zoranm/E+ via Getty Images

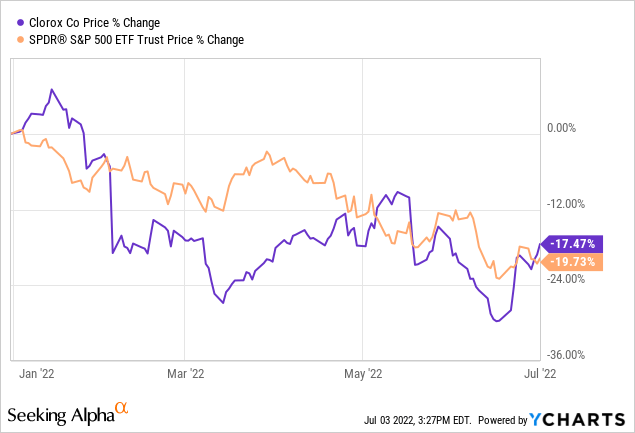

Clorox’s (NYSE:CLX) stock price has declined by about 17% year to date, slightly outperforming the overall market, which has declined by almost 20%.

Although CLX’s stock has a strong track record of outperforming the broader market during times of low consumer confidence, we believe that at the current valuations the firm is not a clear buy. Not only the valuation, but the macroeconomic headwinds, leading to shrinking margins are also raising concerns for us.

Let us take a look first at what we like about Clorox at this point.

Performance during low consumer confidence

Consumer confidence is often regarded as a leading economic indicator, which can help investors gauge, how consumer spending is likely to develop in the near future.

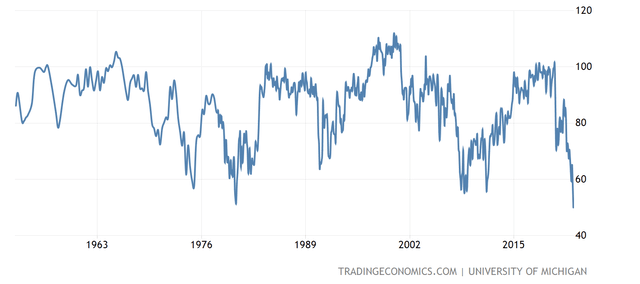

U.S. Consumer confidence (Tradingeconomics.com)

U.S. consumer confidence has been steadily declining in the past months, falling even below levels seen in 2008-2009, during the financial crisis. Although consumer spending has remained strong in the first half of 2022, we believe that the low consumer confidence is likely to have a substantial impact on the spending in the not so distant future.

During times of low consumer confidence, consumers tend to cut or delay purchases of durable, discretionary, non-essential goods. Firms that are selling these kind of products are impacted the most. On the other hand, firms like Clorox, are likely to be relatively unaffected. Even, when confidence is low, people keep buying household products, although a shift to lower cost alternatives is often observed.

So let us see, how Clorox’s stock has actually performed in the last 30 years, during times of low consumer confidence.

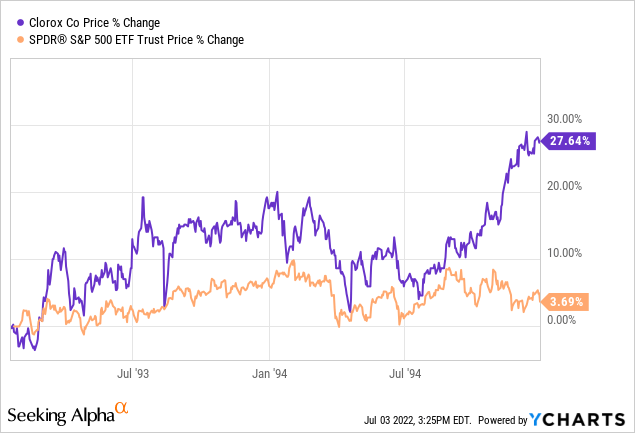

1993-1995

In this time frame, both the S&P 500 (SPY) and Clorox have gained. However, Clorox has outperformed the broader market by about 24%.

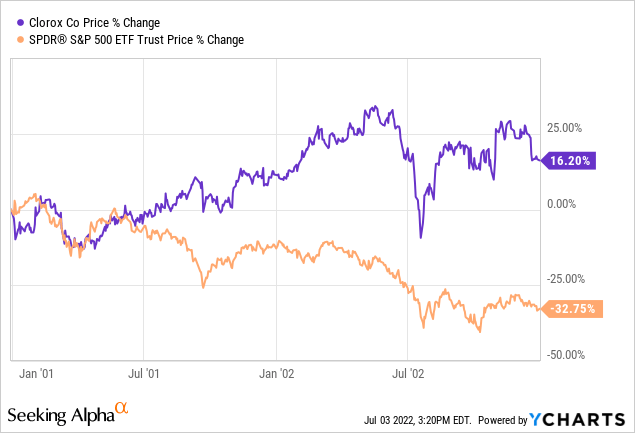

2001-2003

Between 2001 and 2003, after the burst of the dot com bubble, the broader market has declined by as much as 33%, while CLX has gained about 16%.

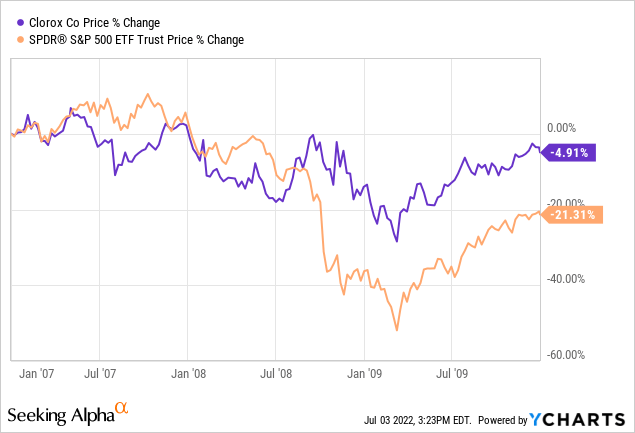

2007-2010

Between 2007 and 2010, the period that contains the financial crisis, both the S&P500 and Clorox have finished in the negative territory. But CLX has once again significantly outperformed the broader market by declining only 5%, compared to the 21% decline of the SPY.

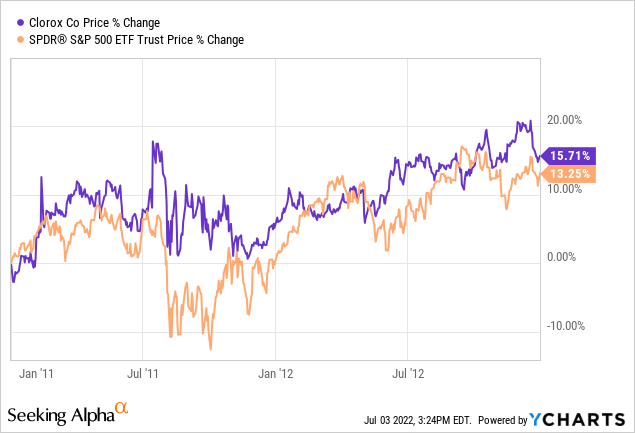

2011-2013

In this time frame, CLX and SPY have more or less performed in line and both have ended the period in the positive territory.

All in all, we can see that CLX has a performed very well historically during times of low consumer confidence.

In our opinion, due to Clorox’s extensive product portfolio and strong brand recognition/loyalty the demand for the firm’s products is going to remain high in the near term. Therefore, we believe that the firm is well-positioned to outperform once again in the current market environment.

Let us now dig into some aspects of the firm that we do not really like at this point.

Declining margins

The firm’s margins have been significantly hit in the first quarter of 2022. Higher costs, including manufacturing, logistics and commodities, substantially hurt the margins. The firm was not able to offset these negative impacts by pricing.

Due to the geopolitical tension in the Eastern European region, we expect the energy prices to remain elevated for the rest of 2022. On one hand, there have been some positive news last month, regarding OPEC+ increasing the production output by a higher than planned amount, however prices have not substantially come down. On the other hand, the gas supply of Europe has become quite uncertain after the supply of Russian gas has been reduced for a period of time. The incident in the Freeport LNG plant in the U.S. has further worsened the situation and caused the gas prices to skyrocket.

Because of the high commodity price uncertainty in the near term, we do not foresee a significant improvement of CLX’s margins in the near term. Before we could rate the stock as “buy”, we would like to see the firm prove that it can be successful in passing on the increased cost to the customers and expand its margins.

Valuation

We believe that the firm is not particularly attractive from a valuation point of view. When looking at a set of traditional price multiples, including price to earnings ratio, EV/EBITDA and price to cash flow, all indicate that the firm is trading at a significant premium compared to its peers.

Although demand for CLX’s products has remained relatively high, the declining margins are having a meaningful effect on the firm’s earnings.

We believe that the current price multiples are not justified and we would like to see the stock price to come down substantially, or the profit margins to improve, before we would consider investing in the company.

Dividends

Clorox has a strong track record of returning value to its shareholders in form of dividend payments. The firm has actually been paying dividends to its shareholders for the last 44 years consecutively, and they even managed to increase the dividend every year in the past 20 years.

Currently the firm pays a quarterly dividend of $1.16 per share, which corresponds to an annual yield of about 3.2%.

On the other hand, Clorox’s dividend payments right now appear to be unsustainable. The dividend payout ratio (TTM) (GAAP) of more than 125% and the cash flow payout ratio (TTM) of 85% are both concerning.

Due to the high payout ratios, we are avoiding CLX’s stock for now. We believe that there are better high yield stocks on the market, with a safer and more sustainable dividend yield.

Key takeaways

Clorox has a strong track record of outperforming the broader market during times of low consumer confidence. As the demand for household products is relatively inelastic, and is expected to remain high, a change in the spending behaviour of the consumer is not likely to have a material impact on Clorox’s financial performance.

On the other hand, due to the increasing costs, including logistics, manufacturing and commodities, CLX’s margins have contracted significantly in the first quarter of 2022. Due to the high uncertainty in energy prices caused by the geopolitical tension in the Eastern European region, we do not expect a significant margin expansion in the near term.

The firm has a dividend payout ratio of more than 100%, which raises concerns about the safety and sustainability of the dividend payments in the near term.

We are avoiding CLX right now.

Be the first to comment