TexBr

Investment thesis: The iShares MSCI China A ETF (BATS:CNYA) is down almost 17% for the year, as I write this. The main culprit is arguably the ongoing zero COVID policy that the Chinese government is pursuing. There is of course an overall decline in global stock indices, which is also a contributing factor. Furthermore, the geopolitical factor is now something that investors need to be aware of and apply an appropriate risk discount. While the downside factors are of considerable magnitude, there are also plenty of reasons to be bullish on Chinese equities and the broader market, which is why I maintain a limited position in CNYA. Some factors that may seem like reasons to be pessimistic, such as the war on China’s technological advancement, may turn out to be a blessing in disguise because China is being forced to innovate, which is improving the odds of major innovation breakthroughs, due to the necessity factor. Geopolitical factors are also moving in its direction, to the detriment of major competitors such as the EU. On balance, CNYA seems like a good bet at this point, with the COVID factor providing investors with a good entry point.

CNYA offers broad exposure to the Chinese market

Before I move on to the main thesis of my argument, namely the geopolitical trends that seem to be breaking China’s way, I want to briefly touch on the fundamentals of CNYA.

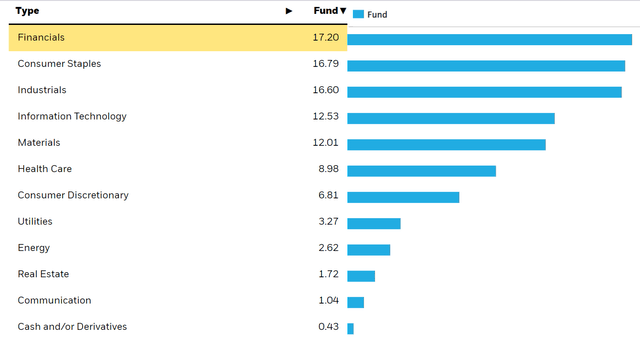

CNYA sectoral exposure (Blackrock)

The coverage of the overall Chinese market that this fund offers is broad & balanced. Its performance should therefore broadly reflect the performance of the Chinese stock markets and its economic trajectory. There are a total of 495 individual stocks represented in the fund.

CNYA fundamentals (Seeking Alpha)

As I write this, the fund is down almost 17% YTD. It is performing slightly better than the S&P for instance, which is down over 20% so far this year. The expense ratio of .6% is a bit on the high side. The yield of 1.3% is lower than the S&P average yield. Other notable metrics include a P/E ratio of around 16 currently, which is far cheaper than the S&P, which is at over 19. We should keep in mind that especially for foreign investors, Chinese assets are far riskier currently, given the heightened geopolitical friction environment we are experiencing.

Western tech embargo is spurring R&D efforts in China, raising prospects of technological breakthroughs

One of the perceived weaknesses that China currently grapples with is the US-led effort to try to deny China vital technologies that might help it to build up its own technological dominance across the world. The Huawei takedown is perhaps emblematic. Since the decision to take down Huawei, which was increasingly seen as an emerging threat to Western and allied dominance in certain sectors of the global IT industry, many restrictions were introduced in regards to Chinese companies being able to use certain Western products, components, or patents.

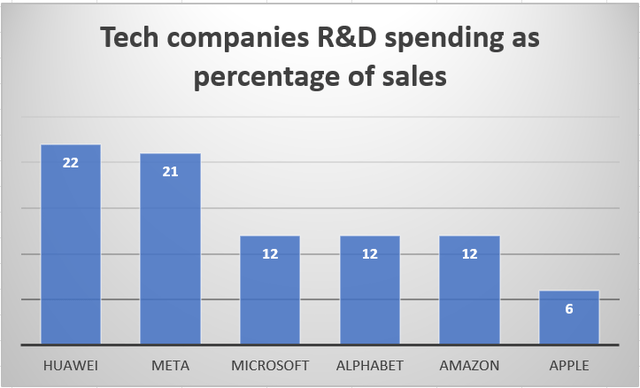

It is widely believed that this should help to slow China down, to the point where at the very least it will stop catching up technologically to the US and allies such as the EU, Japan, or South Korea. It is analogous to forcing a car producer to reinvent the wheel, even as it seeks to build cars that cannot function without wheels. The problem with this approach is that China, unlike most other countries on this planet has the financial resource as well as the human talent to potentially reinvent the wheel. The danger is always out there that as they plug away at reinventing that wheel, they will stumble across something that might be seen as a much-improved wheel. Huawei, for instance, responded to being restricted in its use of Western patents & technological inputs by increasing its in-house R&D efforts to overcome those restrictions, becoming the largest spender as a percentage of sales last year.

According to Bloomberg, Huawei spent over $22 billion on R&D in 2021. It is still unclear how much of an impact such a high level of R&D spending might have on technological breakthrough prospects for Huawei, or for the Chinese economy overall. I should point out that perhaps all it will take is one major breakthrough, for instance in lithography to trigger an entire technological revolution, completely independent of our technological inputs. When combined with China’s massive domestic market, which can sustain a whole tech revolution by itself, as well as its massive manufacturing capacity, combined with its deep integration in the global supply chain, it could potentially lead to a knock-out blow to our own technological dominance. There is no way of knowing whether this will ever happen. Having some exposure to the Chinese market does not hurt, just in case, it will.

Aggressive use of sanctions and other coercive economic and financial measures are driving major energy exporters toward the Chinese markets. China already benefits from cheaper energy as a result

As of May, China was importing about 2 mb/d of Russian oil. It is not always entirely clear just how much Iranian and Venezuelan crude China is buying, but it seems to amount to another 1 mb/d. There seems to be a bit of a cat & mouse game going on with transport vessels which makes it hard to ascertain the true volume of sanctioned oil imports. It is entirely possible that China might be buying slightly more from all three sanctioned countries than we are assuming. Russia’s oil has been trading at a discount of around 30% lately, while Iranian crude may be bought at a significant discount of about $10/barrel as well. Venezuela’s oil is also sold at a discount. Adding it up, it seems that China is saving about $60 million per day by purchasing sanctioned oil. It may be gaining quite an advantage from cheaper Russian natural gas as well, with exports to China surging this year. It can go a long way in outcompeting the EU economy especially, where energy prices have been surging to unsustainable levels, with many industries as well as consumers already affected.

Looking out into the more distant future, it seems that China is outcompeting the EU for vital resources. I should note that the Shanghai Cooperation Organization, with Iran being a recent addition to the club is sitting on roughly half of the official global natural gas reserves on the planet. It may benefit from discounted, reliable energy supplies for many years, even after we may change our minds and lift sanctions. The reality of the current World Order is that Asia is now the most coveted market for energy exporters. Energy exporters may offer some discounting in exchange for gaining market share for the longer term, relative to prices they may charge other customers such as the EU. It is possible that long-term oil contracts may emerge as a dominant feature in Asia, where both suppliers and buyers will be looking for some supply and price stability, at least for a significant portion of the oil.

The US is largely aiming for self-sufficiency, while the EU is losing out thanks to poor policies, based on an endless list of false assumptions, whether in regards to its capacity to run on wind & solar power or in regards to the long-term outlook for the global oil & gas market. We seem to have entered a period where it is a long-term seller’s market. The Western World seems to have missed the mark on its assumptions. As late as this year, it seems that they believed that we can reduce millions of barrels of Russian oil exports, and remove it from the global market, with a replacement readily available in the form of OPEC and others ramping up spare capacities or new supplies in order to plug the gap. It may be a miscalculation that China has been positioning to exploit in the past years, and all indications are that it may have succeeded. We should not underestimate the competitive advantage that cheap energy will have, especially against one of the two main pillars of the Western World, namely the EU. China’s business sector has every opportunity to thrive domestically as well as move on traditional Western business sector turf throughout the world, in part thanks to the cheaper energy advantage.

Investment implications

There are many other advantages that China has, which have been evident in the past few decades, as it grew to become the world’s second-largest economy and is potentially headed for the number one spot, perhaps as soon as the end of this decade. The Belt & Road initiative is unparalleled, and it is set to closely tie much of the World to China’s own economy. The SCO, the BRICS, and other geostrategic and economic circles that center around China are also seeing an expansion, with a growing list of new candidates looking to join. China’s quest to catch up technologically to the Western-dominated developed world is a wildcard. We have no way of knowing what to expect. Clearly, R&D work is being ramped up. There may or may not be major breakthroughs along the way. Typically, when enough resources are allocated to R&D, some progress tends to be achieved. It remains to be seen how much. It may be enough to have a devastating impact on our technological supremacy, or it may end up being just enough to keep China from being totally dependent on our technologies.

There is certainly enough of a positive trend in regards to the long-term Chinese economic outlook to necessitate some exposure to Chinese investment assets. The COVID lockdowns that continue in China, which are out of step with much of the rest of the world can be assumed to be a temporary drag on its economy. The enhanced energy security, with potentially more affordable and secure flows of energy for decades to come, is in direct contrast to the situation we see in the EU, where energy insecurity will become the theme for decades to come. China’s global influence seems to be growing steadily, while it is still unclear whether the tech transfer restrictions we are engaged in will slow down its own technological development, or whether we are producing a situation of innovation through necessity. At this point, it could go either way. The main reason for not seeking exposure to Chinese investment assets is the possible scenario of conflict, such as an invasion of Taiwan, which would likely result in Western investors in Chinese stocks and ETFs seeing a similar situation as investors in Russian assets did this year, where assets are basically frozen from normal trade, with an uncertain final outcome. For this reason, I intend to keep my CNYA exposure limited, even though the fundamentals are looking increasingly attractive.

Be the first to comment