ChrisHepburn/iStock Unreleased via Getty Images

By Albert Grosman | Brian Lund

Uncertainty Weighs on Small Cap Stocks

Market Overview

Financial markets are entering a period unlike any we have seen in decades, and it shows. The uncertainty was reflected not just in rising stock volatility but also in erratic bond markets, where the 10-year U.S. Treasury note saw yields oscillate between 2.7% and 4.0% during the quarter.

The playbook hasn’t been written for an economy where demand exceeds supply and unemployment is near all-time lows, yet interest rates are rising fast, liquidity is draining due to quantitative tightening, and inflation is rampant. Naturally, therefore, most market participants are relying on the playbook they know: Sell cyclicals and financials, buy staples and utilities and short highly leveraged balance sheets. This approach has been working fabulously well, but it risks running off the cliff with the other lemmings when the winds shift.

Valuation matters. Earnings can decline rapidly in a recession, providing little support for stocks, but the value of hard assets generally rises during periods of high inflation. Investors haven’t had to bother with balance sheet analysis for a decade, except momentarily during the financial crisis of 2008-2009. Even then, they were looking at highly leveraged banks, extremely overbuilt housing and overinflated home prices. The result was a major asset impairment at banks and homebuilders.

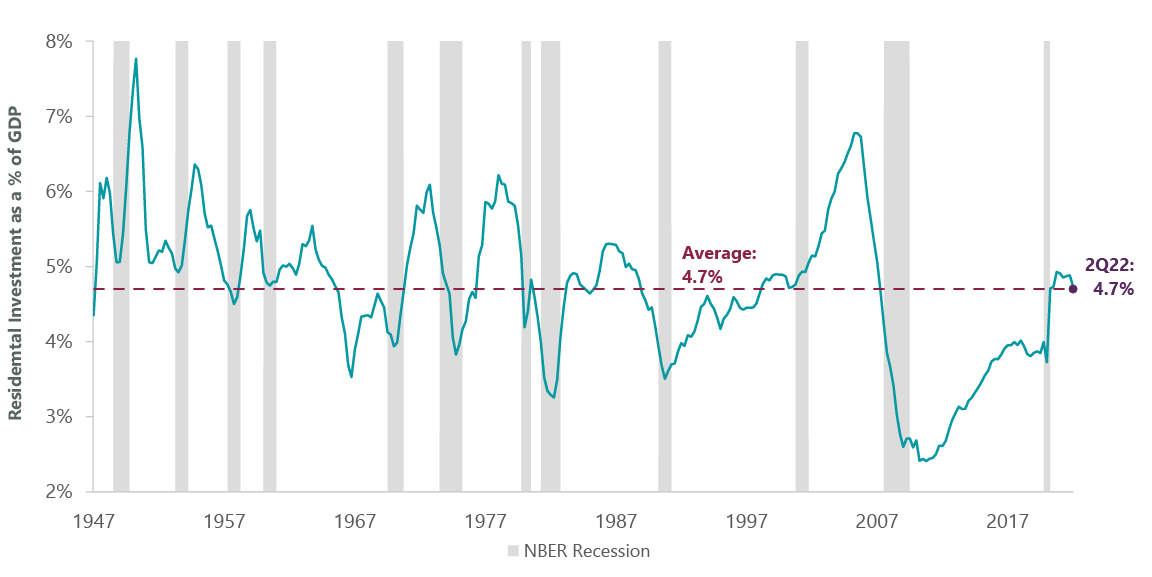

This time around, residential investment has been continuously below long-term averages for a decade, housing inventories are at multi-decade lows (Exhibit 1) and banks have maintained strict underwriting standards and strong capital levels — not by their own choice, but by regulatory decree. We are unlikely to see significant losses in either residential or commercial real estate, and homebuilders’ book value will likely increase over the next few years, but both of these industries are trading near or below their tangible book value.

Meanwhile, the book value of small cap biotechnology companies consists largely of cash, which is rapidly declining in purchasing power. Yet health care is considered a safe haven?

“We recognize these periods for what they are: a transitional disconnect between stock prices and their inherent values.”

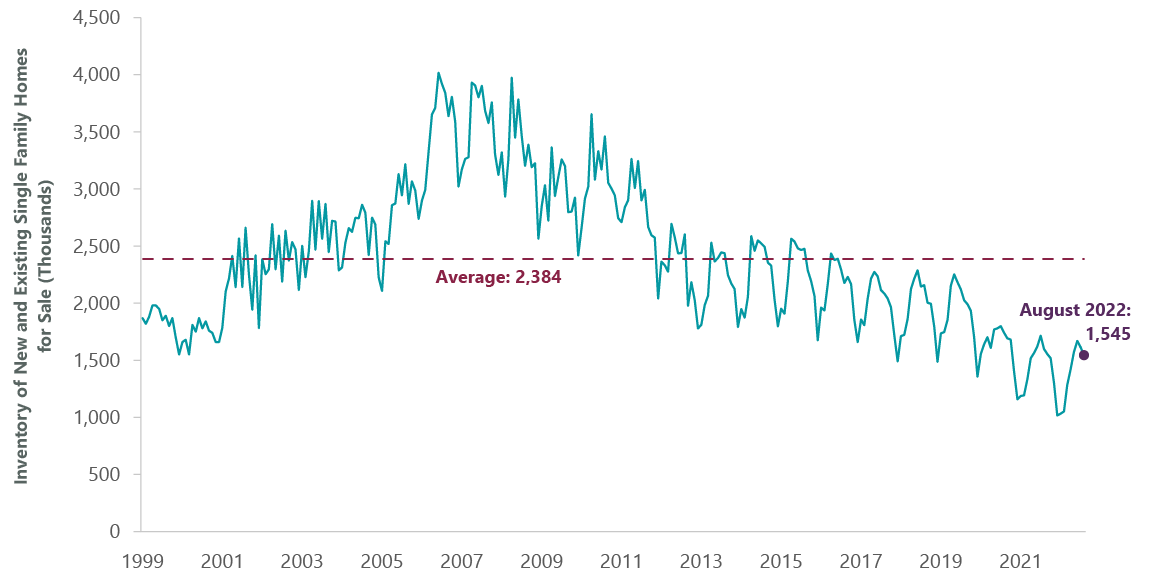

Exhibit 1: Housing Inventories Remain Constrained

Source: ClearBridge Investments, Federal Reserve Economic Data, Bloomberg Finance, L.P. Source: ClearBridge Investments, Federal Reserve Economic Data, Bloomberg Finance, L.P.

Secondly, there are few excesses in the system. Not only are housing inventories historically low, but so are apartment vacancies. Rents continue to rise rapidly and are expected to continue to do so, given higher costs of ownership for landlords. Housing formation can slow to a certain extent, but eventually people will have to pay higher prices for housing. In addition, auto inventories are at record lows for both new and used vehicles. Despite higher interest rates, people need cars.

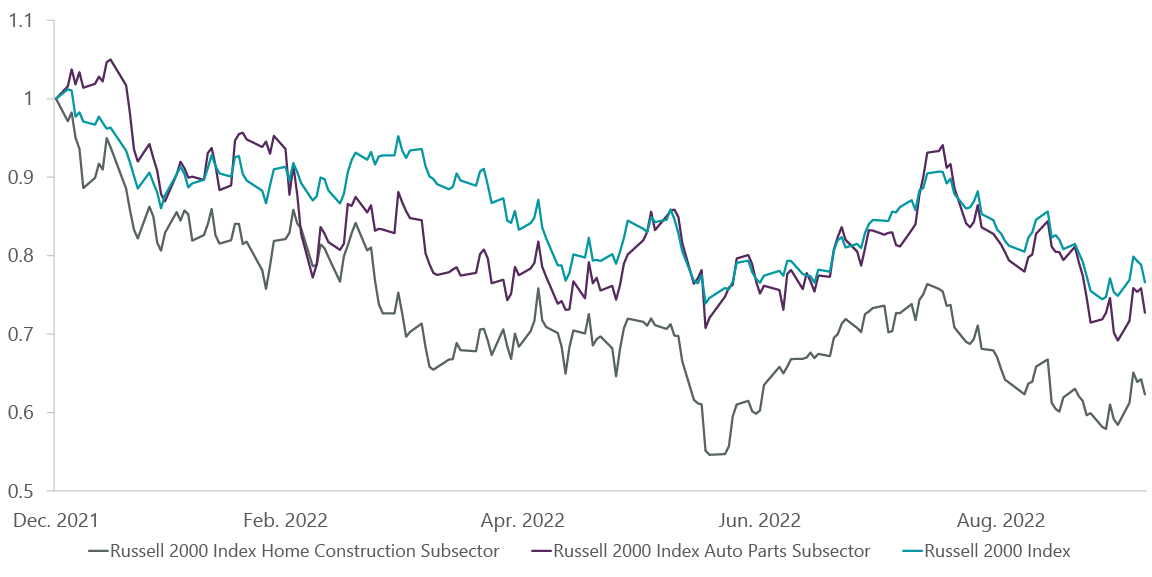

The good news for consumers is that interest rates on homes and autos are lower than other loans, because they are secured by the asset. The bad news is that higher housing and auto costs may crimp their spending on discretionary items like video games, streaming services and crypto-currency speculation. Yet the Russell 2000 homebuilder and automotive subsectors have both underperformed year to date and trade well below average price-to-book levels (Exhibit 2).

Exhibit 2: Investors Undervalue Essential Goods

Data as of Oct. 7, 2022. Source: ClearBridge Investments, Bloomberg Finance, L.P.

We believe the market is greatly overestimating the effect that higher interest rates and inflation will have on durable goods, materials and financial companies, while underestimating their impact on speculative and intangible assets. While it’s painful in the short term to see low-yielding utility and staples stocks outperforming high-yielding durable goods companies with significant demand tailwinds, we believe the long-run profits will be substantial.

The Strategy underperformed its Russell 2000 benchmark during the quarter. Despite their more idiosyncratic nature, small cap stocks could not escape the broader macro headwinds as aggressive increases in interest rates, combined with the looming possibility of an economic recession, pummeled all but the most defensive stocks and sectors.

Our health care holdings weighed on relative performance. While the broader sector benefited from being perceived as more defensive and having greater resilience in the event of a recession, a drop-off in market liquidity due to rate increases and uncertainty over profitability hampered many of the smaller and more growth-oriented companies within the biotech space.

Syneos Health (SYNH), a clinical research company that provides clinical trial services to companies in the pharmaceutical, biotech and medical device industries, saw its stock decline after customers delayed scheduling new trials as they navigate the current economic uncertainty. While we remain underweight the sector, we continue to diligently look for health care names that align with our focus on high-quality companies with strong balance sheets and long-term value creation opportunities.

Information technology (IT) also proved a headwind to performance, with three of the five top detractors coming from the sector. Broadly, the increase in interest rates discounted longer-term cash flows, compressed multiples and pressured share prices for the typically more growth-oriented sector. Rapid7 (RPD), a cybersecurity solutions provider, fits that bill, but it also reduced its earnings guidance for the second half of the year, citing more conservative expectations for its business in Europe and the adverse effects of currency fluctuations.

Still others felt pressure for company-specific reasons, such as the market’s disappointment that ATM and point-of-sale software company NCR (NCR) was no longer the center of a bidding war between two private equity firms. However, we have high conviction in management’s decision to split the company, allowing for each entity to devote greater time and attention to optimizing very profitable and high cash flow generating businesses. We continue to own NCR as we believe the assets, and their respective free cash flow generation, are undervalued regardless of whether it continues as one company or two.

The Strategy benefited from its positioning in less interest-rate-sensitive companies within the real estate sector, where the aggressive increase in rates and hawkish outlook made it the benchmark’s worst performing sector of the quarter. RLJ Lodging Trust (RLJ), which specializes in premium-branded, high-margin hotels, benefited from its ability to adjust pricing to account for higher costs.

Likewise, Corporate Office Properties Trust’s (OFC) long-term leases with government agencies and contractors, particularly those focused on national security, make it less sensitive to higher rates and economic downturns than its more commercial-office peers. Although both companies saw their stock prices decline during the period, they outperformed the broader real estate sector.

Within the utilities sector, solar power and energy storage company Sunnova (NOVA) saw its share price benefit from passage of the Inflation Reduction Act legislation, which includes an array of new and extended tax credits that should not only support but enhance the company’s long-term growth prospects.

Portfolio Positioning

We recognize that the same market tremors that have weighed on performance have also created significant opportunities to add companies that have been mainstays of our watchlist at exceptionally compelling entry points. We continue to refine our positioning to meet the challenges of today but continue to maintain high conviction in the companies we own and their long-term prospects. During the quarter we added six new positions and exited 10.

We added Matador Resources (MTDR), an oil and natural gas exploration and production company. The company has carefully acquired high-quality acreage across the Permian basin of West Texas and New Mexico that we believe could provide up to 20 years of consistent drilling activity. Additionally, the company is the majority owner of its infrastructure and midstream provider, which provides the company with a valuable asset and right of first call on transport capacity, which we believe is a hidden asset not reflected in the company’s share price.

We also seized the opportunity to add OneMain (OMF), in the financials sector, to the portfolio. A consumer finance company with a focus on personal loans to customers who have limited access to traditional lenders, OneMain’s stock has suffered from the perception that a recession would result in significant credit losses particularly at the lower quality end of the spectrum.

While we did see a slight uptick in credit loss rates during the quarter, the rebound is off historic and exceptionally low levels. OneMain maintains strong credit spreads, great returns and a management team composed of efficient operators with extensive experience in navigating the consumer credit market during recessions, making it an excellent addition to the portfolio.

We exited a number of stocks during the period, including Sprouts Farmers Market (SFM) and Goodyear Tire & Rubber (GT). Strong investor sentiment for consumer staples helped bolster Sprouts’s stock price to a level we believe reflected the fair value of the company, and we exited the position to capture the positive returns on the stock.

Alternatively, we sold our position in Goodyear due to the cavalcade of concerns including the company’s elevated debt levels, inflationary pressures from higher input prices, continued manufacturing challenges in the auto industry and complications with the company’s manufacturing volume. With substantial exposure to the automotive industry through our other portfolio holdings, we elected to consolidate our exposure within those higher-conviction holdings.

Outlook

Market downturns, such as the one we find ourselves in, are never pleasant but are nevertheless a component of the full market cycle. While these observations do little to assuage our disappointment in short-term performance, we recognize these periods for what they are: a transitional disconnect between stock prices and their inherent values. This creates challenges for long-term managers as short-term markets are often ruled by investor sentiment and macro factors, which in this case are both pointing toward recession.

However, our process of investing in high-quality companies with strong balance sheets and long-term earnings drivers is designed to generate attractive returns over the full market cycle, not just a part of it. As such, we have high conviction in our process and discipline, and focus on capitalizing on opportunities to lay the foundation for long-term success.

Portfolio Highlights

The ClearBridge Small Cap Strategy underperformed its Russell 2000 Index benchmark during the third quarter. On an absolute basis, the Strategy had losses in nine out of 11 sectors in which it was invested during the quarter. The leading detractors were the IT and communication services sectors, positive contributors included the consumer staples sector and the utilities sector was flat for the period.

On a relative basis, overall stock selection and sector allocation weighed on performance. Specifically, stock selection in the IT, health care, communication services and energy sectors, as well as an underweight allocation to the health care sector detracted. Conversely, stock selection in the utilities and real estate sectors contributed to relative returns.

On an individual stock basis, the biggest contributors to absolute returns in the quarter were Murphy USA (MUSA), CareMax (CMAX), Extreme Networks (EXTR), Sunnova Energy and NMI. The largest detractors from absolute returns were NCR, Semtech (SMTC), Syneos Health, Rapid7 and Primoris Services (PRIM).

In addition to the transactions listed above, we initiated positions in Photronics (PLAB) in the IT sector, Terex (TEX) in the industrials sector and Maravai Lifesciences (MRVI) and Cara Therapeutics (CARA) in the health care sector. We also exited positions in Brigham Minerals (MNRL) in the energy sector, thredUP (TDUP) and Solo Brands (DTC) in the consumer discretionary sector, Advantage Solutions (ADV) in the communication services sector and Health Catalyst (HCAT), Amarin (AMRN), NanoString Technologies (NSTG) and Quotient (QTNT) in the health care sector.

During the period, portfolio holding East Resources Acquisition (ERESU), a special-purpose acquisition company (SPAC), voted to extend its investment window and allowed the portfolio managers to redeem their investment for cash, which we did.

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment