NeilLockhart

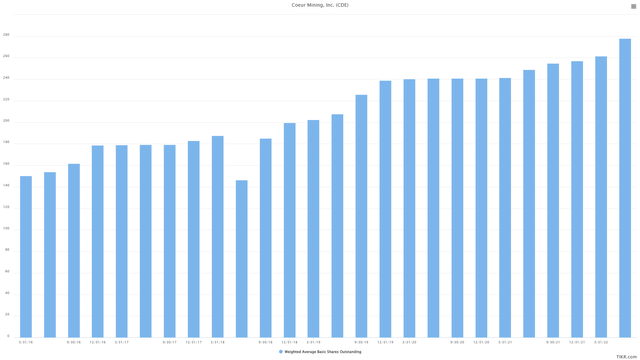

Just over five months ago, I wrote on Coeur Mining (NYSE:CDE), noting that there was a risk of share dilution to improve the balance sheet to ensure it could complete its Rochester Expansion. We saw this shortly after, with Rochester not only selling its Victoria Gold (OTCPK:VITFF) stake but also completing a $100 million At-The-Market Equity offering. Not surprisingly, the stock has declined 30% since then, with Coeur continuing to have one of the worst track records of share dilution sector-wide. Let’s look at the Q2 results and updated valuation to see if the stock is worth betting on at $3.00 per share.

Coeur Mining – Shares Outstanding (TIKR.com)

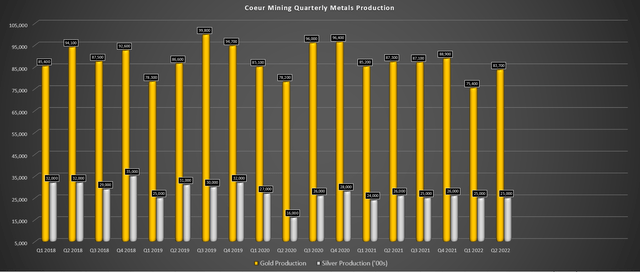

Q2 Production

Coeur Mining released its Q2 results last month, reporting quarterly production of ~83,700 ounces of gold, and ~2.5 million ounces of silver, a 4% decline from the year-ago period. This was related to lower production at its three largest gold-producing assets (pre-Rochester Expansion). In the silver segment, production was also down, with another mediocre quarter from Palmarejo and Rochester, where silver production is down sharply from 2019 levels due to lower grades.

Coeur Mining – Quarterly Production (Company Filings, Author’s Chart)

Beginning with Palmarejo, the Mexican asset produced ~27,100 ounces of gold and ~1.80 million ounces of silver in the period, with silver production up only because the mine was up against easy year-over-year comps (Q2 2021: 1.67 million ounces – its second-worst quarter since Q4 2019). While gold grades have continued to drop at Palmarejo, the asset benefited from better recovery rates of 92.4% on gold and 84.2% on silver, which helped the asset to see an increase in gold production combined with higher throughput (~539,600 tonnes milled). The recovery improvements were due to blending optimization and enhancements in the flotation and solution management processes.

Palmarejo Mine (Company Website)

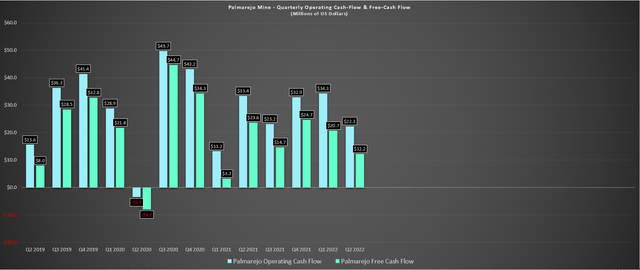

Adjusted costs applicable to sales at Palmarejo dipped to $12.97/oz from $13.34/oz, but the adjusted cost of sales per gold ounce soared by 29% to $855/oz (Q2 2021: $662/oz). As shown below, this was the weakest quarter since Q1 2021 for Palmarejo from a cash flow standpoint, with just $12.2 million in free cash flow, down from $33.4 million in the year-ago period despite similar capital expenditures. Given that this is the only asset generating significant free cash flow for Coeur, it’s no surprise that free cash flow was negative on a company-wide basis with the increased spending on its Rochester Expansion Project.

Palmarejo Mine – Quarterly Cash Flow (Company Filings, Author’s Chart)

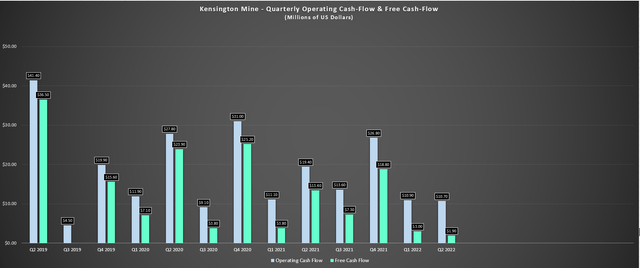

Moving to Kensington, the Alaskan operation saw a marginal decline in production year-over-year, but costs at the operation rose sharply. During Q2, adjusted costs applicable to sales per ounce increased to $1,399/oz, up from $1,088/oz in the year-ago period. This led to a significant dip in operating cash flow, and when combined with increased capital expenditures, quarterly free cash plunged to $1.9 million (Q2 2021: $13.4 million). Coeur noted that it is raising its FY2022 cost guidance by $150/oz at the mid-point to $1,350/oz, reflecting higher diesel, labor, and maintenance costs. Assuming an average realized gold price of $1,850/oz, Coeur will have just $500/oz margins in FY2022 at Kensington, a sharp decline from year-ago levels ($675/oz).

Kensington Mine – Quarterly Cash Flow (Company Filings, Author’s Chart)

Meanwhile, at its two smaller gold-producing assets, Rochester and Wharf combined for just ~28,800 ounces in the period, down from a combined ~31,300 ounces in the year-ago period. While Rochester’s gold production was higher, costs remained elevated at $1,763/oz. During the quarter, Rochester saw a cash outflow of $56 million with the increase in spending as the Rochester Expansion heads closer to completion. At Wharf, adjusted costs applicable to sales soared to $1,233/oz, up 28% from the year-ago period. Fortunately, the mine still generated free cash flow, but cost guidance was revised, moving to $1,300/oz at the mid-point.

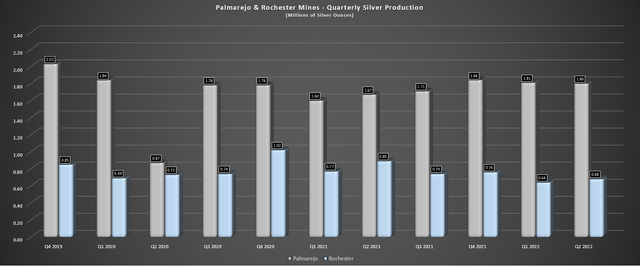

Palmarejo/Rochester Quarterly Silver Production (Company Filings, Author’s Chart)

Finally, looking at the silver segment, we can see that silver production remains at lower levels than pre-COVID-19, and costs are much higher, with Rochester reporting costs of $20.85/oz vs. $13.19/oz in Q2 2019 and $11.89/oz in Q2 2018. Coeur noted that it is revising cost guidance higher to $23.00/oz at the mid-point vs. $21.75/oz previously, leaving little room for margins at the asset. The silver lining is that more than half of Rochester Expansion capital has been incurred, it should come in below $640 million (current estimate: $600 million), and production should increase materially once complete in H2 2023.

Costs & Financial Results

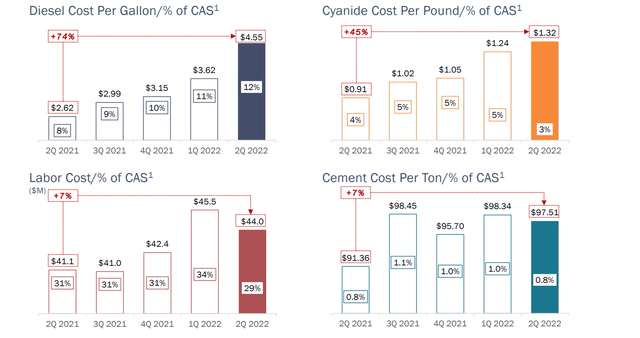

Looking at Coeur’s costs, we can see why cost guidance was raised at multiple assets, with diesel, cyanide, labor, and cement costs continuing to trend higher. The good news is that cement prices appear to be off their peak, and labor costs don’t appear to be as bad as some other companies, with many producers noting that they’re seeing double-digit rises in labor costs due to a heavier reliance on contractors. The most affected regions appear to be Ontario and Western Australia, where Coeur does not operate.

Coeur Mining – Rising Costs (Company Presentation)

Given the sharp increase in costs in the period and the costs that have been revised higher in recent technical reports completed by other companies, the cost assumptions in the Rochester Technical Report look ambitious. In the report, mining costs were estimated at just $1.39/ton and crushing/processing costs at $2.11/ton, suggesting that the previous outlook for $104 million in annual free cash flow generation for the first ten years might be a high estimate. That said, we will still see a dramatic improvement in Coeur’s cash flow profile from the massive outflows we’re seeing currently.

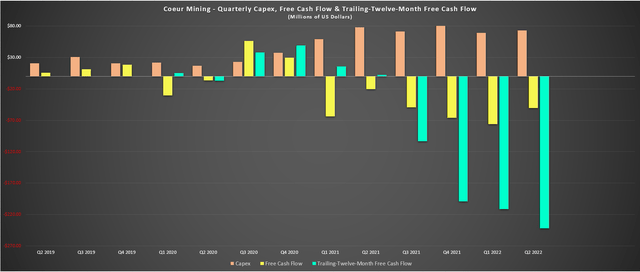

Coeur – Quarterly Capex & Free Cash Flow (Company Filings, Author’s Chart)

During Q2, Coeur reported revenue of $204.1 million, a 5% decline year-over-year despite the higher gold price. Meanwhile, it reported a cash outflow of $50.6 million in the period vs. a cash outflow of $20.2 million outflow during Q2 2021. This was related to elevated capital expenditures with Coeur being in the latter portion of the Rochester Expansion and the impact of much lower operating cash flow due to reduced profitability with higher operating costs across the board. On a trailing-twelve-month basis, Coeur has reported a cash outflow of ~$241 million, with net debt now sitting at more than $400 million, translating to a net debt to adjusted EBITDA ratio of 2.7x.

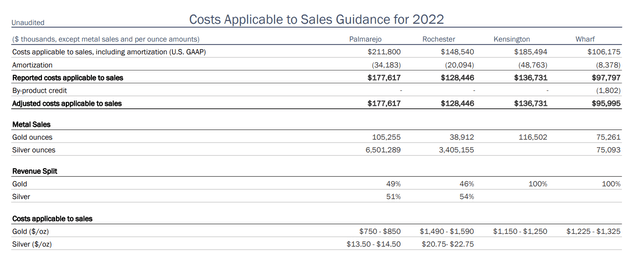

The good news is that the company has hedges for over 220,000 ounces at an average price near $1,970/oz gold, de-risking its expansion plans even if we see a slight cost overrun. As it stands, Coeur has ~$360 million in total adjusted liquidity and up to $400 million in total potential liquidity from the addition of equity investments, meaning that there’s a very low risk of further share dilution, as we saw from Argonaut (OTCPK:ARNGF) which completely mismanaged Magino. That said, if inflationary pressures persist and metals prices don’t improve, Coeur will continue to have relatively high costs vs. the industry average (shown below with adjusted 2022 cost applicable to sales guidance, which isn’t ideal for a company with a weaker balance sheet.

Coeur Mining – 2022 Adjusted CAS Guidance (Company Presentation)

Valuation

Based on ~280 million shares and a share price of US$3.01, Coeur trades at a market cap of $843 million and an enterprise value of ~$1.32 billion. This might appear very cheap for a company of its size (~450,000 GEOs per annum) operating in mostly Tier-1 jurisdictions, and it now trades at ~5.5x FY2023 cash flow per share estimates. While this is a massive discount to its historical cash flow multiple, I believe much of this discount is justified and don’t see any reason the stock would back up to its historical multiple of 12.6x cash flow (10-year average). The reason is that Couer has proven it has one of the worst track records of share dilution sector-wide among its peers and has one of the ugliest production growth per share trends in the industry.

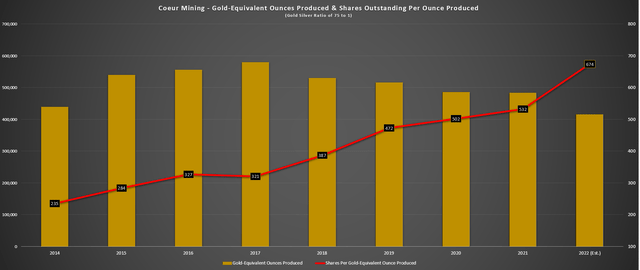

Looking at the chart below, the amount of shares per gold-equivalent ounce produced has nearly tripled in 8 years from 235 to estimates of 674 in FY2022. The latter metric is based on ~280 million shares divided by estimates of 415,000 GEOs produced at a 75 to 1 ratio.

Coeur Mining – GEO Production & Shares Outstanding Per GEO Produced (Company Filings, Author’s Chart)

Given this continued share dilution and the weak balance sheet (net debt of ~$400+ million), I see Coeur as a much higher risk bet than its peers. Besides, while its gold hedges provide some buffer against lower prices, the benefit has been eroded by inflationary pressures, and I would expect less than the $100 million in estimated free cash flow (first ten years) from Rochester previously assumed at more conservative metals price assumptions ($1,725/oz gold / $20.00/oz silver) after factoring in inflationary pressures on operating costs (labor, diesel, consumables).

So, while Coeur will certainly be in a much better cash flow position post-2023 with Rochester operating at a much higher rate, I don’t expect the debt paydown to be as quickly as some expect. Based on this, I think it’s harder to assign much value to Silvertip. A Silvertip restart is being dangled in front of investors, but this looks like a 2028 opportunity, not 2025 as some might assume. This is especially true given the larger scope of the project being explored. The larger scope project should come with much higher capex and potentially more permitting work, meaning this won’t be a small incremental capex bill that can be funded in 2024 or H1 2025 with Couer’s debt levels still elevated.

Summary

To summarize, I see Coeur Mining as an average producer at best, based on its current assets, and when there are companies like Agnico Eagle (AEM) that can be bought for ~7.5x cash flow, it makes little sense to stoop to owning Couer at ~6x forward cash flow estimates. Some will argue that Silvertip and Rochester are game-changers that will transform the company. Still, given the company’s track record of underperformance, it’s difficult to put much faith in future prospects, even if Rochester is nearing the finish line. Finally, while exploration is opening up new opportunities, Kensington has a 2-year mine life, potentially offsetting some production growth from Rochester. For these reasons, I see far better opportunities elsewhere in the sector.

Be the first to comment