Solskin

Investment Thesis

In 2021, I was particularly intrigued with ClearPoint Neuro, Inc. (NASDAQ:CLPT) because of its strong moat – its navigation system that allows neurosurgeons to perform minimally invasive procedures under real-time MRI guidance. Treatments for neurological diseases require injecting drugs directly into the brain with precise accuracy, and ClearPoint Navigation System enables just that.

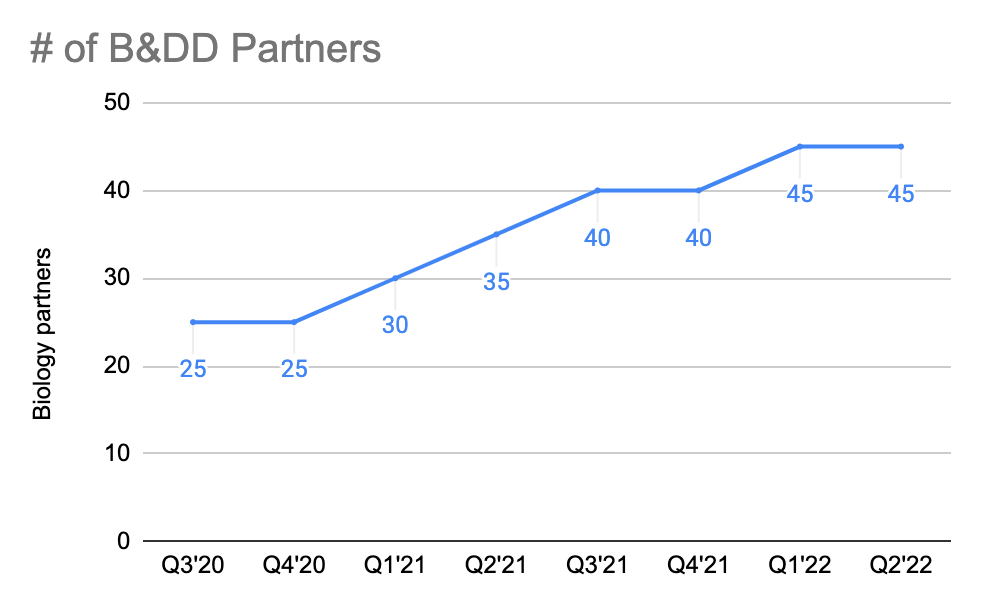

The management’s growth-mindedness to penetrate the operating room (“OR”) market – where 90% of the surgeries take place – has also resulted in an excellent cadence of products in the pipelines. And more excitingly, they are partnered up with over 40 biopharma partners, of which ClearPoint products are involved in multiple FDA clinical trials.

After looking at its most recent 2Q22 result, I strongly believe that the management’s execution continues to be great. And while I believe valuation continues to be priced at a premium, this can be a decent investment for long-term investors.

Breakdown of 2Q22 Results

Functional Neuro Navigation (FNN)

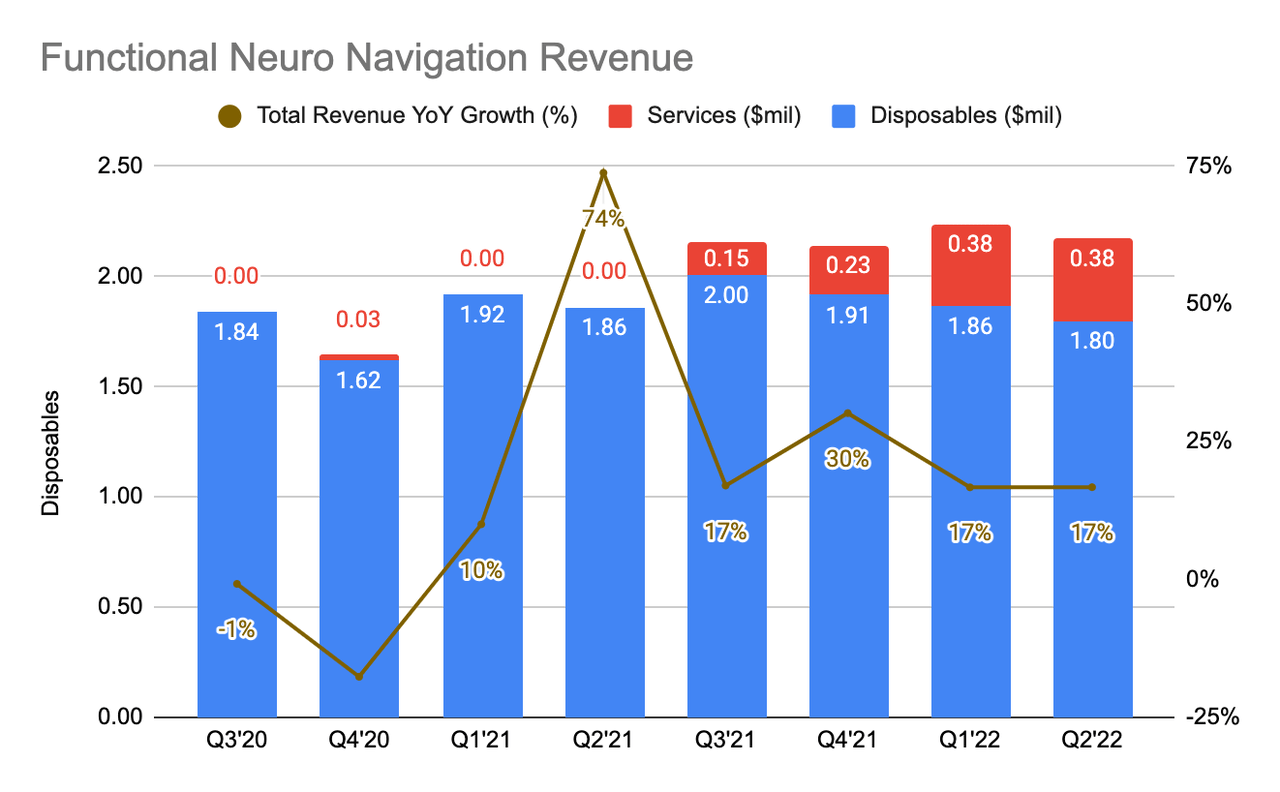

(Source: Image Created From ClearPoint Quarterly Report)

ClearPoint’s FNN grew only 17% Y/Y as hospitals continue to prioritize Covid-19 patients, and this has impacted its case volume. Recall that they have also stopped reporting its case volume, so there is no visibility into whether it is improving. However, CEO Joe Burnett has previously stated in 1Q22 that the cancellation and postponement rate has remained at historic highs, and I do foresee this will likely continue throughout FY22.

Biologics & Drug Delivery (B&DD)

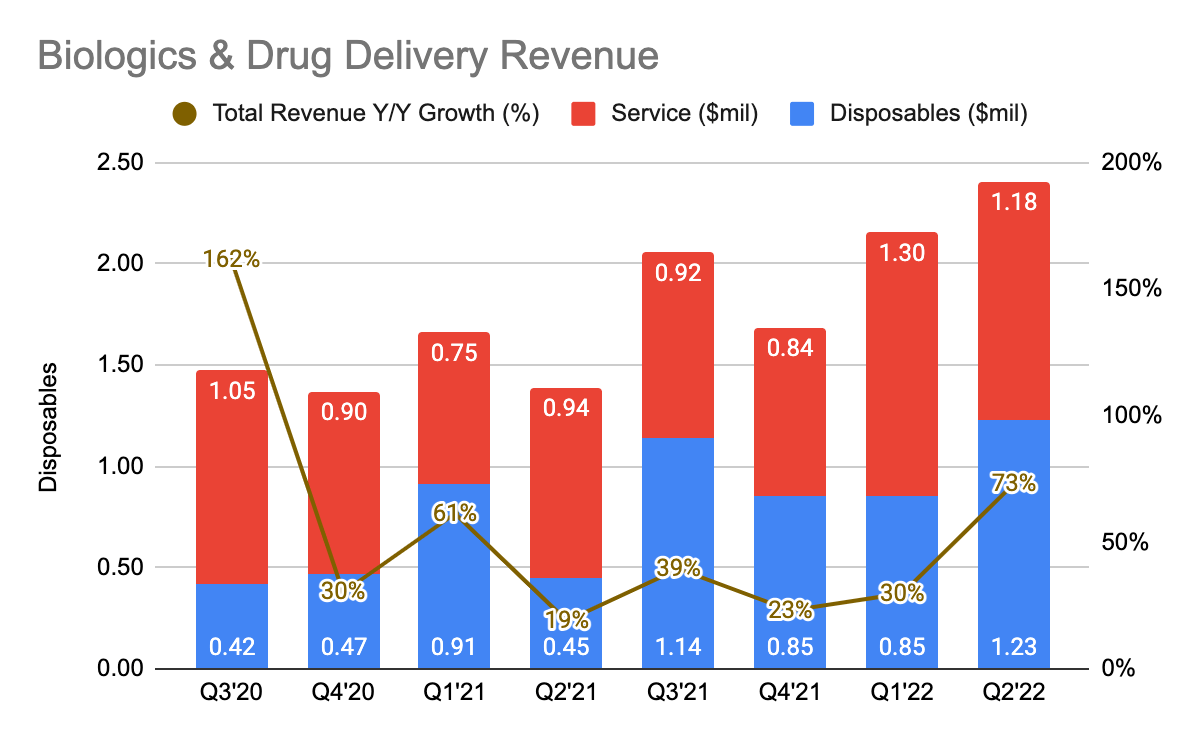

(Source: Image Created From ClearPoint Quarterly Report) (Source: Image Created From ClearPoint Quarterly Report)

ClearPoint B&DD revenue grew 73% Y/Y, and this was driven mainly by its disposable revenue which grew 172% Y/Y. Also, I noticed how B&DD revenue has also been increasingly making up a bigger slice of its total revenue, which I believe will be the largest business over time due to the sheer number of partners they have.

After multiple quarters of delay, the company finally marked its first milestone as PTC Therapeutics (PTCT) announced its first drug approval with PTC-AADC. This brings in sticky and highly recurring revenue for the company in the future, and more importantly, in my view, it brings credibility and helps to accelerate word-of-mouth as a go-to partner for treating neurological diseases.

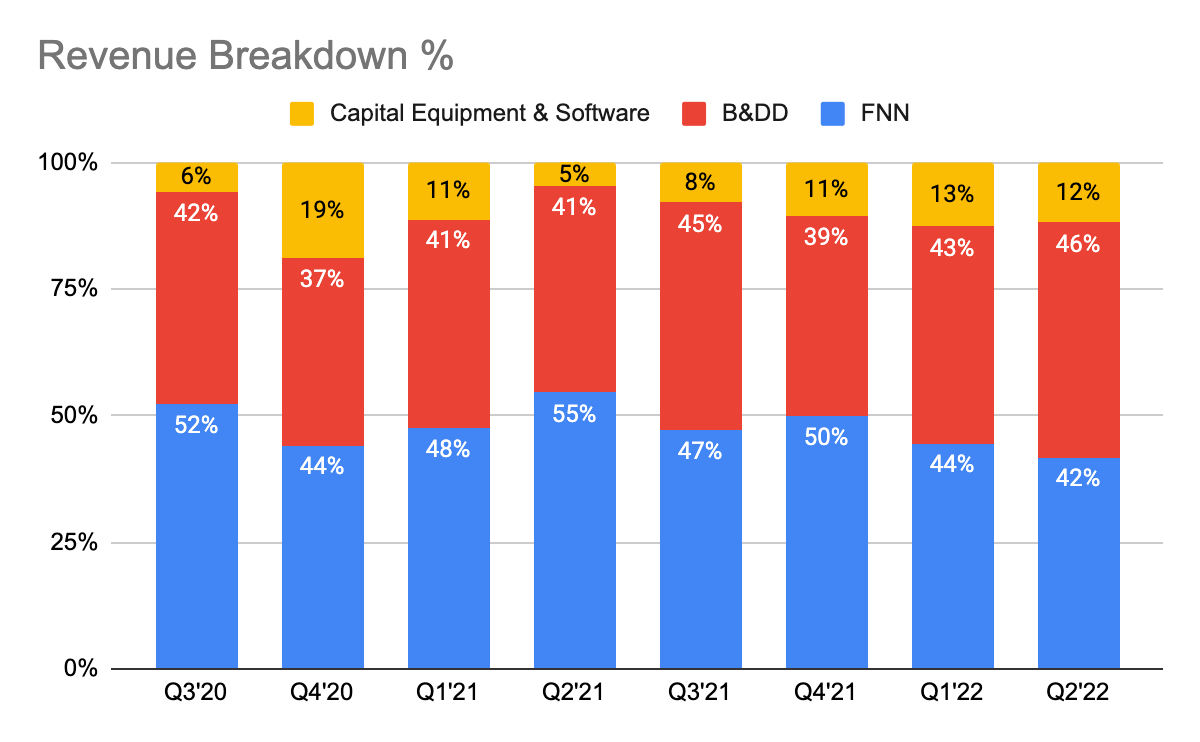

(Source: Image Created From ClearPoint Quarterly Report)

The PTC-AADC approval, however, is only the tip of the iceberg considering that they have over 45 B&DD partners and are growing. Some of these drugs are likely to commercialize in the future (as not all do), bringing in more recurring disposable revenue. Although, ClearPoint still earns revenue from earlier clinical stages, and not only from the commercialization stage. These are huge optionalities in the making, which most investors are particularly bullish about. They have been growing their number of partners really quickly as well since 3Q20.

I also particularly like this statement from CEO Joe Burnett during his 2Q22 earnings call as it tells me about the ambition he has for the company:

“Our goal for our SmartFlow family of cannulas products is to be referenced in the labeling for therapies across multiple partners and indications so that ClearPoint is the go-to delivery mechanism for pharma delivery to the brain and spine.”

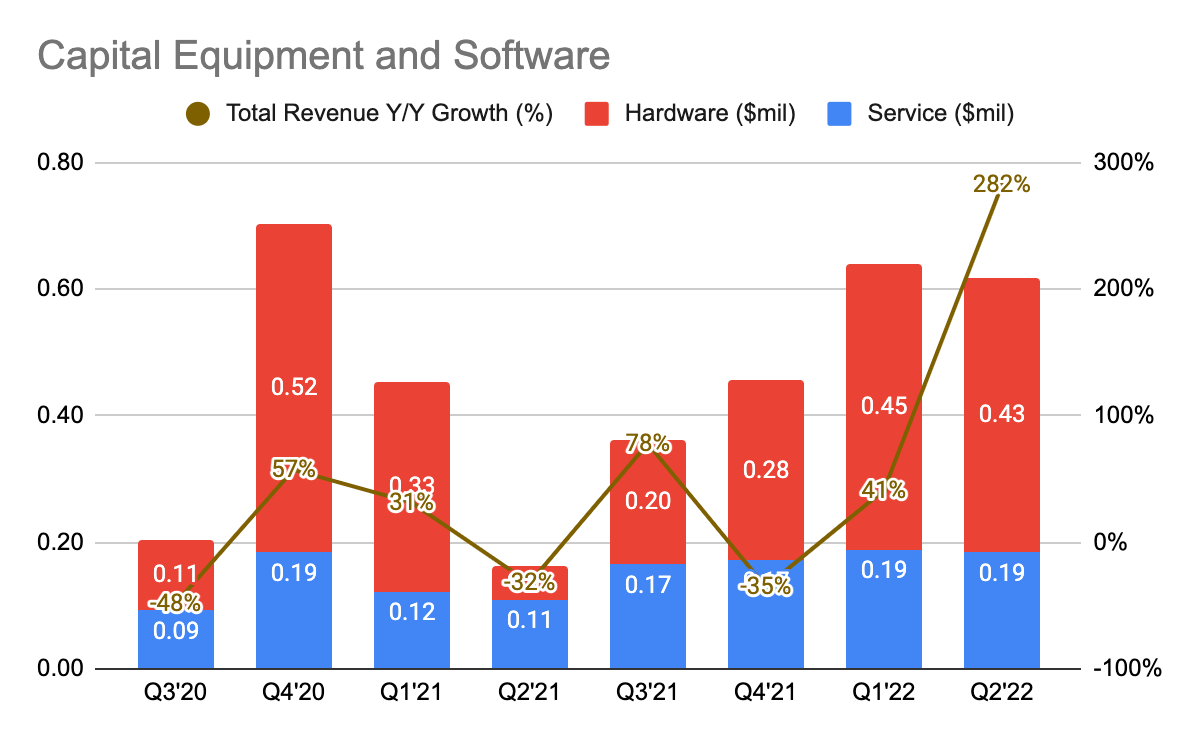

Capital Equipment and Software

(Source: Image Created From ClearPoint Quarterly Report)

(Source: ClearPoint 2Q22 Investor Presentation)

ClearPoint’s capital equipment and software revenue accelerated by 282% Y/Y, and this was primarily driven by the 735% Y/Y increase in hardware sales. They did 4 installments in 2Q22, bringing it to a total of 8 as of 1H22, and they expect another 4 to be done by 2H22.

Covid-19 was a huge bottleneck as the staff was unable to head onsite to install the navigation system for its partners. The 2 consecutive quarters of rebound is a great relief as it suggests that restrictions have eased and the onboarding process has sped up. This also serves as an indication of its future growth for FNN and B&DD revenue as hospitals typically need to install the navigation system before they could start adopting ClearPoint products and services.

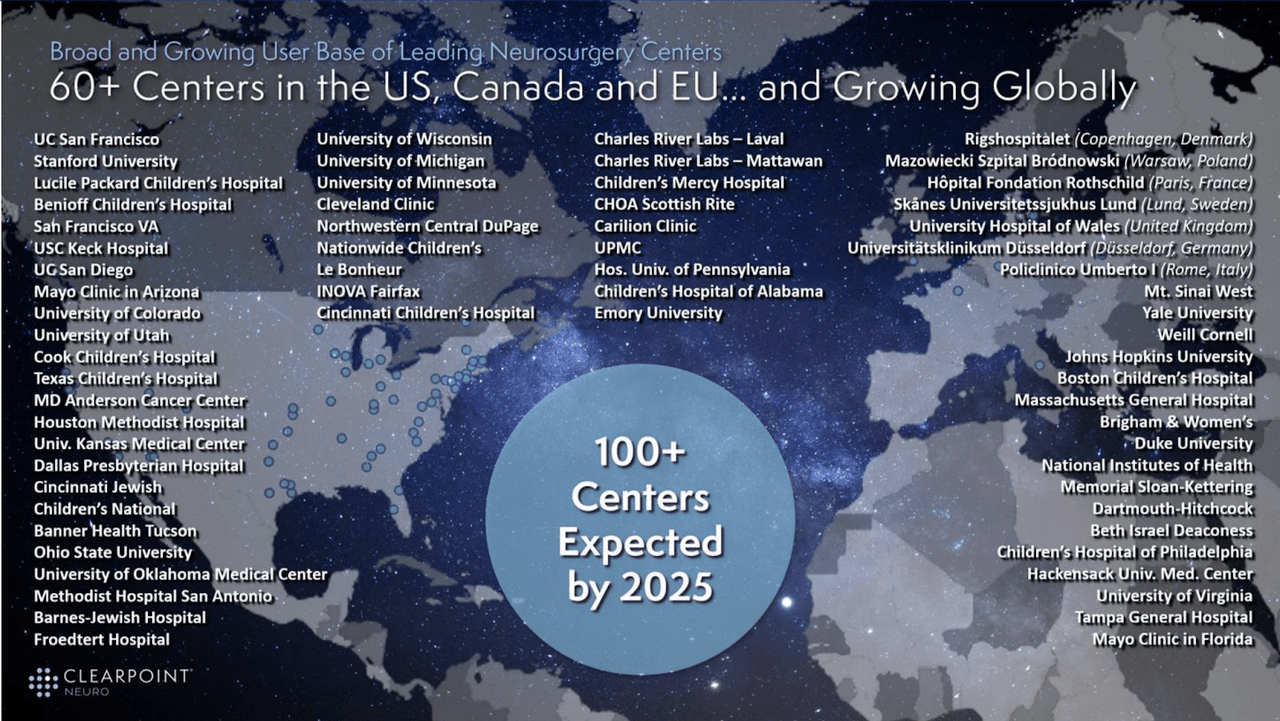

ClearPoint continues to grow its user base this quarter as they brought in the University Hospital of Wales in the U.K, Universitätsklinikum düsseldorf in Germany, Lucile Packard University Hospital, Froedtert Hospital, and Mayo Clinic in Arizona. This implies that they are gaining traction in both U.S. and Europe.

Profitability

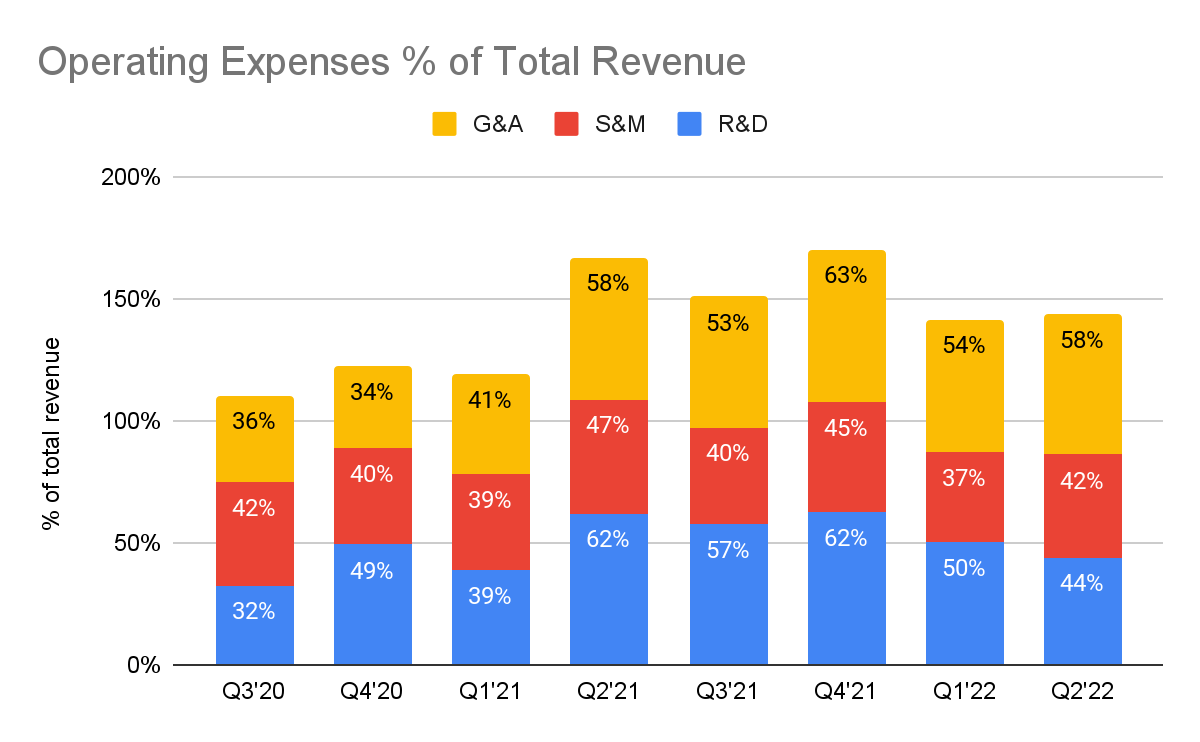

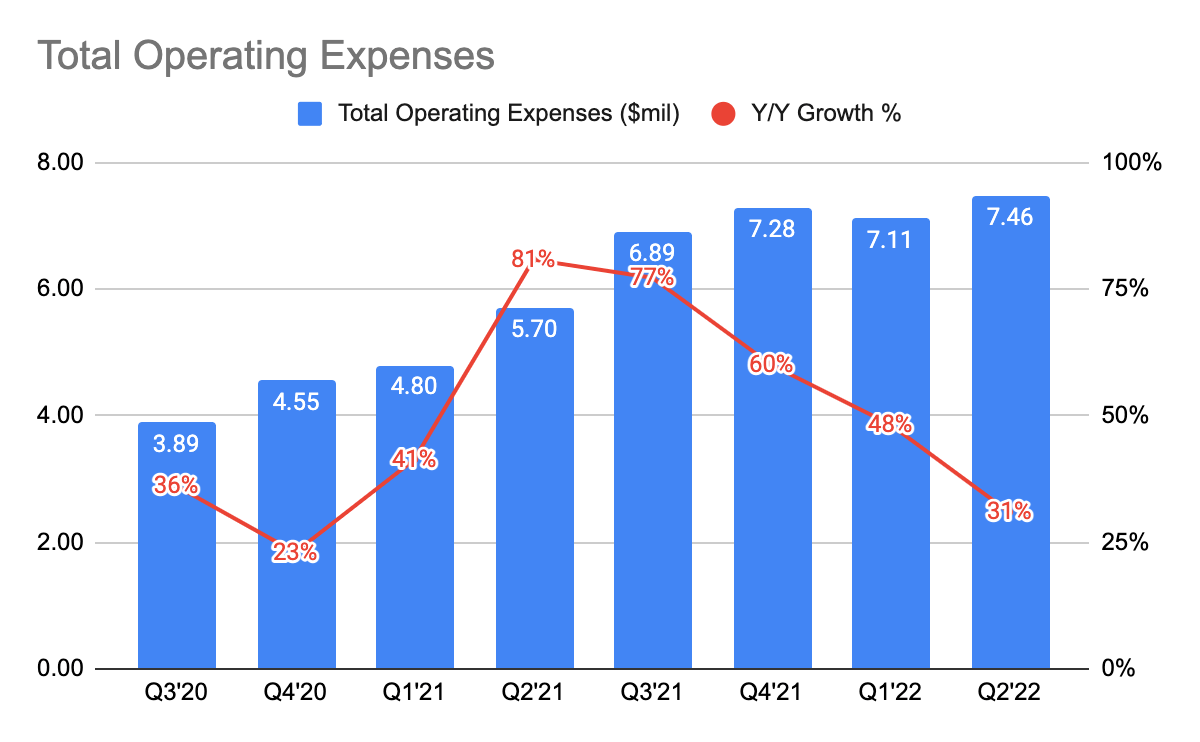

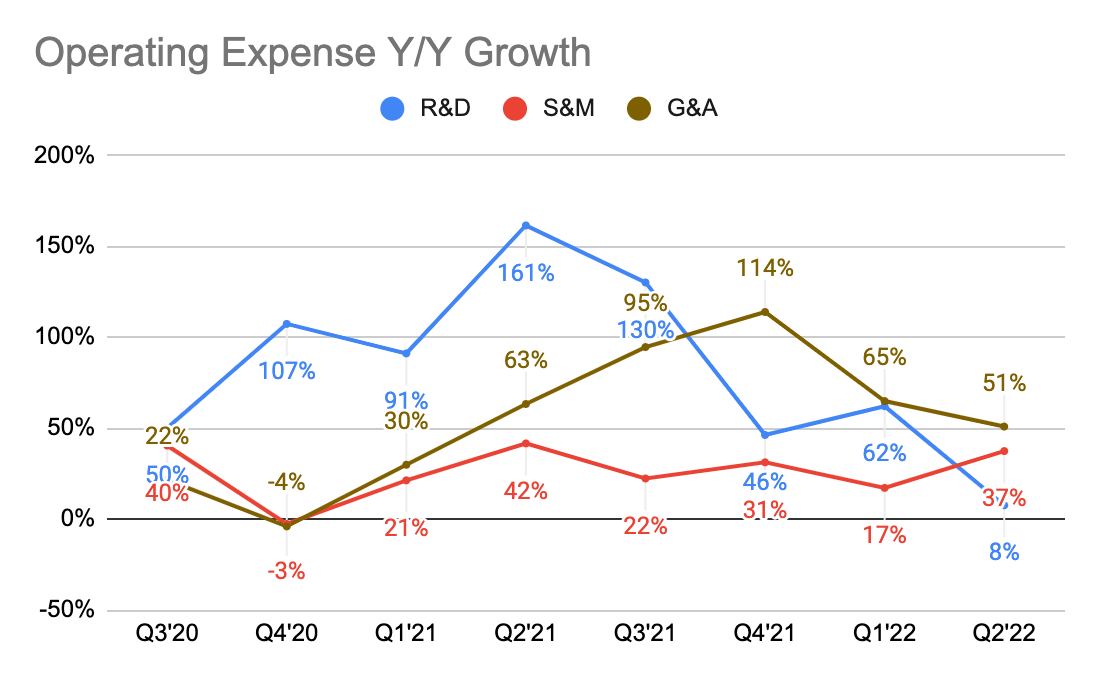

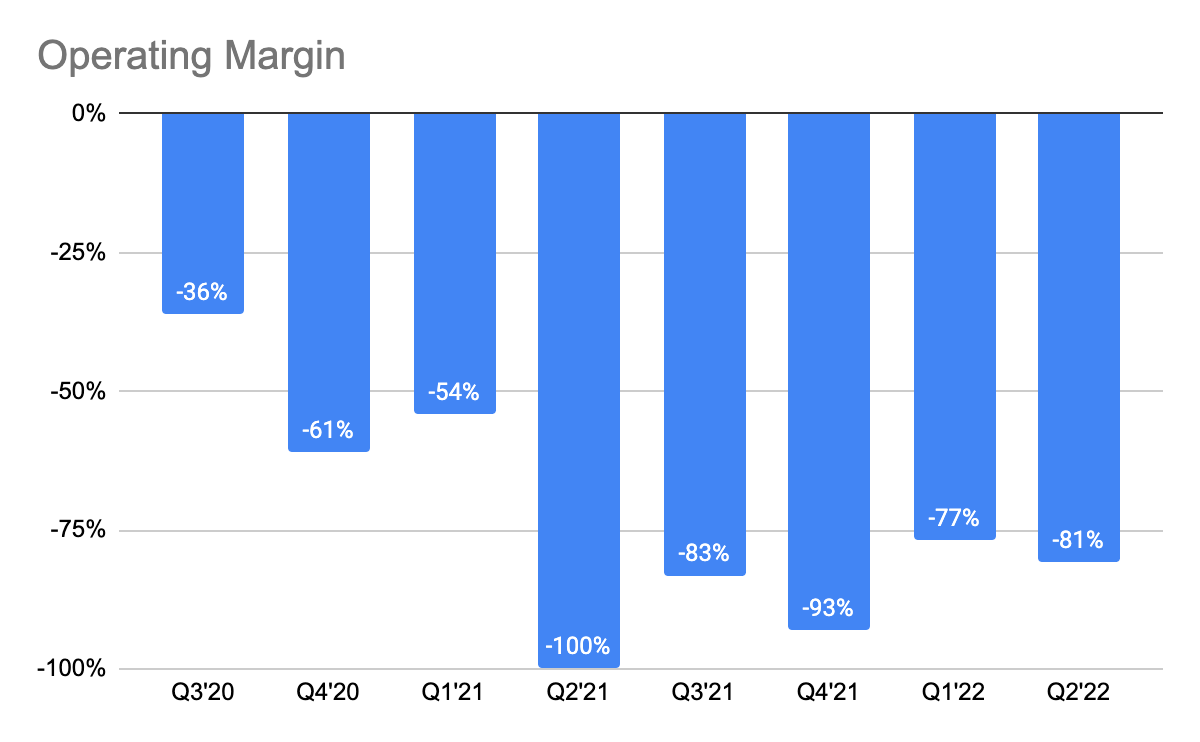

(Source: Image Created From ClearPoint Quarterly Report) (Source: Image Created From ClearPoint Quarterly Report) (Source: Image Created From ClearPoint Quarterly Report)

As ClearPoint is still early in its business lifecycle, its operating expenses are relatively high as a proportion of its total revenue as investments are made in product developments, hiring headcounts to better serve its partners and marketing initiatives. Not to mention, Covid-19 has also slowed down its revenue considerably. However, if we take a close look at its total operating expenses growth, it has been slowing down for the past 3 quarters, driven by the slower growth in R&D and G&A expenses.

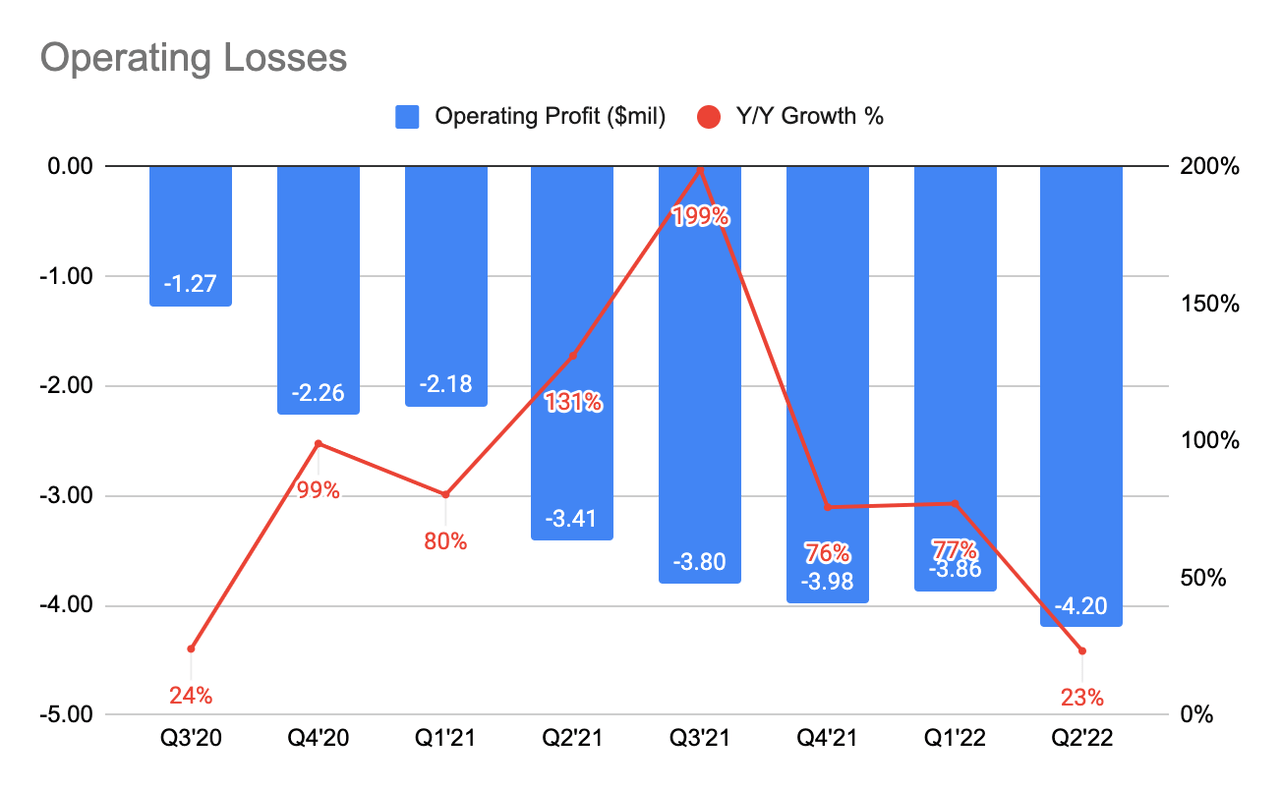

(Source: Image Created From ClearPoint Quarterly Report) (Source: Image Created From ClearPoint Quarterly Report)

As a result of its slower growth in operating expenses, operating losses have also slowed down during the quarter. This may signal that the management is more focused on profitability moving ahead, which I personally think is necessary for this environment.

As of 2Q22, they have total cash of $45.1 million, consisting of cash and cash equivalents, and short-term investments and I believe they have ample cash to sustain their losses in the next 2 to 3 years. That being said, ideally, I still like to see improving operating losses going ahead.

Valuation

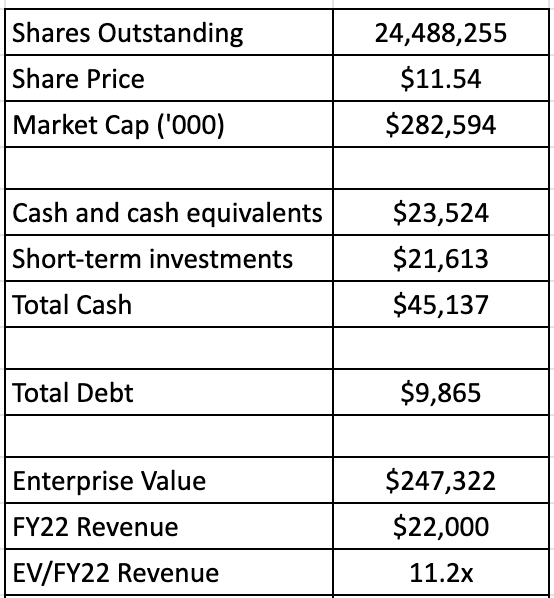

(Source: Author’s Image)

In my valuation, I will not use a discounted cash flow valuation model simply because I find that it is challenging to forecast its future profitability and cash flow due to the uncertainty of the timing of FDA approval (which can take multi-years to materialize) and how much revenue FDA approved drugs could bring in.

Using its enterprise value of $247 million and FY22 revenue of $22 million, this gives us an EV/Sales of 11.2x. Referencing TIKR, its closest peers such as Intuitive Surgical (ISRG) and Medtronic (MDT) have LTM EV/Sales of 11.62x and 4.33x, respectively. It seems that there are premiums baked into ClearPoint’s valuation, which of course, is for very good reasons. And this is also far more attractive than it was back in Feb 2021 when the share price was at its peak of over $30 per share, and a valuation that is as high as 35x.

I do believe that for investors who are looking for long-term play, the company can be a decent investment in the long run.

Conclusion

Overall, the company had a great quarter despite the Covid-19 still lingering. B&DD revenue accelerated during the quarter and the company just had its first-ever approval with PTC Therapeutics, with several more to come in the future. They also did 4 system placements this quarter, with another 4 to be expected in 2H22, which was not possible in the previous year. Overall, their user case continues to grow, and this seems to show that ClearPoint’s state-of-the-art product is garnering more interest, and is slowly becoming a mandated partner in the industry.

However, with the current macro environment, my only concern is that I’d like to see continued improvement in operating losses. The slowdown in operating expenses in the past few quarters also seems to indicate that the management is doing so. And while I think the company is priced at a premium, I do believe this is a far more attractive valuation than before, and this can be a decent long-term play for long-term investors.

What are your thoughts on the quarter? Do let me know in the comments section below!

Be the first to comment