Joe Corrigan/Getty Images Entertainment

Introduction

For the purpose of this note, we will explore Affirm’s business during a high rate environment or a recession that may be imposed by higher rates. This note will illustrate Affirm’s resiliency and why Affirm’s business model is more valuable and demand higher fees during times of economic uncertainty. Affirm recently reported its fiscal year Q3 2022 results which were well perceived by the markets. I invite you to read my analysis of Affirm’s last quarter, Affirm: We Are Just Getting Started

Investment Thesis

Affirm (NASDAQ:AFRM) is reorienting money movement by creating an entirely new payments network that is software-defined, vertically integrated, and data preserving which enables Affirm to offer products that are highly configurable. For the purpose of this note, we will explore the value of Affirm’s products during higher rate environments, specifically for consumers and merchants, as Affirm’s network is a 10x better alternative for merchants to process payments and for consumers to access fair financial products tailored fit to their needs.

The implications of higher inflation:

-

Consumers are more likely to use Affirm during higher interest rate environments because they will need to better manage their cash flows while absorbing less credit card debt due to higher rates.

-

Merchants are more likely to offer Affirm at the point-of-sale (POS) because it leads to higher conversions and higher average order values (AOVs) as Affirm enables its merchants to process more transactions from more customers.

-

Affirm will experience higher funding costs due to higher rates, but Affirm will ultimately demand higher fees for the services it provides as it demonstrates its ability to accurately underwrite risk. Affirm will tighten its underwriting models so that its products demand higher fees during times when Affirm’s products are either more valuable to merchants or consumers. As Affirm tightens its underwriting, it will tighten its funding costs which will thereby increase the demand for its products as Affirm will demand higher take rates because its superior underwriting enables merchants to access new sources of sustainable revenue.

Consumer Products

When it comes to consumers, Affirm is uniquely aligned with its customers as it doesn’t charge late fees or encourage consumers to build up revolving debt. Instead of charging late fees or revolving interest, Affirm depends on its underwriting to accurately identify risk and price credit. Affirm offers consumers a variety of options when they go to make a purchase, whether through a normal “instant” debit transaction, Split Pay (8-week installments), non-interest-bearing short or long duration loans as well as interest-bearing loan products, Affirm makes the terms clear for its customers while it can guide each user to the best financial product, tailored to their needs, and based on the specific purchase for which credit is extended (if any at all).

Since Affirm’s revenue is directly tied to its ability to underwrite and accurately price credit, Affirm is directly aligned with its users and their ability to pay them back when Affirm extends someone a loan. Affirm’s superior risk modeling and underwriting combined with Affirm’s delightful financial products are meant to win over the trust of consumers while also helping consumers better manage their cash flows.

How might Affirm accomplish this?

Through everyday financial products.

Affirm Debit+ will be released to the public in the fourth quarter of 2022 and represents Affirm’s first everyday financial product for consumers. Affirm Debit+ is unbundling the credit card stack because it combines the functionality of a traditional debit card and Affirm’s gamut of financial products. With Debit+, consumers can fund their instant pay purchases directly from their bank account, while users will also have the option to choose to pay overtime for eligible purchases within 24 hours of the transaction from their Affirm Debit+ App.

Affirm will offer its full realm of financial products as options for Debit+ while it has yet to roll out Affirm Rewards. Affirm Rewards will bring cash back rewards to Debit+ which will engage users as well as incentivize healthy consumer behavior. Affirm will reward its customers who demonstrate healthy spending habits and who frequently shop with Affirm. Affirm encourages healthy spending behaviors because it doesn’t “grease the wheels” for regular commerce transactions for small AOVs like credit cards, rather Affirm enables its users to fund purchases directly from their bank account or choose to pay over time.

We believe paying overtime without late fees and gotchas will be in greater demand during a downturn. It is our mission to improve people’s lives and we will be prepared to meet this demand. But again, our approach is only to extend credit that we believe can and will be repaid. The multibillion-dollar business we have today is the result of years of trial and error, ideation, and execution. One of the many attractive properties of operating a network at scale is that it can be very cost-effective to deliver new products and services to a large active audience.” – Affirm’s Q3 2022 Earnings Call

Because there are no hidden fees or “gotchas” consumers will be more inclined to choose Affirm at the checkout page or as their everyday financial product, especially once Affirm announces the reward offers for Debit+. Debit+ is similar to Affirm’s Adaptive Checkout in the sense that it’s like a meta product, and Affirm can offer multiple different products or engage with a variety of parties or networks through one card that can be controlled through a mobile app. Debit+ builds trust between Affirm and its users, but only because Affirm has created a 10x better product that meets the price point as the consumer needs, while it’s also highly configurable.

More on this idea of the reoriented payments network can be found in the link below featuring two of Affirms founders.

- Max Levchin of Affirm on The Future of Credit: Reimagining the Financing Ecosystem

Merchant Products

As consumers look to manage their cash flows more carefully, Affirm’s products will be in greater demand for consumers as well as merchants.

-

Affirm underwrites its loans at the transaction level, therefore, Affirm’s loan portfolio is well-diversified since it’s a pool of loans of individual transactions.

-

Additionally, this enables Affirm to generate an abundance of relative information that is valuable for merchants. For example, during the call, Levchin described how during the onset of the pandemic, Affirm went to merchants and adjust its credit approvals based on whether the partnered merchant wanted to focus on their top-line or bottom-line. Affirm demands higher fees when it supplies credit during moments of uncertainty, while it can also tighten its credit models and lower its fees at partnered merchants focused on their bottom line.

Our proprietary network of directly integrated merchants as well as other sources of non-traditional underwriting data offers us a significant raw data advantage into feature engineering. We maintain a library of over 500 features that we select from as we create new models or update existing ones, while continuously looking for and eliminating any potential for disparate impact in our decisioning both at individual variable and model levels. We train our models using academically well-understood and boosting technique with significant proprietary modifications we’ve invented that help us improve results. Because from the very beginning, we focused equally on consumer and merchant information, we ended up with a large number of models that are specific to our products and merchants who use them. Moreover, as we launch new products with new and existing partners, we acquire new types of data that we incorporate into the models and over time give incremental weight too.”- Max Levchin, FYQ2 2022 Earnings Call

Not only does Affirm use over 500 features to underwrite its loans, but it uses these data points to provide insights for merchants to leverage customers’ behavior with specific SKUs and the product manufacturer. As Affirm rolls out solutions with its merchants, it learns and develops new products that it will then modify and tailor for its other merchants. – Author’s Previous Affirm Note

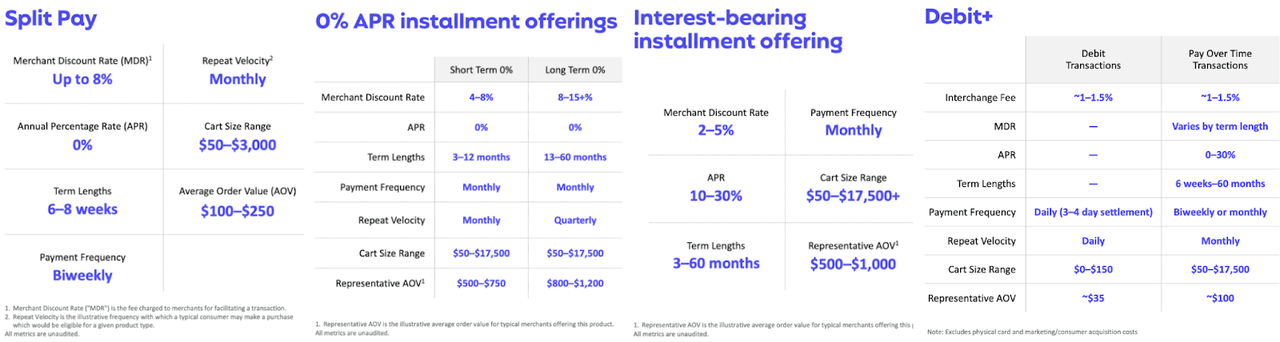

Affirm’s fees are derived from merchants (referred to as the merchant discount rate (MDR) or merchant fee rate) and are directly correlated to the services Affirm provides. For example, as Levchin mentioned in the Q2 earnings call, Affirm tailors its products to the demands of the merchant as well as the consumer. For example, if a merchant wants to boost its top-line revenues it will partner with Affirm to offer non-interest-bearing loans at its POS while the merchant or product manufacturer can subsidize 0% APR loans, such as Split Pay, for specific merchandise at the POS. This results in higher MDRs for Affirm compared to its interest-bearing products, which enables merchants to drive more sales with lower costs or MDRs as the consumers subsidize the product. In return, consumers get to plan out their purchases and pay over time with clearer terms, which ultimately benefits all parties involved. Non-interest-bearing loans and Split Pay will be in greater demand during rising-rate environments as 0% APRs are more appealing to merchants and consumers.

The thing that I think people really misunderstand about our products, maybe because it is more popular outside of high finance perhaps, when the interest rates go up and the prices go really — when prices go up, our product is more useful. If you try to make ends meet and you’re trying to pay for a couch and your credit card is confusing you and the rates just went up and it ends, Affirm gives you clarity and a way to pay for things and a clear schedule and then you’re done and there are no late fees. And half the time, plus or minus, the seller will sponsor a new payment interest.

Just here are the basic thought experiment. If the card rates that you paid went up 5%, for example, how do you feel about the 0% rate that a seller at a homeware shop is offering you powered Affirm, like it’s 5% more compelling. And so as inflation happens, the product that we provide is actually more powerful and more useful, has significantly better bearing on sort of the consumer demand side of it.” – Max Levchin, FYQ2 2022 Earnings Call

The Gamut Of Affirm’s Financial Product:

Affirm Investor Forum

Affirm’s loan products benefit a wide range of merchants, especially considering that Affirm offers loans ranging from $50 to $17,500. Merchants who want to grow their top-line or expand their bottom-line are able to do so when they partner with Affirm, while they also benefit from Affirm’s data preserving network.

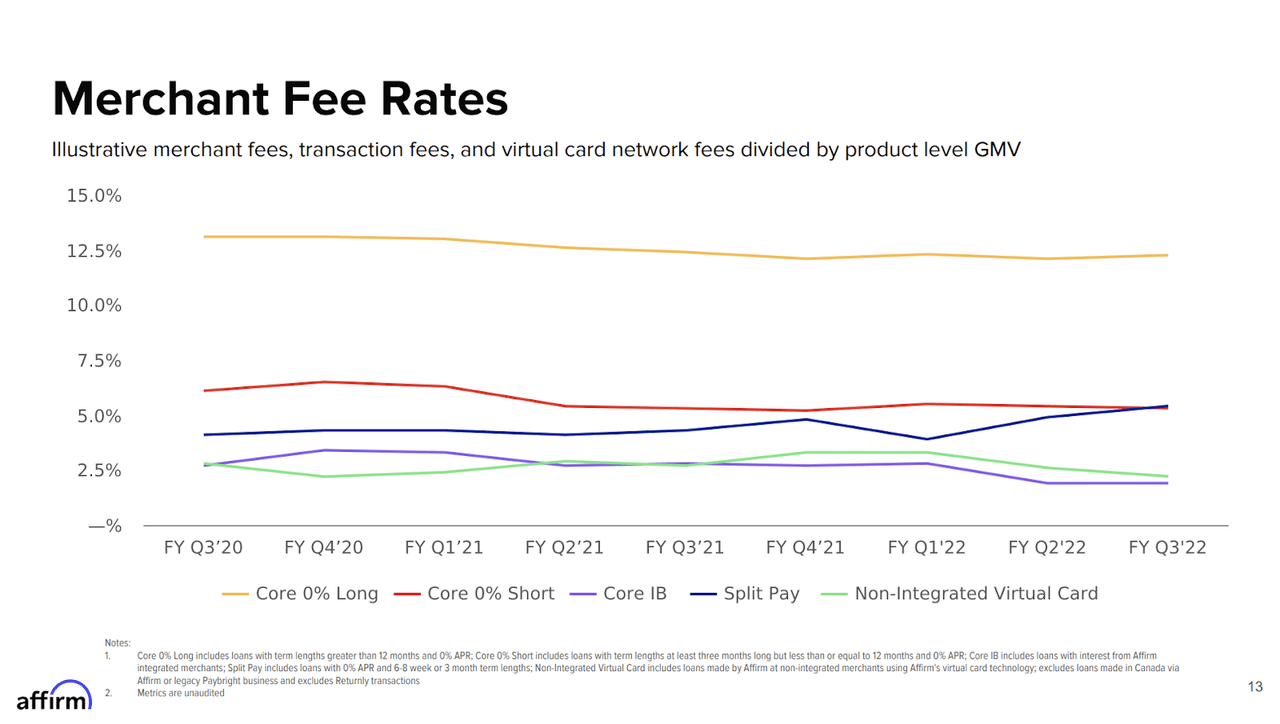

Affirm FYQ3 2022 Investor Presentation

If you look at the merchant fee rate slide in our supplement, you’ll see, again, relatively constant merchant fees. We view that as a real market of success in the face of pretty heavy competition, we’re able to maintain and even grow in some cases, the merchant side. And of course, as we talk a lot about on the APR side and the consumer side. Those rates are strong enough to allow us to deliver really compelling unit economics.” – Michael Lindford, Affirm CFO

The overall strength in Affirm’s merchant fee rates and Affirm’s overall take rate indicate that there’s strong demand for Affirm’s underlying products. Given that capital is in higher demand when interest rates are rising, Affirm’s products become increasingly more valuable to merchants as they are able to unlock the benefits of Affirm’s software-defined, vertically integrated payments network to ultimately guide consumers to the appropriate financial products.

Affirm is reshaping consumer expectations when it comes to commerce because now brands are responsible for ensuring that their customers are offered friendly financial products when they make a purchase from their store rather than offering a layaway option with accruing interest or late fees. Walmart announced before the last holiday season that it was scrapping its layaway program instead of electing to go with Affirm. Merchants are starting to look to Affirm to help their customers experience healthier financial lives while ultimately driving higher conversions and providing them a means to fund their purchases. Since Affirm is fundamentally aligned with both the financial stability of its customers and driving sales for its merchants, Affirm’s network is able to demand higher fees because it produces quality assets with each loan it underwrites.

Ultimately, Affirm’s underwriting will be in greater demand for merchants looking to drive their top or bottom line in times of less liquidity (when liquidity is in greater demand). This is supported by Affirm’s revenue less transaction costs which were 4.7%, up from 4.1% the prior two quarters, indicating the strong demand for Affirm’s products. This was also above management’s long-term guidance of revenue less transaction costs of 3% to 4%.

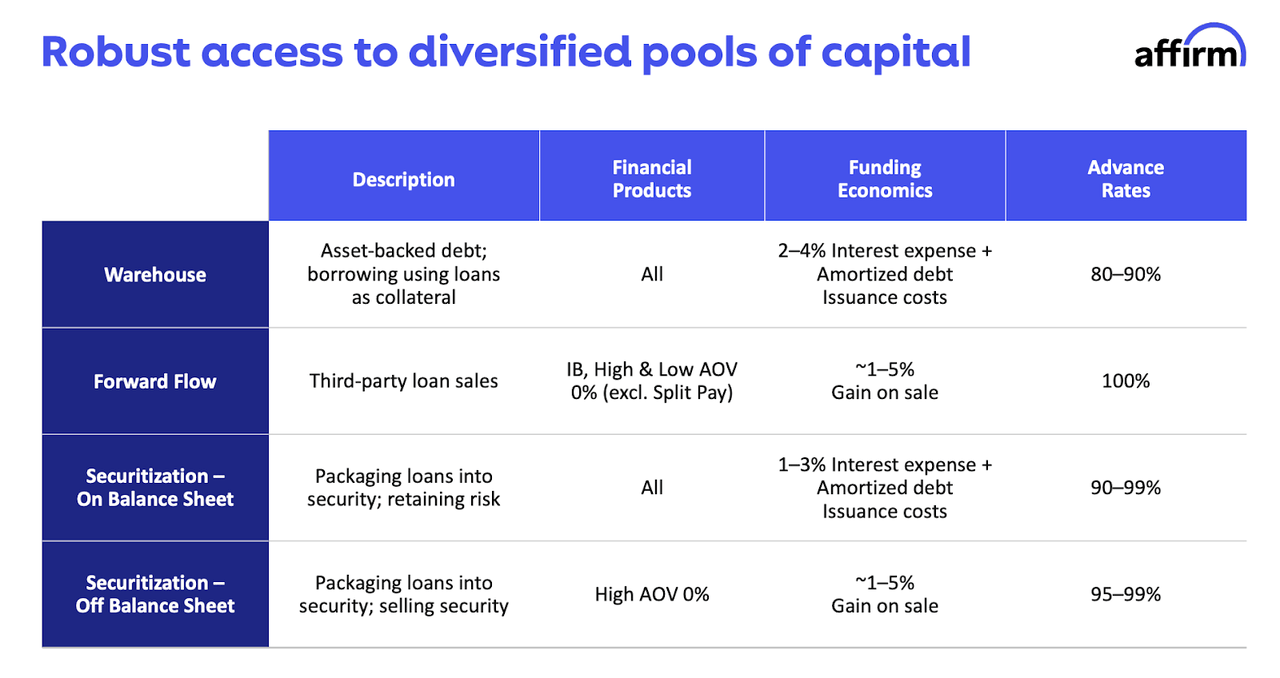

Funding Costs

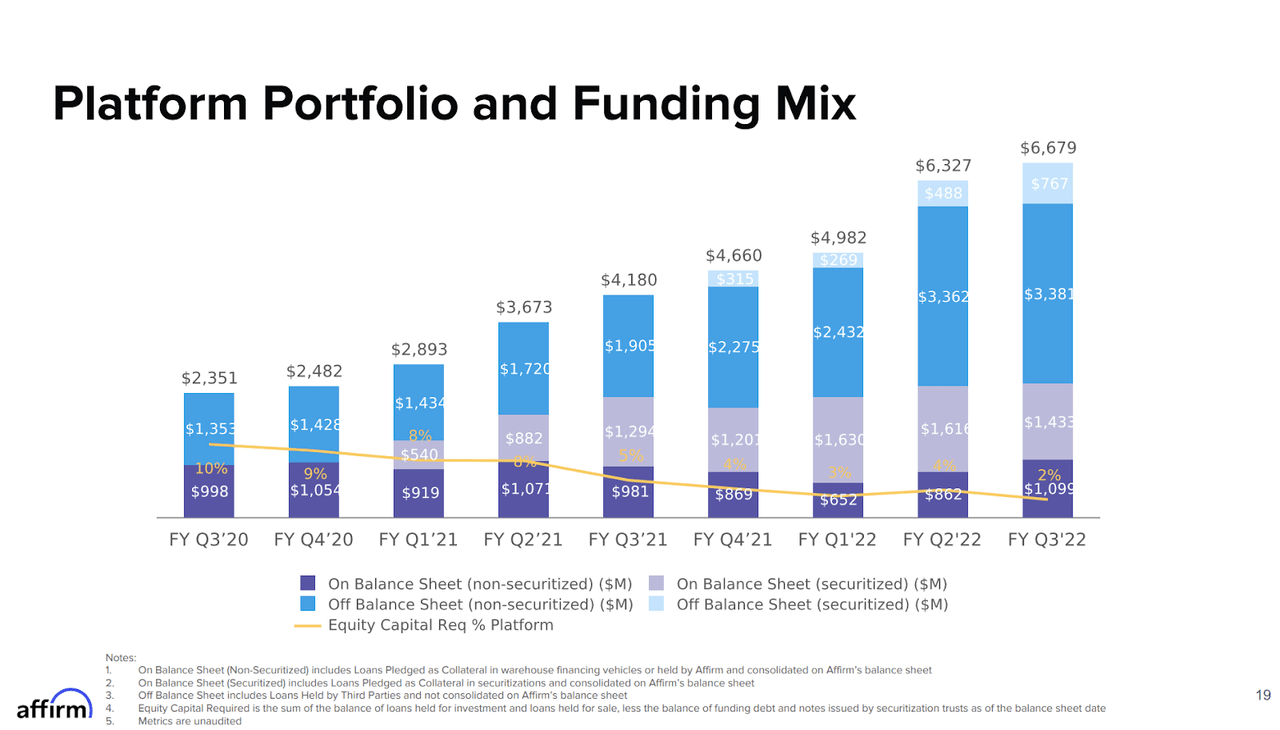

As of date, Affirm has over $10B in funding. It ended last quarter with 53% of its capacity off-balance sheet while Affirm’s bilateral relationships are fully committed with only ~31% of this capacity maturing over the next 12 months. Since the start of the year, Affirm has added $2.5B in new funding capacity coming from both new and existing partners.

In addition to that $2.5 billion, subsequent to the quarter-end, we closed our $500 million 2022 A revolving ABS transaction. And last week, we also added a new multi-year $500 million forward flow partnership with a large Midwest-based insurance company. We expect to continue to add capital through both scheduled commitment increases from existing partners and onboarding new partners. Our capital program is structured to be resilient, flexible and generate increased velocity as we scale.

Our warehouse lines are on balance sheet facilities with spreads ranging from 1.65% to 4%, and we were able to advance up to nearly 90% against the loans we pledged. These bankruptcy remote facilities are non-recourse to our parent company and generally used to fund shorter duration collateral. They also serve as a loan aggregation mechanism for our ABS securitization program. We generally maintain these facilities at low utilization rates. This stood at 37% at the end of the quarter, providing us significant excess capacity.

Our forward flow program represented close to half of the overall capacity across a range of diverse partners and provides highly efficient off-balance sheet funding. These programs allow us to earn most revenue upfront and additional revenue over time via servicing income. Further, loans sold to third parties via the forward flow program do not require an allowance for credit losses on the balance sheet or any related provision expense on the income statement.

Finally, in terms of our ABS securitization program, we have closed 9 securitization transactions that represent roughly $8 billion of volume since launching the program in mid-2020. Our deals have performed really well, and we just achieved our first AAA rating as part of our most recent transaction. Just as we have attracted many leading e-commerce merchants and platforms to Affirm, we have also attracted a diverse set of blue-chip investors to our capital program. This is a real competitive advantage for Affirm. We believe our scale and asset quality will ensure that this advantage continues into the future. Affirm is strongly positioned to continue to drive outsized growth in the ABS market, which is highly liquid with over $1.5 trillion outstanding across all asset classes.” Michael Lindford, FYQ3 2022 Earnings Call

Affirm Investor Forum

-

Over $10.1B in capacity today (added over $1B in funding since the end of last quarter), indicating that there is “widespread support” for the assets Affirm generates

-

Affirm closed a $500M asset-backed securitization on May 4th and offered five classes of fixed notes ranging between AAA (SF) and BB (SF), Affirm’s first AAA rating.

-

Affirm also added a new $500M forward flow partnership with a large Midwest-based insurance company.

-

-

Can currently support $22-$25B in GMV with current funding capacity.

-

Only 2% of equity capital was required as of last quarter, down from 5% a year ago, while Affirm continues to add funding capacity. Management intends to keep equity capital required below 5% long-term.

-

For the fiscal year of 2023, Affirm expects that a further 100 basis point rate increase would result in a 20 basis point impact to revenue less transaction costs as a percentage of GMV based upon Affirm’s current funding and GMV mix.

-

Beyond the fiscal year of 2023, Affirm expects revenue less transaction costs to be impacted by approximately 40 basis points for every 100 basis points of rate movement beyond the current forward curve.

Affirm FYQ3 2022 Investor Presentation

Affirm has a diverse set of funding methods to tap into, which enables them to be nimble and only pursue deals that Affirm finds attractive or requires.

It is true that as rates go up, there is pressure on the funding side of our business. But it is a mistake to think about that as a flow-through on a linear basis. We have many different funding channels with staggered maturities and very different structures. And as I mentioned, for example, we just onboarded a new fourth flow partner who’s an insurance company has a very different view of rates and how they think about that versus, say, access to quality assets over time. That allows us to manage it in the nearer term.

I think in the very long run, so going out more than a year, you would expect us to need to start to take action, but that’s more of a long-term thing than anything we deal with tactically in the near term.” – Michael Lindford, FYQ3 2022 Earnings Call

Affirm’s execution in capital markets demonstrates that the company generates a high-quality asset while its capital markets team is capable of managing its funding capacity even as rates are rising, and the markets are in turmoil. Affirm’s fees are derived from the assets it produces, and during times of higher rates, Affirm’s take rates are associated with the sales it facilitates for merchants, and when consumers choose to better manage their cash flows with Affirm. A strong funding mix and capital markets expertise enable Affirm to fulfill the demand of its network while Affirm’s revenues are directly correlated to the value it generates.

We have significant advantages to help us mitigate the impact of rising rates, including broad and diverse funding partnerships, that allow us to shift funding to less rate-sensitive counterparties, sophisticated underwriting and risk management infrastructure that allows us to manage unit economics with changes to our cost environment and high turnover short-term assets that make our portfolio inherently nimble and able to react quickly to changing market conditions.

At a constant product and funding mix, we estimate that a 100 basis point increase beyond the increase implied by the current yield curve would only result in a 10 to 20 basis point impact to revenue-less transaction cost as a percentage of GMV for the remainder of fiscal year 2022.

Looking out to fiscal 2023, we believe that a further 100 basis point rate increase, again beyond current expectations would only result in approximately 20 basis point impact to revenue less transaction cost as a percentage of GMV based upon our current funding and GMV mix. And that is before we apply any of the numerous offsets we have including consumer and merchant pricing, funding strategies and credit optimizations.

Looking beyond fiscal year 2023 at our current funding and product mix, we estimate the impact to revenue less transaction costs as a percentage of to be approximately 40 basis points for every 100 basis points of rate movement beyond the current forward curve. And again that’s before applying any cost, credit and revenue optimization.” Michael Lindford, FYQ2 2022 Earnings Call

We are confident in management’s ability to manage capital markets and sustainably fund the business, especially as Affirm has ample funding for the next 12 to 14 months, even when assuming 80%+ GMV growth. Affirm will continue to demonstrate resilience as Affirm continues to prove that it generates high-quality assets. We will continue to monitor Affirm’s funding capacity moving forward.

Conclusion

As seen in the Tweet above, Affirm CEO is moderately excited about the likelihood of a recession and if rates were to increase above 5% to 6% over the next 12 months or reach even high levels, that would surely make it harder on consumers while liquidity will be in greater demand. Affirm was built for times like these because of its vertically integrated network and ability to underwrite transactions on an item-by-item basis, leveraging the data available in the new open banking paradigm.

We maintain our conviction in Affirm and will continue to take advantage of price volatility over the short run.

Thanks for reading and happy investing!

Be the first to comment