Godji10

Don’t waste your time with explanations: people only hear what they want to hear. ― Paulo Coelho

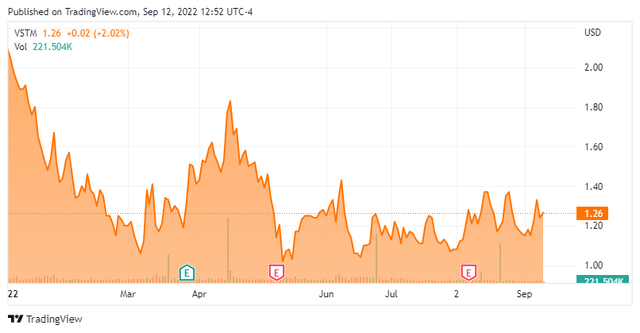

We haven’t taken a look at Verastem, Inc. (NASDAQ:NASDAQ:VSTM) since an article on this small biotech name early last year. There has been some news flow around the company since then and Verastem recently posted a new investor presentation, so it seems a good time to circle back on this story.

Company Overview

Verastem is based out of Massachusetts. The company developed ‘Copiktra’ which received FDA approval for chronic lymphocytic leukemia (CLL)/small lymphocytic lymphoma (SLL)/follicular lymphoma in the summer of 2018. The company soon after sold the global rights to this compound for a significant upfront payment. It continues to collect royalties and milestone payments from this arrangement.

August Company Presentation

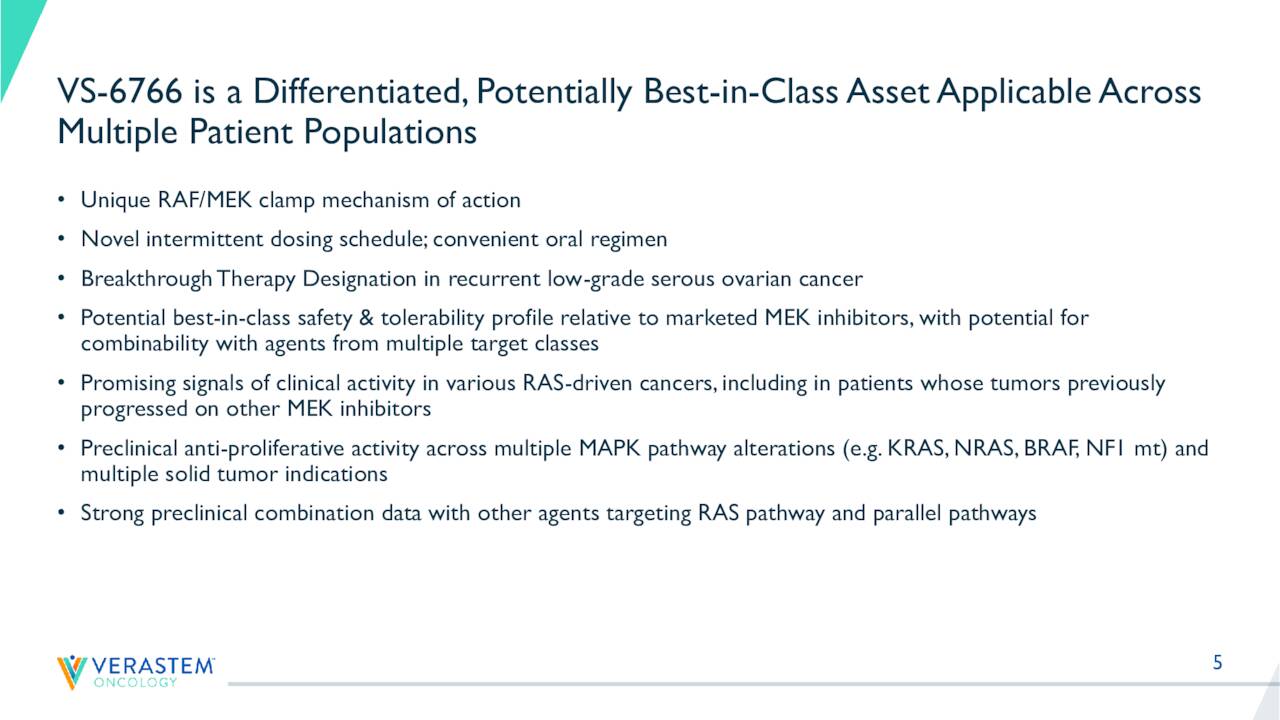

The company is currently focused on establishing its candidate ‘VS-6766’ as the backbone therapy for RAS-driven solid tumors. This is how management describes VS-6766 on its last earnings press release.

August Company Presentation

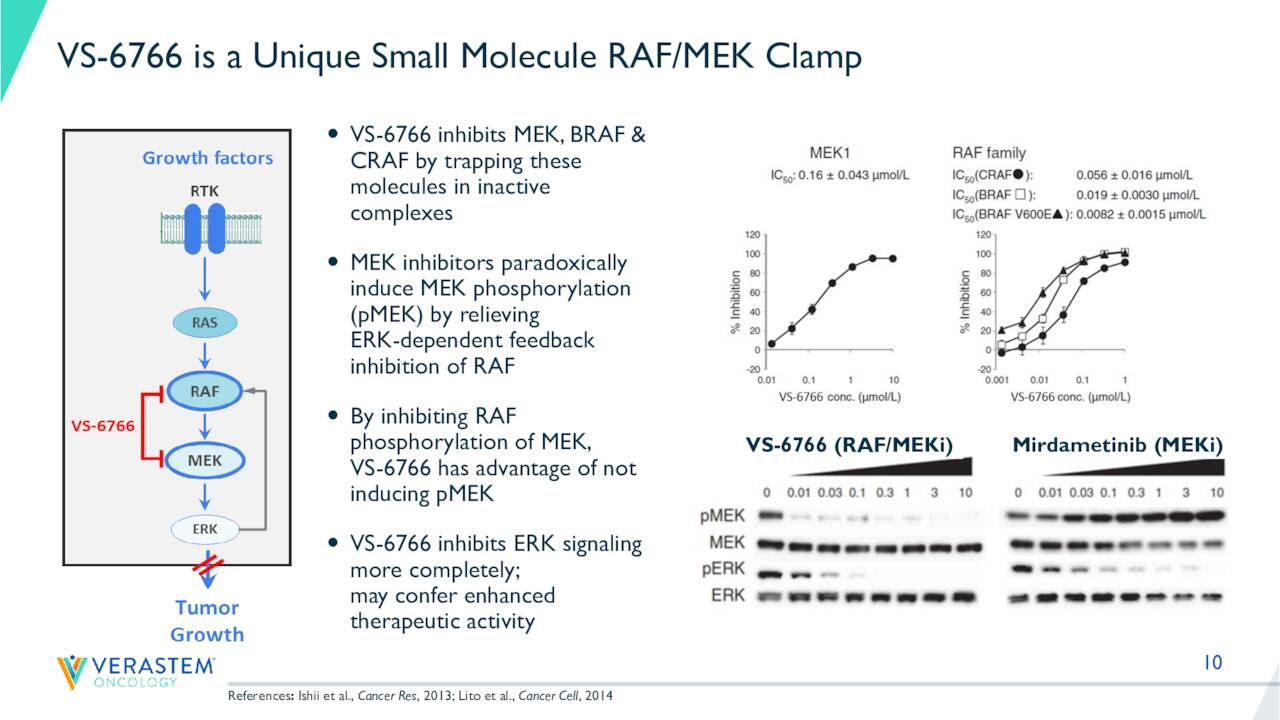

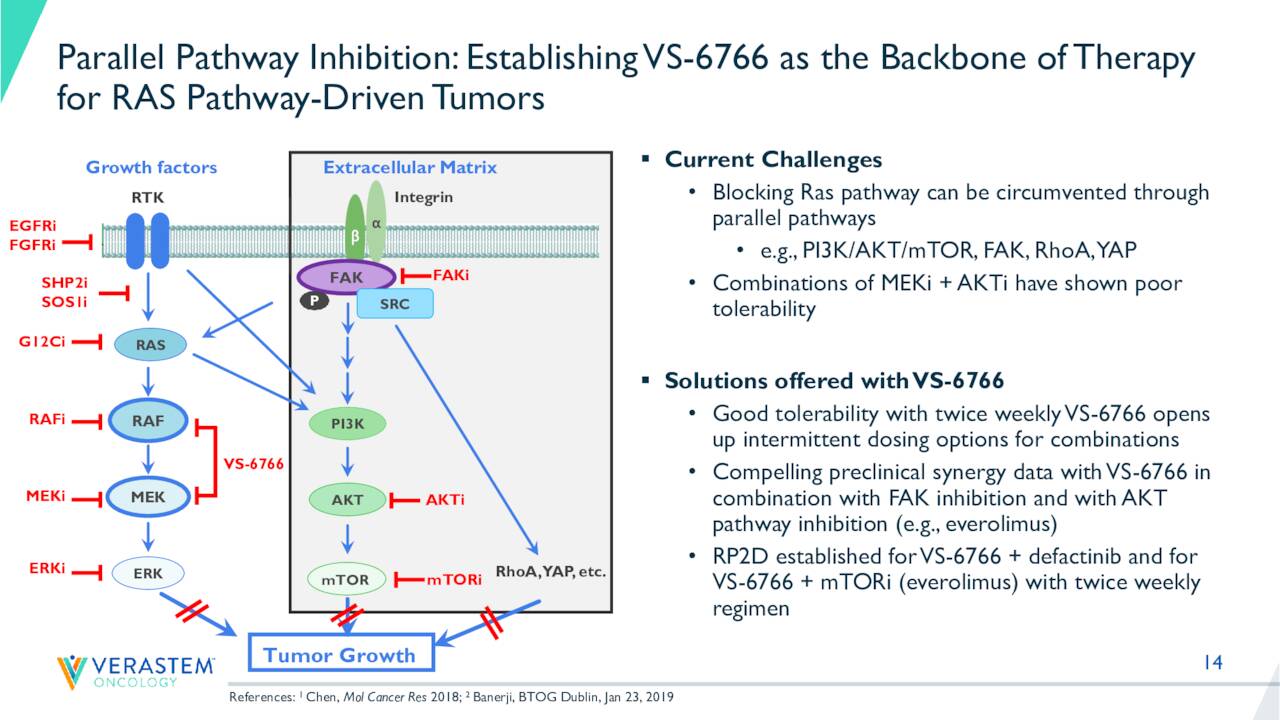

VS-6766 is a RAF/MEK clamp that induces inactive complexes of MEK with ARAF, BRAF and CRAF potentially creating a more complete and durable anti-tumor response through maximal RAS pathway inhibition. In contrast to other MEK inhibitors, VS-6766 blocks both MEK kinase activity and the ability of RAF to phosphorylate MEK. This unique mechanism allows VS-6766 to block MEK signaling without the compensatory activation of MEK that appears to limit the efficacy of other inhibitors.

August Company Presentation

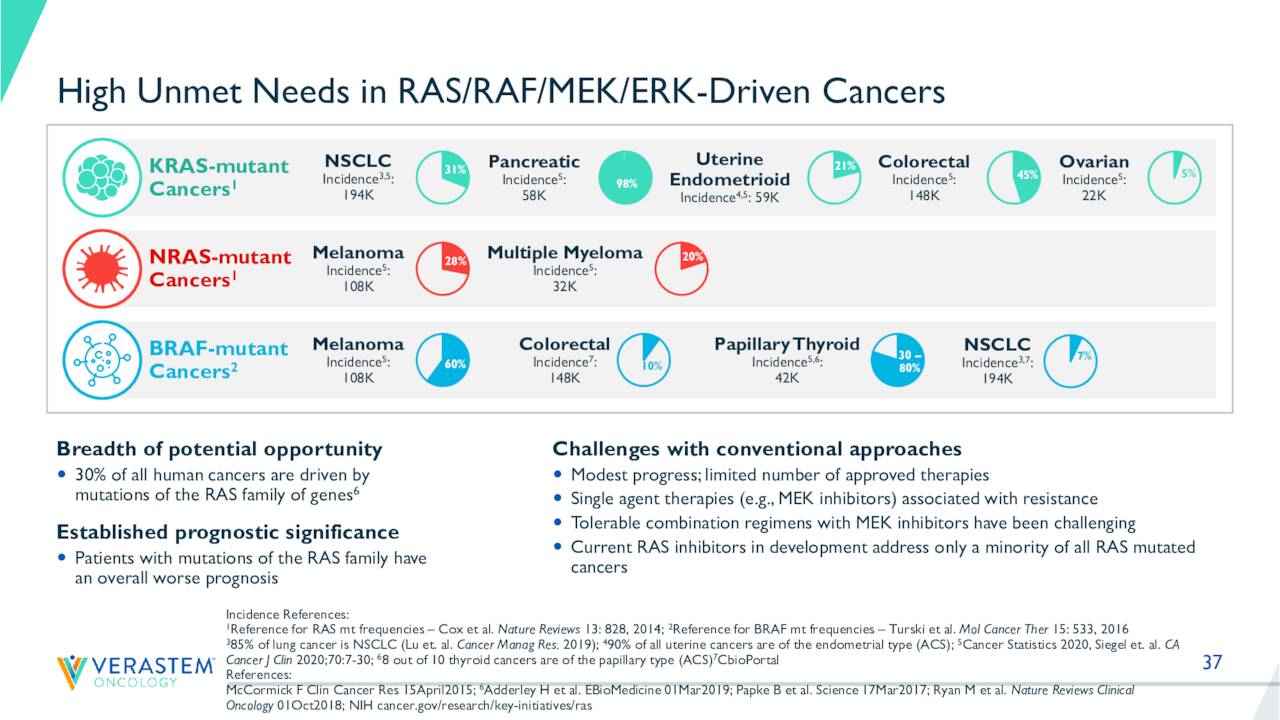

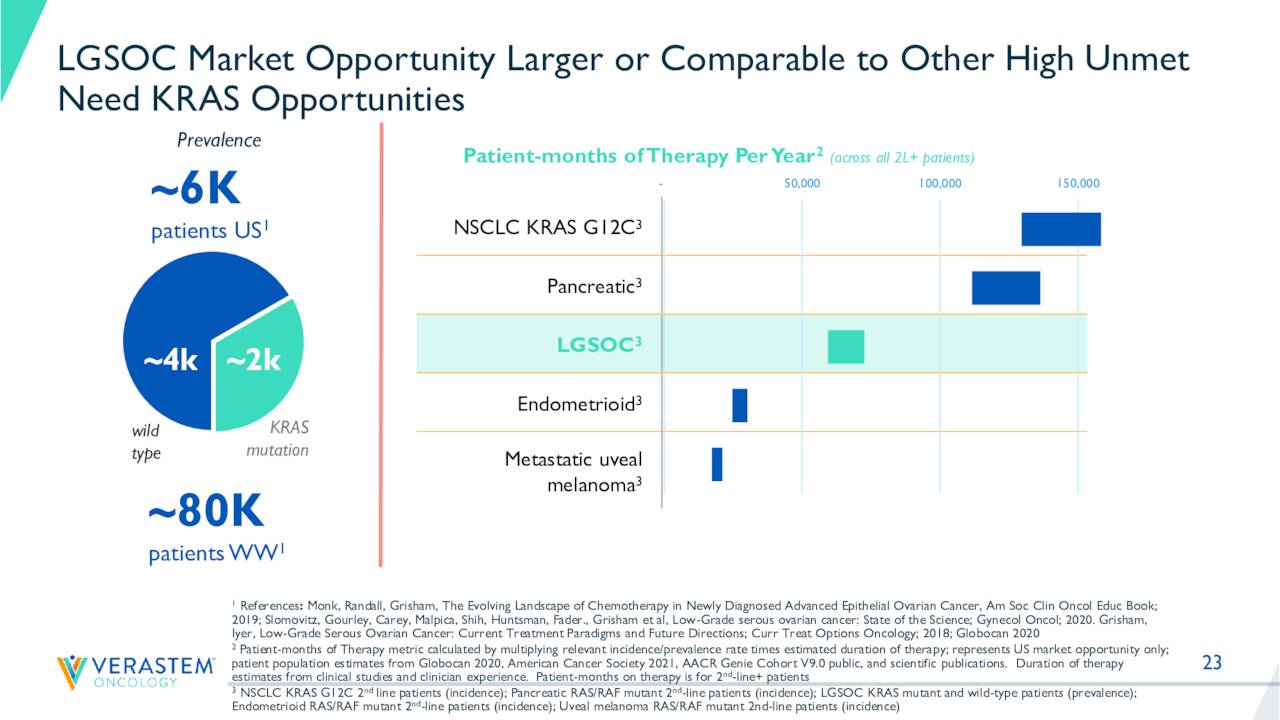

There is a high unmet need in the cancers VS-6766 is targeting in development. The stock currently trades around $1.25 a share and sports an approximate market capitalization of $230 million.

August Company Presentation

Developmental Progress

August Company Presentation

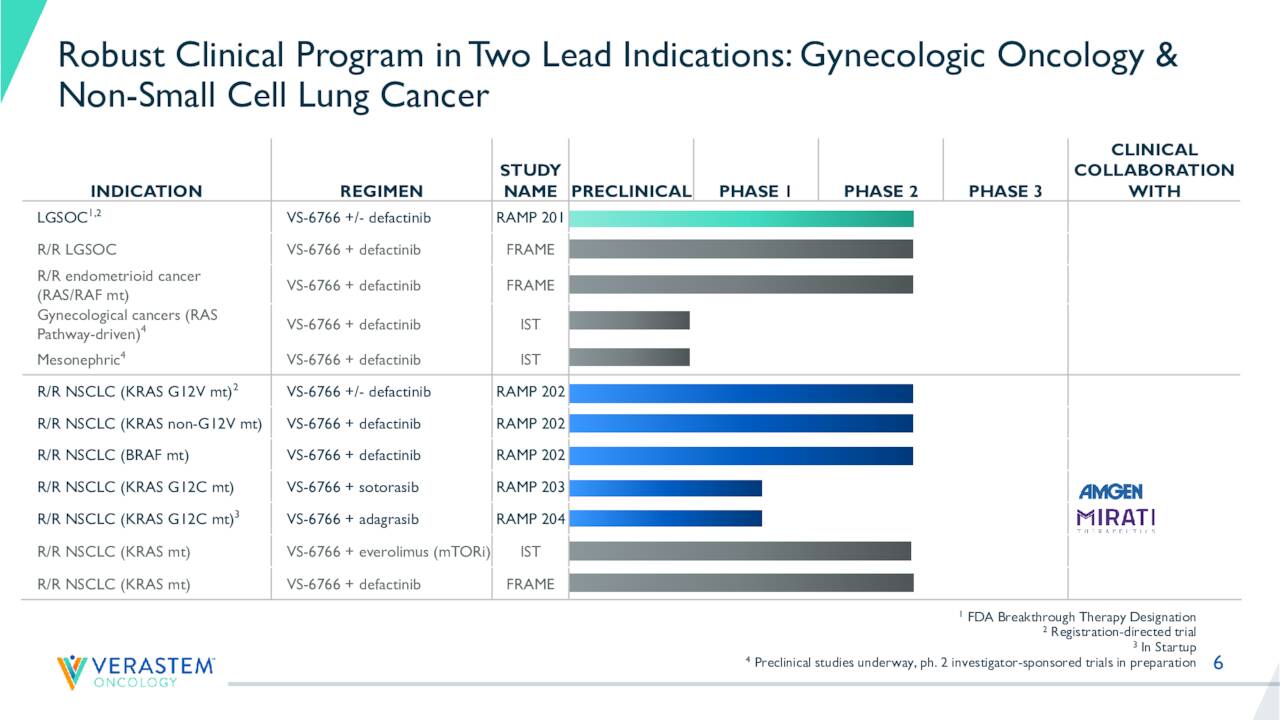

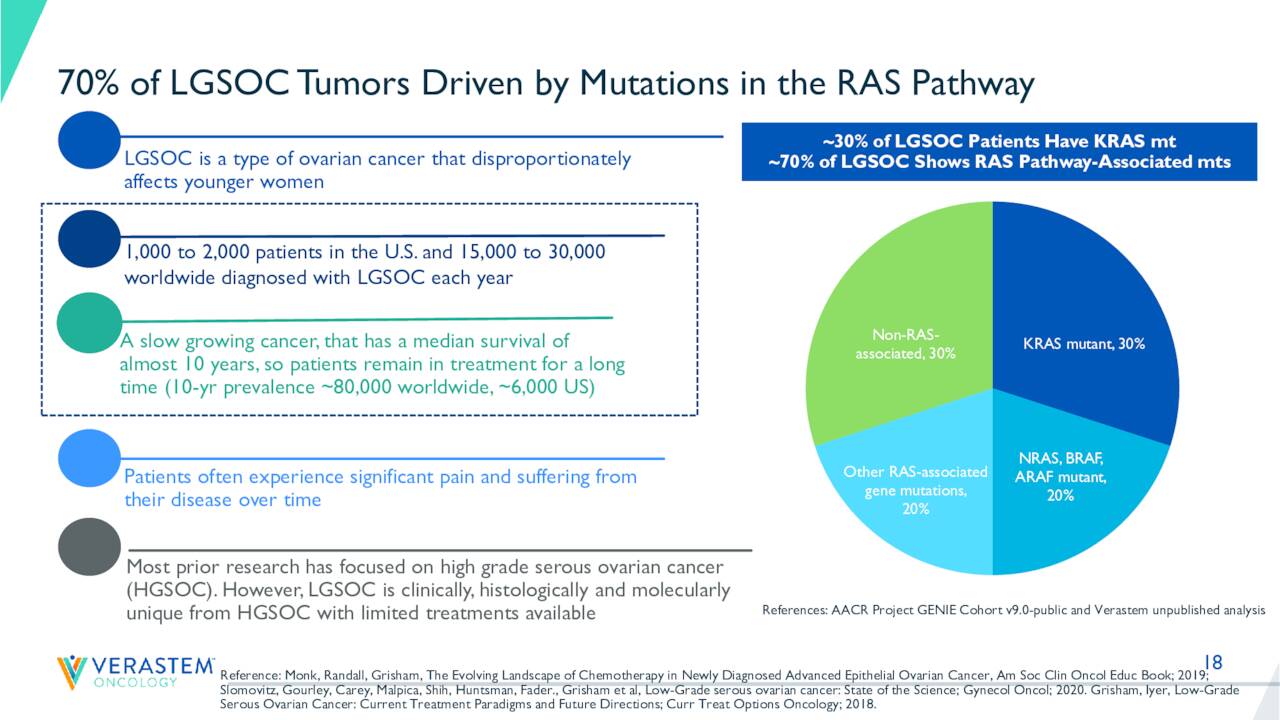

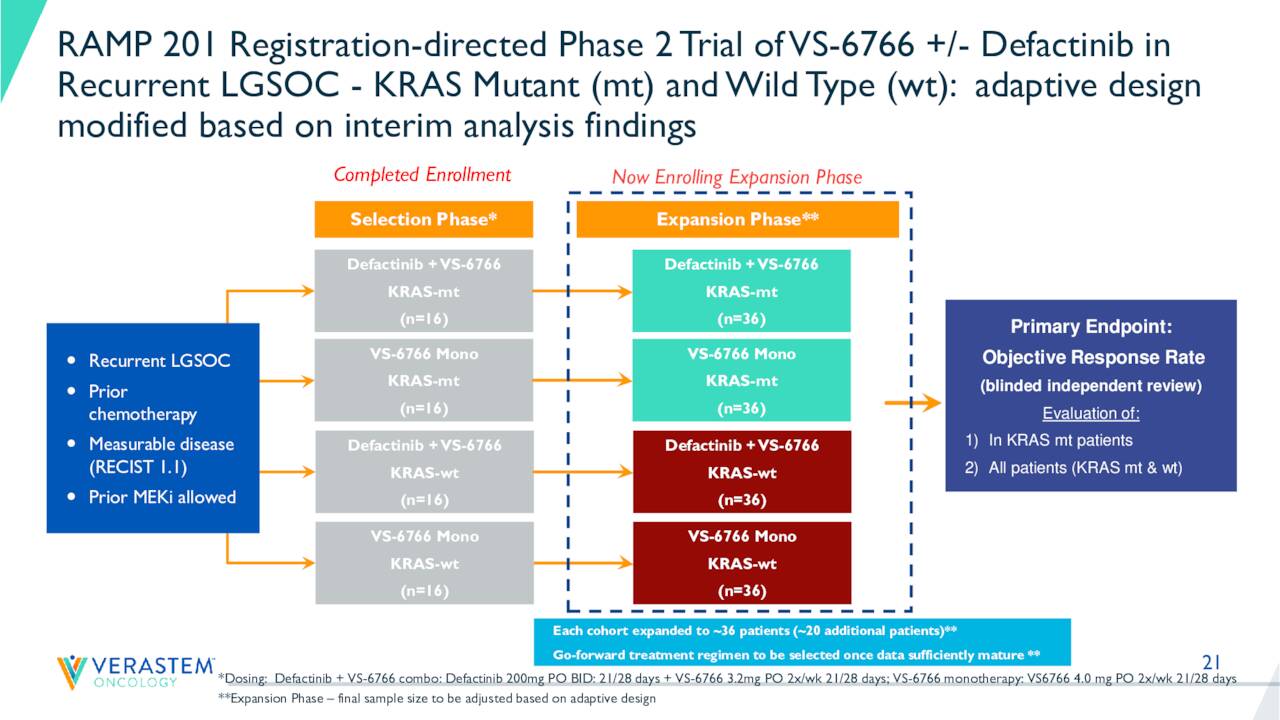

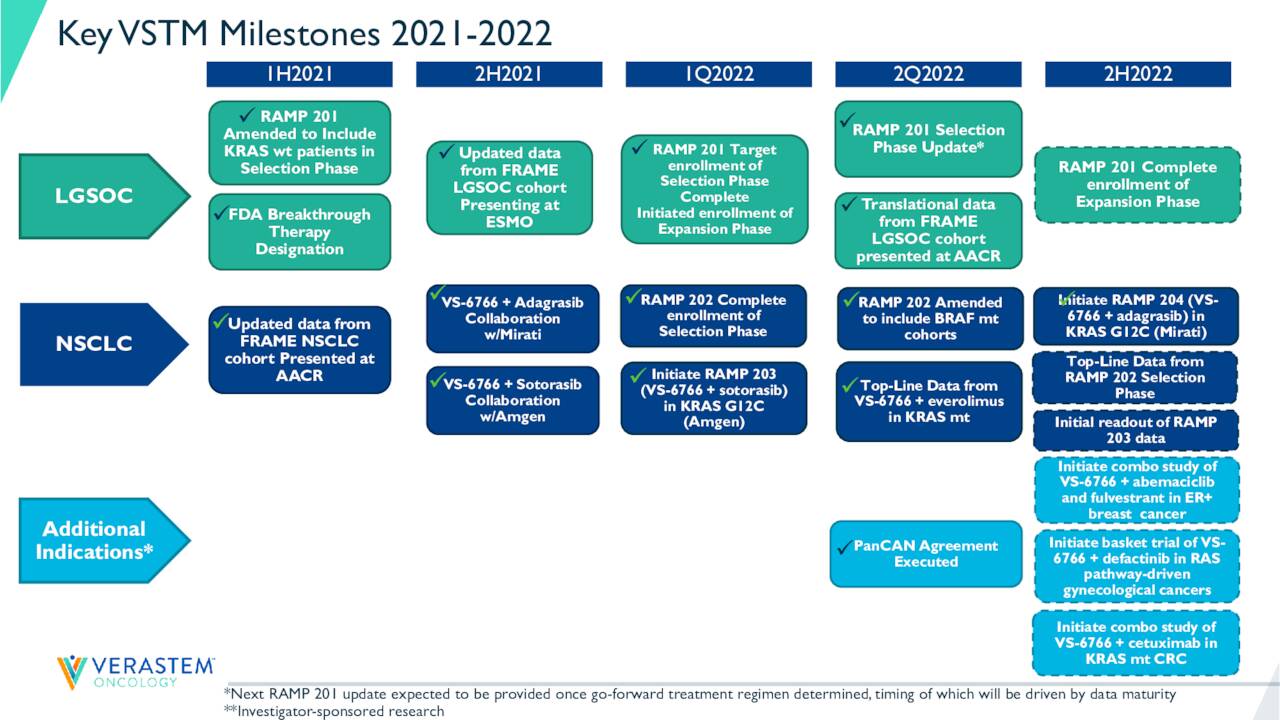

As can be seen above, VS-6766 is in numerous combination therapy trials and as a monotherapy focused on Non-Small Cell Lung Cancer (NSCLC) and Gynecologic Oncology. Most of these studies pair VS-6766 with another Verastem pipeline asset Defactinib, a FAK inhibitor. The most critical of these are RAMP 201 and RAMP 202. Both are registration-directed phase 2 studies and were initiated in the fourth quarter of 2020. RAMP 201 is targeting low-grade serous ovarian carcinoma or LGSOC and RAMP 2022 is targeting NSCLC.

August Company Presentation

Both studies should see top line results out in 2023. In mid-June, interim results came out from the RAMP 201 trial that showed VS-6766 as both a standalone therapy and in combination with defactinib showed encouraging efficacy with confirmed responses in patients with recurrent LGSOC, regardless of KRAS mutation.

August Company Presentation

The company is also conducting a trial called RAMP 203 in conjunction with Amgen (AMGN). This phase 1/2 with evaluate the ‘tolerability and efficacy of VS-6766 in combination with Lumakras in patients with KRAS G12C-mutant NSCLC who have not been previously treated with a KRAS G12C inhibitor as well as in patients who have progressed on a KRAS G12C inhibitor.’

RAMP 204 is a collaborative trial between Mirati Therapeutics (MRTX) and Verastem around the combination of Mirati’s adagrasib and VS-6766. Currently this is single-arm, open-label Phase 1/2 trial is to determine the maximum dose.

Analyst Commentary & Balance Sheet

Since the last quarterly update, RBC Capital and H.C. Wainwright ($5 price target) have maintained Buy ratings on Verastem while Alliance Global Partners ($6 price target) resumed coverage with a Buy rating last week as the analyst firm sees “multiple potentially positive catalysts over the next 6-12 months” for VS-6766.

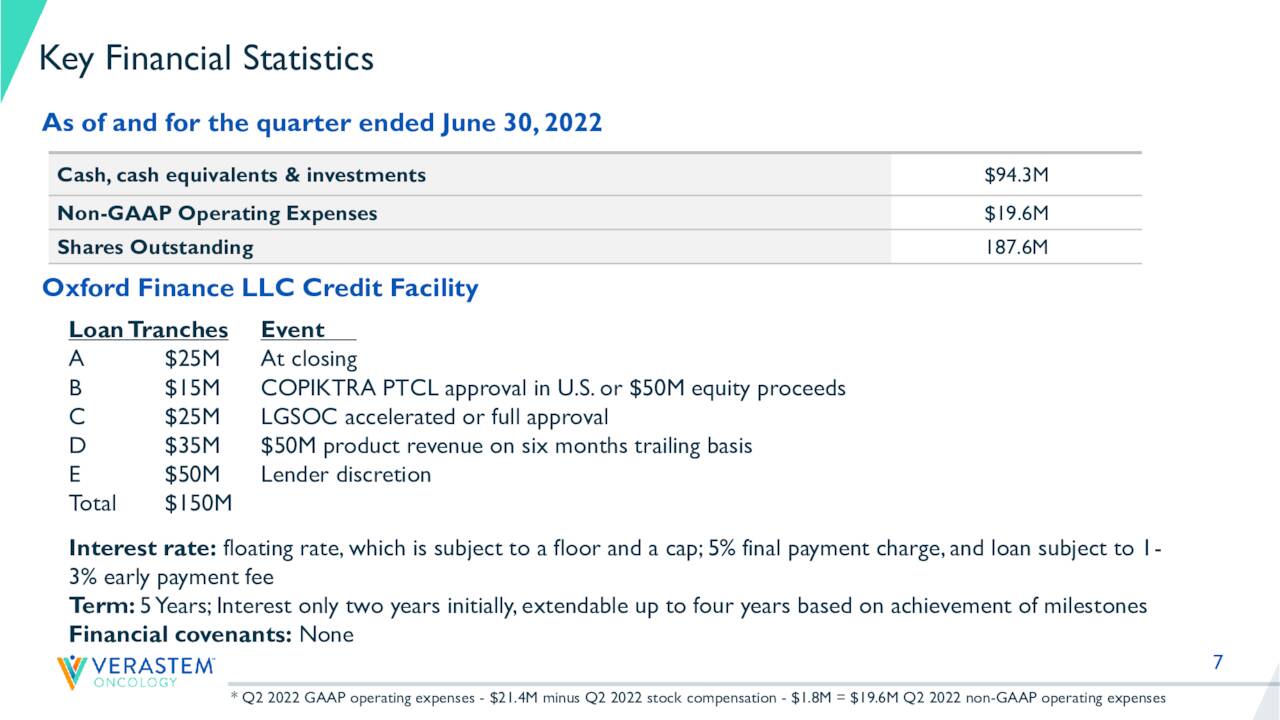

After posting a net loss of $17 million in the second quarter, the company ended the first half of the year with just under $95 million of cash and marketable securities on its balance sheet. Combined with a recently secured debt facility with Oxford Finance LLC for up to $150 Million, management believes Verastem is well funded into 2025. The debt facility arrangement consisted of $25 million upfront and $75 million based on certain pre-determined milestones as well as $50 million of which is available at the lender’s discretion. Just over two percent of the outstanding float is currently held short. There has been numerous, but small sell orders from several insiders so far in 2022, but they total less than $200,000 in aggregate.

August Company Presentation

Verdict

August Company Presentation

The company continues to advance VS-6766 across its pipeline in a somewhat methodical pace. Verastem has secured the funding it needed to get its key trials to the finish line and VS-6766 seems to have good potential. While the company is some time away from any commercialization opportunities, there is enough to this evolving story to merit to continue to hold a small ‘watch item‘ position in VSTM pending further developments.

August Company Presentation

Don’t spend time beating on a wall, hoping to transform it into a door. ― Coco Chanel

Be the first to comment