Jonathan Kitchen

As I’ve written a few times before, those unfortunate enough to have seen me dance know that my timing isn’t always great. In January 2020, I suggested that the shares of The Clorox Company (NYSE:CLX) were overpriced in an article with the not-so-original title “Clorox is Overpriced.” Right on cue, the shares spiked higher in price. You may remember that the world was struck by a global pandemic in early 2020, and the demand for bleach spiked. When I suggested the shares were overpriced, they were trading at about $153 per share. During the pandemic-induced buying frenzy, they got up to about $230 per share, so this was a painful call for a while. The shares have since fallen down to Earth, and are currently trading hands at about $138 per share, or $15 below where they were when I suggested the stock was too dear.

It’s time to revisit the name, because a stock trading at $138 is, by definition, a less risky investment than the same stock that’s trading at $153. I’ll decide whether to add this equity to the portfolio by looking at the most recent financial performance and comparing that to the stock. I’ll also offer notes on the most recent earnings call for you to save you the time and hassle of reading it for yourself, because apparently readers like that sort of thing. Finally, I recommended people sell put options in lieu of buying the stock, and I cannot wait to write about how that trade worked out.

I try to keep my “thesis statements” to a paragraph or less, especially on a Friday when I know my readers are busy making plans about which high-end resort to visit over the coming 48 hours, or which supermodel to take to dinner tonight. Sometimes there’s a bit more than a paragraph of “thesis”, though, and this is one of those occasions I’m afraid. I’ll do my absolute best to get you in and out of this article as fast as possible, though. Although the latest financial performance outperformed expectations, results were poor in my view. Additionally, the company is forecasting adding 200 basis points to gross margin, while they admit that the headwinds they face will remain a challenge for an unknown period of time. At the same time, the level of debt has grown, which increases the level of risk here. With this as a backdrop, we see the shares trading at very rich valuations. I don’t think this will end well for investors. I think I made a great risk-adjusted return on my short puts previously, I can’t recommend that trade on this occasion because the shares are trading so far above what I would consider to be reasonable strike prices.

Also, I wouldn’t be the petty jerk that I am if I didn’t point out that the analyst community dropped the ball on this name over the past few years. You may remember that in mid-December of 2020, Citi, for example, rated Clorox a buy. At the time, the shares were trading at about $204. Wall Street analysts remained quite optimistic about this company in spite of warnings from very wise investors like Jim Chanos. When the stock was down about 16% from its peak and appeared to be heading lower, the analyst at Wells Fargo may switch from an “overweight” on the stock with a price target of $240 to a “sell” with a $170 target. I’m pointing out how badly analysts generally fouled the ball here for a few reasons. First, I take pleasure in it. Second, it gives me a chance to remind you readers, yet again, of the value of the Seeking Alpha business model. The wisdom of the crowd that we represent often does better than Wall Street.

Finally, although I’m going to avoid the shares, I would not short this stock. While I don’t think it’s likely that the optimism currently embedded in price will work out well, the market can be quite forgiving sometimes. For example, I can see the crowd collectively saying something like “well, the company didn’t meet the expectations we had for it, but let’s give them a pass because they were impacted by FX and inflation headwinds and those can’t be helped.” Based on this, the market may drive the shares higher in the same way it would have done had the company achieved its targets. This “heads I win, tails you lose” dynamic often takes hold of stocks, which makes shorting very dangerous. Thus, I recommend just sitting on the sidelines until price inevitably falls to more closely line up with value.

Notes From Clorox’s Q1 FY23 Earnings Call

I’ll just offer up what I consider to be the most relevant points to come from the most recent earnings call, and I’ll do this in bullet point form to make reading it that much easier for you. This is further proof that I’m absolutely obsessed with trying to make your reading experience as pleasant as possible.

- The company beat expectations on both the top and bottom lines. Specifically, revenue was about $40 million higher than expected, and EPS of $.93 was about $.15 ahead of expectations.

- According to the CEO, the company managed to deliver better-than-expected results, which was a reflection of the strength of the brands, ongoing consumer loyalty, and solid execution.

- The company continues to contend with a number of macro headwinds, like the strength of the U.S. dollar, for instance. The CEO contends that the company is addressing these challenges in an agile manner. The CEO referenced the IGNITE strategy in which the company plans to deliver 3-5% sales growth over the long term.

- At the beginning of the year, the company forecasted about $400 million in inflation expenses impacting the supply chain, and, according to the CFO, they’re a bit over that target as of the end of the first quarter, though not by much.

- The company expected to deliver gross margin of about 38% for the year, which is about 200 basis points higher than it was last year. That seems a bit rich to me, given the ongoing strength of the U.S. dollar, and the negative impact of $400 million in inflation-driven expenses.

- The CFO pointed out that the entire leadership team is committed to rebuilding margins to pre-pandemic levels, but acknowledged that that will take a while. He acknowledged that making predictions about when margins will return to pre-pandemic levels relies on inputs that are outside of the company’s control.

I’d be very surprised if the company can deliver higher margins in the teeth of these admittedly unpredictable headwinds. That said, I’m often surprised. For instance, I was recently surprised by the many great uses of Clorox bleach, so my surprise proves nothing.

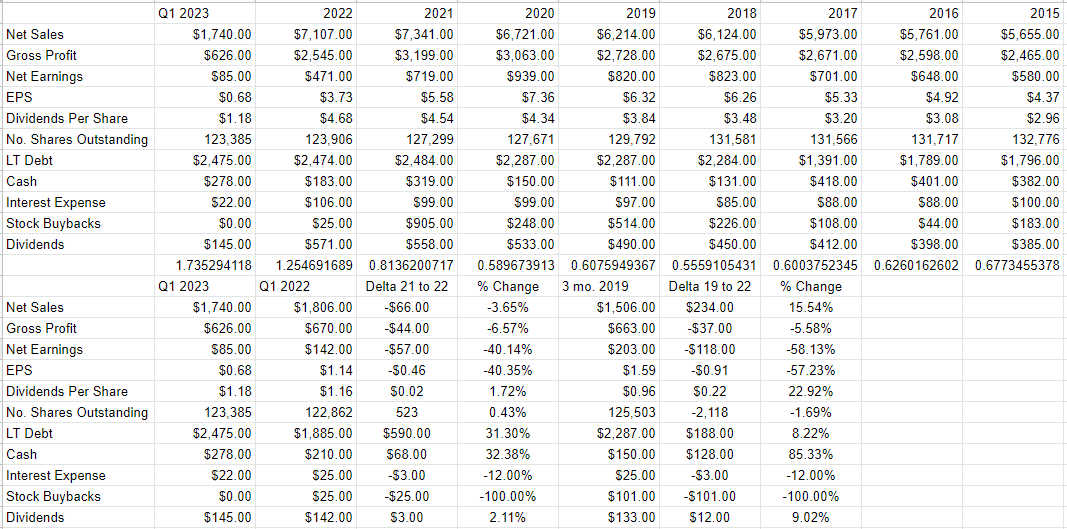

Clorox Financial Snapshot

The financial history has been pretty bad recently in my view. As the CFO pointed out on the most recent earnings call, margins have declined for about 5 quarters, and it shows. When compared to the same period a year ago, the most recent quarter was pretty soft in my estimation. Specifically, revenue and net income were off by 3.7% and a whopping 40% respectively. Things may have been slightly less bad if we could point to a single item that caused net income to slide so precipitously, but we can’t. A $21 million reduction in advertising expenses was slightly eclipsed by a $25 million uptick in selling and administrative expenses, for instance. When margins are this thin, a $66 million reduction in revenue takes a toll. Additionally, the capital structure has deteriorated fairly massively, given that long-term debt is about $590 million, or 31%, higher now than it was this time last year. On the bright side, interest expenses are down slightly, but I don’t like seeing a company take on massive amounts of new debt in the current environment.

In some sense, things look less bad when compared to 2019 in some ways. Revenue is up about $234 million, or 15.5%, for instance. The mood turns much more sour, though, when we note that net income in the most recent quarter is actually about $118 million lower than it was in the pre-pandemic era. All of the above suggests to me that there’s little to get excited about here. I’d be comfortable buying the shares, but only if they’re trading at a very attractive valuation.

Clorox Financials (Clorox investor relations)

The Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. A business buys a number of inputs, like sodium hypochlorite, to pick an input totally at random, adds value to those inputs, and then sells the results for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company, and the stock is buffeted by a number of forces some of which may have little to do with the underlying business. Inflation and the rising dollar may impact the business significantly. A fashionable analyst may decide that “Clorox is in a very unique position as its products are not only being stored but also consumed by households and businesses.” The crowd may form a view about the relative attractiveness of stocks in general, and that drives shares up or down. Strangest of all in my mind, stock investors can be mesmerized by the pronouncements of Fed officials, as if the difference between a 50 and 75 basis point move in the overnight rate matters all that much.

Although it’s tedious to see your favorite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. This is why I only ever want to buy a stock that is relatively cheap, and it’s why I’m reconsidering Clorox. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

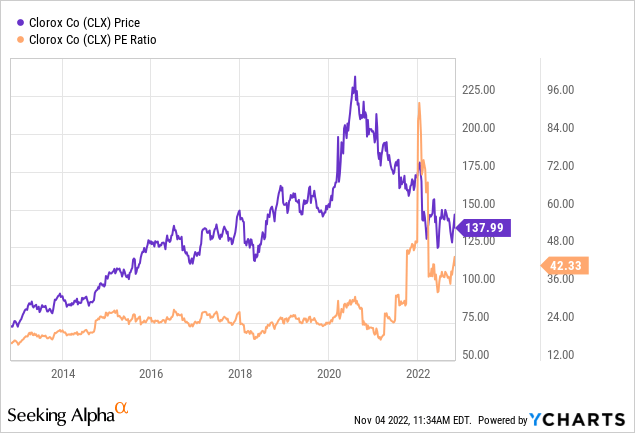

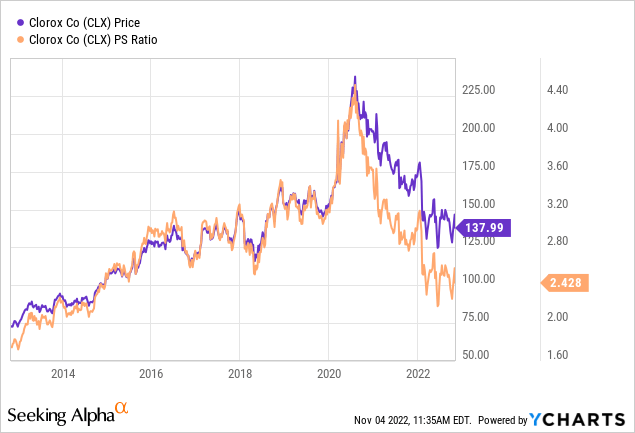

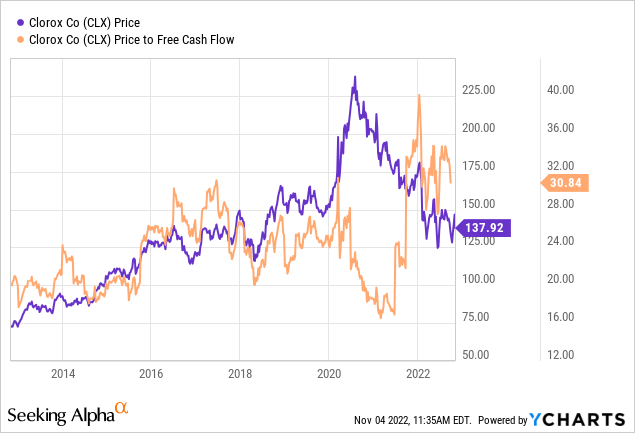

As my regulars know, I use a host of measures to judge the relative cheapness (or not) of a given stock, some of which are quite simple, some of which are quite sophisticated. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you’ve forgotten, I eschewed Clorox stock when it was trading at a price-to-earnings ratio of 24.23 times. Fast forward these months, and the shares are about 75% more expensive on this basis. While the shares are “cheaper” on a price-to-sales basis, they’re hardly cheap, especially by historical standards. The market continues to pay $2.43 for $1 of sales here, which I consider to be a bit excessive. Not unexpectedly, the shares are relatively expensive on a price to free cash flow basis, too.

If you know I like cheap stocks, you also know that I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Clorox at the moment suggests the market is assuming that this company will grow earnings at a rate of ~6.5% in perpetuity, which I think is very optimistic. Given all of the above, I’ll continue to avoid this name until the price drops further.

CLX Options Trade

In my previous missive on Clorox, I recommended people sell the July 2020 puts with a strike of $130 for $1.70. I sold 10 of these myself and pocketed $1,700 as the shares rose in price, and these expired worthless. I would say that the returns I generated on these were actually a superior risk-adjusted return to those earned by stockholders. I would either pocket the $1.70 in premium, or I would have been “forced” to buy the stock at a price about 15% below the level it was at when I wrote the puts. This definitely compares favorably to the people who bought the shares for about $227 on the day the puts expired worthless. I write all of this to brag, obviously, but also to point out that short put options often offer a superior risk-adjusted return. The investor either collects a decent income, or they are obliged to buy a company they like at a price that is attractive to them.

While I normally like to repeat success, I can’t in this case because there are insufficient premia on offer for puts at reasonable strike prices. If the shares drop in price from current levels, I’ll certainly reconsider this trade. For the moment, though, I’m going to simply sit this one out.

Be the first to comment