da-kuk

Thesis

Clough Global Dividend and Income Fund (NYSE:GLV) is a multi-asset closed end fund. The vehicle has a broad mandate, but currently sports a 70% equity / 30% bonds build. As per its literature:

The Fund intends to invest in a managed mix of equity and debt securities. The Fund is flexibly managed so that, depending on the Fund’s investment adviser’s outlook, it sometimes will be more heavily invested in equity securities or in debt or fixed income securities. Investments in non-U.S. markets will be made primarily through liquid securities, including depositary receipts (which evidence ownership in underlying foreign securities). Investments in corporate debt may include both investment grade and non-investment grade issues.

In the equity sleeve the CEF is overweight Financials and Industrials, while on the bond side the fund is mostly invested in investment grade securities. The fund has a 31% leverage ratio and total return as its objective:

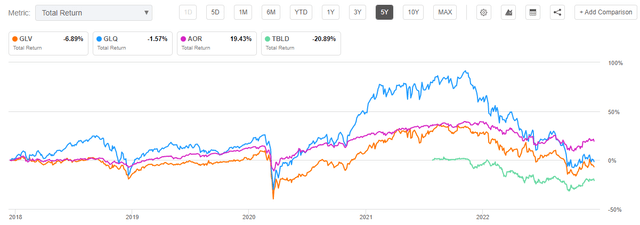

The CEF however has not really performed very well. Indeed it is down this year due to the sell-off in equities and bonds, but long term it underperforms its index and a non-leveraged 60/40 ETF, namely the iShares Core Growth Allocation ETF (AOR). Furthermore the fund is utilizing more than 90% of ROC this year due to a lack of performance in its underlying assets.

When comparing a CEF with an ETF that have similar mandates, we want to see CEF outperformance to justify charged fees and the higher volatility obtained through leverage. We see neither here. While the fund has a positive long term result, we do not see anything here that would warrant a retail investor to hold this name versus AOR. We are in the Sell camp here, feeling that a retail investor is better served in obtaining a 60/40 portfolio exposure via the AOR ETF, which outperforms GLV by a mile.

GLV Holdings

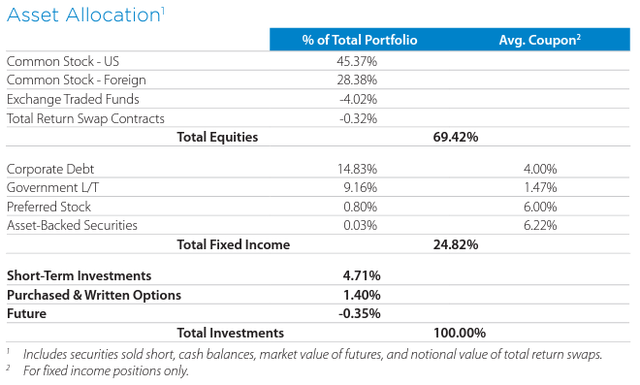

The fund holds a 70/30 portfolio:

GLV Portfolio (Fund Fact Sheet)

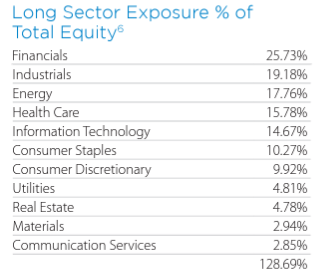

We can see from the most recent table from the fund’s fact-sheet that the fund holds around 70% equities and 30% in bonds and cash. On the equity side, the portfolio is composed of mostly U.S. equities, with an emphasis on financials:

Equity Sector Allocation (Fund Fact Sheet)

The equity portfolio is fairly conservatively built, with the largest sectors being high cash flow generators. Information Technology, a sector which was hit hard this year, represents only 14.67% of the portfolio.

Energy has a very high weighting in the CEF’s portfolio:

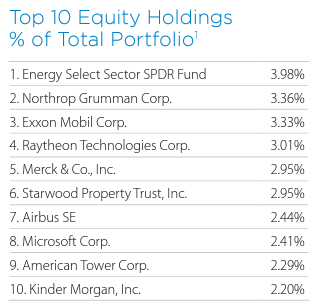

Holdings (Fund Fact Sheet)

We can see the fund holding (XLE) to the tune of 3.98%, followed by large positions in Exxon (XOM) and Kinder Morgan (KMI). Energy has been an outperformer this year, so this fund composition works towards accentuating the strong sectors in the market.

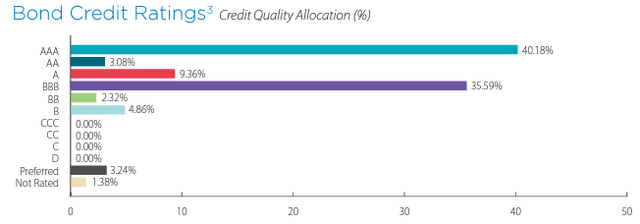

On the bond side, the fund’s composition is overweight investment grade bonds:

We can see that the current portfolio contains more than 40% in AAA assets, with the rest of the investment grade buckets well populated. BB, B and CCC bonds are almost non-existent. The portfolio is set-up well for widening credit spreads.

GLV Performance

The fund is down substantially this year:

We can see the CEF down over -27% this year, with its sister fund GLQ (higher leverage) down even more. Another 70/30 fund, namely TBLD which we covered here, is down much less. 60/40 portfolios have done extremely poorly this year on the back of weak equities and rising rates. When leverage is added on top the results are not pretty. The unleveraged 60/40 ETF AOR has a -14% total return performance in 2022.

The fund is now negative from a performance stand-point on a 5-year time-frame:

It is interesting to note that GLV has historically underperformed its sister fund GLQ, which we covered here. GLQ has a higher leverage ratio and has moved higher in an up market, but also has lost altitude much faster in 2022.

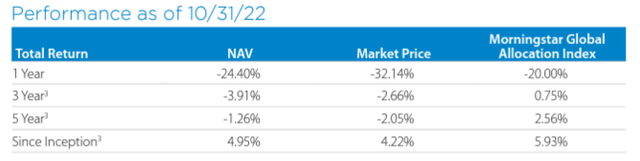

GLV does not impress on a longer time-frame:

GLV Performance (Fund Fact Sheet)

We can see that from a market price standpoint the fund underperforms its index on any chosen time period.

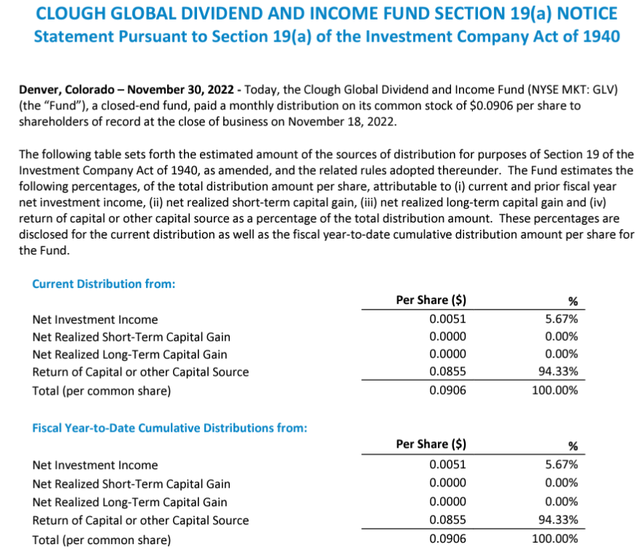

GLV Distribution

The fund has a 16% distribution rate, but it is not supported:

We can see that in 2022, the vast majority of the distribution for the fund has been constituted by return of capital. That is basically your own money being return to you as a “dividend”. As a reminder, if a CEF is not making money via capital appreciation in its equities portfolio or income via its fixed income sleeve, then it really does not have anything to pass on to investors.

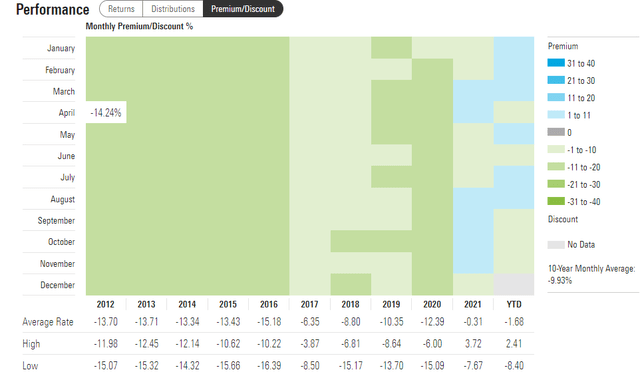

Premium / Discount to NAV

The fund has generally traded at discounts to NAV:

Premium / Discount to NAV (Morningstar)

It is interesting to see the CEF trading at premiums to NAV in 2022. It is not warranted. The fund is not making any money, so it is puzzling that after a decade of discounts to NAV the market has decided to reward this fund with a premium. We do not feel a premium is appropriate here since the fund has not really achieved much in terms of outperformance.

Conclusion

Clough Global Dividend and Income Fund is a CEF with a 70% equities, 30% bonds portfolio. On the equity side the fund is overweight Financials and Industrials, while on the bond side the vehicle has a high allocation to investment grade bonds. The CEF layers a 31% leverage ratio on top, but fails to achieve appealing results. The vehicle lags its index and a simple unleveraged 60/40 ETF, namely AOR. The fund has a negative 5-year total return and has underperformed. Its current 16% dividend yield is unsupported, being composed of return of capital for more than 90% of the distribution. That basically translates into investors getting their capital back rather than a true distribution. There is not much to like about GLV since it fails to outperform a simple, unleveraged ETF and it is currently just returning investors their own capital. We feel an investor looking for a 60/40 build is better served by just investing directly in AOR. If you hold this name already swap into AOR, while if you represent new money looking to enter the space you are not well served by looking at GLV.

Be the first to comment