Vladimir Zapletin

Article Thesis

A sharp increase in global interest rates has increased worries about an economic downturn, which has made the stocks of many steel companies drop this year. This might provide buying opportunities for patient investors. In this article, we’ll highlight the strengths and weaknesses of Cleveland-Cliffs Inc. (NYSE:NYSE:CLF) and United States Steel Corporation (NYSE:NYSE:X) in order to see which steel company is better for different types of investors.

Recession Worries Make Steel Stocks Drop

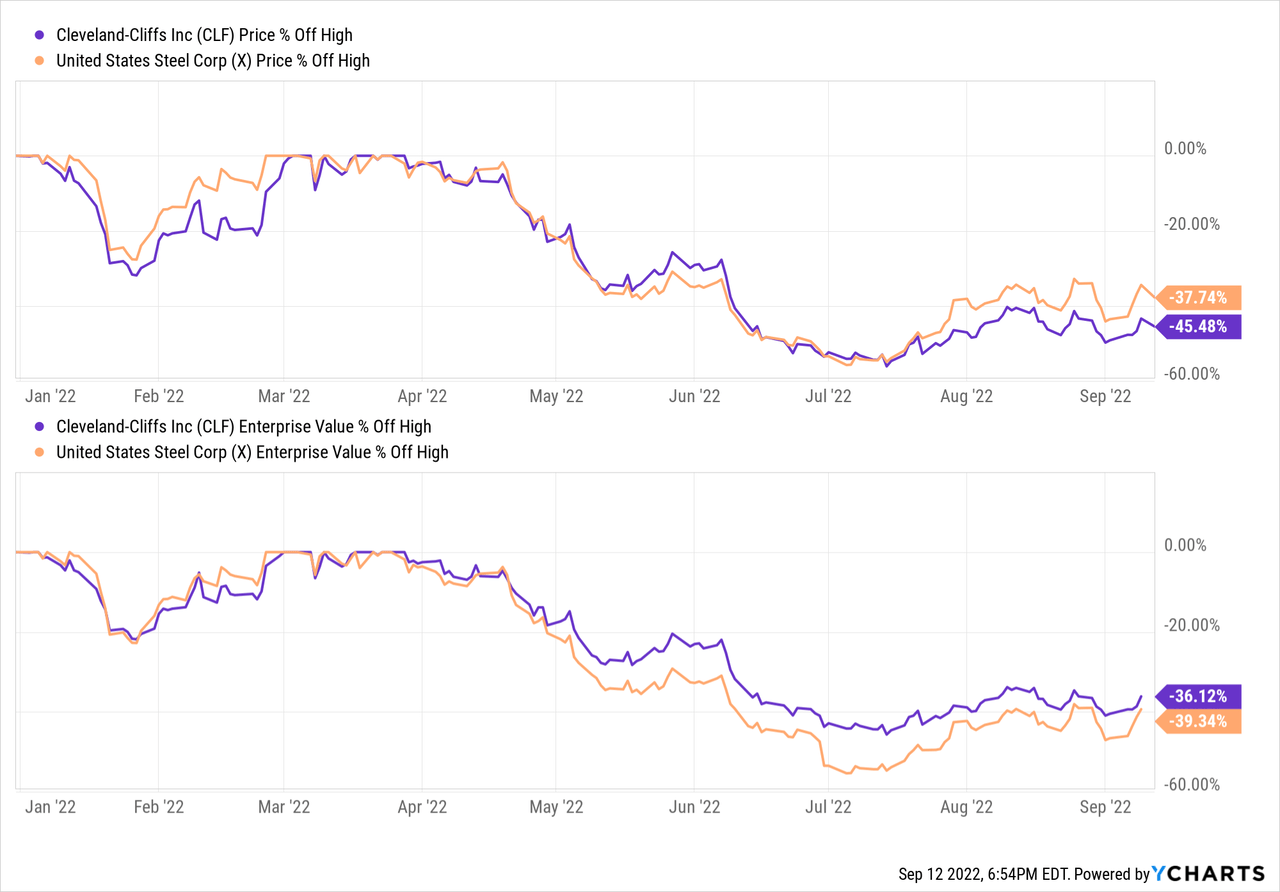

The global economy is facing a range of macro headwinds. The current Russia-Ukraine war, lockdowns in China, and rising interest rates in many parts of the world have led to a harsh economic environment. Steel companies traditionally have been economically sensitive, which is why the share prices of United States Steel, Cleveland-Cliffs, and other steel stocks is down meaningfully this year:

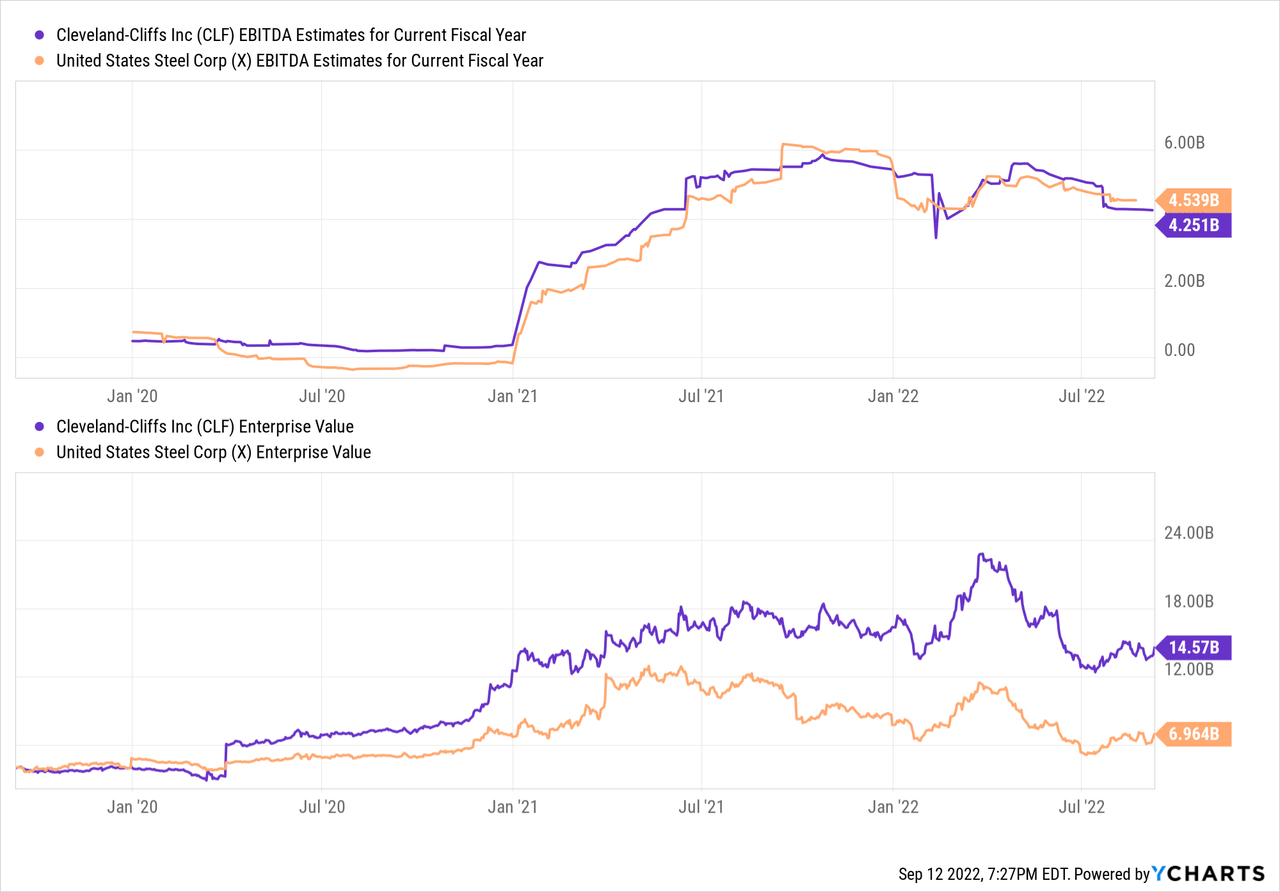

Cleveland-Cliffs has dropped by a hefty 45% from its 2022 high, while United States Steel is down by a pretty large 38%. Even on an enterprise value, i.e. when we also include the net debt position of the two companies on top of their market capitalizations, the drop was hefty, at more than 36% for both companies.

The market is forward-looking and anticipates a significant deterioration in business conditions, or at least the market is pricing these two steel companies for such a scenario. 2022 will most likely still be a banner year for both steel players:

Cleveland-Cliffs is forecasted to generate $4.3 billion in EBITDA this year. That makes for an enterprise value to EBITDA multiple of 3.4, suggesting a pretty low valuation in a static environment. Of course, if EBITDA drops considerably next year and beyond, then the forward valuation is not as low and CLF does not necessarily look as attractive any longer. But it is clear that CLF is pretty cheap based on what the company can earn in the current environment/in 2022. United States Steel is even cheaper, currently trading at an enterprise value to EBITDA multiple of just 1.6. That’s around half of CLF’s valuation, which could indicate that the market sees United States Steel’s EBITDA drop more in 2023 and beyond.

The valuation difference may also be attributable to the fact that CLF is seen as a company with above-average management quality, which could warrant a valuation premium versus CLF’s peers. CLF’s strong position in the automobile market also is another reason that helps explain its higher valuation, relative to X, although CLF still looks rather inexpensive in absolute terms.

Balance Sheet Strength And Shareholder Returns

Steel isn’t a high-growth industry, so investors put a lot of value on shareholder returns via dividends and buybacks. When it comes to dividends, neither company looks strong. Cleveland-Cliffs does not pay any dividends at all, while United States Steel makes some dividend payments, but at an almost negligible level: Its current dividend yield is 0.8%, which isn’t appealing for income investors.

Buybacks are more significant, and one could argue that they are also more important for steel companies overall. After all, stock prices for steel companies are highly volatile, and so are their cash flows. Paying a regular dividend isn’t easy for steel companies due to the ups and downs in the industry. On the other hand, they can return a lot of cash to shareholders during the good times. Since the volatility in steel companies’ share prices is bound to make for some attractive buying opportunities, buybacks can be a great way to generate shareholder value — as long as management teams are utilizing these buyback programs at the right time without damaging the balance sheets.

Looking at the balance sheet strength of CLF and United States Steel, it is pretty clear that Cleveland-Cliffs is the more heavily indebted company right now. Its net debt comes in around $5 billion, while United States Steel has only around $1 billion in net debt today. This nets the cash position of both companies against their gross debt positions. Since both companies are forecasted to generate relatively comparable EBITDA this year, CLF thus employs around 5x the leverage X uses, as their respective net debt to EBITDA ratios are ~1 and ~0.2 today.

Cleveland-Cliffs is forecasted to see its EBITDA decline less next year and in 2024, relative to United States Steel. CLF is, according to the analyst consensus estimate, poised to see its EBITDA drop by 33% in 2023, and by another 1% in 2024. Meanwhile, analysts believe that United States Steel will see its EBITDA drop by 54% next year, and by another 11% in the year after. That is explainable by CLF’s more resilient business model thanks to the contracts it has with automobile manufacturers that should have a positive impact on its average sales price, relative to what X will see in the next two years.

Still, even when we look at 2023 EBITDA estimates, CLF employs considerably more leverage than United States Steel, as its net debt to EBITDA multiple is around 1.8, versus ~0.5 for X. No matter how one looks at this, X is the company with the stronger balance sheet today. That positions the company very well for shareholder returns, which is why the company has spent heavily on buybacks in recent months. During the second quarter, the company bought back $400 million worth of shares, which is equal to 7% of the current market capitalization — or 28% annualized. In July alone, the company has spent another $130 million on share repurchases, effectively keeping the buyback pace in line with Q2. A new $500 million buyback program has been announced in July as well, thus it seems likely that the company has been spending heavily in August as well, and buybacks could remain high throughout the remainder of the year. Since X is trading at a very inexpensive valuation while having a strong balance sheet, buybacks seem opportune to me. Reducing the share count by a significant margin in the current environment could pay off handsomely for longer-term holders.

Due to its higher valuation and its weaker balance sheet, Cleveland-Cliffs hasn’t been as active when it comes to buybacks. Nevertheless, the company has not stood still, buying back around 1.5% of the company’s shares during the second quarter. That makes for a very solid ~6% annual buyback pace, although that is considerably lower compared to United States Steel’s numbers. With CLF making progress in lowering its debt position, the company could increase its buybacks in future quarters, although there is no guarantee for that.

Strategy Versus Valuation

United States Steel is cheaper, has a stronger balance sheet, and offers a way higher buyback pace relative to Cleveland-Cliffs. So far, it looks like X is the clear winner among these two companies. But Cleveland-Cliffs has some advantages as well. It is the clear market leader in automobile steels, and technical leadership in this space makes it likely that CLF will continue to receive premium prices for its products. X’s steel is, by comparison, more commoditized, making X more vulnerable versus competition and market downturns.

CLF’s management also has been expanding the company in order to generate higher profits along the value chain and in order to become more independent from other companies. Acquisitions also increased CLF’s scale, which generates some cost advantages in areas such as administration, purchasing, etc. In 2020, CLF was very active, acquiring both AK Steel and ArcelorMittal USA. With its vertically integrated model, CLF owns assets in pellets, HBI, and prime scrap. Its raw material comes from owned US locations, which makes CLF less dependent on imports relative to other steel manufacturers including United States Steel — CLF is the only US steel company that does not depend on imported pig iron, for example.

I’d thus say that CLF is the better company when it comes to defensiveness, resilience, and strategy. Investors can thus decide whether they want to pay up for these qualities and buy CLF at a higher valuation, or whether they prefer the ultra-low valuation and potential for massive buybacks that X offers. A case can be made for both, and I believe this is more a question of investing style and how risks are perceived, instead of a question of one company being good and the other one being bad.

Both Companies Could Benefit From European Macro Issues

Energy costs in Europe are ultra-high, which has resulted in some shut-ins of production across the continent. More of those could follow in the coming months. For non-European producers, that could be positive. At the same time, there are some issues in China due to lockdowns and electricity shortages due to a draught that reduces electricity generation from reservoir dams. Add the war in Ukraine that adds supply disruptions and sanctions on Russia, and US-based steel manufacturers could benefit from issues for many non-US-based competitors. If there is a harsh recession, that may not help much. But in case the economic slowdown is less pronounced than thought, US-based producers could be quite advantaged and the inexpensive valuations of CLF and X could result in considerable share price gains. Both companies have upside potential of more than 60% to their respective 52-week highs.

Be the first to comment