fermate

It’s not treason if you win.”― Lisa Shearin

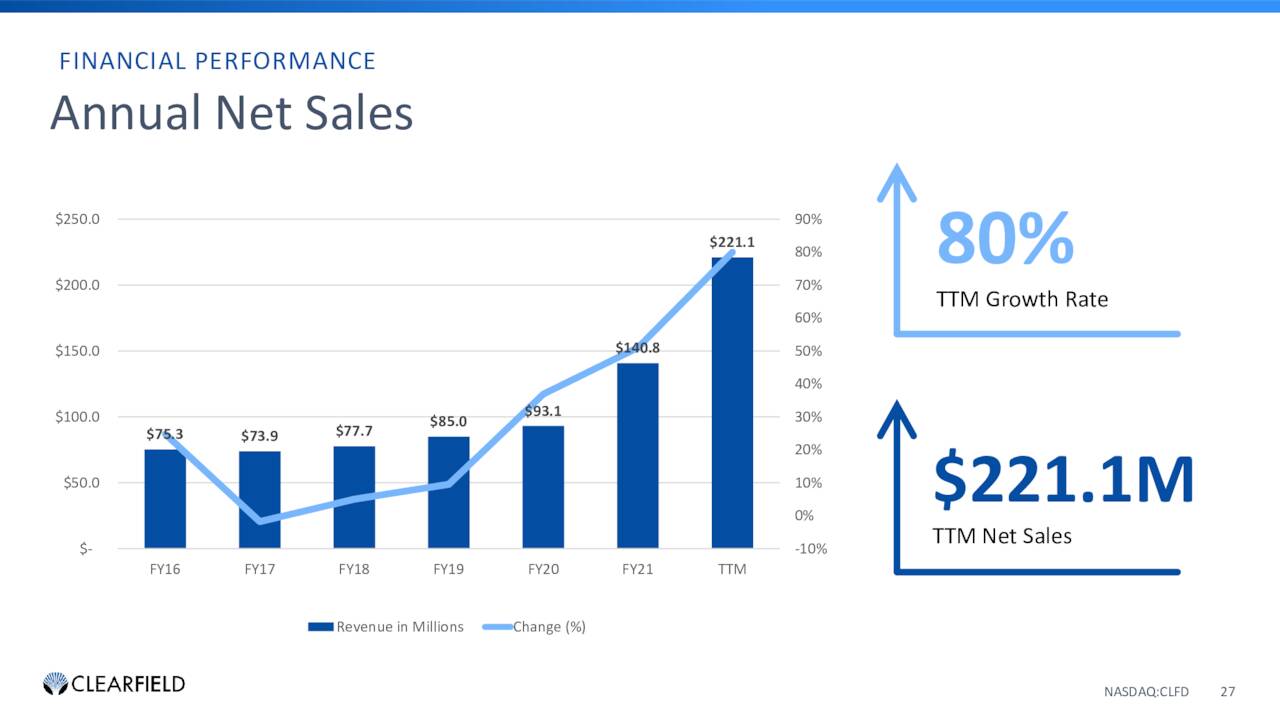

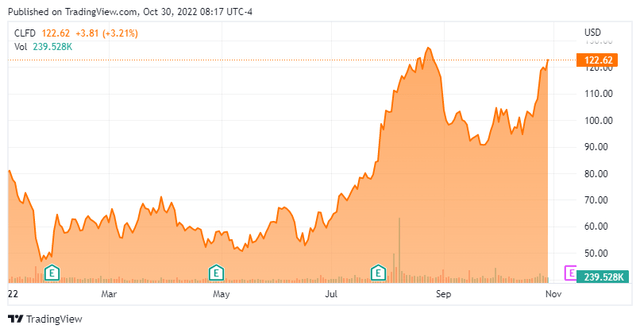

Today, we take our first look at Clearfield, Inc. (NASDAQ:CLFD). This small-cap communications equipment provider has seen rapid growth in both earnings and sales here in FY2022. Shareholders have been rewarded with better than a 50% return this year. With growth expected to slow substantially in FY2023, a spate of insider selling in summer, and stock looking like it might be topping out, can the good times continue? An analysis follows below.

Company Overview:

July Company Presentation

Clearfield, Inc. is based in Minneapolis, MN. This firm manufactures and sells standard and custom passive connectivity products to the fiber-to-the-premises, enterprises, and original equipment manufacturers markets in the United States and globally.

July Company Presentation

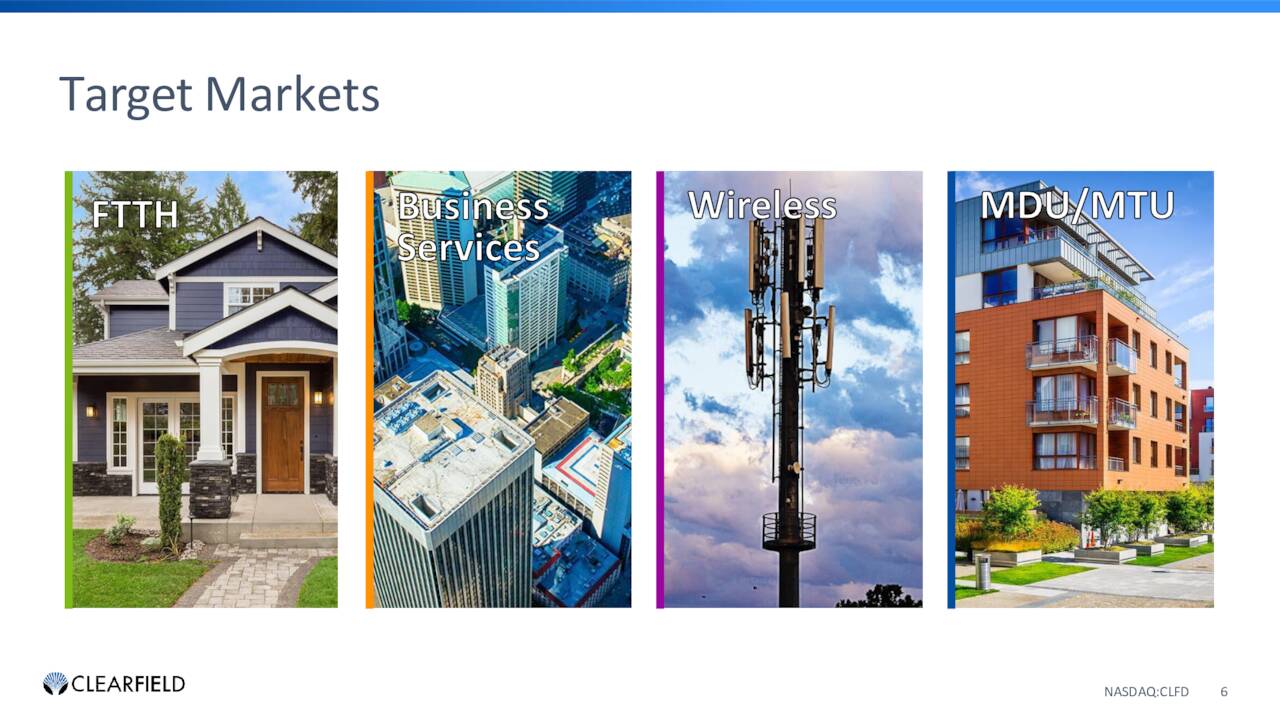

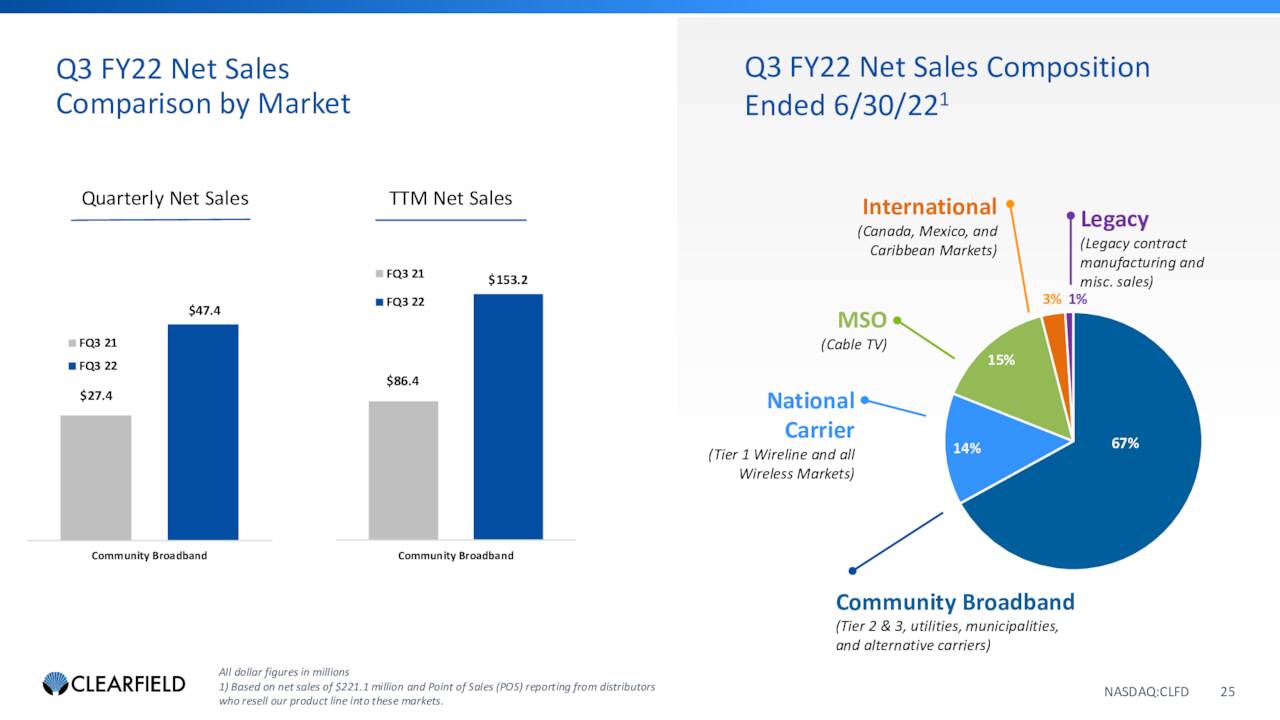

Clearfield’s five targeted markets are Business Services, Wireless, Multiple Dwelling Units, Multiple Tenant Units, and Fiber to the Home. The company operates in a fiscal year that ends on September 30th. Clearfield’s primary end market is community broadband, which is predominantly comprised of Tier 2 and Tier 3 incumbent local exchange carriers and a growing number of municipalities, utilities, co-ops, and wireless carriers. Currently, the stock trades just above $120.00 a share and sports an approximate market capitalization of $1.7 billion.

July Company Presentation

Third Quarter Results:

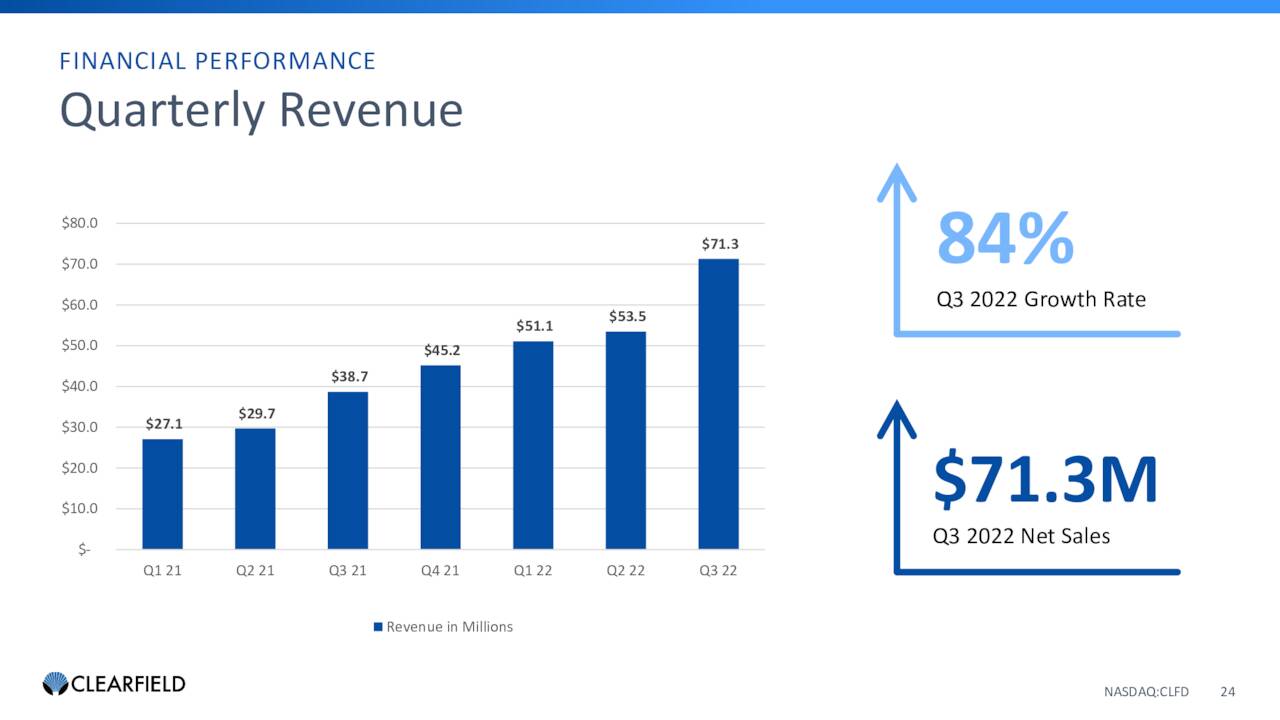

The company posted third quarter numbers on July 28th. Clearfield delivered GAAP earnings of 92 cents a share, more than double the 44 cents a share of profit it posted in 3Q2021. Revenues were up nearly 85% on a year-over-year basis to $71.3 million. Quarter-end backlog increased 16% sequentially from 2Q2022 to a record $157 million.

July Company Presentation

Not only were top and bottom line results well-received, but management also took their full-year sales guidance up to a range of $243 million to $247 million. The analyst consensus was hovering around $216 million at the time. The new projections incorporated anticipated revenues from the recent acquisition of Nestor Cables. Nestor generated €31.7 million in revenue in FY2021. The company had a longstanding relationship with Nestor and the purchase price was under $25 million. This new revenue guidance represents growth of 72% to 75% over fiscal year 2021.

July Company Presentation

Analyst Commentary & Balance Sheet:

Over the past two weeks, both Needham (price target $115, from $110 previously) and Lake Street (price target $122, up from $104 previously) have reiterated Buy ratings and lifted their price targets on Clearfield. Northland Securities ($95 price target, up from $78 previously) took the same action the day after third quarter results were posted. Westlake Capital initiated the shares with a Hold on September 13th.

Just over seven percent of the outstanding float in the shares are currently held short. After a couple of small insider purchases in the first half of 2022, several insiders, including the CEO, sold approximately $8.5 million worth of shares in August as the stock was rallying to touch its 52-week for the first time this year. The company ended the third quarter with just under $20 million in cash and marketable securities on the balance sheet against no long-term debt.

Verdict:

July Company Presentation

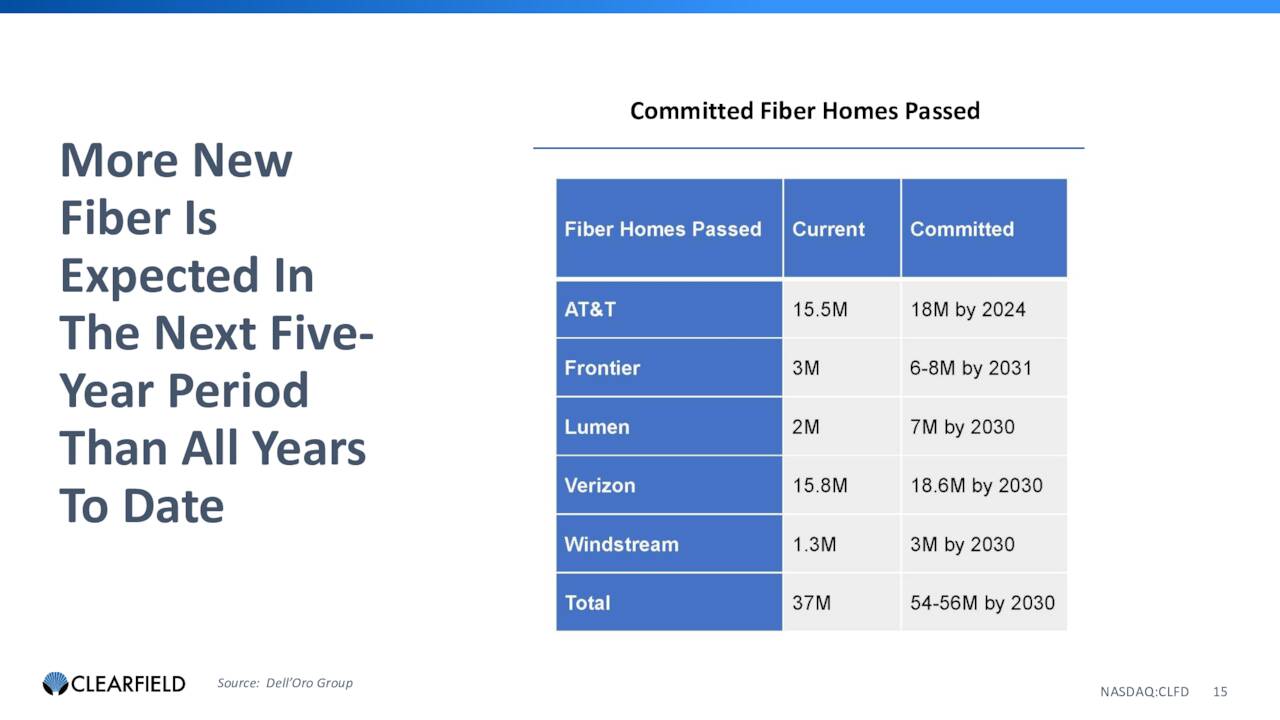

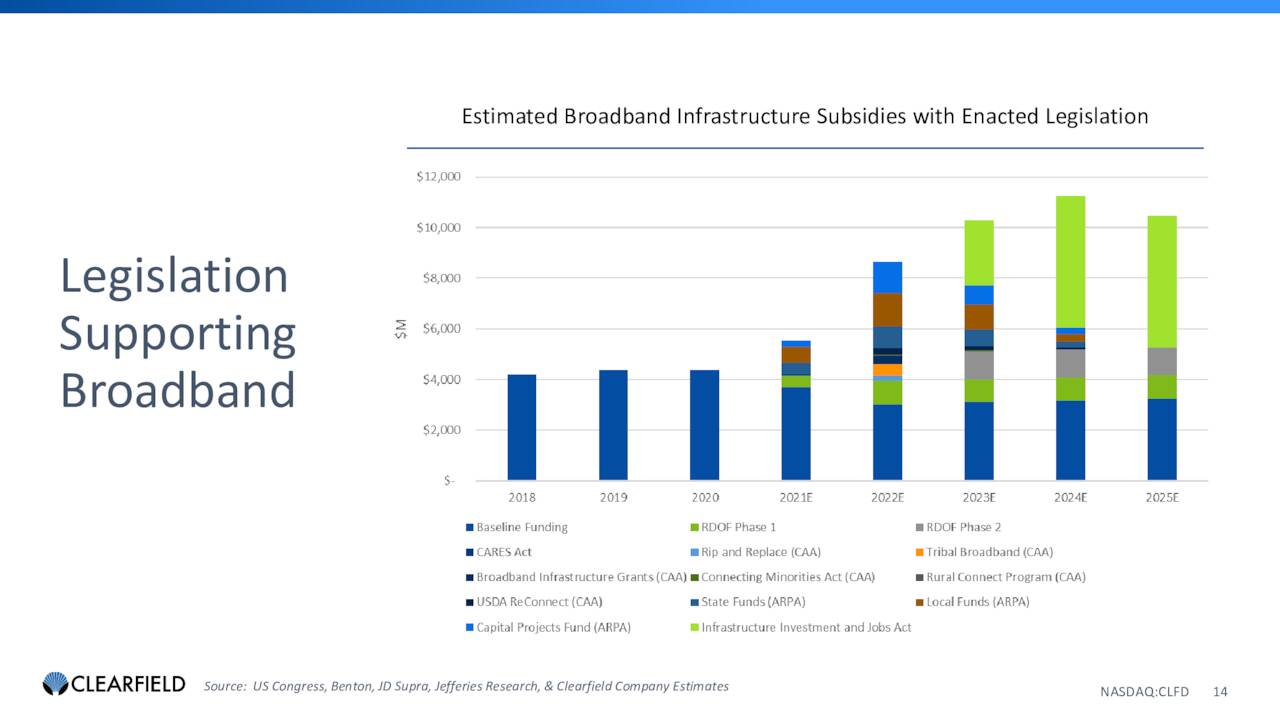

The current analyst firm consensus is for the company to earn some $3.20 a share in FY2022 as sales rise some 75% to just under $250 million. Growth is projected to slow markedly in FY2023 with just over $3.50 a share in profit as revenues increase by just over $300 million. The company is clearly benefiting from the build-out of 5G as well as the internet of things. Increased government spending on bandwidth infrastructure and deployment is another tailwind for the industry. Over $60 billion over a half-decade was allocated to this space within the Infrastructure Investment and Jobs Act.

July Company Presentation

At nearly 40 times this year’s likely profits and over six times sales, the stock seems overvalued. This is especially in light of slowing earnings and sales growth in FY2023 after an explosion of revenue growth in FY2021 and FY2022 compared to historical trends (below). The stock also potentially is forming a double top and the spate of insider selling the first time the equity hit these levels is somewhat concerning. The shares are also hitting up against or exceeding current analyst firm price targets.

July Company Presentation

The company should post fourth quarter results very shortly, giving investors some updated data points. Clearfield seems a well-run operation, but I am not one to chase the stock’s very positive performance here in 2022 at current trading levels.

Treason is an easy word to speak. A traitor is one who fights and loses. Washington was a traitor to George III.”― Thomas Dixon Jr

Be the first to comment