DKosig

Investment Thesis

Cloudflare (NYSE:NET) is a founder-led, mission-driven, fast-growing business with its core offerings including a content delivery network as well as DDoS cybersecurity solutions. The company has continually rolled out new products to its >150,000 paying customers, all whilst building a global, ‘serverless’ network that is making the internet both safer and faster.

But does that make Cloudflare a good investment right now? I put it through my framework to find out.

Business Overview

Cloudflare has one of the best mission statements I’ve ever seen: “To help build a better internet”.

It is simple but can also double up as a north star for the business to focus on achieving. This is a complex business to understand (and took a lot of research for me to get my head around it), so I think this mission statement helps to underline what you’re investing in when you invest in Cloudflare. But let’s take a look at what the business does.

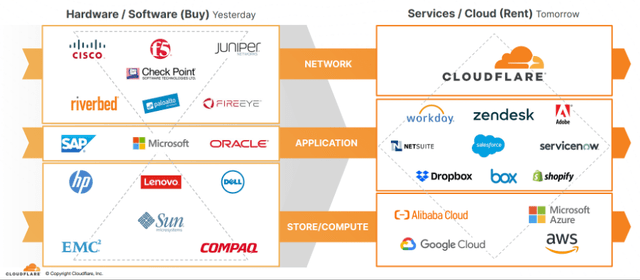

The backbone of Cloudflare’s cloud-native offerings is its efficient, scalable, global network that customers can join in order to improve both their security and performance. In the old world, companies would have been required to purchase hardware in order to solve their network challenges, but Cloudflare has built a ready-made network that businesses can simply plug into.

Cloudflare May 2022 Investor Presentation

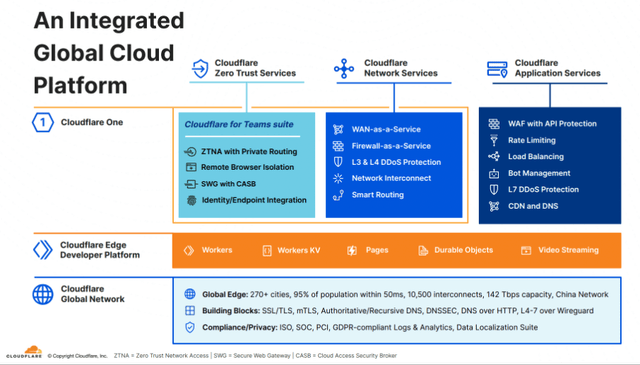

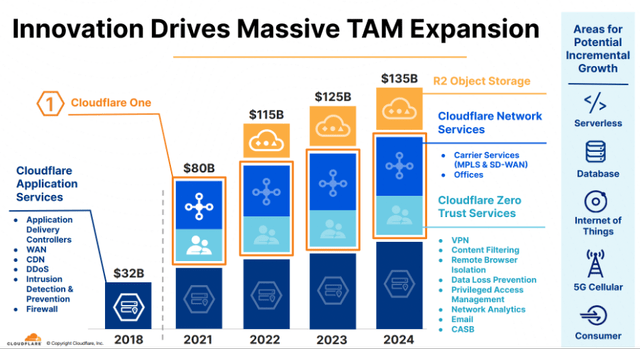

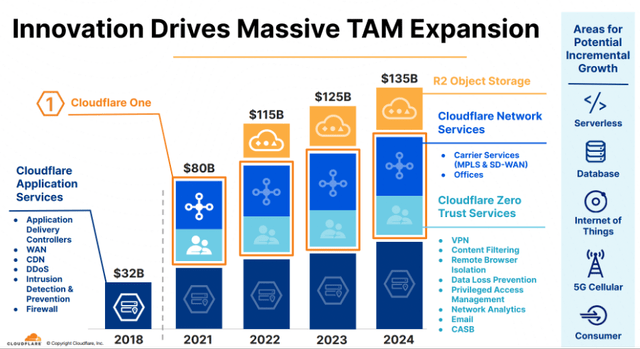

Cloudflare offers a broad range of solutions. I’ll split these into three main categories & also include a link to each for further reading – as mentioned, Cloudflare is a complex business & understanding the nuts and bolts will take some time:

- Cloudflare Application Services: Delivers performance and security solutions across applications through services such as DDoS Protection, Web Application Firewalls, and Content Delivery Networks. (learn more)

- Cloudflare Zero Trust Services: Helps ensure that users within an organization can access the right cloud-based application at the right time. A zero-trust approach essentially means ‘trust no-one’ – that is, verify everyone. (learn more)

- Cloudflare Network Services: Helps enterprises connect, secure, and accelerate their corporate network, which in turn helps network teams manage edge and multi-cloud environments more efficiently. (learn more)

Cloudflare May 2022 Investor Presentation

I believe Cloudflare’s main offerings right now are specialising as a content delivery network as well as focusing on protecting businesses, websites, and applications from DDoS attacks. But as you can see, it does so much more with its huge global network.

There is a lot to understand here, and it is a particularly technical business – but I want to reemphasize that the backbone of everything Cloudflare does is its global network that blocks attacks, accelerates traffic, and deploys serverless code at every location.

Cloudflare May 2022 Investor Presentation

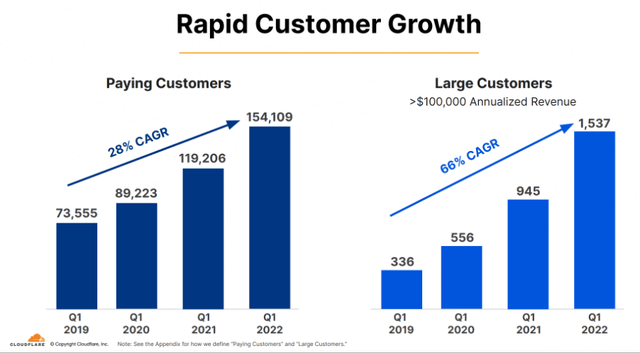

And clearly the company is doing something right, as it has grown its paying customer base quickly. Even more impressive is the company’s growth among large customers, with the number of customers paying Cloudflare over $100k in annualized revenue growing at a 66% CAGR since 2019.

Cloudflare May 2022 Investor Presentation

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

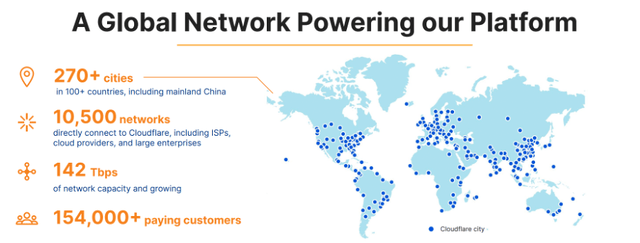

Given the introduction to Cloudflare, I think it’s important to highlight its scale as the first economic moat. Cloudflare is able to offer this improved network performance since its data centres are placed as close as possible to both its users and internet exchanges – and it will always connect customers’ applications to the closest data centre.

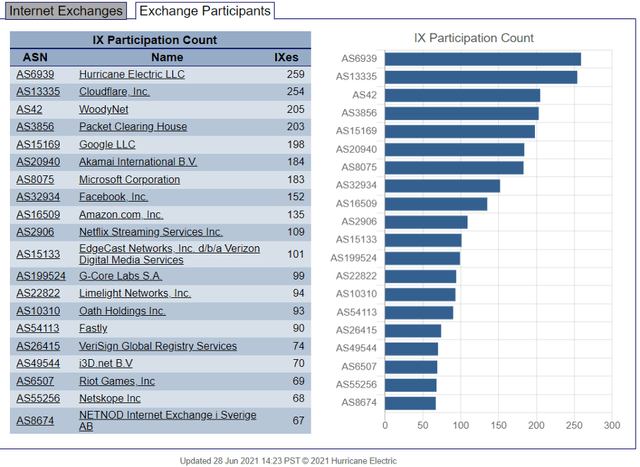

In the world of content delivery networks, scale and proximity to customers can provide a huge boost, and Cloudflare delivers on this front. According to Hurricane Electric, it is the second largest internet exchange participant globally, only slightly behind Hurricane Electric itself. Furthermore, it is way ahead of larger competitors such as Amazon (AMZN), and it also way ahead of Akamai (AKAM) – this indicates that scale is a moat for Cloudflare, and one that it will look to keep expanding.

I also think Cloudflare benefits from a substantial network effect. The company has developed a single software stack responsible for all its products, which has made scaling, debugging, optimizing, and operating its network and products easier and cheaper – meaning that each incremental product or user added is cheaper still. The company is also able to learn from all the data it takes in through its network, or cybersecurity threat that it prevents, and so every additional customer can make the network stronger.

But the biggest network effect, for me, relates to the number of customers Cloudflare has on its platform combined with the number of new products and solutions it has rolled out. Cloudflare actually operates a freemium model, and as such has a huge number of non-paying customers who may eventually turn into paying customers. Through this model, Cloudflare now has a huge network of over 150,000 paying customers and over 1,500 large customers with over $100k in annualized revenue. Combine this with Cloudflare’s ability to continually roll out new solutions and expand its market opportunity – the result? More customers already on its network means that it already has an existing customer base to upsell, and its cloud-native approach results in easier installations and integrations for these customers.

Cloudflare May 2022 Investor Presentation

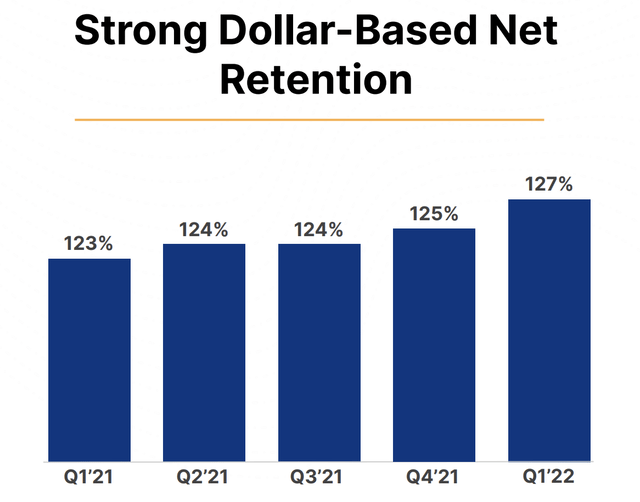

I also believe that Cloudflare benefits from switching costs. Its customers have Cloudflare solutions embedded into the day-to-day running of their business; it would be extremely onerous to try and switch away from Cloudflare, particularly if they take up multiple solutions. This plays out in Cloudflare’s gross retention of over 90%, and the company’s impressive dollar-based net retention rates.

Cloudflare May 2022 Investor Presentation

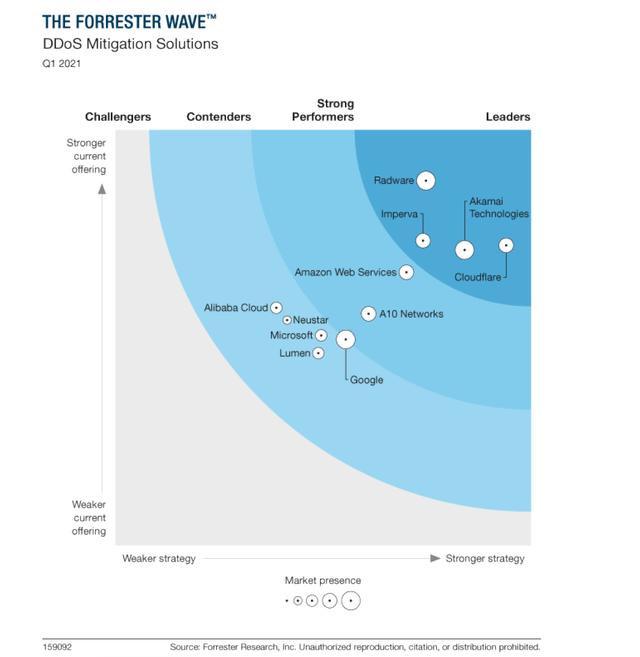

I could also give Cloudflare some credit for a combination of technical expertise and brand power. The company was named as a leader in the Forrester Wave for DDoS Mitigation Solutions, and I believe this will be critical for companies making cybersecurity decisions. DDoS attacks can be a nightmare for businesses, causing huge disruption and often substantial losses. So this is not an expense that companies would skimp on, and as such I think it pays to be the best in breed.

Forrester Wave DDoS Mitigation Solutions (Forrester Research)

Outlook

I’ll go back to a previous slide from Cloudflare’s May 2022 Investor Presentation to highlight not only Cloudflare’s current total addressable market, but also the way in which it has continually increased its TAM by offering new solutions.

Cloudflare May 2021 Investor Presentation

If we compare the 2024 TAM of $135 billion to Cloudflare’s trailing-twelve-month revenue of $730.54m, it’s clear the company has barely scratched the surface of the opportunity ahead – in fact, its TTM revenues make up just 0.5% of that 2024 TAM, so the opportunity for this business lies very much in front of it.

It’s also worth highlighting the list of ‘Areas for Potential Incremental Growth’ that Cloudflare has yet to expand into but sees as opportunities. Given Cloudflare’s ability to expand into wider offerings, combined with its existing network, I would not be surprised to see this TAM continue to increase over time.

Management

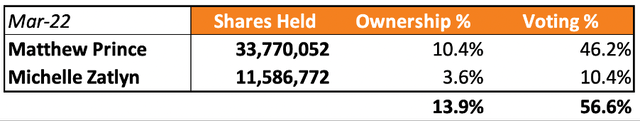

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I get a bonus with Cloudflare since it has not one but two co-founders in its leadership team. There is Board Chairman & CEO Matthew Price as well as Chief Operating Officer, President & Director Michelle Zatlyn.

CEO Matthew Price and COO Michelle Zatlyn (Cloudflare)

I want to invest in companies where leadership has skin-in-the-game, and I also get this here at Cloudflare, with Prince owning ~10% of all shares and Zatlyn owning ~4%. They also have voting power of ~46% and ~10% respectively, which isn’t an issue for me personally, but something that certain investors may feel uncomfortable with.

Cloudflare 2022 Proxy Statement / Excel

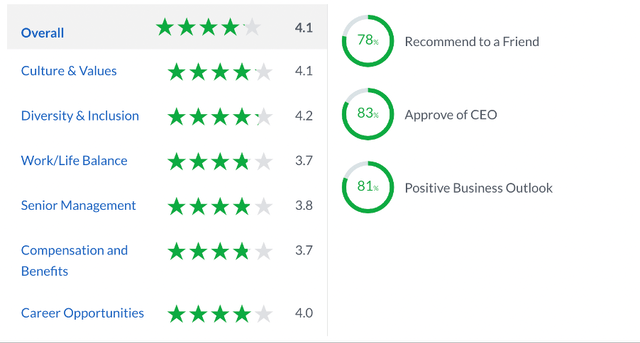

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Cloudflare gets some pretty good scores from the 346 reviews left by employees. Any score over 4.0 is impressive, and Cloudflare achieves this with a 4.2 in Diversity & Inclusion and a 4.1 in Culture & Values. The scores dragging it down relate to Work / Life Balance, Senior Management, and Compensation and Benefits – these are common detractors for companies on Glassdoor. Those aside, it looks like the majority of employees would recommend Cloudflare as a place to work for a friend, have a positive business outlook, and approve of CEO Prince. Not the best scores I’ve ever seen, but certainly pretty good, and it does give me confidence that most employees are happy working at Cloudflare.

Financials

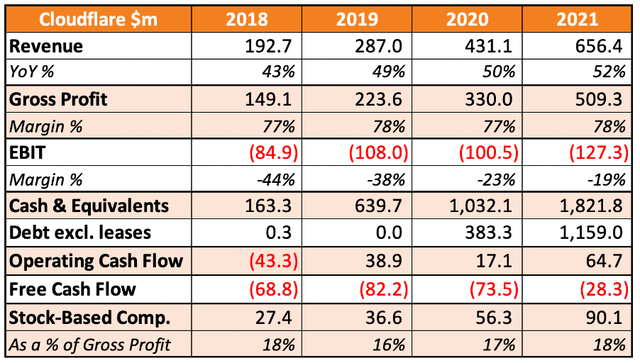

Cloudflare has a pretty impressive financial profile, with revenues growing at a 50% CAGR over the past 3 years. It’s worth noting that this revenue growth has actually accelerated each year, eventually hitting 52% YoY growth in 2021. This has been achieved all whilst having gross profit margins in excess of 75%, so it very much has the financial profile of a fast-growing SaaS business.

Cloudflare SEC Filings / Excel

The company is, however, consistently loss making and free cash flow negative. I personally am comfortable with loss making companies as long as they have positive free cash flow, so this is a bit of a yellow flag for me. Yet the FCF loss is both negligible and improving, and Cloudflare also has a fairly strong balance sheet. The debt shown refers to convertible senior notes, and as such this debt is most likely to result in shareholder dilution in the future.

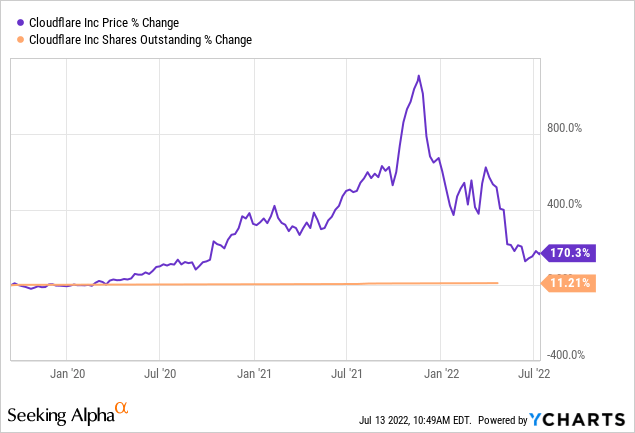

I know that stock-based compensation is a big talking point when it comes to companies such as Cloudflare, and in 2021 SBC was ~18% of total gross profit. An increase in SBC value can be driven by both an increase in shares outstanding (resulting in shareholder dilution) and an increase in share price.

As we can see below, Cloudflare’s shares outstanding have increased by just 11.2% since its 2019 IPO, whilst the share price itself has increased by over 170%. I would say that a little bit of shareholder dilution certainly isn’t harmful when a company is growing its share price so substantially, so I am not concerned about Cloudflare’s stock-based compensation for now.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Cloudflare is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

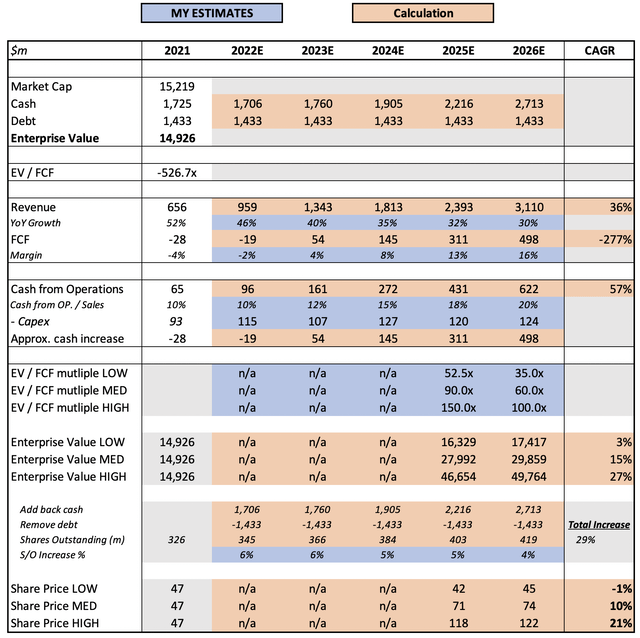

Cloudflare SEC Filings / Excel

I have assumed 2022 revenue growth at the high end of management’s guidance in the Q1’22 results press release. Cloudflare has a tendency to beat and raise guidance, and so I feel that my current forecast for 46% YoY growth is conservative, as is the expected slowdown given Cloudflare’s continued ability to roll out new solutions – but, I would rather be too conservative than too optimistic.

I am expecting free cash flow to turn positive in 2023 as Cloudflare continues to benefit from economies of scale, and I think it has the potential to accelerate this FCF margin quite rapidly. Even at a closing margin of 16% in 2026, I think the company will have more room to expand – hence I am assigning it a particularly high EV / FCF multiple of 60x in my mid-range scenario, because I think the market will continue to price in both future revenue growth and margin expansion.

I have assumed shares outstanding to increase by 29% over this period; again, I think it is prudent, however I should highlight that Cloudflare guided to 345 million weighted average shares outstanding for 2022, so shareholder dilution is very much going to continue throughout 2022 at a minimum.

Put all that together, and I can see Cloudflare’s shares achieving a 10% CAGR through to 2026 in my mid-range scenario.

Summary

This is a complex, technical business, but the numbers and independent research do not lie – this is a business that is successfully growing both its number of high paying customers & revenues fast. I am particularly drawn towards cybersecurity & business-critical companies at the minute, since I believe them to be fairly recession proof, and Cloudflare ticks this box.

Is the share price still expensive? Yes.

Do I feel comfortable paying the current price? Also, yes.

Sometimes you have to pay for quality as an investor, and there is a lot of future success priced in for Cloudflare, but I think that is understandable. This is a high-quality founder-led business with a huge network of customers to whom it can continue to roll out new products.

Given everything I’ve discussed about the business, I think it’s clear that Cloudflare can succeed for decades to come.

Be the first to comment