Steve Jennings

Investment Thesis

Fastly, Inc. (NYSE:FSLY) has been on a turnaround for about two years, and the addition of new CEO Todd Nightingale last quarter marks a complete revamp of the entire management team. In my previous article, I described its 2Q22 quarter as disappointing, which appears to be the case for its 3Q22 quarter. However, I appreciate new CEO Todd’s candor in acknowledging the existing issues, and, unlike CEO Joshua Bixby, he is committed to reducing operating losses in the future.

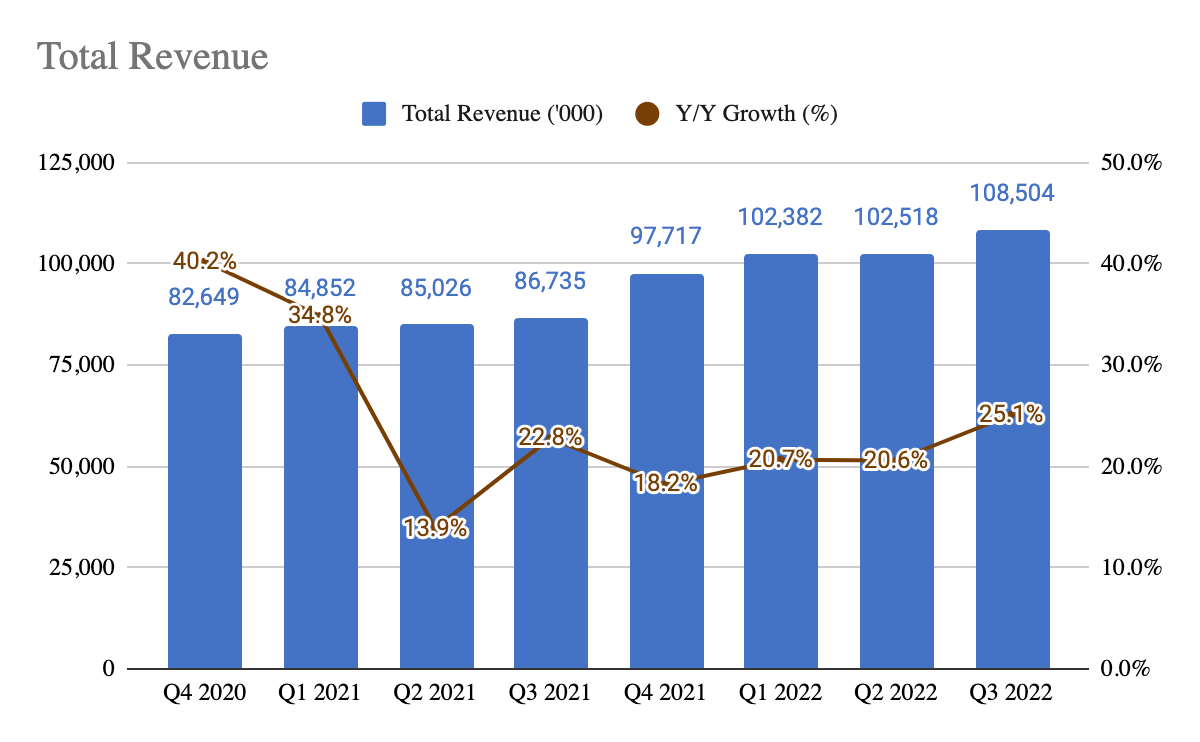

Revenue Growth

Fastly 10-Q

3Q22 revenue came above guidance, growing 25% Y/Y. Unlike the previous quarters, management did not disclose Signal Science’s revenue. According to management, this growth is driven by cross-selling in Signal Science and Compute@Edge. While this growth seems decent, how did they fare in other areas?

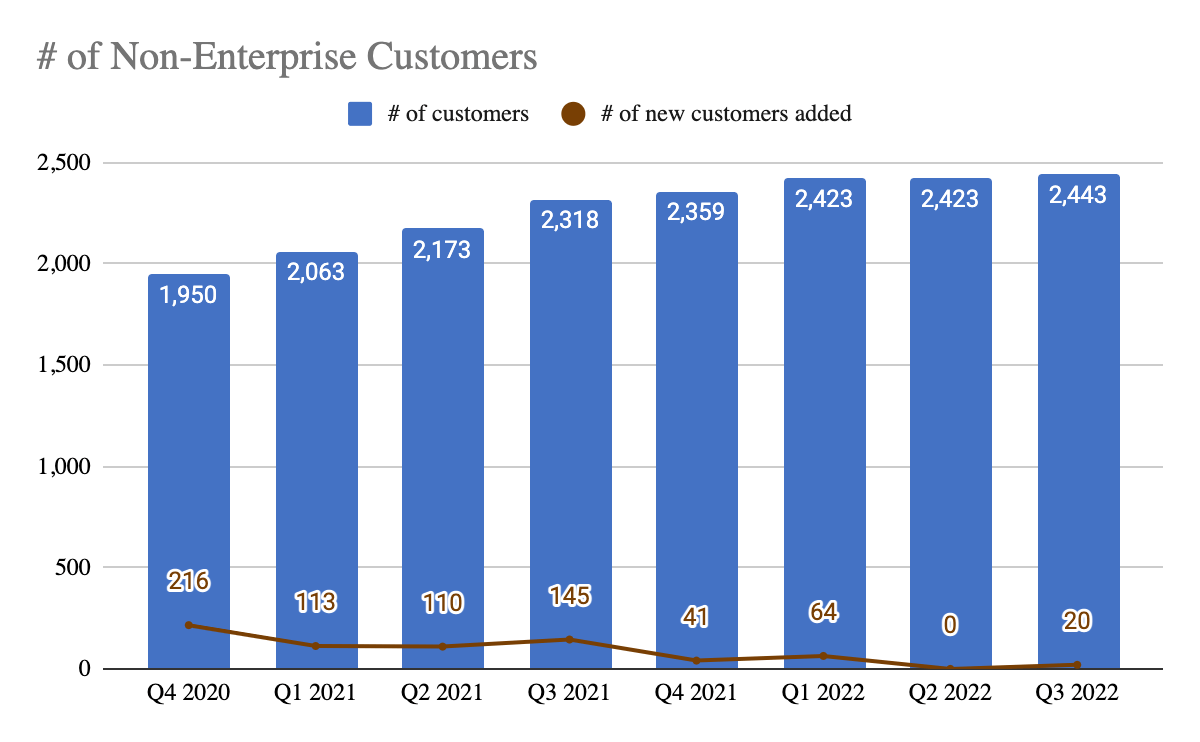

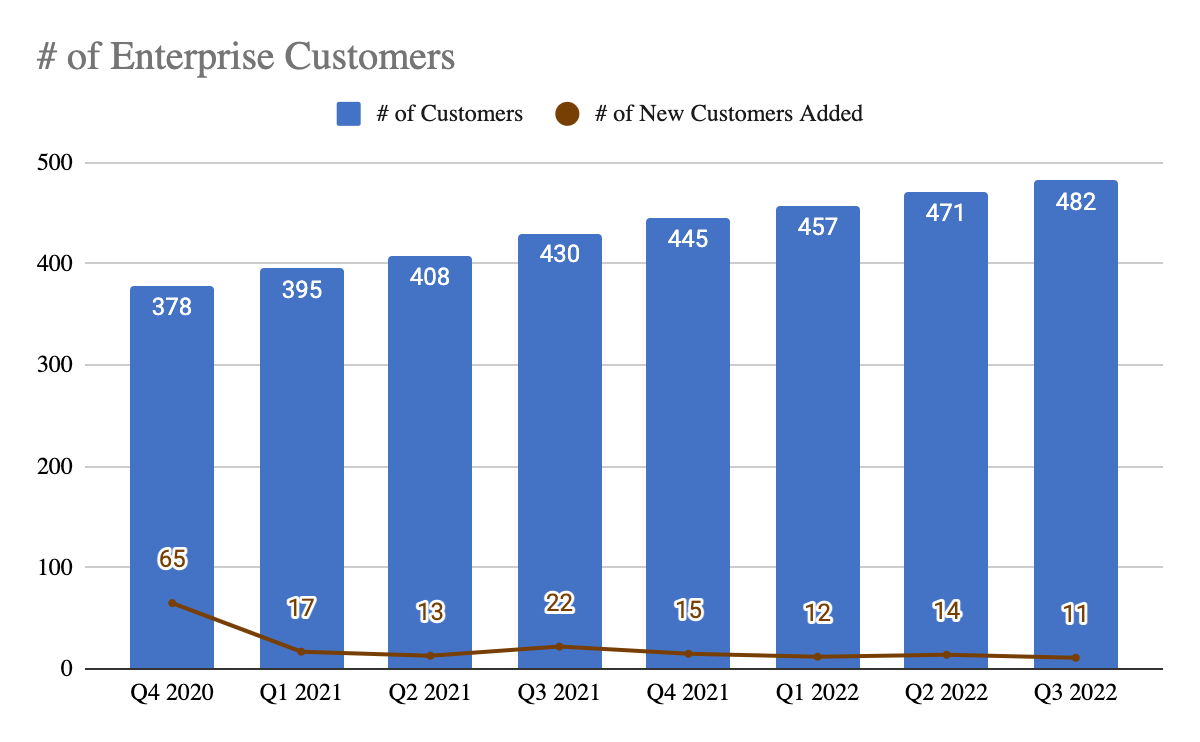

Continued Struggle To Acquire Customers

Fastly 10-Q Fastly 10-Q

Fastly’s struggle to acquire customers continue as they added only 20 new non-enterprise and 11 enterprise customers this quarter. During the 3Q22 earnings call, management also attested that the revenue growth is driven by existing spending, and the sales cycle has not changed for onboarding new customers:

“…As far as new customer logo sales cycle changes, haven’t seen any yet, but I think it’s a good thing for us to look out for…what’s been driving the business thus far is expansion with our existing customers where we’ve actually seen maybe even less friction and expanding on existing customers.”

Furthermore, management strove to simplify its product offerings to reduce sales friction:

“And I will be focused on: number 1, simplifying our product packaging. This will enable our customers to understand “purchase” our technology more effectively, and our team can operate with less friction.”

While enterprise customers are the core of Fastly’s operation, the rate they are growing their enterprise customers is nothing short of disappointing. Furthermore, their business is driven by a land-and-expand strategy, I would argue that growing its non-enterprise customers are equally as important. And there seems to be a product-market fit issue as they have not found any success with landing non-enterprise customers.

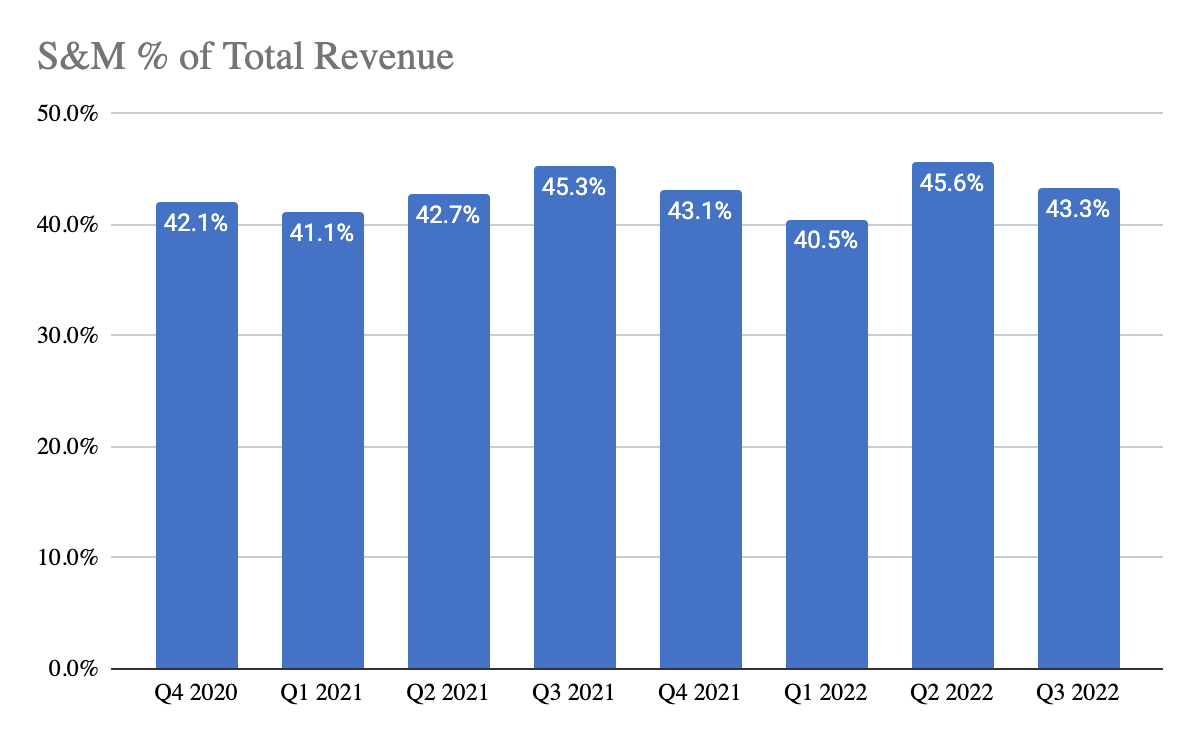

Fastly 10-Q

This weak sales operation is also evident from its poor sales efficiency, as its sales and marketing (“S&M”) expenses as a proportion of total revenue continue to be really high.

High Operating Losses and Worrying Negative Free Cash Flow Margin

Fastly 10-Q

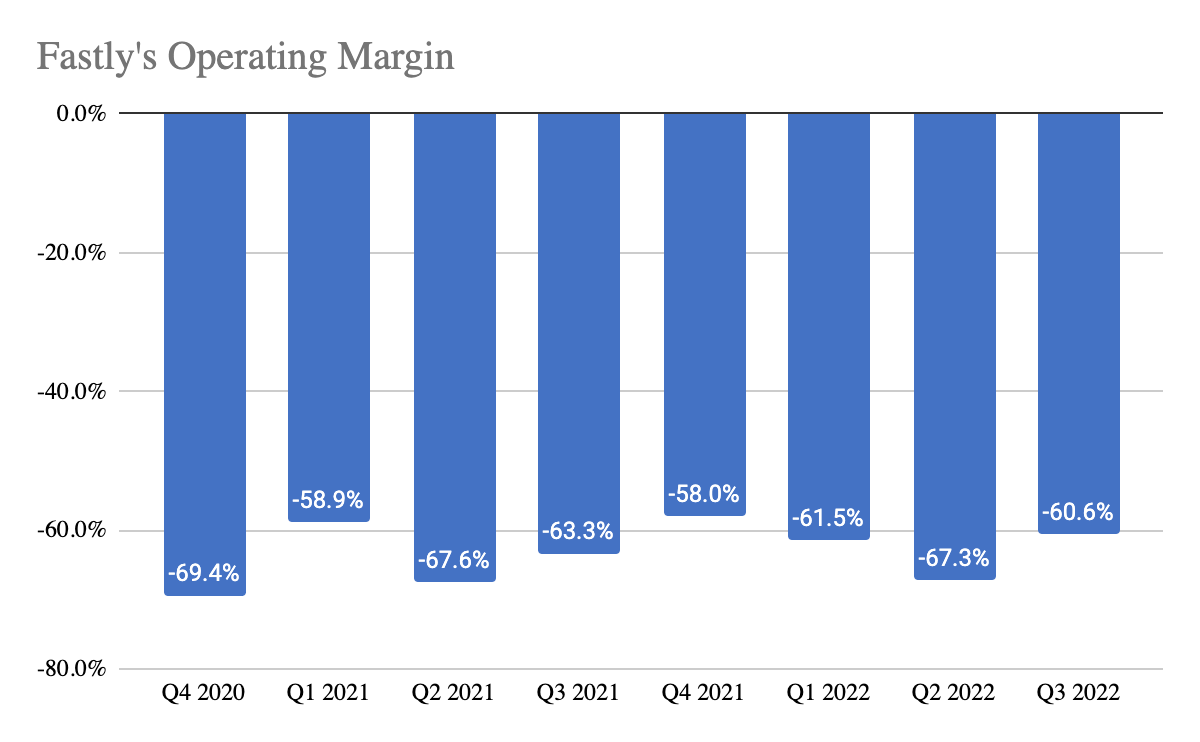

Fastly’s continued struggle to acquire customers and its high operating expenses are evident in the operating losses as its operating margin remains in the 60% range. CEO Todd acknowledged this during the quarter:

“….we have a real opportunity to post a far more profitable or far better operating losses next year than this year…that is incredibly top of mind for me and our whole leadership team…discussion of deploying every single dollar spent to Fastly’s to fuel growth, be radically more efficient with our spend, more judicious and even scrappy with that spend is incredibly top of mind for us because it’s not lost on me that we have to improve profitability here and specifically our cash burn…”

In the entire earnings call, the management reiterated numerous times the focus on reducing operating losses, and analysts were also harping on the topic of profitability. In my view, this should have been the core focus under the leadership of the previous CEO, Joshua Bixby.

Fastly 10-Q

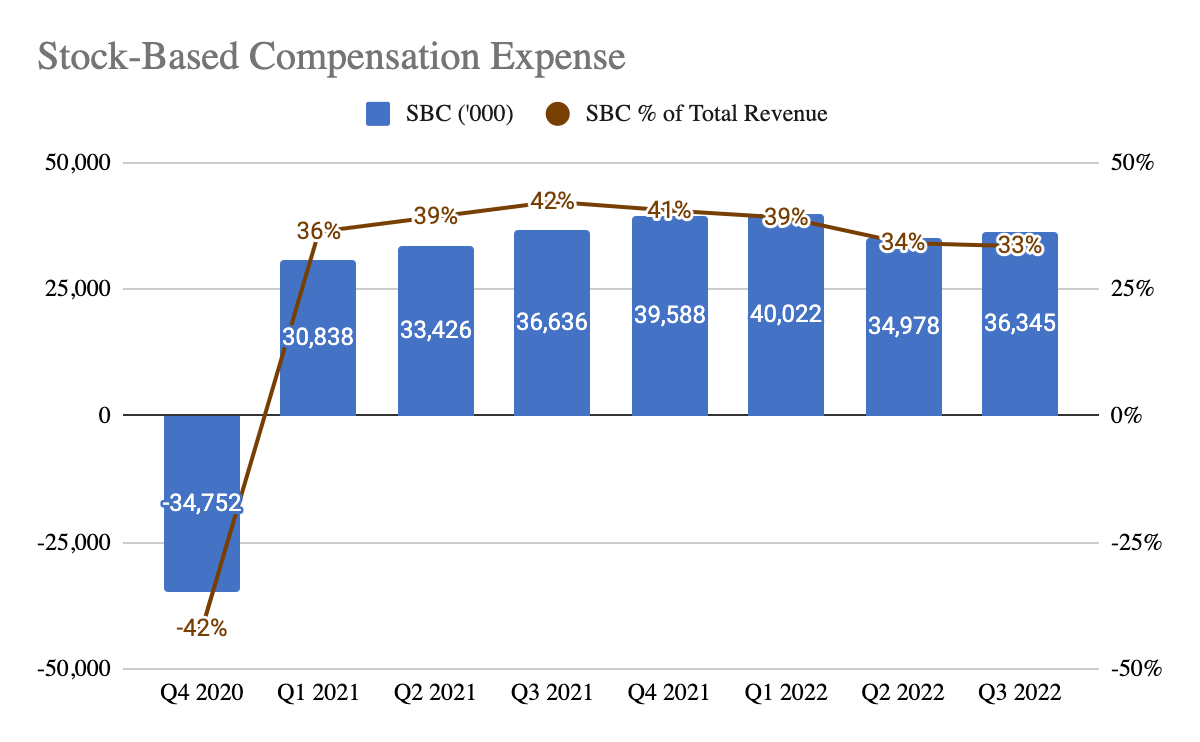

Previously, I have also talked about the high stock-based compensation (“SBC”) expense that Fastly is incurring, making up a huge portion of its total revenue. Since it is a non-cash expense, software companies tend to add back SBC into the cash flow operation (“CFO”) and exclude it in non-GAAP metrics such as adjusted EBITDA, which I personally do not agree with, and Aswath Damodaran has also addressed the issue of doing so.

Fastly 10-Q

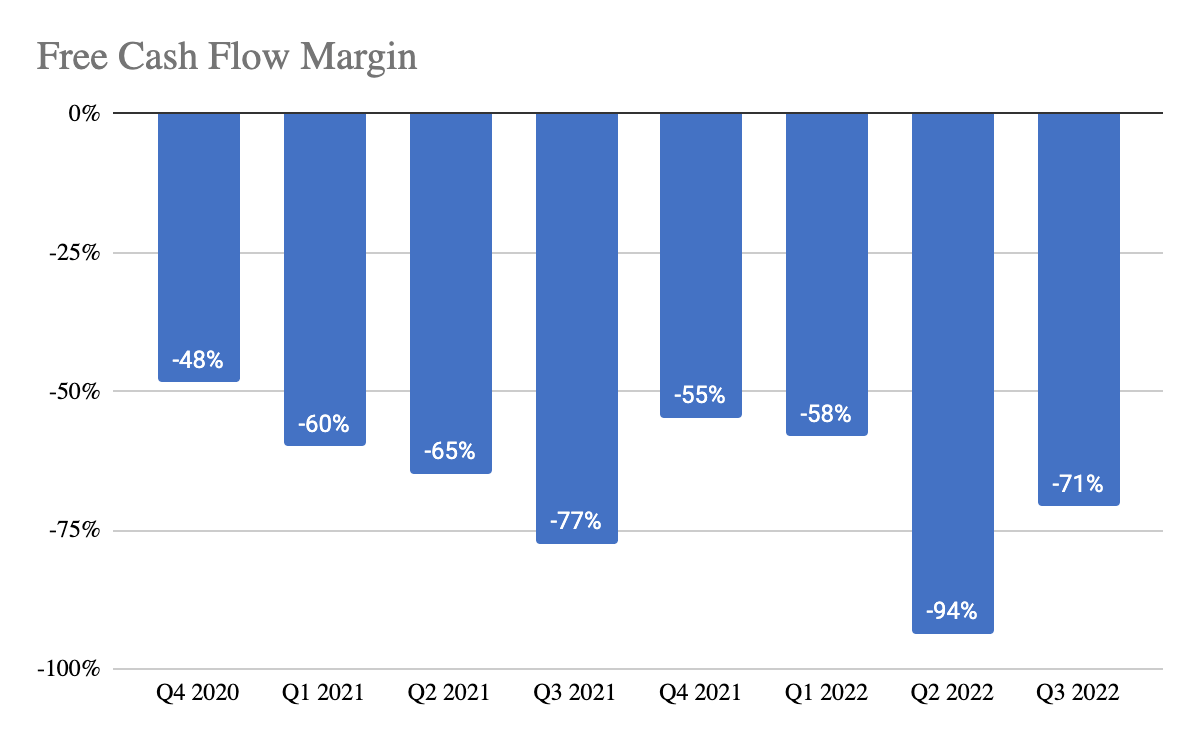

Adding back the SBC into the CFO gives us a negative 71% free cash flow (“FCF”) margin for the quarter. This is extremely worrying, as they are burning cash quickly at the expense of the weak sales operation, which is destroying shareholders’ value. Let’s also not forget that $704 million of convertible senior notes maturing on March 2026 are sitting on the balance sheet, which is 3.3 years from today.

Conclusion

Fastly had a rather disappointing quarter overall. While CEO Todd has acknowledged these issues, it remains to be seen whether material improvements will be made in the coming quarters. While I appreciate the management’s candid remarks, I will not place too much emphasis on them. There is still a lot of uncertainty in terms of investments at this point due to the lack of a clear path to profitability, and the Fastly turnaround will take longer due to the need to address its product-market fit and sales execution issues.

What are your thoughts on the quarter? Do let me know in the comment section below.

Be the first to comment