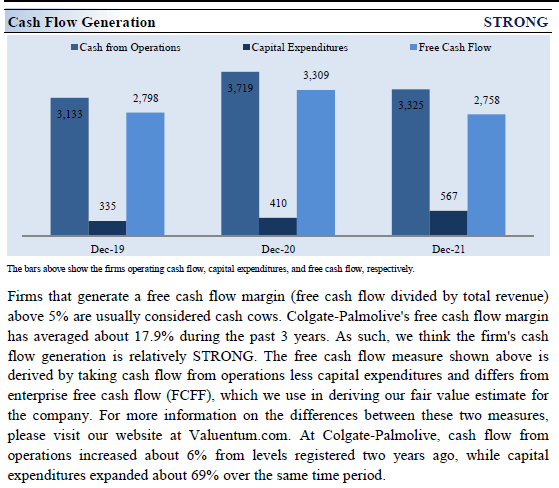

In 2019, Colgate acquired Laboratoires Filorga Cosmétiques, a skin care company, for ~USD$1.7 billion in cash. In 2020, Colgate acquired Hello Products, an oral care company, for ~USD$0.35 billion in cash. Colgate is a serial acquirer and acquisitions represent a core part of its business strategy. The company has also been a strong cash flow generator, helping to assuage concerns that it may be stretching too far with its acquisitive nature.

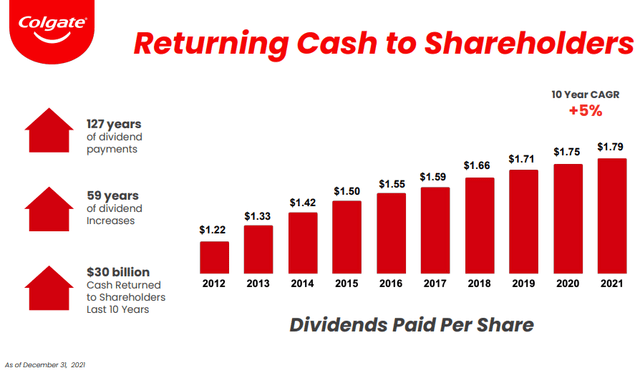

Colgate has raised its dividend in each of the past nearly 60 years. (Image: Colgate-Palmolive’s Investor Overview, May 2022 )

Colgate has raised its dividend every year for the past ~60 years, a remarkable track record. As the image above notes, management is extremely shareholder friendly, having returned an impressive $30 billion to shareholders during the last 10 years. The firm is revamping its IT operations to place a greater focus on analytics in order to stay competitive and to speed up product development timetables.

Colgate-Palmolive’s Economic Profit Analysis

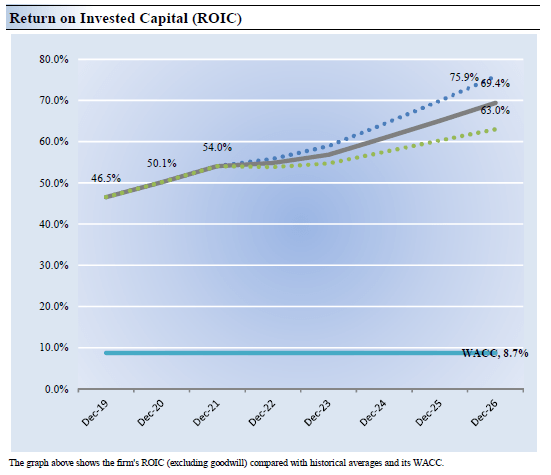

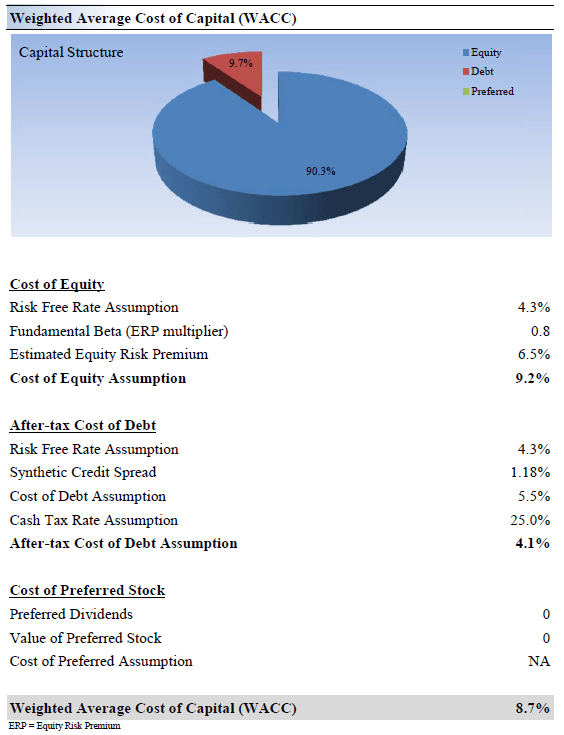

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Colgate-Palmolive’s 3-year historical return on invested capital (without goodwill) is 50.2%, which is above the estimate of its cost of capital of 8.7%.

As such, we assign Colgate-Palmolive a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Despite cost headwinds during 2022, we expect Colgate-Palmolive to continue to generate value for shareholders.

Image source: Valuentum. The probable path of Colgate-Palmolive’s economic profit stream. (Image source: Valuentum) Image source: Valuentum. How we calculate Colgate-Palmolive’s weighted average cost of capital. (Image source: Valuentum)

Colgate-Palmolive’s Cash Flow and Valuation Analysis

Image source: Valuentum. Colgate-Palmolive is an impressive free cash flow generator. (Image source: Valuentum)

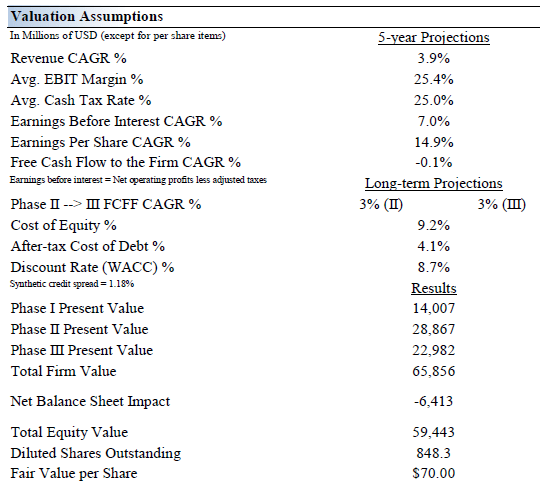

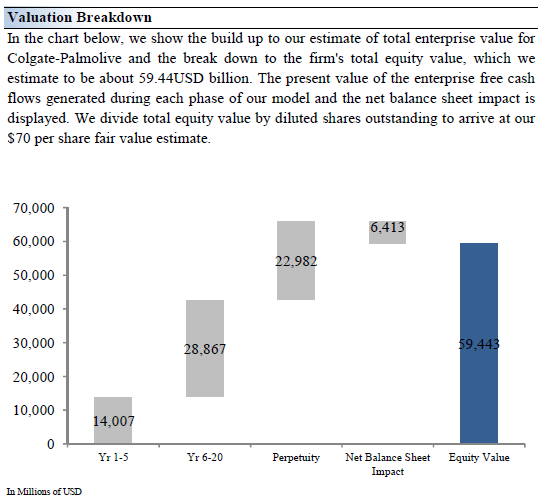

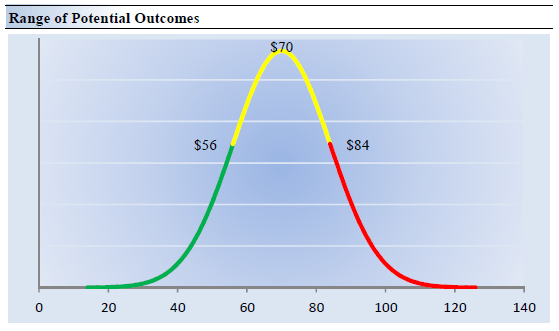

On the basis of our discounted cash flow process, we think Colgate-Palmolive is worth $70 per share with a fair value range of $56-$84 per share. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 3.9% during the next five years, a pace that is higher than the firm’s 3- year historical compound annual growth rate of 3.9%.

Our valuation model reflects a 5-year projected average operating margin of 25.4%, which is above Colgate-Palmolive’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3% for the next 15 years and 3% in perpetuity. For Colgate-Palmolive, we use a 8.7% weighted average cost of capital to discount future free cash flows.

Image source: Valuentum. Our key valuation assumptions for Colgate-Palmolive. (Image source: Valuentum) Image source: Valuentum. The distribution of value composition for Colgate-Palmolive based on our discounted cash flow process. (Image source: Valuentum)

Colgate-Palmolive’s Margin of Safety Analysis

Image source: Valuentum. The fair value estimate range for Colgate-Palmolive based on our assessment of its risk rating. (Image source: Valuentum.)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm’s fair value at about $70 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example).

After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Colgate-Palmolive.

We think Colgate-Palmolive is attractive below $56 per share (the green line), but quite expensive above $84 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Colgate-Palmolive is a Dividend Aristocrat with a stellar track-record. The firm has paid uninterrupted dividends on its common stock since 1895, and Colgate has raised its payout over the past ~60 consecutive years (adjusting for stock splits). That streak is supported by Colgate’s dominant position in the oral care business, led by products sold under its namesake Colgate brand. Additionally, Colgate is a big player in the personal care market though its Palmolive, Softsoap, Speed Stick, and Sanex brands, and increasingly, Colgate is becoming a bigger player in the pet nutrition space through its Hill’s brand. We expect Colgate will continue growing its payout going forward.

Colgate has been around for a very long time, having been founded in 1806, and despite vigorous global competition, very few other firms can match its brand awareness and share strength in key consumer staples verticals. The company will still have to be active in launching new innovative products and line extensions to retain its dominance, however. One of Colgate’s biggest weaknesses is its net debt load, a product of its sizable share repurchases and numerous acquisitions over the years (the company is a serial acquirer). Given its high quality cash flow profile, we view Colgate’s net debt load and future dividend obligations as manageable. 2022 may be a difficult year for the company, but its lofty ~2.5% dividend yield remains quite attractive. Colgate-Palmolive’s Dividend Cushion ratio stands at a healthy 1.5.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment