Sundry Photography

Thesis

Cloudflare, Inc. (NYSE:NET) will report its Q2 earnings release on August 4. NET has been battered massively in 2022, as the market justifiably trounced unprofitable growth stocks with a massive premium.

Despite its unprofitable growth, NET was one of those stocks with a massive run-up from 2019 to 2021. However, the chickens finally came home to roost as the market parsed its growth premium.

NET also seems to be forming a near-term bottom on its long-term chart. However, we have not observed a sustained bottom yet, so its price action remains tentative. Even though NET held its June lows, our valuation analysis indicates that investors should stay on the sidelines.

Cloudflare still has a lot to prove at its current valuation. Even though it’s projected to gain operating leverage rapidly, it may not be sufficient to sustain its growth premium.

As a result, we reiterate our Hold rating on NET. There are many other higher-quality growth stocks that are more reasonably valued to choose from, given the tech bear market.

Cloudflare’s Revenue Growth Is Fast, But Where’s The Profitability?

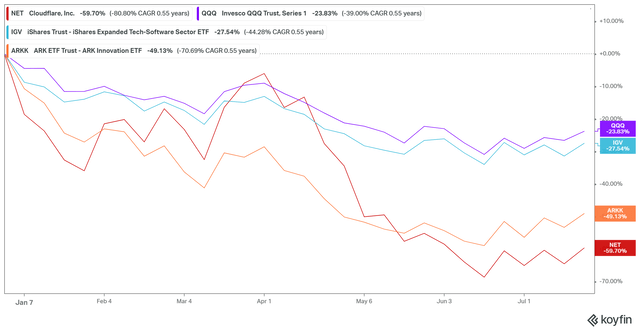

NET YTD performance % (koyfin)

The tech bear market has been brutal toward unprofitable growth stocks, as seen above. The ARK Innovation ETF (ARKK) has lost close to 50% YTD, significantly underperforming the Invesco QQQ ETF (QQQ).

But, NET has even underperformed ARKK, as it posted a YTD return of close to -60%. It also massively underperformed its software peers, as indicated by the iShares Expanded Tech-Software Sector ETF (IGV).

Given its massive surge over the past two years, such a sell-off is not surprising. However, we believe weak fundamentals have also played a critical role in its de-rating, as Cloudflare has struggled to deliver sustainable profitability.

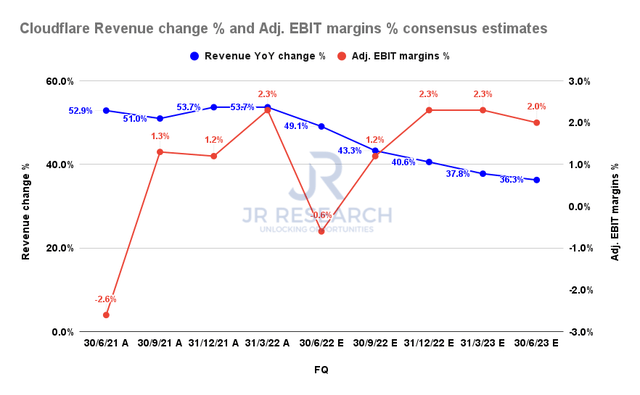

Cloudflare revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (generally bullish) suggest that Cloudflare’s revenue growth will likely decelerate through FY23. Notwithstanding, the Street expects its Q2 adjusted EBIT margins to reach a nadir before recovering.

However, we think posting an adjusted EBIT margin of 2.3% on topline growth of 40.6% suggests that Cloudflare’s tremendous revenue growth has not driven sustained profitability.

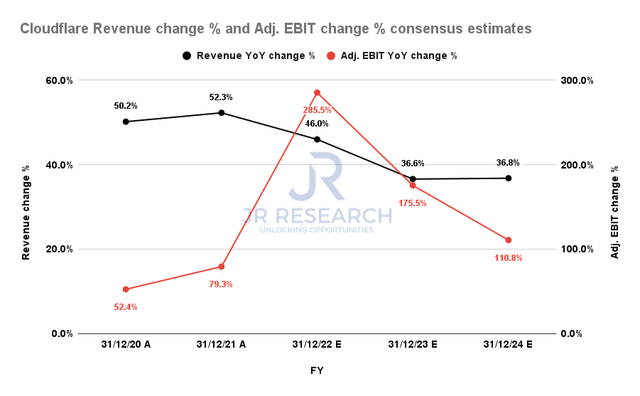

Cloudflare revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Notwithstanding, the company emphasized it remains focused on gaining operating leverage. Management accentuated in May (edited):

And we anticipate being free cash flow positive in the second half. That’s a really important statement. We made that at the end of last year, not knowing where the macroeconomic environment would take us. We’ve made significant progress in achieving operating leverage. We also said that we want to be around slightly above breakeven as long as we see there is a return. (Investor Day 2022)

The Street also expects Cloudflare to continue gaining operating leverage rapidly, despite a significant moderation in its revenue growth. For instance, the Street estimates Cloudflare to post revenue growth of 46% in FY22, with an adjusted EBIT growth of 286%. Therefore, Cloudflare is projected to accelerate toward its long-term operating model, Yet, the market has decided to de-rate it. Why?

NET Shares Are Still Priced At A Steep Premium

| Stock | NET |

| Current market cap | $17.29B |

| Hurdle rate [CAGR] | 25% |

| Projection through |

CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 20% |

| Implied TTM Revenue by CQ4’26 | $4.67B |

NET reverse cash flow valuation model. Data source: S&P Cap IQ, author

We tweaked our previous model to allow more growth leeway for Cloudflare to arrive at our bull-case scenario.

We applied a market-outperform hurdle rate of 25%, which is the lowest we will accept for high-growth stocks. We also used an FCF yield of 2%. Anything lesser, investors need to have a very high (read extremely high) conviction of Cloudflare’s execution and operating model. But, we urge investors to apply an appropriate margin of safety.

Using a TTM 20% FCF margin based on the guidance in its long-term model, we derived a TTM revenue of $4.67B by CQ4’26. Based on the revised consensus estimates, Cloudflare is unlikely to meet our bull case assumption.

If we revert to our base case assumption, NET is markedly overvalued.

Is NET Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on NET.

The company’s Q2 release could come under pressure in the near term due to intensifying macro headwinds. However, it’s unlikely to be structural, as it continues to gain operating leverage.

We believe NET is overvalued even with a bull case assumption. There’s still too much froth in its growth premium. Therefore, even though it held its June lows, we believe the going will likely remain volatile. We urge investors looking to add exposure to wait for a deep retracement. We believe levels closer to $30 are more reasonable.

Be the first to comment