byakkaya

Investment Thesis

Cloudflare (NYSE:NET) is a founder-led, industry-leading, cloud-native CDN (content distribution network) and cybersecurity company, with a mission “to help build a better internet”, which I personally love. The company offers an efficient, scalable, global network that customers can simply ‘plug into’ in order to improve both their security and performance.

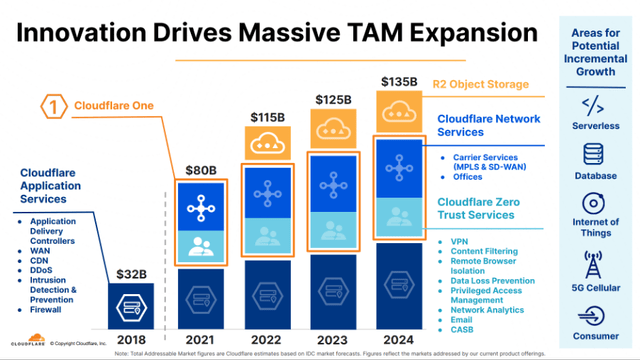

Similar to many something-as-a-service companies, Cloudflare is able to lean on its existing customer base when releasing new products in order to generate additional sales, since it is a lot easier to integrate new ‘add-ons’ if a business is already using Cloudflare. Through this, the company has managed to continually increase its total addressable market.

Cloudflare Q2’22 Investor Presentation

My personal thesis for investing in Cloudflare is the following: it is a leader in multiple growing industries transitioning to the cloud, from CDN to cybersecurity, and operates in business-critical areas, making Cloudflare more recession resistant than other companies. It has continually, successfully rolled out new products to existing customers (as evidenced by its high dollar-based net retention rates) & has seen substantial growth thanks to this. The company has an attractive long-term operating model, with operating margins expected to exceed 20%, and it has been growing rapidly over the last few years & should continue to do so in the future.

Cloudflare just released its Q2 results, and as I type this, shares are up over 15% in pre-market. So, is the market getting a bit overexcited, or were the results just that good? Let’s take a look.

Earnings Overview

Recession? What recession?

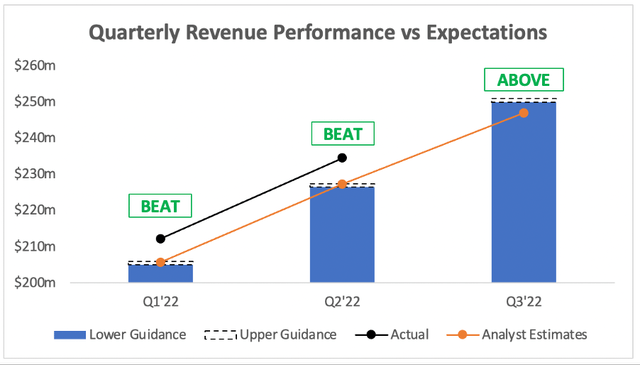

That’s probably the easiest way to sum up Cloudflare’s revenue for Q2, as it grew 54% YoY to reach $235m, beating analysts’ estimates of $227m & also beating Cloudflare’s own guidance of $226.5-$227.5m.

Investing.com / Cloudflare / Excel

Even more impressive was the guidance for Q3’22 of $250-$251m, coming in above analysts’ estimates of $247m. This makes me smile even more because, let’s face it, Cloudflare will probably go and beat this guidance as well when Q3 comes around.

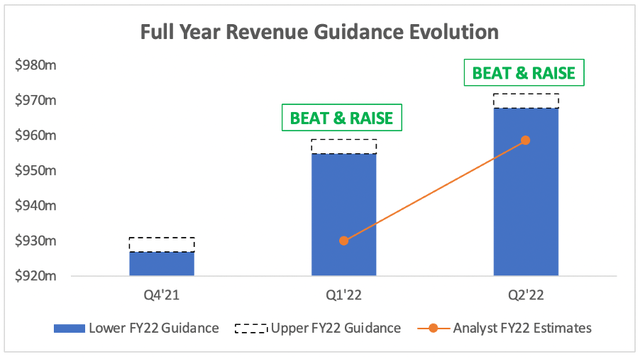

The icing on the cake was Cloudflare’s full year revenue guidance, which was raised substantially from $955-$959m to $968-$972m, once again coming in way ahead of analysts’ estimates of $959m.

Seeking Alpha / Cloudflare / Excel

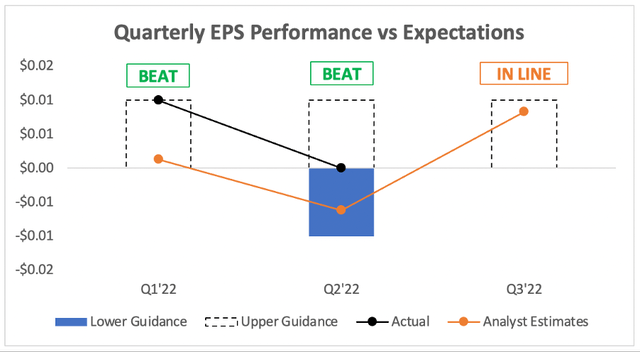

It was once again a stellar quarter in terms of top line growth for Cloudflare, and this is one reason that shareholders should be happy. But growth at any price is not the flavor of the stock market today, and the market is equally focused on Cloudflare’s bottom line – thankfully, adjusted EPS of $0.00 came in above analysts’ estimates of ($0.006) & at the top end of Cloudflare’s ($0.01)-$0.00 guidance.

Investing.com / Cloudflare / Excel

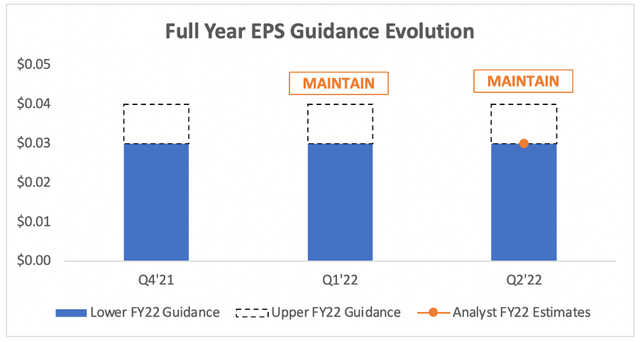

In terms of full year EPS, Cloudflare’s guidance remained the same as it has been for the last few quarters; between $0.03 and $0.04.

Seeking Alpha / Cloudflare / Excel

All in all, an extremely strong quarter for Cloudflare when compared to analysts’ estimates & its own guidance, particularly on the top line. This certainly goes some way to explaining the pop in shares following the announcement of these results.

Customer Trends

Cloudflare’s freemium business model gave it a foothold in customers of all sizes in its earlier days, but as the company itself has scaled, it has looked to reach more large customers. Not only are these large customers able to pay more, but they will also be easier to upsell new products to & will be less likely to go out of business any time soon.

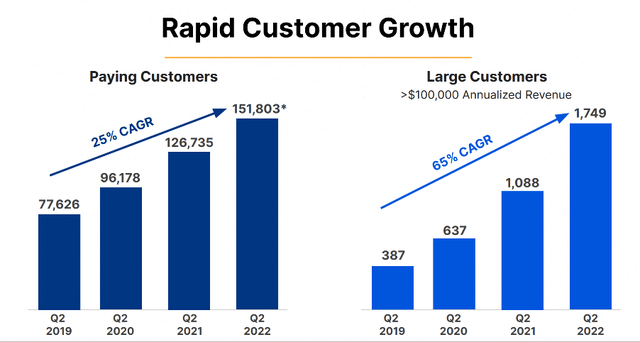

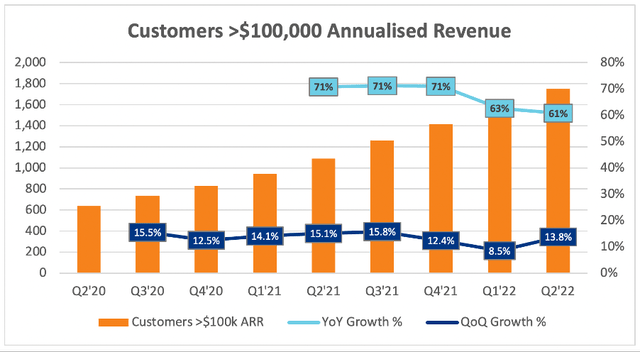

The trend in customer growth speaks for itself, as Cloudflare’s move upmarket appears to be paying off. The number of Large Customers (defined as customers with more than $100k in annualised revenue) has grown at a 65% CAGR over the past few years, reaching 1,749 in the latest quarter. This has dramatically outpaced the growth of all paying customers, which has grown at a 25% CAGR over the same time period.

Cloudflare Q2’22 Investor Presentation

Digging a bit deeper into these Large Customer trends, we saw a warning sign back in Q1’22 in terms of growth. Not only did the YoY increase fall from 71% in Q4’21 to 63% in Q2’22, but the sequential growth rate was at its lowest for some time – in fact, the QoQ growth of 8.5% was the first time sequential growth had been in single digit percentages over the past couple of years. I recently wrote an article on Datadog’s (DDOG) Q2 results, where this SaaS company also saw sequential growth in large customers drop to single digits for the first time & shares fell on the news.

So, did Q2’22 offer more of the same?

The good news is that the quarterly slowdown was short lived, and sequential growth in Q2’22 was 13.8% – happy days! The YoY growth was still down slightly at 61%, but realistically Cloudflare was never going to be able to keep that YoY figure growing; not only is 2021 a very difficult year for comparisons since it was such a great year for Cloudflare, but these growth levels are naturally going to ease up. Either way, 61% YoY growth in Large Customers is still pretty fantastic!

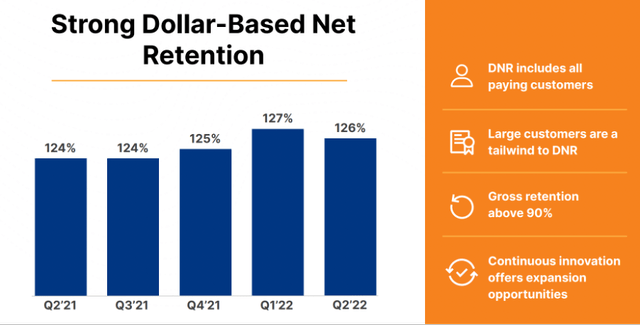

Even more impressive is Cloudflare’s dollar-based net retention rate of 126% for Q2’22. It has been consistently above 120% over the past 5 quarters, driven by a combination of Cloudflare’s ability to upsell customers with new products & the fact that it is moving upmarket, and that these larger customers now make up a greater share of revenue. This is even better when you consider that the DBNRR was 115% in Q2’20, so it has been consistently heading in the right direction.

Cloudflare Q2’22 Investor Presentation

This isn’t enough for Co-Founder & CEO Matthew Prince, however, as he called out in the earnings call:

Our dollar-based net retention remained strong at 126%, down 1% over last quarter. While there may be some noise in this number from quarter-to-quarter, we won’t be satisfied until it’s above 130% and best of breed among the companies we consider peers.

Looks like investors could see this number expanding further, which would be more validation of the investment thesis in this company.

The Prince Of Earnings Calls

I’ve read through a lot of earnings call transcripts over the past few weeks, and they talk about the business and everything that’s going on – but, in truth, they’re pretty boring. So when I read through the Cloudflare transcript and saw Co-Founder & CEO Matthew Prince’s personality shine through, I thought it only makes sense to share some of the more interesting lines from him – particularly since they are important to investors!

Co-Founders Matthew Price & Michelle Zatlyn (Cloudflare)

He spoke a bit about the fears of a recession, and how it’s impacting Cloudflare:

I’m not a member of the National Board of Economic Advisers, so I’m not the person to say whether we’re in a recession or not, how bad it may be or how quickly we may rebound. But I am the CEO of Cloudflare. And while our business remains strong, I believe this is a time for prudence and caution. The metaphor I’ve been using with our team is to talk about the different conditions you may face driving a car on the road. A year ago, we could see for miles and the road was clear, so it made sense to open up the throttle. Today, we find ourselves in what my grandmother used to call it tule fog. The road ahead is less certain, so it makes sense to keep our hands on the wheel, our eyes on the road and let up a bit on the accelerator.

Whether we’re in one or not, recessions suck. They hurt everyone. No company is recession-proof. But some are more recession-resilient than others. Some things I know are universally true. No matter how bad this recession may get, companies aren’t going to abandon the Internet. They’re not going to give up on the cloud and go back to on-premise boxes and packaged software. Hackers aren’t going to stop hacking, so cybersecurity will remain a must-have, not a nice to have. And we’re already seeing evidence of all of this, with our gross renewal rate in every region for the first half of the year, hitting all-time highs since we went public. We are not recession-proof, but I wouldn’t trade places with any other CEO right now.

This is again more validation of the thesis; Cloudflare might be seeing the same uncertainty that other businesses are seeing, but it is much more recession-resistant than a lot of other companies. Cybersecurity in particular is a must-have, and so I feel happy owning a few of these companies in my portfolio (disclaimer: CrowdStrike (CRWD) is my largest holding).

I’ve also highlighted that incredible line about gross renewal rates being the highest they have been since Cloudflare’s IPO in 2019, which is stunning when investors consider the economic uncertainty at the minute. I gave Cloudflare substantial credit for switching costs in my initial thesis, and this seems to confirm my belief.

Cloudflare also announced that they expect to be free cash flow positive in the second half of this year, which is great because positive FCF gives me a lot more comfort. Again, Prince had a story for this:

14 years ago, in 2008, at the onset of the last global recession, Google pulled their full-time offers for all their summer interns, which included my co-founder at Cloudflare, Michelle Zatlyn. If that hadn’t happened, Cloudflare would have never been born. At the same time, I learned what a margin call was and, simply embarrassingly, literally had to borrow money from my mom to pay my rent. That’s when I got an extremely personal lesson on the importance of free cash flow, and it’s why I’m ensuring right now in this uncertain time that Cloudflare is prioritizing being free cash flow positive.

This is one earnings call transcript that I would actually recommend going and reading, particularly Prince’s opening remarks, as it is both fairly entertaining and incredibly informative for investors.

Valuation

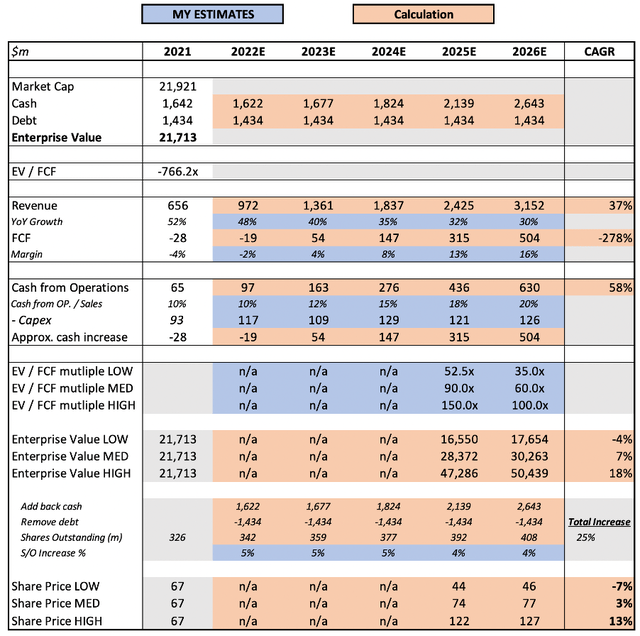

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Cloudflare is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have outlined my assumptions in my previous article, and so will only highlight any changes. I have updated the inputs for enterprise value with Cloudflare’s latest figures, and I have also updated the 2022 revenue estimate such that it is now in line with Cloudflare’s top-end guidance. The final change I have made is a very slightly decrease the level of dilution, since Cloudflare is focusing more on bringing in free cash flow & so the need for dilution should reduce.

Put all that together, and I can see shares achieving a 3% CAGR through to 2026 in my mid-range scenario. Now, clearly this is a pretty poor return, but I truly believe that Cloudflare is capable of outperforming my estimates – as it has consistently beaten expectations in the past, and has a huge opportunity ahead.

Investment Thesis: On Track

Cloudflare is continuing to move upmarket, upsell existing customers, and exceed all expectations. The focus on generating positive free cash flow in the second half of this year & beyond gives me a lot more comfort, and everything in this latest report makes me very happy as a Cloudflare shareholder.

The share price is still expensive, but in truth, I don’t think a company such as Cloudflare will ever be anything other than expensive. Sometimes you have to pay for quality & potential exponential growth, and that is what the market is doing for Cloudflare.

It won’t be everyone’s cup of tea, but it is certainly mine, and I will be reiterating my previous ‘Buy’ rating.

Be the first to comment