RichVintage/E+ via Getty Images

Investment Thesis

Since my last article covering Clover Health (NASDAQ:NASDAQ:CLOV), the broader market volatility knocked down the stock by 17% to its current price of $3.16, valuing the fledgling Managed Care insurance company at $1.25 billion at the time of this writing, despite the improving Medicare Advantage margins discussed last month.

This article highlights CLOV’s strategy shift from a growth-oriented to a profitability-focused approach and how management plans to drive the company to higher multiples. This strategy shift coincides with a leadership transition and comes at a time when CLOV is facing its largest legal fight yet, including payment conflicts with some suppliers, a class action lawsuit over deceptive statements about Clover Assistant, and failing to disclose previous legal challenges before going public.

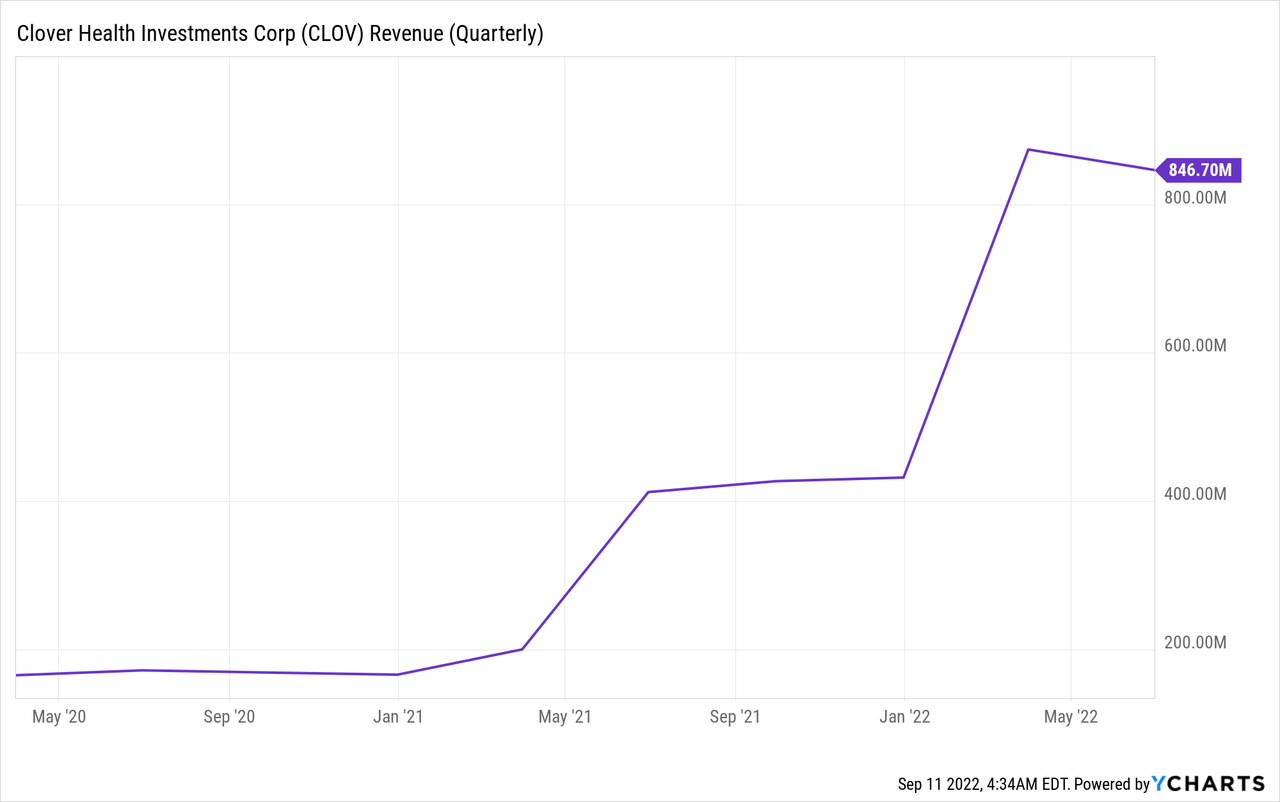

Revenue Trends

In the second quarter, CLOV brought in $847 million, which was 3% less than the $874 million it brought in the first quarter. Is this something to worry about? I don’t think so. The Medicare enrollment season opens from October 15 to December 7, and US residents who become eligible for Medicare during the year must wait until the open period to join Medicare. Thus, the revenue decline doesn’t mirror a flaw in its growth premise. Management cited natural mortality rates among its enrollees when questioned about the fall in enrollment. It is critical to incorporate this seasonality when assessing the company’s revenue trends.

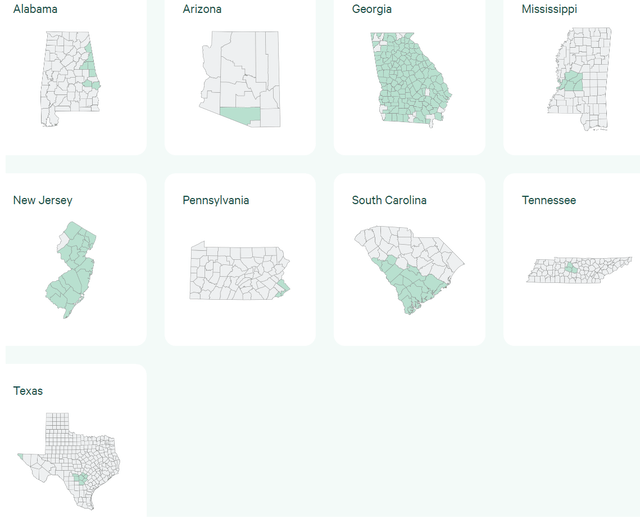

Does that imply that one can anticipate the business to resume the same levels of growth in future quarters as enrollment picks up during the customary enrollment period? Well, it is a bit complicated. Recall that last year CLOV launched its MA plans in 101 new counties. This year, it plans to add only thirteen, focusing its marketing efforts on existing regions.

Moreover, in Q2 last year, the company started participating in the Direct Contracting “DC” payment model, a pilot risk-sharing program run by the CMS. All DC enrollees are members of Original Medicare, assigned by the CMS to Direct Contracting Entities “DCE” based on their geographic locations. From my understanding, the CMS assigns enrollees to DCEs during the enrollment season except for the commencement year 2021, when it assigned the enrollees at the program’s start in April.

DC has been a propeller of growth during the past few quarters. This year, the number of DC enrollees increased at a faster pace compared to MA enrollees. However, in the absence of guidance regarding CMS’s allocation plans, it is impossible to determine whether the growth in DC enrollees will continue at the same rate. However, understanding these dynamics sheds light on the seasonality of CLOV’s business, underpinning the small premium fluctuations on a quarter-to-quarter basis.

It is worth noting that the CMS will be implementing changes to the DC model starting next year, which are, from my understanding, immaterial to CLOV and unlikely to affect the company’s enrollee base.

Margin Trends

In Q2, CLOV reported a net loss from operations of $103 million, an improvement from last year’s $182 million net loss. In the previous article, I discussed the dynamics behind improving profitability, powered by a lower Medical Cost Ratio “MCR” in its MA segment. However, its DC segment remains unprofitable, casting doubt on the company’s ability to turn a profit. Management didn’t seem as confident about its DC business as it was in its MA business during the earnings call.

As of the end of Q2, the company had a net current asset balance of $270 million, which isn’t particularly impressive for a company that burned $220 million in the TTM that ended June 2022. To continue to grow the company profitably, I believe that CLOV will need to either improve its performance in the DC segment or raise additional capital to fund the venture. Judging from the recent decline in the company’s stock price, it seems unlikely that investors will be willing to provide additional funding to the company in the near future, leaving debt financing as the only option available to management. This would significantly reduce yearly FCF, especially given rising interest rates.

Management

The company made some changes in its management structure. The previous CFO resigned in April 2019 due to personal reasons, and the new CFO has only been with the company for a few months. The CEO also recently announced that he would be stepping down at the end of the year but will remain an executive chairman, while Andrew Toy will take his place.

There isn’t much to report on the Clover Assistant lawsuit. The parties are unlikely to settle outside court, so the trial will likely happen sometime next year. However, I am somewhat concerned that this lawsuit could harm investor confidence going forward.

Summary

CLOV remains a speculative trade despite profitability improvements. The DC model is still nascent and subject to execution risks, and the company could be in trouble if it does not turn the segment around in the next few quarters. Overall, I still think the stock is a compelling buy at the current price level as a speculative, high-risk/high-reward exposure. The company’s financial position isn’t exactly solid, but its debt load is not excessive at this time. Nonetheless, operating expenses are burning much faster than revenue, which means that the company is operating at a deficit. Although its current market cap of about $1.25 billion is not exceptionally high by industry standards, it remains to be seen if the company can actually turn a profit and generate sustainable FCF over the next few years.

Be the first to comment